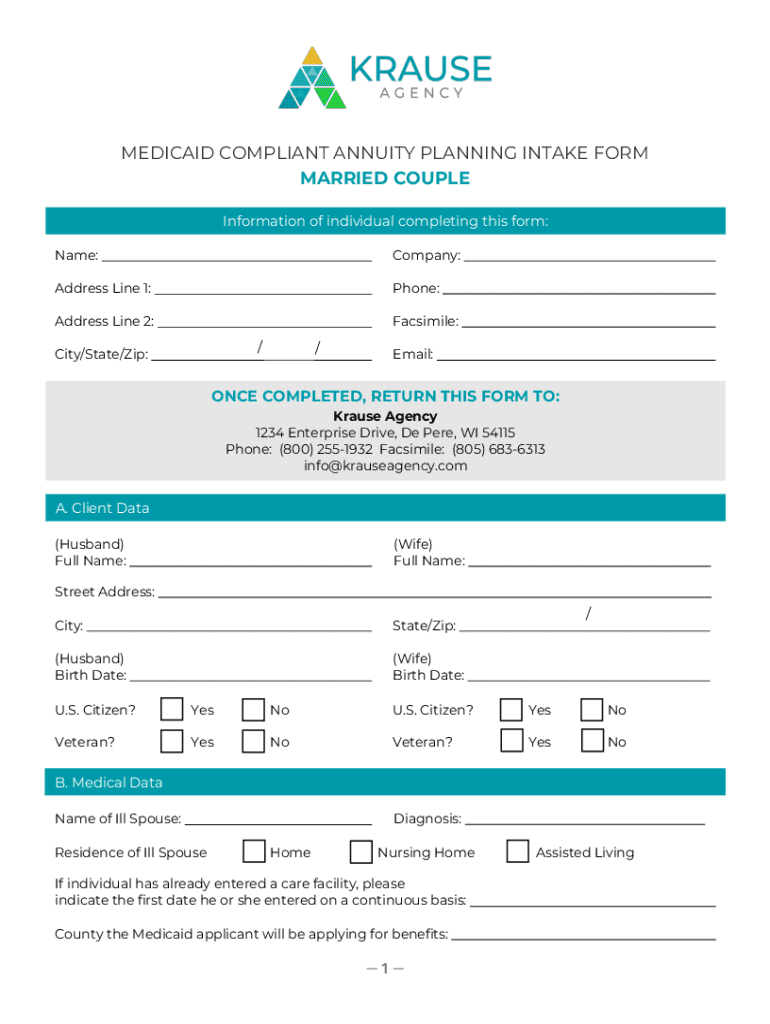

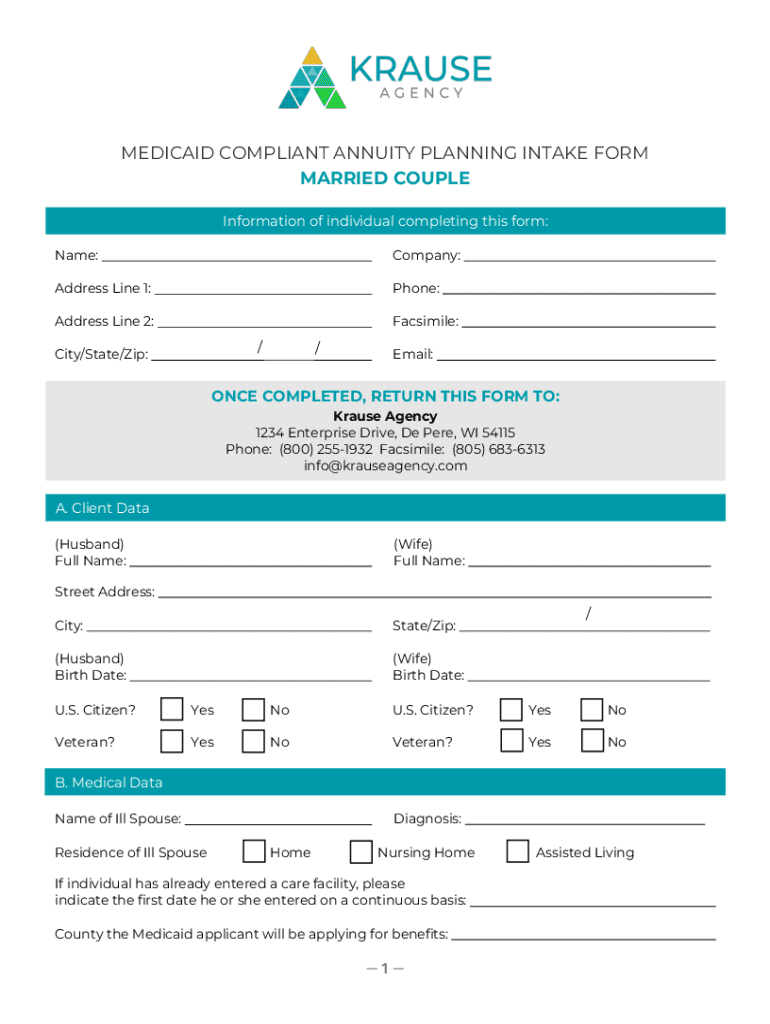

Get the free MEDICAID COMPLIANT ANNUITY PLANNING INTAKE FORM ...

Get, Create, Make and Sign medicaid compliant annuity planning

How to edit medicaid compliant annuity planning online

Uncompromising security for your PDF editing and eSignature needs

How to fill out medicaid compliant annuity planning

How to fill out medicaid compliant annuity planning

Who needs medicaid compliant annuity planning?

Comprehensive Guide to Medicaid Compliant Annuity Planning Form

Understanding Medicaid compliant annuities

A Medicaid compliant annuity is a financial product specifically designed to align with Medicaid's regulations. It allows individuals, particularly those planning for long-term care, to convert their assets into income while still qualifying for vital Medicaid benefits. This planning tool is essential in safeguarding wealth, ensuring that an individual can receive quality care without depleting their savings or leaving loved ones financially vulnerable.

The importance of these annuities cannot be overstated, as they offer individuals a path to maintain their standard of living in the face of healthcare needs that can otherwise overwhelm finances. Through proper structuring of an annuity, individuals can transfer assets in a manner compliant with Medicaid's strict eligibility criteria.

Eligibility criteria

To qualify for Medicaid, applicants must meet specific financial eligibility criteria. Generally, this includes income and asset limits, which can vary from state to state. Medicaid compliant annuities are strategically designed to utilize the allowable asset limits while offering recipients a steady stream of income.

The basics of annuity planning

Annuity planning involves understanding various types of annuities that individuals can choose based on their financial needs and goals. The two primary types are fixed and variable annuities, which provide different benefits related to returns and risks.

Additionally, annuities can be categorized into immediate and deferred options. Immediate annuities begin providing income payments right after a lump sum payment, while deferred annuities accumulate funds over time and start distributing payments at a later date.

Understanding these distinctions is vital for effective long-term care planning and ultimately opting for the most suitable solution tailored to individual financial situations.

How Medicaid compliant annuities function

The primary role of Medicaid compliant annuities in Medicaid planning is to protect assets while ensuring ongoing financial support for individuals requiring long-term care. These annuities serve as a financial shield, allowing individuals to transfer assets but still access necessary healthcare without the fear of depleting their savings.

The structure of the annuity must comply with Medicaid’s rules to qualify as an exempt asset. In practice, this means that the annuity must be irrevocable, non-transferable, and should provide a fixed stream of income to the individual for a specified period, typically their life expectancy.

Examples of Medicaid compliant annuities

Let’s consider a scenario: a retiree with a home and a few bank accounts wishes to qualify for Medicaid while ensuring they can pay for long-term nursing care. By investing in a Medicaid compliant annuity, they convert their excess cash into a structured income which preserves their eligibility for state assistance. They receive monthly payments that support their care and keep their primary home intact.

In another example, a couple with significant assets might separate certain assets into a Medicaid compliant annuity to ensure one spouse qualifies for Medicaid without losing their joint home. The structured payments allow them financial breathing room, supporting care needs without undue risk.

The Medicaid compliant annuity planning form: a key tool

The Medicaid compliant annuity planning form serves an important purpose in documenting all necessary financial structures involved in obtaining a compliant annuity. This form acts as a comprehensive record outlining personal and financial details required for effective asset protection strategies.

A dedicated form provides clarity in the significant details involved in annuity planning to ensure compliance with Medicaid requirements and avoid potential pitfalls during the application process. This becomes particularly crucial as inaccuracies can lead to disqualification from benefits.

Step-by-step guide to completing the annuity planning form

Completing the Medicaid compliant annuity planning form involves several preparatory steps. Start by gathering all relevant documentation, including bank statements, income advisories, and any relevant legal paperwork. Having this information readily available will ensure accuracy and streamline the completion process.

Pre-completion preparations

Detailed walkthrough of the form

Common mistakes to avoid

Filling out the Medicaid compliant annuity planning form can be straightforward, yet mistakes can create significant issues. A key pitfall is providing inaccurate information, which may lead to delays or outright denials of Medicaid benefits. It’s crucial to double-check every entry against supporting documents to ensure consistency.

Another common blunder involves failing to disclose all financial assets. Omitting significant assets can result in non-compliance leading to major consequences. It’s advisable to consult with financial advisors or estate planning attorneys who specialize in Medicaid compliance to avoid these traps.

After submission: what to expect

Once the Medicaid compliant annuity planning form is submitted, applicants should expect a thorough review process. Understanding the typical timeline can ease any anxieties—usually, the review takes a few weeks, depending on the completeness of the application and the current caseload within the local Medicaid office.

Being prepared for potential follow-up actions is also wise. The application reviewers may request additional documents or clarifications to support the financial standings reported. Having all relevant papers organized can expedite this process.

Integrating pdfFiller for document management

Managing the Medicaid compliant annuity planning form can be made simpler using pdfFiller’s comprehensive document management tools. Users can edit, customize, and ensure their submission meets all compliance criteria without the usual hassles of physical paperwork.

With pdfFiller, document collaboration doesn't just streamline the filling process; it incorporates user-friendly tools. For instance, one can edit any sections needing updates directly within the platform, ensuring flexibility and accuracy.

Frequently asked questions

As individuals prepare to navigate the complexities of Medicaid compliant annuities, several common concerns arise. Many wonder what their options are if a financial situation changes post-submission. It’s essential to note that significant changes in income or asset status must be reported to the Medicaid office as these may impact eligibility and benefits.

Moreover, applicants often seek clarity on whether it’s permissible to modify the annuity after initial submission. Changes to the annuity structure can be delicate, and professional consultation is advised to navigate these waters. Being informed about the nature of compliance regarding annuities ensures a smoother process.

Real-life impact of Medicaid compliant annuities

The positive results of employing Medicaid compliant annuities are exemplified through numerous client success stories. Families who effectively implement these strategies often express feelings of relief and financial security, knowing they can meet health needs without sacrificing their wealth.

One testimonial highlights how a family could keep their home and also facilitate long-term care for their loved ones. By engaging in thorough planning, they were able to navigate complicated Medicaid processes with ease, demonstrating the lasting benefits of planning with compliant annuities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get medicaid compliant annuity planning?

How do I execute medicaid compliant annuity planning online?

How do I fill out medicaid compliant annuity planning using my mobile device?

What is medicaid compliant annuity planning?

Who is required to file medicaid compliant annuity planning?

How to fill out medicaid compliant annuity planning?

What is the purpose of medicaid compliant annuity planning?

What information must be reported on medicaid compliant annuity planning?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.