Get the free CONTINUATION OF COVERAGE AFTER TERMINATION

Get, Create, Make and Sign continuation of coverage after

Editing continuation of coverage after online

Uncompromising security for your PDF editing and eSignature needs

How to fill out continuation of coverage after

How to fill out continuation of coverage after

Who needs continuation of coverage after?

Continuation of Coverage After Form: Your Comprehensive Guide

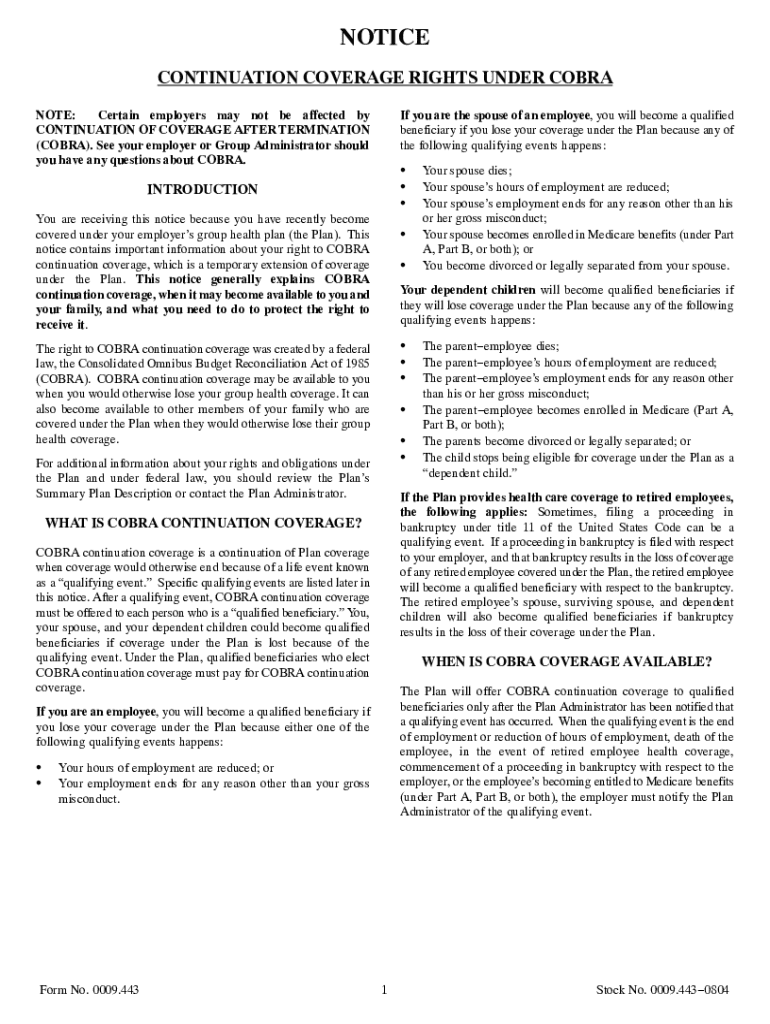

Understanding continuation of coverage

Continuation of coverage refers to the right to retain your existing health insurance coverage after specific qualifying events, such as job loss or plan termination. This provision is crucial for individuals seeking uninterrupted access to medical care, ensuring that their health needs are sufficiently met without incurring exorbitant costs associated with finding new insurance.

The importance of continuation of coverage lies in the ability to maintain access to the same healthcare services, providers, and benefits you had while employed. With the rise of unexpected job losses or changes in employment status, understanding your options becomes vital in safeguarding your health and financial well-being.

Eligibility for continuation of coverage

Eligibility for continuation coverage primarily depends on the type of insurance plan you have and the circumstances under which your coverage would terminate. Generally, employees who lose their jobs or experience reductions in work hours that impact their health insurance status may qualify for continuation coverage.

The duration of continued coverage varies, but many plans offer a protection period lasting up to 18 months, with some circumstances extending beyond that. Special provisions may apply to dependents, allowing coverage to continue for children even after turning 26 under specific plans, such as the Federal Employees Health Benefits (FEHB) Program.

The continuation of coverage process

Applying for continuation of coverage is an essential step for those looking to maintain their health insurance. The process starts with reviewing your current healthcare plan to fully understand the coverage you had previously and recognize what will carry over into your continuation coverage.

Next, complete the necessary forms as specified by your employer or health plan provider. Submitting your application on time is crucial, as you generally have a series of deadlines to meet; after which, pay close attention to payment instructions to secure your continuation coverage. Failure to adhere to deadlines could lead to a loss of your coverage.

Critical timelines include the initial notification period after job loss and the grace periods for submitting payments to avoid interruption of coverage. Familiarize yourself with these deadlines to avoid unnecessary stress.

Benefits and limitations of continuation of coverage

The advantages of choosing continuation coverage are significant. One key benefit is that you can retain your current healthcare provider, which often leads to a smoother transition during a particularly stressful life change. Additionally, maintaining existing healthcare benefits can provide peace of mind, knowing that your medical needs will remain attended to without interruption.

However, common limitations of continuation coverage warrant consideration. Unlike regular employer-sponsored health plans, the costs associated with continuation may be higher, and coverage typically has a defined duration, restricting access beyond a specific period. Understanding both sides of this decision is crucial in assessing your needs and determining the right course of action.

When to consider alternatives

While continuation coverage can be a great lifeline, there are scenarios where considering alternatives may be essential. For individuals facing significant changes in health status or financial limitations, evaluating the cost effectiveness of continuation coverage versus available market options will be necessary.

If the anticipated expenses associated with continuation coverage seem unmanageable, alternative health insurance options like marketplace plans or short-term health insurance should be thoroughly assessed. Exploring these alternatives can sometimes lead to more affordable, tailored healthcare solutions.

Managing your continuation coverage

Once you have achieved coverage, active management becomes a priority. This includes knowing how to make changes to your coverage, whether it involves adding or removing dependents or updating personal information. Keeping your coverage records current ensures you have the best protection for yourself and your family.

Monitoring coverage and claims is also paramount. Utilize available tools to track benefits during this period and collaborate efficiently with your healthcare providers. Understanding how to file claims correctly saves both time and money, ultimately improving your experience with continuation coverage.

Interactive tools and resources

For those navigating continuation of coverage, having access to interactive tools and resources can make the process more manageable. Fillable forms for continuation of coverage are readily available, allowing users to quickly and accurately complete required documents, reducing the likelihood of errors or delays.

Cost estimator tools can also provide valuable insights into comparing costs associated with continuation coverage against alternatives. Understanding what you’re paying for in real-time not only helps in budgeting but also aids in making informed decisions regarding your healthcare options.

Impact of change: special circumstances

Special circumstances can introduce complexities into the continuation of coverage landscape. For instance, when a child turns 26, typically, they lose dependency status under family health plans; however, options under certain programs like the Federal Employees Health Benefits (FEHB) can allow for the continuation of coverage to avoid disruptions in healthcare for young adults.

Similarly, transitioning from high school to college often raises questions about health insurance. Many educational institutions provide coverage options, and understanding the nuances of these plans can significantly impact financial and health outcomes for students and their families.

Temporary continuation of coverage (tcc)

Temporary continuation of coverage (TCC) serves as an alternative for individuals who may not qualify for COBRA but need to maintain health coverage. TCC is often offered under specific plans, enabling enrollees to keep their insurance for a limited period while exploring longer-term solutions.

Eligibility criteria for TCC vary by plan, and the application process typically includes specific documentation and timelines to meet. Costs associated with TCC can be comparable to that of COBRA, making it another option for ensuring health coverage remains active.

Conclusion of coverage timeline and communication

Understanding notifications regarding coverage end dates is vital during this transition. Timely communication with insurers can make all the difference in maintaining continuous health coverage without lapses. The obligation falls on the insured to stay informed of timelines and actions required to protect their benefits.

Reach out proactively to your customer support team or agency representatives to clarify any uncertainties and ensure compliance with your health plan's requirements. Transparent communication and consistent follow-up can alleviate stress while navigating the complexities of continuation coverage amidst changing life circumstances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find continuation of coverage after?

How do I fill out the continuation of coverage after form on my smartphone?

How do I edit continuation of coverage after on an iOS device?

What is continuation of coverage after?

Who is required to file continuation of coverage after?

How to fill out continuation of coverage after?

What is the purpose of continuation of coverage after?

What information must be reported on continuation of coverage after?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.