Get the free Taxes for Business - Department of Revenue - Georgia.gov

Get, Create, Make and Sign taxes for business

How to edit taxes for business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out taxes for business

How to fill out taxes for business

Who needs taxes for business?

Taxes for Business Form: A Comprehensive Guide

Overview of business tax obligations

Understanding business taxes is vital for any entrepreneur or business owner. Taxes not only fund public services but also reflect the fiscal health of your business. A well-informed approach to taxes can significantly impact your bottom line, and failing to comply with tax obligations can lead to penalties and additional fees.

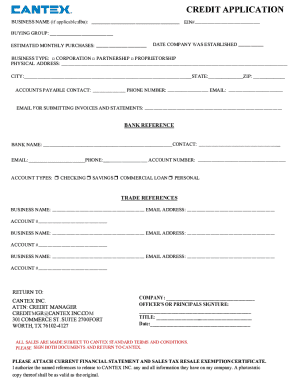

Each type of business structure has its own set of tax responsibilities. Familiarizing yourself with the different types of business tax forms you need to file is crucial. Whether you operate a corporation, a partnership, or a sole proprietorship, it’s essential to understand your income tax returns, payroll taxes, and any relevant state and sales tax forms.

Remember, there are specific deadlines for filing these forms and making payments, and missing them could expose your business to additional penalties. Each tax type has its own schedule, making it crucial to keep a calendar and stay organized to meet these deadlines.

Taxes for business form: An in-depth look

A business tax form is a document that taxpayers use to report income, expenses, and other tax-related information to the IRS or their local tax authority. Understanding these forms ensures compliance and helps in maximizing potential deductions. Common examples include Form 1120 for corporations, Form 1065 for partnerships, and Schedule C for sole proprietorships.

Each form serves a distinct purpose in the tax reporting process, tailored to the specific business structure. Submitting the correct form based on your company's legal structure ensures appropriate tax treatment and prevents issues.

Steps to complete common business tax forms

Completing business tax forms requires careful organization and documentation. Start by gathering necessary paperwork such as financial statements, expense receipts, and employee payroll records. Organizing these documents before you begin filling out your forms can save significant time and reduce errors.

Once you have the required documents, filling out the business tax form becomes easier. Utilizing a tax preparation software or an interactive online tool can simplify this process, helping you navigate through the necessary fields.

Editing and revising your forms is another critical step. Make sure everything is accurate and current; review each entry carefully before submission. Tools like pdfFiller allow you to store historical data, making it easier to return to previous forms if needed.

Managing and submitting your business tax forms

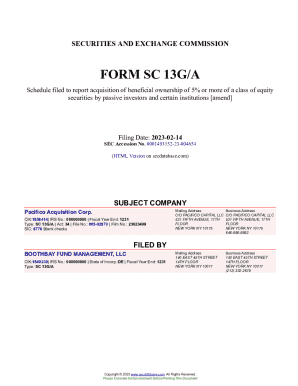

Filing your taxes online is often more efficient than paper filing. E-filing can result in quicker processing times and faster refunds. Before you submit, ensure that you comply with all e-filing requirements to avoid complications.

When managing your submissions, utilizing a platform like pdfFiller can be a great asset. With integrated e-signing capabilities, cloud storage, and easy collaboration, your team can streamline the process and ensure that nothing falls through the cracks.

Lastly, storing and organizing your tax documents in the cloud secures them against loss and allows for easy access, ensuring that you have everything you need at your fingertips.

Common challenges and solutions in business tax filing

Business tax filing can be fraught with challenges. Common issues include miscalculations, missed deadlines, and incomplete submissions. These problems can trigger penalties and unwanted scrutiny from tax authorities.

To mitigate these challenges, implement processes that check for common mistakes before submission. Informing yourself about available resources can also assist in resolving issues, such as understanding how to correct mistakes on submitted forms or where to turn for audit support from professional audit consulting groups.

Reviewing each form for completeness can preempt costly mistakes. If a mistake does occur, know that amendments are possible, allowing you to correct the record efficiently.

Frequently asked questions (FAQ)

Navigating taxes for business forms can generate many questions. It’s important to seek clarity on these topics as they can greatly affect your financial standing. For instance, what steps should you take if you miss a deadline? Or, how can you effectively reduce your business tax liabilities?

Additionally, understanding whether you can amend a tax form you’ve already submitted and knowing what support is available for tax form preparation could help alleviate the stress of tax season.

Final thoughts on business tax forms

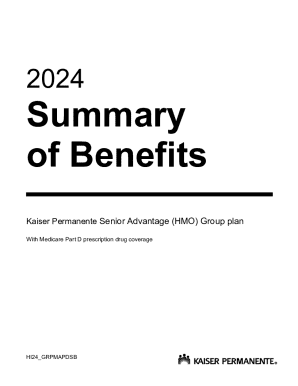

Effective tax management is not just about compliance; it can lead to long-term benefits such as increased profitability and improved cash flow. By understanding your obligations related to taxes for business forms, you empower yourself to optimize your financial situation.

Adopting a proactive approach to tax management can optimize your financial outcomes. Platforms like pdfFiller can help simplify this process, offering tools for seamless editing, eSigning, and document management, all in a single, accessible cloud-based solution. This ensures your business stays organized and prepared throughout the year, reducing tax-related stress when the deadlines approach.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify taxes for business without leaving Google Drive?

Can I edit taxes for business on an iOS device?

How do I complete taxes for business on an Android device?

What is taxes for business?

Who is required to file taxes for business?

How to fill out taxes for business?

What is the purpose of taxes for business?

What information must be reported on taxes for business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.