Get the free IRS Form W-9 - Request For Taxpayer Identification ...

Get, Create, Make and Sign irs form w-9

Editing irs form w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form w-9

How to fill out irs form w-9

Who needs irs form w-9?

IRS Form W-9: A Comprehensive Guide for Individuals and Teams

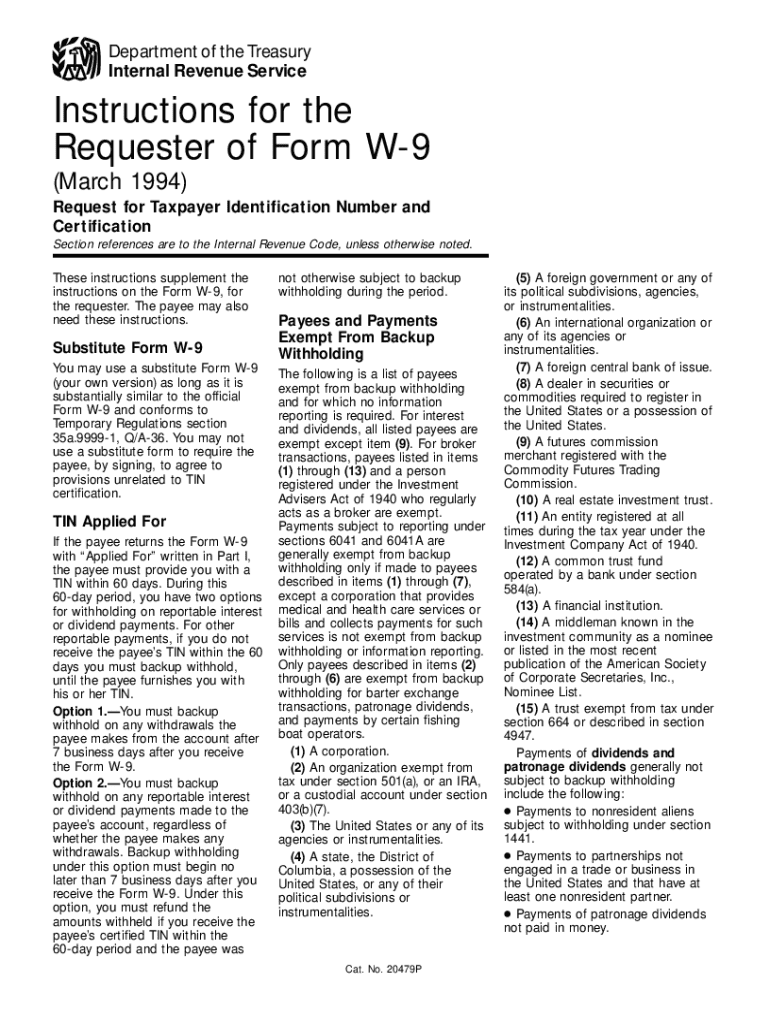

Understanding the W-9 form

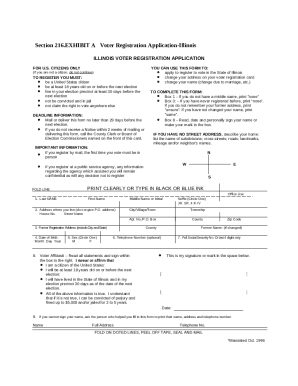

The IRS Form W-9 is a crucial document for tax reporting in the United States, specifically utilized by individuals and entities to furnish their taxpayer identification information to other parties. This form serves as a request for taxpayer identification number (TIN) and certification, designed primarily for independent contractors, freelancers, and businesses that receive income from other sources. The importance of the W-9 form lies in its role in ensuring accurate tax reporting and withholding processes.

Anyone who faces the necessity of providing their TIN to others for tax purposes should fill out a W-9 form. This includes self-employed individuals, sole proprietors, corporations, and partnerships. Notably, organizations that hire freelancers will request this form to keep accurate records for IRS reporting. In essence, the W-9 helps facilitate transparency between payers and recipients concerning taxpayer information, a foundational element in maintaining compliant tax practices.

Key components of the W-9 form

The W-9 form is structured into distinct sections that gather specific information necessary for tax compliance. These sections include Part I, which captures taxpayer identification information, and Part II, dedicated to the certification of the information provided. Understanding these components is vital to ensure that all required data is accurately reported and compliant with IRS standards.

In Part I, users must provide their name and business name, if applicable, along with their address and taxpayer identification number (TIN). It’s crucial to understand that the TIN can be formatted in various ways depending on the individual or business structure: Social Security Numbers (SSN) for individuals and Employer Identification Numbers (EIN) for businesses. Additionally, common mistakes such as errors in the TIN or misidentifying the entity type can significantly delay processes, hence attention should be applied when filling this information.

How to fill out the W-9 form

Completing the IRS Form W-9 is a straightforward process that can be efficiently done by following a step-by-step approach. First, gather all necessary information, such as your full legal name, business name (if applicable), and your taxpayer identification number. Having this information on hand will streamline the completion process.

Next, fill in your personal and business details in the designated sections. Carefully provide your TIN, ensuring you use the correct format—SSN for individuals and EIN for businesses. Once all sections are filled out, review the certification statement at the bottom of the form to confirm accuracy and then sign it. Submission can be done digitally or physically to the requesting party, ensuring they receive it promptly for their records.

Digital solutions for completing the W-9 form

Leveraging digital platforms like pdfFiller can greatly enhance your experience when filling out the IRS Form W-9. With pdfFiller, users can access the form from anywhere, making it convenient for those on the go or working remotely. Beyond simple completion, pdfFiller offers easy editing and collaboration features that streamline the document management process.

By using pdfFiller, users can navigate directly to the W-9 template, seamlessly input their information through interactive tools, and eSign their documents securely. Additionally, the platform allows for easy saving and sharing of the completed W-9 form with the necessary parties, simplifying the submission experience.

How and when to submit the W-9 form

Submitting your W-9 form correctly is just as critical as filling it out accurately. The form should be sent to the requester—usually an employer or a financial institution—directly after completion. It’s essential to follow their specific submission instructions, whether they request digital copies via email or physical submissions through postal mail.

With digital tools like pdfFiller, tracking your submission becomes easier. Users can manage their completed forms alongside other documents on the platform, ensuring that nothing is overlooked. Maintaining a record of your submission proves beneficial for personal documentation and for future reference regarding tax inquiries.

Special circumstances and considerations

There are instances when updating your W-9 information becomes necessary. For example, any change in your legal name, business structure, or taxpayer identification number necessitates a new W-9 submission. As such, it’s vital to keep your W-9 information current to prevent tax reporting discrepancies.

Moreover, if you realize there’s an error on your W-9 after submission, rectify it promptly. Contact the requester to discuss the mistake and submit a new form with corrected information. Failing to provide accurate details can result in IRS penalties and complications in tax filings, thus the onus falls on the individual or business to remain diligent in maintaining accurate records.

Compliance and legal aspects related to the W-9

Compliance with IRS regulations surrounding the W-9 form is crucial. The IRS mandates strict adherence to accurate reporting of taxpayer information, which influences how businesses identify independent contractors and freelancers for tax purposes. Regularly updating your information in the W-9 form ensures compliance and helps avoid unnecessary complications during tax season.

Furthermore, failing to submit a W-9 when required can lead to withholding of taxes on payments made to you, which can ultimately affect your earnings. Entities that do not provide a W-9 may find that payers are obligated to withhold additional tax to meet IRS requirements, highlighting the grave importance of timely submission and accuracy.

Resources and tools for W-9 management

To facilitate easy management of the W-9 form, pdfFiller provides an array of interactive tools that guide users through the process. From simple editing features to comprehensive eSigning options, users can make adjustments as needed without hassle. pdfFiller also recommends helpful guides and FAQs about the W-9 to ensure users are well-informed.

In addition to these resources, pdfFiller offers access to additional templates and forms, which are invaluable for users needing to manage various documents, cementing pdfFiller’s position as a one-stop solution for document management needs.

Conclusion: Streamlining your document needs with pdfFiller

In summary, the IRS Form W-9 is an indispensable document for ensuring proper tax reporting and compliance for individuals and businesses alike. Utilizing digital solutions such as pdfFiller not only simplifies the process of filling out and managing this form but also greatly enhances the overall experience through accessible tools and resources tailored to meet the evolving needs of users.

With comprehensive features that allow for seamless editing, eSigning, and collaboration, pdfFiller stands out as an essential platform for managing the W-9 form and other documents efficiently. Individuals and teams are encouraged to utilize pdfFiller to streamline their document management processes, making tax reporting and compliance more manageable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my irs form w-9 directly from Gmail?

How do I complete irs form w-9 online?

How do I make edits in irs form w-9 without leaving Chrome?

What is irs form w-9?

Who is required to file irs form w-9?

How to fill out irs form w-9?

What is the purpose of irs form w-9?

What information must be reported on irs form w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.