Get the free STOP PAYMENT - REISSUE CHECK AUTHORIZATION ...

Get, Create, Make and Sign stop payment - reissue

How to edit stop payment - reissue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out stop payment - reissue

How to fill out stop payment - reissue

Who needs stop payment - reissue?

Stop Payment - Reissue Form: How-to Guide on Managing Your Stop Payment Requests

Understanding stop payments

A stop payment request serves as a formal order to a financial institution, instructing it to refuse payment on a specific check or transaction. Situations warranting a stop payment can include instances of lost or stolen checks, disputes regarding services rendered, or when payments need to be redirected due to changes in agreement terms.

While stop payments are an essential safeguard against unauthorized transactions, they can have financial repercussions. Most banks charge a fee for processing stop payment requests. Additionally, account management may become more complex, particularly if stop payments lead to issues with overdrafts or delayed payments to vendors.

The importance of a stop payment - reissue form

When you initiate a stop payment, you may later encounter situations that necessitate the need for a reissue. This is especially prevalent if a check is lost, the recipient's details change, or if you need to process a payment again after a stop payment has been established.

Understanding the legal and financial implications of a stop payment - reissue form is critical. By completing this form correctly, you not only mitigate your liability but also clarify your responsibilities. For instance, if a stop payment involves a corporate check, understanding company policies can prevent potential legal conflicts.

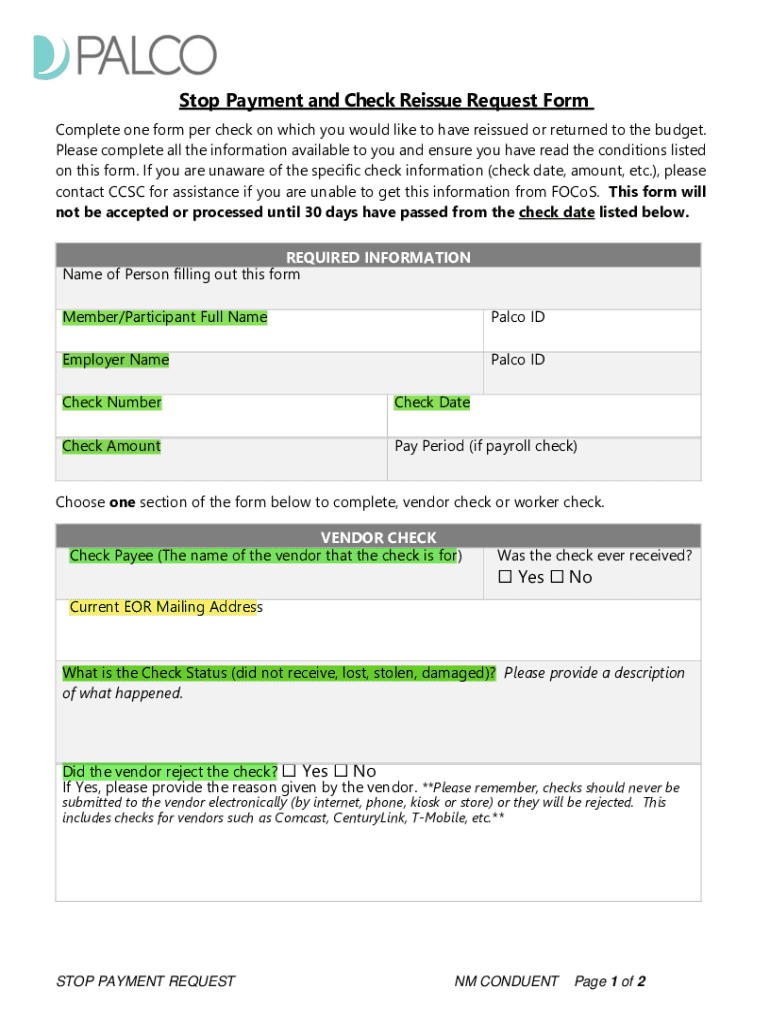

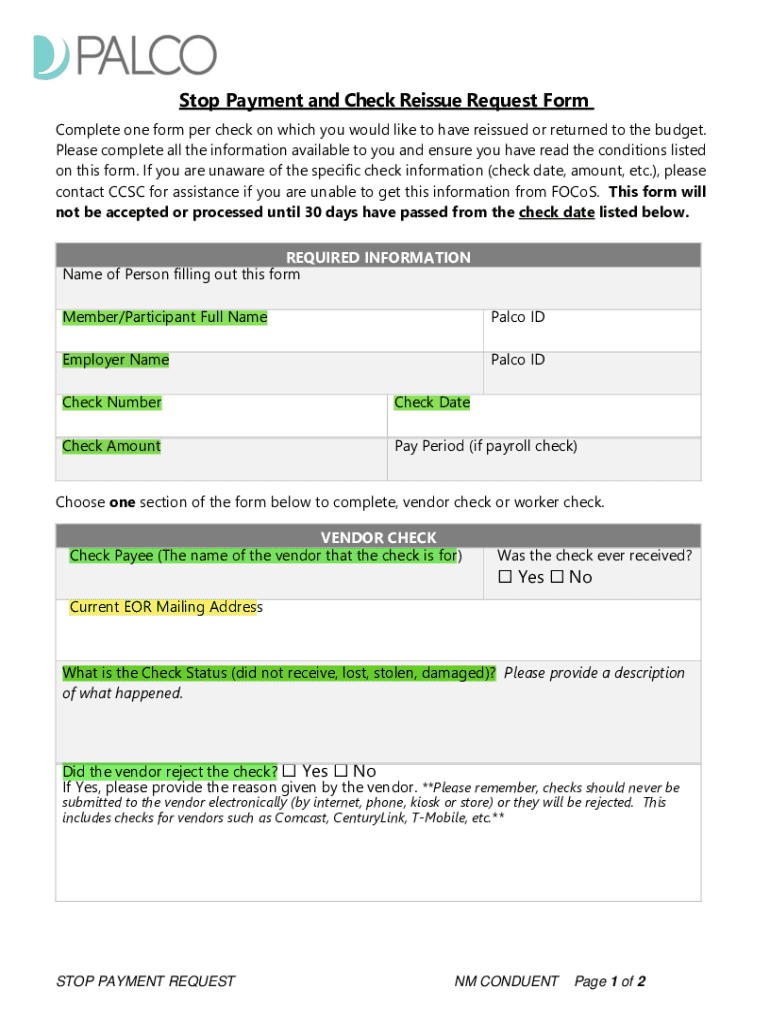

Preparing to fill out the stop payment - reissue form

Before diving into the process of filling out the stop payment - reissue form, it’s essential to gather all necessary information. This usually includes your account information such as the account number and bank branch details. Additionally, you should have the original payment details like the check number, payment amount, and recipient.

Selecting the right form is equally essential. Many banks offer specific stop payment forms, while generic forms may be available online or at pdfFiller. Depending on your bank's policies, these forms may vary and can often be found directly on your bank’s website or through their customer service options.

Step-by-step instructions for filling out the form

The stop payment - reissue form typically includes three main sections. In the first section, enter your personal information accurately. This usually consists of your name, address, and contact information to facilitate communication.

The second section focuses on payment details, where you should specify the original transaction. Clearly indicate the original payment amount, recipient details, and any applicable check numbers. Accuracy here minimizes potential disputes.

Finally, ensure you sign and date the form in the appropriate section. A failure to sign may delay processing your request, so it's crucial to review the entire document before submitting it.

Editing and customizing your stop payment - reissue form

Utilizing tools within pdfFiller allows you to modify the stop payment - reissue form effectively. By editing the form in a cloud-based environment, you can ensure maximum accuracy and ease of access, streamlining the process.

In addition to editing, adding eSignatures can significantly expedite the process. Electronic signatures are legally recognized in many jurisdictions, making it convenient to finalize your requests without the hassle of traditional signing.

Submitting your stop payment - reissue form

Once you have filled out and customized your stop payment - reissue form, it's time to submit it. Many banks allow online submission directly through their platforms, which can often expedite the process.

Alternatively, you may choose to fax or mail the form. Each method has its pros and cons; online submission is generally faster, while faxing or mailing may suit users who prefer physical documents or need to retain a physical copy for records.

After submission, tracking your request is vital. Most banks provide confirmation once a stop payment request is processed, allowing you to stay informed about the status of your transaction.

FAQs about stop payment - reissue forms

Several questions frequently arise concerning stop payment requests. One common inquiry is, 'How long does a stop payment last?' Typically, stop payments can be effective for six months but may vary by institution.

Another question many ask is, 'Can a stop payment be revoked?' Yes, under specific circumstances if the check has not been processed. It's also important to note what to do if a payment already went through despite a stop payment request; contact your bank immediately to discuss next steps.

Using pdfFiller for ongoing document management

Managing your forms efficiently is paramount for ongoing financial organization. With pdfFiller, users can keep track of their forms, ensuring no essential paperwork gets lost in the shuffle. This platform allows individuals and teams to collaborate effectively on finance-related documentation.

The benefits of cloud-based document management cannot be underscored enough. Accessibility from anywhere allows for swift modifications and submissions, while top-notch security features protect sensitive information from unauthorized access.

Real-world scenarios involving stop payment - reissue forms

Consider Jane, a freelance graphic designer who once issued a check to a client. Upon reviewing her records, she realized the check was lost. Jane quickly filled out her stop payment - reissue form through pdfFiller, enabling her to secure her funds and reissue the payment. This prompt action ensured the project continued smoothly without further complications.

On the other hand, a small business faced multiple payment issues with vendors during a financial review. By adopting a systematic approach using the stop payment - reissue forms available on pdfFiller, the team managed all pending payments effectively, preserving vital vendor relationships while maintaining accurate records.

Tips for future document management

For successful financial navigation, regularly monitoring transactions is crucial. Maintain copies of all submitted forms for your records. This creates a clear history, which is invaluable if any disputes arise.

Leveraging pdfFiller can significantly streamline your document management needs, making it easier to create, edit, and submit forms. Utilizing templates and making use of cloud capabilities can enhance your efficiency, ensuring you're prepared for any situation that might demand stop payments in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify stop payment - reissue without leaving Google Drive?

How do I make changes in stop payment - reissue?

How can I fill out stop payment - reissue on an iOS device?

What is stop payment - reissue?

Who is required to file stop payment - reissue?

How to fill out stop payment - reissue?

What is the purpose of stop payment - reissue?

What information must be reported on stop payment - reissue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.