Get the free ENVISION WEALTH PLANNERS - Investment Adviser Firm

Get, Create, Make and Sign envision wealth planners

Editing envision wealth planners online

Uncompromising security for your PDF editing and eSignature needs

How to fill out envision wealth planners

How to fill out envision wealth planners

Who needs envision wealth planners?

Navigating the Envision Wealth Planners Form: A Comprehensive Guide

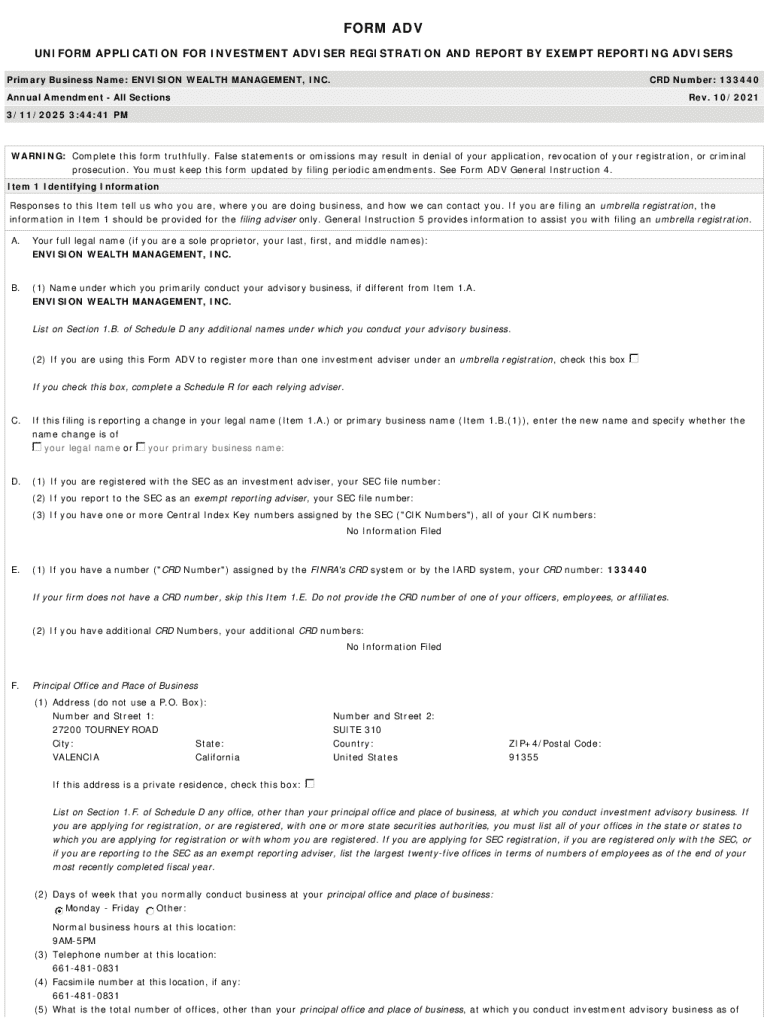

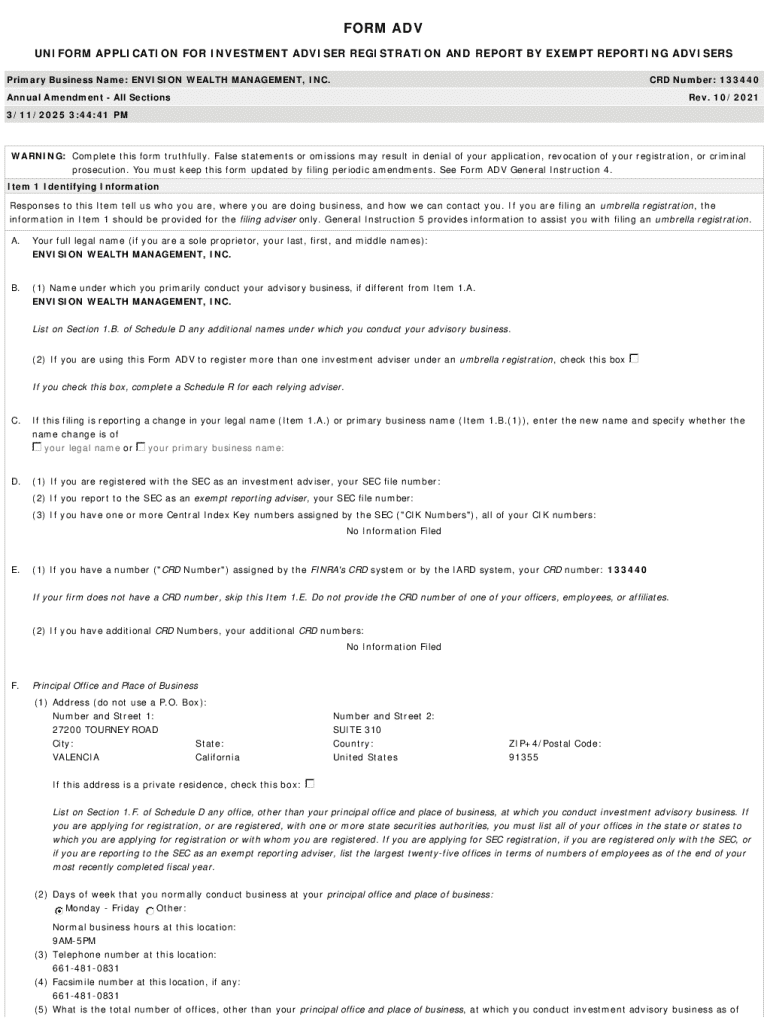

Overview of the Envision Wealth Planners Form

The Envision Wealth Planners Form serves as an essential tool for individuals looking to establish a detailed and actionable wealth management strategy. This form helps to consolidate various financial data into a single, coherent document, making the process of evaluating one’s financial health straightforward.

Understanding wealth planning forms is crucial as they guide users in gathering pertinent information about their assets, liabilities, and overall financial goals. A comprehensive strategy allows individuals and families to plan efficiently for future needs, from retirement to generational wealth transfer.

The Envision Wealth Planners Form stands out by offering features tailored to detailed financial planning. Users can expect a user-friendly interface, customizable sections, and tools that facilitate collaboration with financial advisors, all aimed at enhancing the overall wealth management experience.

Key benefits of using the Envision Wealth Planners Form

Utilizing the Envision Wealth Planners Form brings numerous benefits that cater to both individuals and teams. One of the most notable advantages is the enhanced financial clarity it provides.

Users can achieve a detailed breakdown of their assets and liabilities, ensuring that no financial element is overlooked. This clarity is pivotal in understanding one’s total net worth and planning accordingly.

Step-by-step guide to filling out the Envision Wealth Planners Form

Filling out the Envision Wealth Planners Form can be simplified by following a structured approach. Here’s a step-by-step guide that ensures everything is accounted for.

Tips for effective editing and management of the form

Once the Envision Wealth Planners Form is completed, effective management becomes essential. pdfFiller’s editing tools offer comprehensive functionalities that allow users to modify text, add signatures, and incorporate comments with ease.

Additionally, the collaborative sharing features prove invaluable for individuals looking to engage with their financial advisors or family members. By sharing the form digitally, you ensure that all parties are on the same page, facilitating better communication around financial decisions.

Ensuring security and compliance

Given the sensitive nature of financial information, ensuring document security while using the Envision Wealth Planners Form is of utmost importance. pdfFiller employs robust encryption and security protocols to guard against unauthorized access.

Additionally, understanding eSignature laws is essential for compliance. With the regulatory framework evolving, users must ensure their electronic signatures are legally binding in their region. pdfFiller provides users with a clear outline of these legalities, ensuring peace of mind throughout the documentation process.

Troubleshooting common issues when using the Envision Wealth Planners Form

While pdfFiller offers an intuitive user experience, some users may encounter technical challenges. Common issues might include difficulties with filling out form fields or submission errors.

For immediate assistance, pdfFiller's customer support team is readily accessible. Users can easily contact support through the help center for quick resolutions to any issues encountered while using the Envision Wealth Planners Form.

Interactive tools for enhanced planning experience

Beyond the standard features, pdfFiller offers interactive tools that significantly enhance the planning experience. These include specialized calculators and planning tools aimed at helping users analyze their financial situations more effectively.

Moreover, real-time collaboration features allow teams and advisors to work together seamlessly within the platform. This capability ensures that updates and discussions can occur in real time, improving efficiency in the wealth planning process.

Advanced strategies for wealth management using the form

For those looking to deepen their wealth management strategies, the Envision Wealth Planners Form can be instrumental in incorporating advanced financial tactics. For instance, understanding and integrating tax strategies can have a significant impact on net worth and retirement planning.

Users should consider long-term planning factors such as asset growth, retirement contributions, and techniques for generational wealth transfer. The form acts as a foundational tool that can facilitate thoughtful discussions and strategic planning, ensuring users are proactive rather than reactive in their wealth management approach.

Conclusion on the value of the Envision Wealth Planners Form

The Envision Wealth Planners Form integrates various financial elements into a cohesive approach to wealth management. By facilitating clarity, customization, and collaboration, it empowers users to navigate their financial journeys with confidence.

Utilizing pdfFiller enhances the document management experience, ensuring that all aspects of wealth planning are accessible and manageable from anywhere. With its capabilities, the Envision Wealth Planners Form serves not only as a financial document but as a catalyst for transformative wealth strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find envision wealth planners?

How do I make edits in envision wealth planners without leaving Chrome?

How do I edit envision wealth planners straight from my smartphone?

What is envision wealth planners?

Who is required to file envision wealth planners?

How to fill out envision wealth planners?

What is the purpose of envision wealth planners?

What information must be reported on envision wealth planners?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.