Get the free Investment Adviser Firm - AURUM EP GP LLC

Get, Create, Make and Sign investment adviser firm

How to edit investment adviser firm online

Uncompromising security for your PDF editing and eSignature needs

How to fill out investment adviser firm

How to fill out investment adviser firm

Who needs investment adviser firm?

Investment Adviser Firm Form - How-to Guide Long-Read

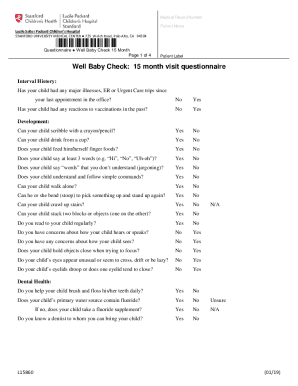

Understanding the investment adviser firm form

The investment adviser firm form serves as a crucial document for firms looking to provide investment advice. This form is primarily used by investment advisers to register with the Securities and Exchange Commission (SEC) or state regulators, acting as a formal declaration of intent to operate in the financial sector. Compliance with these forms is mandatory for maintaining regulatory standards and assures clients of the firm's legitimacy.

The importance of the investment adviser firm form cannot be overstated; it signifies a firm's willingness to adhere to strict regulatory measures designed to protect investors. Properly completing this form is vital not only for legal compliance but also for building trust with potential clients.

Key components of the form

The investment adviser firm form comprises several key components that must be accurately filled. This includes the firm's name, physical address, contact information, and specific details about the advisers responsible for managing assets. Each section serves a specific purpose in ensuring compliance and facilitating easy communication with regulatory bodies.

The regulatory framework governed by the form

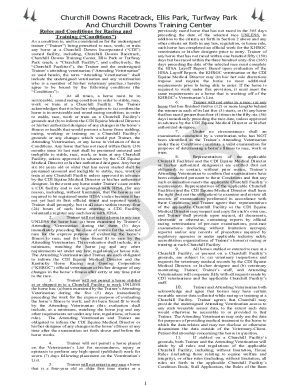

Determining who needs to fill out the investment adviser firm form is essential. Typically, all investment advisory firms providing advice about securities must comply with this requirement unless they fall under specific exemptions. This includes firms under the SEC jurisdiction as well as those regulated by state authorities.

Understanding the distinction between SEC and state registrations is crucial. While larger firms that manage significant assets often register with the SEC, smaller firms typically register with state regulators. The added regulatory scrutiny necessitates that firms remain diligent in meeting all compliance requirements, as failures can lead to severe consequences, including fines and penalties.

Compliance requirements and consequences

Investment advisers must adhere to specific legal obligations, which are outlined in the investment adviser firm form. These obligations include disclosing potential conflicts of interest, maintaining proper records, and undergoing annual audits. Non-compliance with these requirements can result in significant repercussions, such as administrative penalties, restrictions on business operations, or even criminal charges for egregious offenses.

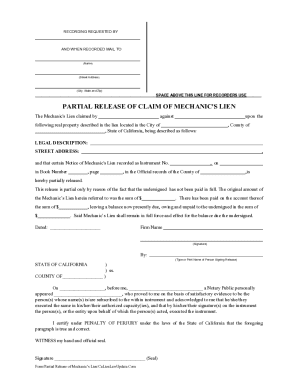

Steps to complete the investment adviser firm form

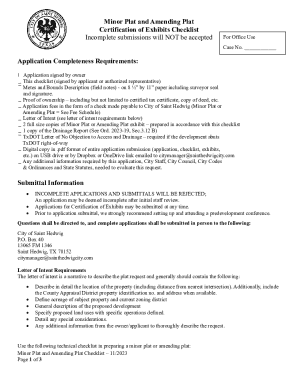

Completing the investment adviser firm form can seem overwhelming, but breaking it down into manageable steps simplifies the process. The first step involves preparing the required documentation. Firms should gather essential documents such as articles of incorporation, compliance manuals, and other certifications that will inform the filling process. Efficient information gathering is key to a smooth completion of the form.

Utilizing interactive tools can aid in filling these forms. pdfFiller offers an interactive form-filling tool designed for ease of use. With features that provide guidance through each step, users can navigate the often intricate requirements of investment adviser registration effortlessly.

Following best practices, firms must avoid common pitfalls like misunderstanding sections or skipping required disclosures. Each section is crafted to elicit essential information, so thoroughness is crucial.

Editing and customizing the form

Once the investment adviser firm form has been filled, utilizing the editing features on pdfFiller can enhance the submission. The platform offers functionalities like annotations and revisions, allowing teams to collaboratively review and optimize the content before submission.

Ensuring accuracy is vital. Thorough proofreading should be conducted to catch any errors that could affect the submission. Utilize pdfFiller's audit trail feature to maintain document integrity and track any changes made during the editing process.

Signing and submitting the form

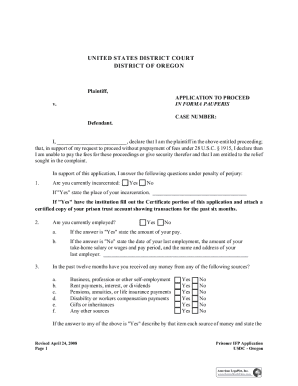

Next, signing the investment adviser firm form typically requires electronic signatures, which have gained legal credibility alongside traditional ink signatures. With pdfFiller, adding an e-signature is straightforward, leading to a quicker submission process.

Submitting the form can be achieved online or through physical methods. Online submission through regulatory websites is encouraged for speed and efficiency, while physical submissions may still be relevant in certain contexts. Knowing best practices for document delivery, such as ensuring correct addresses and tracking submissions, can help in ensuring a smooth process.

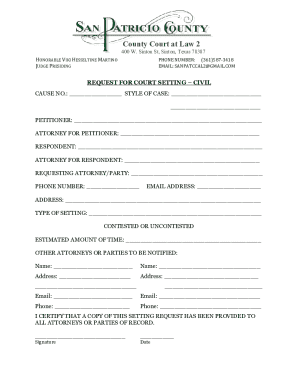

Post-submission: Managing your investment adviser firm form

After submission, firms should establish a system for tracking the status of their applications. Regulators often have specific timeframes within which they notify firms about the processing of submissions. Staying informed helps firms maintain operational continuity while they wait.

If amendments to the initial submission are necessary due to changes or additional information, knowing how to navigate the revision process is critical. Regular updates may also be required to ensure that the firm remains in good standing with regulatory bodies, including current contact information and operational changes.

Resources and tools for investment advisers

Investment advisers can benefit from a wealth of resources available through platforms like pdfFiller. With numerous templates tailored to regulatory forms and processes, advisers can streamline their document management, allowing them to focus on primary business activities rather than paperwork.

In addition to pdfFiller, external resources from regulatory bodies like the SEC offer valuable guidance on compliance and best practices. Engaging with expert support resources, such as customer service and informative webinars, can further enhance knowledge and application processes.

Frequently asked questions (FAQs)

Many individuals and firms have queries when managing their investment adviser firm form. Common questions often revolve around the specific documentation required, timelines for submission review, and best practices for ensuring compliance. By addressing these FAQs, advisers can avoid pitfalls and navigate the regulatory landscape with greater confidence.

User experiences and testimonials

Real-life success stories from investment advisers who have utilized pdfFiller for their submission process highlight the tool's effectiveness. Feedback indicates increased confidence due to the platform's comprehensive nature and collaborative features.

Engaging with the community through forums and user groups can yield insights into best practices and areas for improvement. Personal experiences can illuminate tips for both new and seasoned investment advisers managing the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify investment adviser firm without leaving Google Drive?

How do I edit investment adviser firm on an iOS device?

How do I complete investment adviser firm on an iOS device?

What is investment adviser firm?

Who is required to file investment adviser firm?

How to fill out investment adviser firm?

What is the purpose of investment adviser firm?

What information must be reported on investment adviser firm?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.