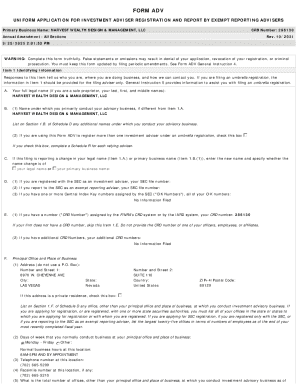

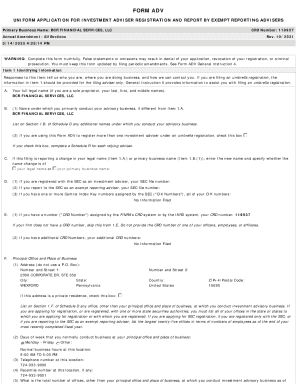

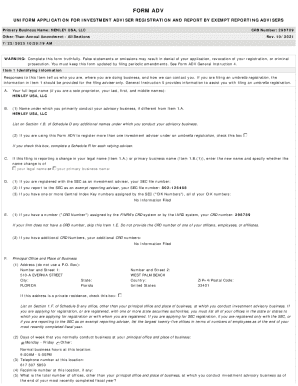

Get the free TRITON WEALTH MANAGEMENT, PLLC

Get, Create, Make and Sign triton wealth management pllc

Editing triton wealth management pllc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out triton wealth management pllc

How to fill out triton wealth management pllc

Who needs triton wealth management pllc?

A Comprehensive Guide to Completing the Triton Wealth Management PLLC Form

Overview of Triton Wealth Management PLLC Form

The Triton Wealth Management PLLC Form is a crucial document designed to capture a client's financial information and investment preferences. Its primary purpose is to facilitate tailored wealth management services. By providing accurate and detailed responses, individuals ensure that their financial advisors can offer personalized advice that aligns with their goals.

In the realm of wealth management, the importance of this form cannot be overstated. It serves as the foundational data set for financial planning strategies, helping advisors construct portfolios that match risk tolerances and investment objectives. Understanding the key elements of the form enables clients to effectively communicate their needs.

Preparing to complete the Triton Wealth Management Form

Before diving into the Triton Wealth Management form, it's crucial to gather all required information. This preparatory step ensures completeness and accuracy, which, in turn, affects the quality of service received from wealth management professionals.

Essential information to collect includes personal identification details such as your full name, address, date of birth, and social security number. Additionally, comprehensive financial details encompassing income sources, existing investments, properties, and any liabilities must be assembled. Finally, reflecting deeply on your financial goals—such as saving for retirement, purchasing a home, or funding education—will allow you to articulate a clear vision to your advisor.

Understanding the instructions provided within the form is also crucial. The form will typically be segmented into sections, each focusing on various aspects of your financial profile, so a summary of these sections can aid in comprehension.

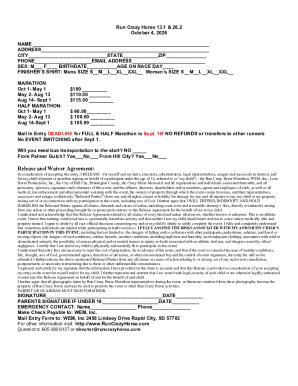

Step-by-step instructions for filling out the form

Completing the Triton Wealth Management form involves following a structured approach. Start by filling out Section 1, which asks for personal information. This includes your name, contact information, and date of birth. Adhering to formatting guidelines ensures that the form is processed without hitches.

In Section 2, you’ll provide financial information. This section typically requires details about your current holdings, including securities, funds, positions, and performance numbers, such as the turnover ratio. It’s essential to avoid common mistakes, such as rounding off figures inaccurately or failing to disclose all liabilities, as this may skew your financial representation.

Section 3 focuses on your investment preferences. Clearly articulate your risk tolerance and any specific investment choices you may favor. If you prefer conservative investments, mention that, or highlight any interest in sectors such as technology or real estate.

Lastly, Section 4 addresses signatures and acknowledgments. Signing the form signifies that all information provided is truthful and complete. Understanding the legal implications here is paramount, so ensure you read all acknowledgments carefully. Many users also opt for digital signatures through platforms like pdfFiller for convenience.

Editing and managing your Triton Wealth Management form

After completing the form, you may find that some details need editing or updating. Using pdfFiller for this purpose makes the process simple and efficient. You can upload your completed document, access it easily from anywhere, and make necessary modifications without needing to print it out again.

Moreover, pdfFiller offers collaborative editing features, allowing multiple stakeholders to review and suggest changes in real-time. This is especially useful when working as a team to finalize financial documentation.

When managing sensitive financial information, it’s essential to keep your documents secure. Setting permissions restricts access to authorized users only, while version control ensures that you can trace back to previous iterations of the document if necessary.

Interactive tools for enhanced document management

pdfFiller doesn’t just stop at facilitating edits; it provides a range of interactive tools to enhance document management. Template customization is a fantastic feature that allows users to create a personalized version of the Triton Wealth Management form for future adaptations. Whenever financial information changes, you can update the template rather than starting from scratch.

Integrating a document workflow through pdfFiller enables a seamless transition from filling out forms to submitting them. This can be particularly beneficial for wealth management teams handling multiple submissions. Efficient tracking of changes and updates is critical, as keeping a documented history allows you to address inconsistencies quickly.

Troubleshooting common issues

Despite thorough preparations, issues may arise while filling out or submitting the Triton Wealth Management form. Common questions often revolve around specific field requirements or submission deadlines. The FAQs section on pdfFiller can provide immediate help for these queries.

For more complex problems or technical difficulties, contacting support for assistance is straightforward. pdfFiller offers several support options, including live chat and email support, ensuring that users are never left in the dark.

Ensuring a smooth submission process can hinge on understanding all requirements upfront. Carefully reread your entries, check for missing fields, and double-check the submission instructions provided to avoid any headaches.

Understanding the impact of your form submission

Once the Triton Wealth Management form is submitted, you may wonder about the next steps. Typically, a financial advisor will review your information to develop a comprehensive wealth management strategy. Understanding the implications of your submission can inform your financial decisions moving forward.

The impact on your wealth management goals can be profound. By accurately conveying your investment preferences and financial situation, you set the stage for tailored advice that can optimize portfolio performance and better align with your objectives.

It's also essential to keep your financial information up to date. As circumstances in your life, like income changes or shifts in investment strategies, evolve, revisit and revise your information to ensure continued alignment with your goals.

Feedback and testimonials

User experiences with the Triton Wealth Management process highlight its efficacy in aiding individuals manage complex financial documentation. Many clients appreciate how comprehensive the form is, noting that it brings clarity to their financial standing. Testimonials emphasize how this thoroughness fosters productive discussions with financial advisors.

Furthermore, many users have found that pdfFiller significantly simplifies their document management processes. The platform's intuitive interface allows for seamless document collaboration, ensuring teams can contribute effectively without confusion. This enhanced ease of use encourages users to embrace technology in managing significant financial communications.

Best practices for future document management

Maintaining an organized approach to document management in wealth management is essential for success. Regularly updating your documents and financial details ensures that your advisors continually have the most relevant information at their disposal. Implementing a routine check on your documents can help reinforce this.

Leveraging technology for financial documentation can also be a game-changer. pdfFiller not only simplifies form completion but also provides features that support ongoing engagement with financial documentation. Adopting strategies that emphasize document organization—such as categorizing by date or relevance—can enhance overall efficiency.

Final thoughts on utilizing the Triton Wealth Management PLLC form

Embracing digital document solutions like the Triton Wealth Management PLLC form through platforms such as pdfFiller makes complex financial documentation more manageable. Transitioning from paper-based processes to a cloud-based platform fosters greater accuracy and reduces overhead costs.

pdfFiller enhances the overall experience of managing financial forms, ensuring that users have the tools they need to edit, sign, and manage documents efficiently. Whether an individual investor or part of a large team, utilizing these advanced capabilities can streamline your wealth management journey and help in navigating the intricacies of your financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my triton wealth management pllc directly from Gmail?

How do I edit triton wealth management pllc in Chrome?

How do I edit triton wealth management pllc on an Android device?

What is triton wealth management pllc?

Who is required to file triton wealth management pllc?

How to fill out triton wealth management pllc?

What is the purpose of triton wealth management pllc?

What information must be reported on triton wealth management pllc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.