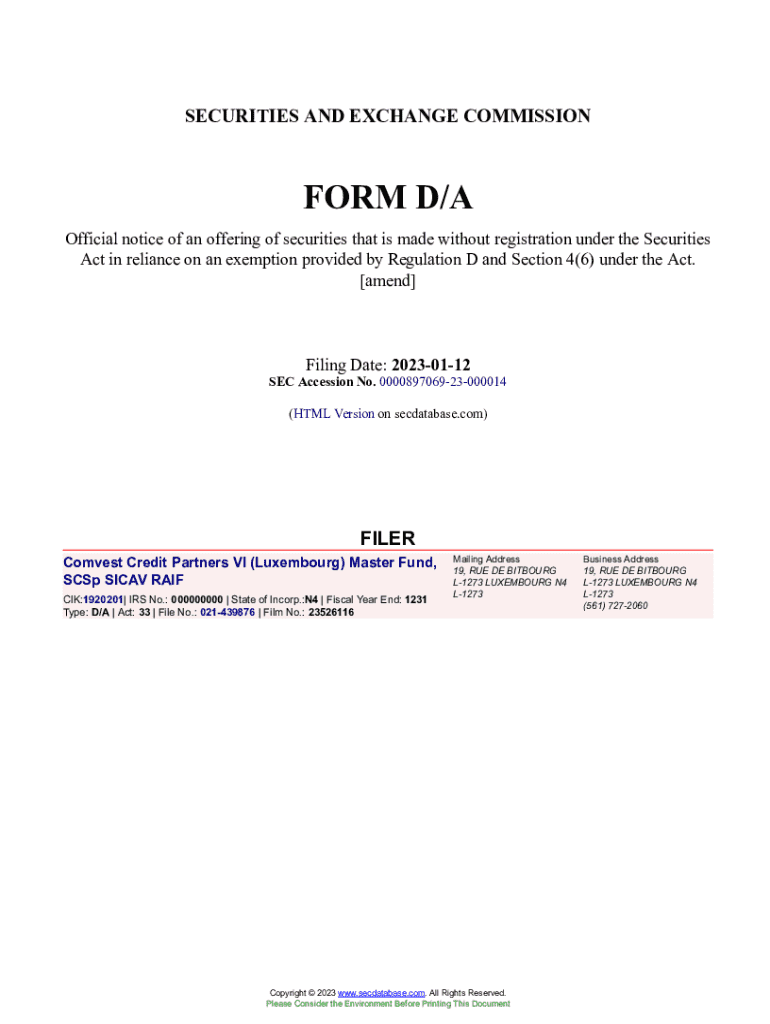

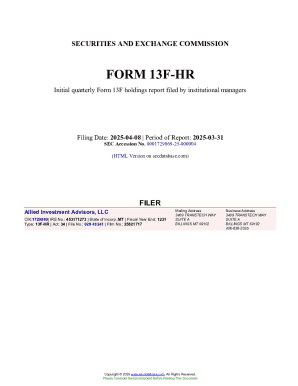

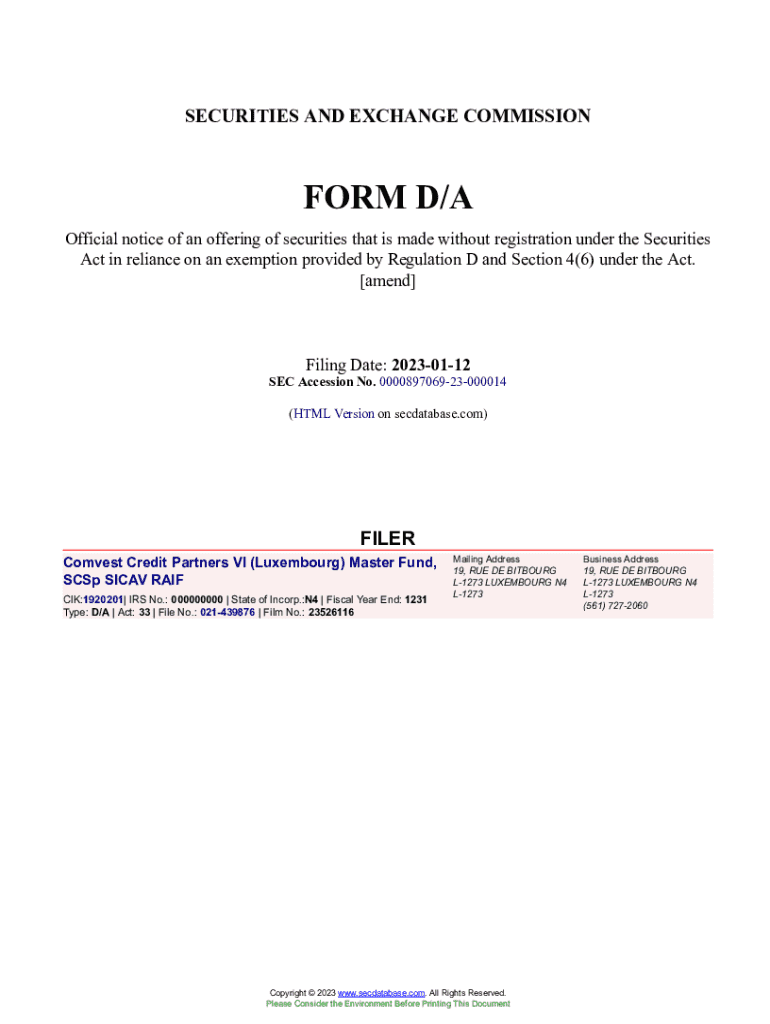

Get the free Comvest Credit Partners VI (Luxembourg) Master Fund, SCSp SICAV RAIF Form D/A Filed ...

Get, Create, Make and Sign comvest credit partners vi

How to edit comvest credit partners vi online

Uncompromising security for your PDF editing and eSignature needs

How to fill out comvest credit partners vi

How to fill out comvest credit partners vi

Who needs comvest credit partners vi?

Your Comprehensive Guide to the Comvest Credit Partners Form

Understanding the Comvest Credit Partners form

The Comvest Credit Partners VI form is a critical document used in various financial transactions, serving as a representation of an investor's commitment to a partnership or investment vehicle. This form plays a central role in documenting and formalizing the intentions and details surrounding investment activities, ensuring transparency and compliance with applicable regulations. Its importance cannot be overstated, as it encapsulates not just financial details but also personal identification elements that are essential in confirming the legitimacy of the parties involved.

Typically, private equity firms, venture capital groups, and other institutional investors utilize the Comvest Credit Partners VI form when engaging in investment opportunities. By understanding the nuanced details of this form, investors can ensure that their submissions meet legal and compliance requirements, thus minimizing potential complications during the investment process.

Preparing to fill out the Comvest Credit Partners form

Before diving into filling out the Comvest Credit Partners VI form, it’s crucial to gather the necessary information and supporting documents to streamline the process and avoid common pitfalls. Essential personal identification information includes your full name, address, social security number, and contact details. This information verifies your identity and aligns with legal requirements surrounding financial transactions.

Furthermore, financial statements and supporting documents are vital to accurately convey your financial standing. This includes not just your income statement and balance sheet but also documentation related to existing investments, assets, liabilities, and any relevant financial certifications or statements that affirm your credibility as an investor. To gather this information efficiently, consider creating a checklist to ensure you have all relevant data at your fingertips before filling out the form.

Step-by-step instructions for completing the Comvest Credit Partners form

Section 1: Personal information

In this section, you will need to accurately fill out fields that register your personal details. Required fields typically include your full legal name, date of birth, and current residential address. It’s essential to ensure that all this information matches your identification documents to avoid delays during processing. Common mistakes to avoid include typos in your name or incorrect address, as any discrepancies can lead to significant issues later on.

Section 2: Financial information

Here, you will report your financial status comprehensively. Begin with a breakdown of your financial statements, including assets and liabilities. Clearly categorize all your possessions, like real estate and liquid assets, while also detailing any debts owed, from loans to credit obligations. A fictional example may clarify this: if you own a home valued at $300,000 but have a mortgage of $200,000, your asset reporting should reflect that accurately to present a true financial picture.

Section 3: Investment details

In this part of the form, it’s critical to clearly articulate the nature of your current investments and the structures they are built upon. Whether you are dealing with private equities, real estate investments, or venture capital, the details will vary significantly. Be mindful to disclose all relevant information that could affect your investment status, as transparency is key in these transactions.

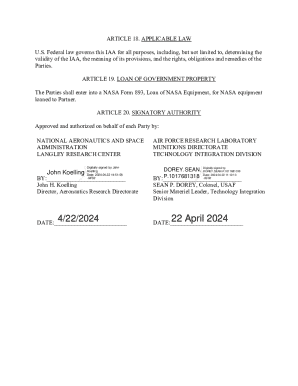

Section 4: Signatory details

This section confirms who is authorized to submit the Comvest Credit Partners VI form on behalf of any entities involved. Make sure that the individuals signing the form have actual compliance or legal authority to do so. For those moving towards digital submissions, ensuring the authentication process for eSignatures is straightforward reduces potential issues. Work with your legal team to confirm the proper protocols are in place.

Utilizing pdfFiller to enhance your experience with the Comvest Credit Partners form

pdfFiller simplifies the process of filling out the Comvest Credit Partners VI form, offering a seamless experience that allows you to upload your documents or utilize available templates. With pdfFiller, users can quickly access the form from anywhere, ensuring that your investment documentation remains organized and manageable.

Editing the Comvest Credit Partners VI form becomes a breeze thanks to the user-friendly interface. Adjustments can be made swiftly, whether you're correcting errors or updating financial data. One of the highlights of using pdfFiller is the collaborative features that allow multiple team members to work on the document efficiently, ensuring that all details are accurately represented.

When it comes to signing, pdfFiller allows users to add digital signatures securely. With straightforward steps to add your signature, you can complete the process without needing to print or scan documents. The security features of pdfFiller’s eSign functionality include encrypted signatures that safeguard your information against unauthorized access, ensuring both compliance and peace of mind.

Managing your completed forms through pdfFiller’s platform facilitates easy storage and organization. Users can effortlessly categorize their forms, making it simpler to find the necessary documents in the future. Additionally, sharing options enhance transparency and foster communication among teams, as shared forms can be viewed and discussed collectively.

Common pitfalls when completing the Comvest Credit Partners form

Completing the Comvest Credit Partners VI form isn’t without its challenges, as several frequent errors can significantly hamper its processing. One common pitfall is the incomplete disclosure of assets or liabilities, which could lead to delays in the approval of investment transactions. Always ensure every part of the form is filled out adequately and truthfully to avoid compliance issues down the line.

Best practices include reviewing your submission thoroughly before sending it off. Taking the time to double-check figures, confirming contact information is correct, and verifying disclosures align with existing documentation can save time and prevent complications. In certain situations, seeking legal or financial advice can enhance your understanding of specific clauses within the form and guarantee comprehensive completion.

Case studies and real-world applications

Examining real-world applications of the Comvest Credit Partners VI form reveals the significant impact that correctly completed forms can have on transactions. For instance, a private equity firm successfully closed a substantial investment by submitting their form with accurate financial and personal data, which streamlined the due diligence process. Properly executed disclosures not only speed up approvals but also help in creating a trustworthy rapport with counterparties.

Testimonials from users of the Comvest Credit Partners VI form highlight satisfaction with the efficiency gained from utilizing pdfFiller. Users report that having a well-structured form filled out correctly led to faster response times from investment counterparts and facilitated smoother negotiations. The importance of transparency and compliance has never been more evident than in these successful case studies.

Interactive tools for filling out the Comvest Credit Partners form

To aid in the completion of the Comvest Credit Partners VI form, various interactive tools are available to help streamline the process. Calculators and estimators can assist in determining appropriate values for assets and liabilities, ensuring accuracy as you report your financial standing. These tools can be invaluable, especially when navigating complex components of the form.

Furthermore, using interactive guides can make it easier to navigate complicated sections. These guides often include step-by-step instructions alongside visual aids to clarify expectations, which can minimize user error. Additionally, questionnaires designed to gather necessary information facilitate a smoother flow of data entry, ensuring that no critical element is overlooked.

Conclusion of the process: Next steps after submission

After submitting the Comvest Credit Partners VI form, it’s essential to know what to expect moving forward. Typically, you may receive feedback or requests for further information from the investment firm as they process your submission. Timely responses to inquiries can significantly facilitate the overall efficiency of the investment evaluation.

Follow-up procedures might include additional meetings or discussions regarding your investment proposal. Keeping communication lines open with Comvest Credit Partners is crucial, as it ensures clarity and reinforces trust. For any issues that arise post-submission, consulting with legal or financial advisors can provide guidance based on your unique circumstances, helping you align with the necessary compliance requirements.

Frequently asked questions (FAQs) about the Comvest Credit Partners form

It's common to have questions regarding the Comvest Credit Partners VI form's intricate details. Some frequently asked questions include, 'What if I need to make changes after submission?' and 'How long does it take to process the form?' Understanding these aspects will offer clarity to users, helping them navigate the complexities of investment documentation effectively.

Clarifications on the most confusing aspects of the form, such as specific documentation required or expected timelines for response, can alleviate stress and enhance user experience. By providing detailed answers to these queries, users are better equipped to handle their submissions efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify comvest credit partners vi without leaving Google Drive?

How do I complete comvest credit partners vi online?

How can I fill out comvest credit partners vi on an iOS device?

What is comvest credit partners vi?

Who is required to file comvest credit partners vi?

How to fill out comvest credit partners vi?

What is the purpose of comvest credit partners vi?

What information must be reported on comvest credit partners vi?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.