Get the free Mortgage Redundancy

Get, Create, Make and Sign mortgage redundancy

How to edit mortgage redundancy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage redundancy

How to fill out mortgage redundancy

Who needs mortgage redundancy?

Mortgage redundancy form: How to navigate your mortgage obligations in tough times

Understanding mortgage redundancy: What you need to know

When you experience redundancy, it can have a profound impact on your finances, especially if you have a mortgage. Redundancy means losing your job, which immediately affects your income stream. With your salary gone, your ability to meet monthly mortgage obligations can become strained. Understanding how redundancy affects your financial situation is key to navigating these challenges.

Mortgage obligations are legal responsibilities. If you fail to meet your payment schedule, you risk entering a spiral of debt that may lead to foreclosure. Early intervention is crucial. As soon as you realize that redundancy is affecting your finances, it is essential to address potential mortgage issues to prevent them from escalating.

Assessing your financial situation post-redundancy

After being made redundant, the first step is to evaluate your financial health. This includes a thorough review of your income versus expenses. Understanding precisely where your financial standing lies will help you make informed decisions moving forward.

Once you have a clear picture of your finances, calculate potential budget adjustments. Utilize tools like budget templates available on pdfFiller to track your income and expenses systematically.

Options to consider when facing redundancy

Facing redundancy forces individuals to confront tough choices regarding their mortgage. However, there are various options available.

Begin by considering temporary measures for your mortgage payments.

Additionally, claim financial protection through mortgage payment protection insurance (MPPI). Understand the steps to file a claim, and what documentation is required. Distinguish between MPPI and unemployment benefits, as they serve different purposes.

Exploring government assistance programs is also vital. Familiarize yourself with any unemployment benefits or financial aids you might qualify for, including eligibility criteria and how to apply.

Engaging with your lender

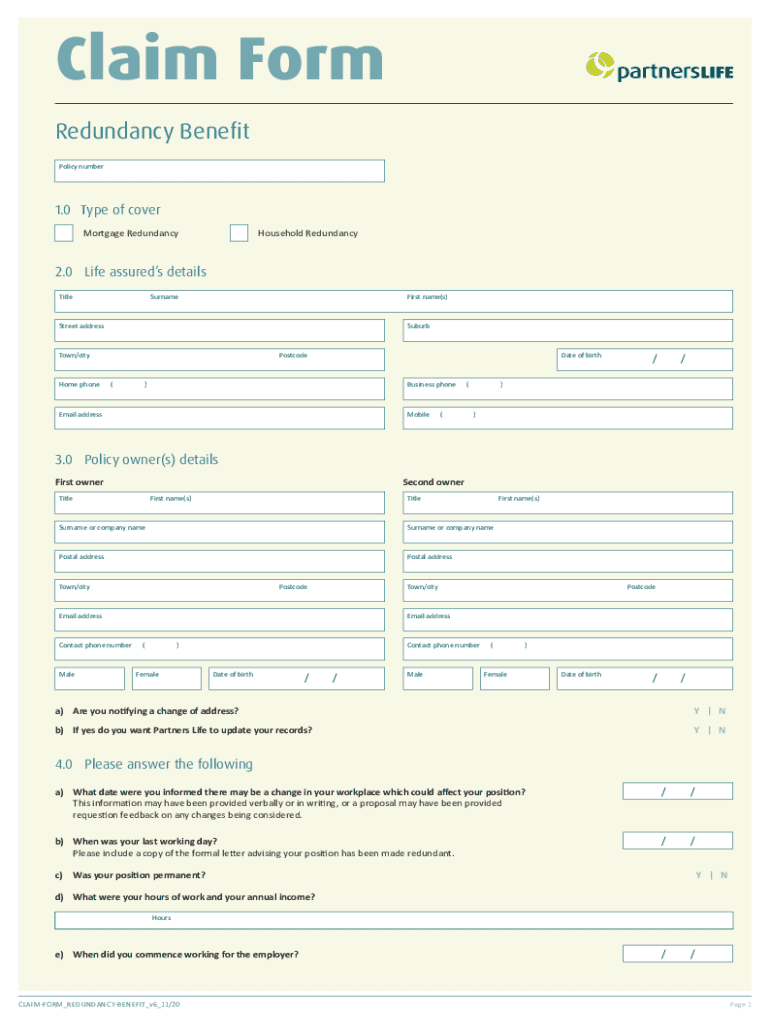

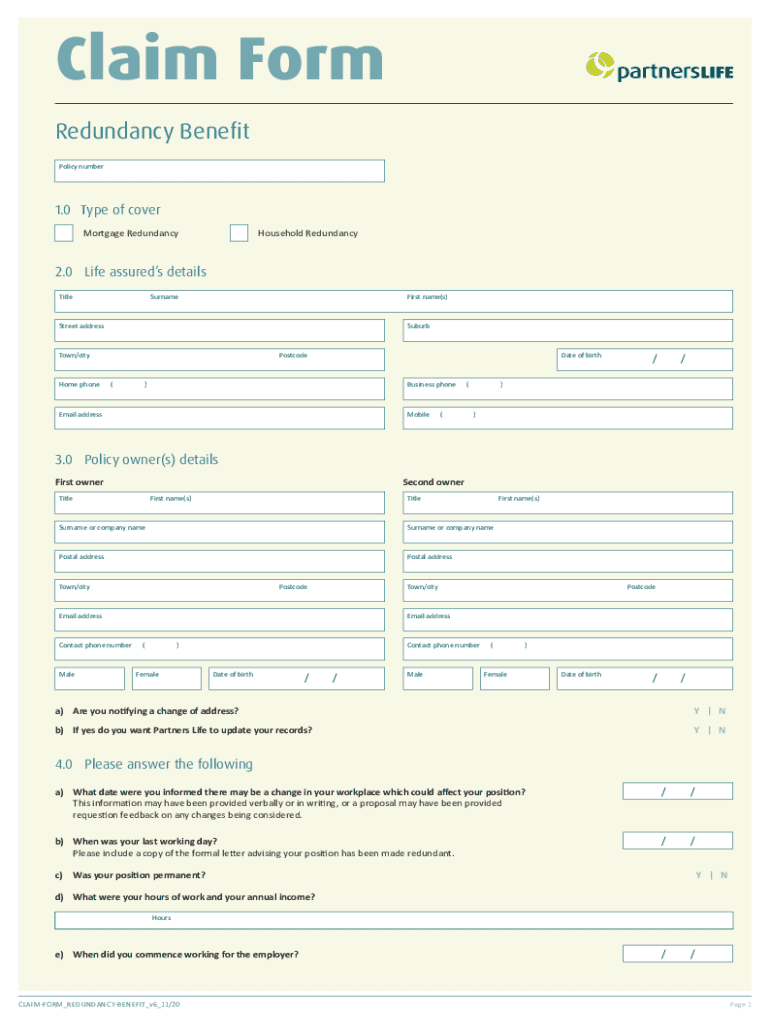

Communication with your lender is crucial when facing redundancy. Prepare for a conversation by gathering necessary documents, including the mortgage redundancy form, which outlines your current financial state.

Understanding the potential solutions and negotiating with your lender can greatly alleviate financial pressure during this difficult time.

Essential tools for managing documentation

Managing documentation during redundancy is essential. Using pdfFiller to fill out the mortgage redundancy form effectively will streamline your efforts. Follow this step-by-step guide for completing the form online:

eSigning the mortgage redundancy form using a cloud-based platform has additional benefits. This method allows for quick and secure signing, reducing the hassle of physical document handling.

Financial planning for the future

Post-redundancy, a solid financial recovery plan is crucial. One of the first steps is reassessing your mortgage and loan options. Gather all necessary information regarding your outstanding debts and available refinancing options to make informed decisions.

Exploring alternative income sources can also provide stability in uncertain times. Consider leveraging skills or pursuing freelance work to generate additional income. Don't overlook the importance of maintaining good communication with your lenders and financial advisors; they can offer invaluable assistance and insights tailored to your financial circumstances.

Community and professional support networks

Engaging with community and professional support networks is vital during redundancy. Financial advisors or mortgage counselors can provide you with expert guidance tailored to your unique situation. Don't hesitate to reach out for support—there are many resources designed to help you.

Moreover, consider connecting with support groups focused on redundancy stress management. Sharing experiences and learning from others can make a significant difference in coping during these challenging times.

Frequently asked questions about mortgage redundancy

It's common to have questions surrounding mortgage obligations during redundancy.

Additional tips for document management and preparation

Utilizing tools like pdfFiller can enhance your document management while dealing with redundancy. Maximize benefits by regularly updating and organizing your documents for easy retrieval during this turbulent time.

Creating templates for frequently used forms, such as the mortgage redundancy form, can streamline your efforts and reduce stress. Maintain both digital and printed copies as a backup, ensuring you're always prepared.

Conclusion of the process

Navigating redundancy and mortgage obligations is challenging but not insurmountable. By understanding your financial options, communicating effectively with your lender, and utilizing essential tools like pdfFiller, you can manage this stressful period with confidence.

Take control of the situation by being proactive and informed. Remember, there are resources and people willing to support you through this process, providing peace of mind during difficult times.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortgage redundancy for eSignature?

How do I edit mortgage redundancy online?

How do I complete mortgage redundancy on an Android device?

What is mortgage redundancy?

Who is required to file mortgage redundancy?

How to fill out mortgage redundancy?

What is the purpose of mortgage redundancy?

What information must be reported on mortgage redundancy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.