Get the free Reverse Mortgage Power of Attorney Template

Show details

This document serves as a legally compliant Power of Attorney that grants authority to the designated Agent to act on behalf of the Principal regarding matters related to a reverse mortgage.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is reverse mortgage power of

A reverse mortgage power of attorney is a legal document that allows a designated individual to manage and execute reverse mortgage transactions on behalf of a borrower.

pdfFiller scores top ratings on review platforms

ITS AN AWESOME SOFTWARE

Excellent service!

excellent

An easy way to fill your docs

Great Service

I enjoy the service, it's easy to navigate via computer or phone.

Good to use this applications

good

its a very good app to have for business

Who needs reverse mortgage power of?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Reverse Mortgage Power of Attorney

This guide provides a detailed approach to understanding how to fill out a reverse mortgage power of attorney form, focusing on key aspects that ensure clarity and compliance.

Understanding the purpose of a power of attorney for reverse mortgages

A Power of Attorney (POA) in the context of reverse mortgages is a legal document allowing someone (the agent) to make decisions on behalf of another (the principal) regarding financial matters, particularly those related to real estate. Having a POA is essential for managing a reverse mortgage, as it grants authority to navigate complex financial interactions with lenders. This arrangement can simplify the process for families dealing with the mortgage's intricacies.

-

A legal document that allows one person to act on another's behalf.

-

It provides clarity and simplifies management of the reverse mortgage.

-

Helps reduce confusion and stress during financial decision-making.

Key parties involved in a power of attorney

Understanding the roles of the principal and agent is vital when creating a Power of Attorney for reverse mortgages. The principal is the person granting authority while the agent is entrusted with making decisions. Ensuring that accurate details like names, addresses, and birthdates are included is crucial to the POA's effectiveness.

-

The individual who grants power to another and can revoke it at any time.

-

The trusted individual who makes decisions and takes actions for the principal.

-

Incorrect information may invalidate the document or cause delays.

Essential definitions to know

Familiarizing oneself with specific definitions associated with the Power of Attorney is crucial. The principal is the person who conveys authority, while the agent is a trusted party who acts on behalf of the principal. A Durable Power of Attorney remains valid even if the principal becomes incapacitated, whereas revocation involves rescinding the authority granted to the agent.

-

The individual granting the power.

-

Individual trusted to act on the principal's behalf.

-

Remains effective despite the principal's incapacity.

-

The process through which the Power of Attorney can be cancelled.

Scope of authority granted to the agent

The agent's authority under the Power of Attorney encompasses a range of responsibilities, specifically related to the management of reverse mortgages. This includes handling finances, executing necessary documentation, and communicating with lenders. It's essential to delineate these responsibilities clearly to avoid future disputes.

-

Overseeing all monetary aspects related to the reverse mortgage.

-

Filing necessary paperwork with appropriate authorities.

-

Establishing direct connections with financial institutions for better management.

-

Making crucial decisions concerning the property tied to the mortgage.

Limitations of authority for the agent

Despite the significant powers an agent may hold, certain restrictions must be followed. Agents are typically prohibited from transferring property ownership or altering beneficiaries linked to the reverse mortgage. Understanding these limitations helps clarify both parties' responsibilities, ensuring compliance with the overarching legal framework.

-

Agents cannot transfer ownership of the property to another person.

-

No person can change who benefits from the reverse mortgage without the principal's consent.

-

Clarifying restrictions protects the principal's interests and guides the agent's actions.

Effective date and duration of the power of attorney

Setting an effective date for a Power of Attorney is paramount. Determining when authority begins and understanding how long it lasts ensures both parties are on the same page regarding its use. Conditions under which the POA may terminate are equally important and must be outlined clearly in the document.

-

Specify when the agent can begin to act under the authority.

-

Define how long the authority is valid to avoid confusion.

-

Identify when the Power of Attorney will end to provide clarity.

Revocation clause explained

The revocation clause details the procedures for the principal to rescind a previously granted Power of Attorney. It highlights the importance of providing written notice to the agent and any necessary parties involved, establishing clear communication to avoid misunderstandings.

-

Outline the principal's steps to cancel the Power of Attorney.

-

Notify agents and critical parties to ensure no actions are taken under the revoked authority.

-

Understanding how revocation affects ongoing obligations and potential liabilities.

Governing laws related to power of attorney documents

Powers of Attorney are governed by specific legal frameworks that vary by state, especially concerning reverse mortgages. Understanding these regulations is vital for ensuring compliance with local laws and avoiding potential legal issues related to the document.

-

Insight into the laws regulating Powers of Attorney across different states.

-

Different jurisdictions may have unique needs for valid POA documents.

-

Ensuring documents align with state laws prevents legal challenges.

Signing and notarization requirements

A valid Power of Attorney often requires signatures and notarization to be legally binding. This ensures that the document is legitimate and recognized by authorities. It is also essential to have witnesses present during the signing process to reinforce authenticity.

-

Signatures must be clear and matched against official identification.

-

Involves a notary public validating identities and witnessing the signing.

-

Some states require third-party witnesses to confirm the signing process.

Utilizing pdfFiller for creating and managing your power of attorney

Using pdfFiller’s cloud-based platform allows for streamlined document creation and management. The platform offers interactive tools for filling out the Power of Attorney form and collaboration features, making the reverse mortgage process smoother for both individuals and teams.

-

Users can easily edit and eSign documents directly on the platform.

-

Customize the Power of Attorney form to suit your specific needs.

-

Teams can work together efficiently, ensuring all documents are completed accurately.

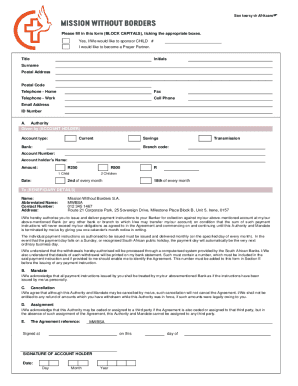

How to fill out the reverse mortgage power of

-

1.Visit the pdfFiller website and log in to your account or create a new one.

-

2.Search for 'reverse mortgage power of' template in the template library or upload your own document.

-

3.Open the document in the editor for customization.

-

4.Start by filling in the name and contact information of the borrower at the top of the document.

-

5.Assign a trusted individual as the Agent by providing their full name and contact information in the appropriate section.

-

6.Specify the powers granted to the Agent regarding reverse mortgage transactions, ensuring to detail any limitations if necessary.

-

7.Review the document for accuracy, ensuring all sections are completed properly, including signatures where required.

-

8.Once satisfied, save your changes and download the completed document or send it directly to the relevant institution for processing.

What is a Reverse Mortgage Power of Attorney Template?

A Reverse Mortgage Power of Attorney Template is a legal document that allows an individual to designate another person to manage their reverse mortgage transactions on their behalf. This template simplifies the process of handling financial matters related to reverse mortgages, ensuring that actions can be taken when the original homeowner is not able to do so. Utilizing a well-structured Reverse Mortgage Power of Attorney Template can protect your interests and streamline communication with lenders.

Why is a Reverse Mortgage Power of Attorney Template important?

The importance of a Reverse Mortgage Power of Attorney Template lies in its ability to provide a clear and legal framework for someone to act on your behalf regarding reverse mortgage decisions. In situations where homeowners may become incapacitated or unable to manage their financial affairs, this template ensures that their wishes are properly communicated and respected. It also helps to prevent potential disputes among family members about who should handle such significant financial transactions.

How do I create a Reverse Mortgage Power of Attorney Template?

Creating a Reverse Mortgage Power of Attorney Template can be accomplished through various means, including using contract creation tools like pdfFiller. To start, gather the necessary information about the parties involved and the specific powers being granted. A carefully crafted template can help ensure that all relevant details are included, making it valid and effective in managing reverse mortgage responsibilities.

Who should I designate in my Reverse Mortgage Power of Attorney Template?

When choosing who to designate in your Reverse Mortgage Power of Attorney Template, consider selecting someone trustworthy and reliable, such as a family member or a close friend. This individual will have access to crucial financial decisions and must understand your goals concerning the reverse mortgage. Take the time to discuss your intentions with them beforehand to ensure they are willing and prepared to take on this responsibility.

Can I revoke a Reverse Mortgage Power of Attorney Template?

Yes, a Reverse Mortgage Power of Attorney Template can be revoked at any time, provided that you are mentally competent to do so. To revoke it, a written notice should be prepared, clearly stating your decision to cancel the powers granted. It is essential to inform the designated agent and any relevant financial institutions to prevent any unauthorized actions based on the prior template.

What are the potential risks of not using a Reverse Mortgage Power of Attorney Template?

Not using a Reverse Mortgage Power of Attorney Template can lead to significant risks, especially if unforeseen circumstances arise that render you unable to manage your reverse mortgage. Without a formalized template, decisions regarding your financial affairs may rest in the hands of individuals who are not familiar with your wishes, potentially leading to poor financial outcomes. Utilizing a Reverse Mortgage Power of Attorney Template mitigates these risks by ensuring your preferences are documented and followed diligently.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.