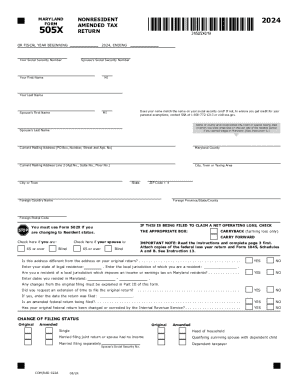

MD Comptroller 505X 2023 free printable template

Show details

Enter a complete explanation in Part III of Form 505X. COMPLETE PAGES 3 AND 4 OF FORM 505X. PART I Enter the amount of income or loss from your federal return as corrected in Column A. Marylandtaxes. gov or from any office of the Revenue amended return. Enter any interest due on line 26 of Form 505X. Provide the dates you resided in Maryland for the tax year and explain any changes from your original filing in Part III of Form 505X. Explain each change in Part III of Form 505X and attach any...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign maryland 505 form

Edit your maryland 505 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maryland 505 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit maryland form 505 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit md form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Comptroller 505X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out maryland form 505

How to fill out MD Comptroller 505X

01

Download the MD Comptroller 505X form from the official website.

02

Read the instructions carefully before filling out the form.

03

Begin with providing your personal details in the designated sections.

04

Fill in the required financial information accurately.

05

Provide any necessary attachments, such as supporting documents, if required.

06

Review the completed form for any errors or omissions.

07

Sign and date the form where indicated.

08

Submit the form by the specified deadline through the appropriate channel.

Who needs MD Comptroller 505X?

01

Individuals or entities who have made an error on their previous MD Comptroller tax filings.

02

Taxpayers needing to correct or amend their tax returns.

03

Anyone seeking to claim a refund based on updated information.

Fill

form 505nr maryland

: Try Risk Free

People Also Ask about maryland state income tax

How to calculate tax?

What is the sales tax formula? Sales tax rate = Sales tax percent / 100. Sales tax = List price x Sales tax rate.

Is Maryland tax friendly?

The Maryland tax system is actually quite friendly to shoppers, though. Like Michigan, there's a 6% state sales tax, but that's it – there are no additional local sales taxes to pay. That means the overall state and local sales tax burden on Marylanders is below average.

What is Maryland tax rate 2022?

Maryland has a 6.00 percent state sales tax rate and does not levy any local sales taxes. Maryland's tax system ranks 46th overall on our 2022 State Business Tax Climate Index.

Are Maryland taxes too high?

The Maryland tax system is actually quite friendly to shoppers, though. Like Michigan, there's a 6% state sales tax, but that's it – there are no additional local sales taxes to pay. That means the overall state and local sales tax burden on Marylanders is below average.

How do you calculate Maryland sales tax?

Maryland has a 6% statewide sales tax rate, and does not allow local governments to collect sales taxes. This means that the applicable sales tax rate is the same no matter where you are in Maryland. Simplify Maryland sales tax compliance!

What are Maryland taxes on $30000?

If you make $30,000 a year living in the region of Maryland, USA, you will be taxed $5,447. That means that your net pay will be $24,554 per year, or $2,046 per month. Your average tax rate is 18.2% and your marginal tax rate is 24.4%.

How much federal tax do I pay on $33000?

If you make $33,000 a year living in the region of California, USA, you will be taxed $5,740. That means that your net pay will be $27,260 per year, or $2,272 per month. Your average tax rate is 17.4% and your marginal tax rate is 25.2%.

How much do I pay in taxes for $30000?

If you make $30,000 a year living in the region of California, USA, you will be taxed $3,411. Your average tax rate is 6.32% and your marginal tax rate is 12%.

What are the taxes like in Maryland?

For tax year 2021, Maryland's personal tax rates begin at 2% on the first $1000 of taxable income and increase up to a maximum of 5.75% on incomes exceeding $250,000 (or $300,000 for taxpayers filing jointly, heads of household, or qualifying widow(ers).

What is the most tax friendly state?

1. Wyoming Taxes State Income Tax Range: None. Average Combined State and Local Sales Tax Rate: 5.36% Median Property Tax Rate: $545 per $100,000 of assessed home value.

How much is tax in Maryland?

For tax year 2021, Maryland's personal tax rates begin at 2% on the first $1000 of taxable income and increase up to a maximum of 5.75% on incomes exceeding $250,000 (or $300,000 for taxpayers filing jointly, heads of household, or qualifying widow(ers).

What is the state income tax for Maryland?

For tax year 2021, Maryland's personal tax rates begin at 2% on the first $1000 of taxable income and increase up to a maximum of 5.75% on incomes exceeding $250,000 (or $300,000 for taxpayers filing jointly, heads of household, or qualifying widow(ers).

What is Maryland State tax 2022?

Maryland Tax Rates, Collections, and Burdens Maryland has a 8.25 percent corporate income tax rate. Maryland has a 6.00 percent state sales tax rate and does not levy any local sales taxes. Maryland's tax system ranks 46th overall on our 2022 State Business Tax Climate Index.

What is the Maryland state tax rate for 2022?

Maryland has a 8.25 percent corporate income tax rate. Maryland has a 6.00 percent state sales tax rate and does not levy any local sales taxes.

What will the 2022 tax rates be?

The 2022 Income Tax Brackets (Taxes due April 2023) For the 2022 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket is determined by your filing status and taxable income.

How much tax is on a dollar in Maryland?

Every time you purchase taxable tangible goods, whether in person, over the phone, or on the Internet, the purchase is subject to Maryland's 6 percent sales and use tax if you use the merchandise in Maryland.

What percentage does Maryland take out for taxes?

For tax year 2021, Maryland's personal tax rates begin at 2% on the first $1000 of taxable income and increase up to a maximum of 5.75% on incomes exceeding $250,000 (or $300,000 for taxpayers filing jointly, heads of household, or qualifying widow(ers).

What is the Maryland standard deduction for 2022?

The standard deduction amounts for the State of Maryland have changed as follows: The minimum Standard Deduction has changed from $1,550 to $1,600. The maximum Standard Deduction has changed from $2,350 to $2,400.

Is Maryland a good tax state?

Maryland has a 6.00 percent state sales tax rate and does not levy any local sales taxes. Maryland's tax system ranks 46th overall on our 2022 State Business Tax Climate Index.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify maryland income tax rate without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your maryland income tax into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send maryland tax brackets 2025 for eSignature?

Once your maryland state income tax rate is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute 505x online?

pdfFiller makes it easy to finish and sign maryland tax brackets online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

What is MD Comptroller 505X?

MD Comptroller 505X is a tax form used in the state of Maryland for reporting certain tax information, including the collection and remittance of various taxes.

Who is required to file MD Comptroller 505X?

Businesses and individuals who have specific tax obligations in Maryland, particularly those involved in activities subject to the taxes covered by the form, are required to file MD Comptroller 505X.

How to fill out MD Comptroller 505X?

To fill out MD Comptroller 505X, gather the necessary financial and tax information, complete the provided fields on the form accurately, and ensure that all required attachments and documentation are included before submitting.

What is the purpose of MD Comptroller 505X?

The purpose of MD Comptroller 505X is to provide the Maryland Comptroller's office with the necessary information to assess tax liabilities, ensure compliance with tax laws, and facilitate the collection of taxes due.

What information must be reported on MD Comptroller 505X?

The information that must be reported on MD Comptroller 505X typically includes business identification, income details, tax amounts owed, and other relevant financial data pertinent to the taxes being reported.

Fill out your MD Comptroller 505X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maryland State Tax Rate is not the form you're looking for?Search for another form here.

Keywords relevant to md state income tax rate

Related to maryland state tax brackets

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.