Get the free Title Report for Property Template

Show details

This Title Report documents the ownership and encumbrances associated with real property, intended for use in transactions involving the transfer of interests in the property.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is title report for property

A title report for property is a document that outlines the ownership history and claims against a property, ensuring that a buyer can acquire clear title.

pdfFiller scores top ratings on review platforms

What do you like best?

I love how easy it is to navigate. the User-functionality makes it very easy to use and know how to create new content.

What do you dislike?

I wish there was a more user friendly version in IOS or Android App Store.

Recommendations to others considering the product:

There is so much this Program can do. If you have the time, watch videos and contact the support team to ask questions about how to use this effectively.

What problems are you solving with the product? What benefits have you realized?

I have not had many problems because of how easy it is to use. I wish there were more payment options to choose from though.

This has everything I need plus more…

This has everything I need plus more and it's not hard to use. No training involved - thank goodness! Can just jump right in and get going. So far, I'm loving pdfFiller. Thank you developers!

this program is top notch amazing

everything is working perfect so far

Great

Great, except the last minute free trial after creating first document

Perfect for all my business needs. I use for signatures, fillable workbooks.. Always great, speedy support.

Who needs title report for property?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Title Report for Property

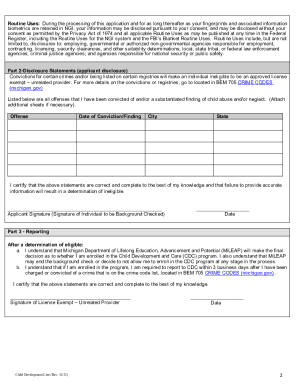

How to fill out a title report for property form

Filling out a title report for property is essential for understanding property ownership and encumbrances. This process involves gathering necessary documents, accurately filling out the form, and submitting it for review. Here, we provide a comprehensive overview to ensure you navigate this essential paperwork effectively.

Understanding the title report

A title report is a critical document in property transactions, providing insight into the ownership and legal status of a property. It plays a pivotal role in protecting both buyers and lenders by ensuring clear title and revealing any encumbrances, like liens or mortgages, that may affect ownership.

What are the key components of a title report?

-

This section verifies the current owner of the property, ensuring the seller has the legal right to sell it.

-

This provides precise boundaries and measurements of the property, which is vital for all transactions.

-

Highlights any claims against the property, like mortgages or liens, which can impact its value.

-

Details the responsibilities of sellers, buyers, and other stakeholders, ensuring accountability.

Who are the parties involved in the title report?

In any property transaction, the primary parties include the seller and buyer, each with distinct responsibilities. The seller must disclose all relevant information included in the title report, while the buyer needs to understand the implications before finalizing the sale. Effective communication is critical in this process.

How to navigate encumbrances in title reports?

-

Encumbrances, such as mortgages and liens, are legal claims against the property that need addressing before a sale.

-

These claims can complicate ownership, potentially resulting in legal disputes or additional costs for the buyer.

-

It's crucial for buyers to know how to dispute or correct any encumbrances listed in the report for a clear title.

What is the step-by-step process for completing a title report?

-

Collect all relevant documents, such as prior deeds, tax records, and any existing mortgage agreements.

-

Ensure all sections are accurately filled following the required formats to minimize processing delays.

-

Once completed, submit the title report to your local clerk or title company for review and processing.

-

Use pdfFiller to edit, eSign, and manage your title report, providing a seamless digital solution for document management.

What costs are associated with title reports?

-

The cost of obtaining a title report typically ranges from $300 to $1,000, depending on property details.

-

Factors such as location, size of the property, and complexity of the title history can influence prices.

-

It's wise to set aside a budget for title report-related expenses, including potential attorney fees.

How to understand turnaround times for title reports?

Typically, you can expect to receive a title report within several days to a few weeks. Turnaround times can be affected by the complexity of the property’s title history and the workload of the title company. It's advisable to communicate with the title company during this period to manage expectations.

What legal considerations are there regarding title reports?

-

Each state has unique regulations pertaining to title reports, which can affect the process and the necessity of certain disclosures.

-

Review local laws to ensure that your title report complies with state regulations and standards.

-

Failing to review a title report can lead to legal issues post-purchase, such as claims against the property.

How to finalize your title report?

-

Always review the report for correctness of information to avoid potential disputes.

-

Make sure all involved parties sign the document, as required, to formalize the agreement.

-

Keep a copy of the finalized title report for your records, as it may be needed for future transactions.

How does pdfFiller facilitate document management?

pdfFiller provides robust features for editing PDFs, including digital signing and collaborative tools designed for teams working on property transactions. By using pdfFiller, you streamline the management of your title documents, all from a single cloud-based platform. This enhances efficiency and maintains organization throughout the process.

How to fill out the title report for property

-

1.1. Start by opening the title report form on pdfFiller.

-

2.2. Enter the property address in the designated field to specify the location.

-

3.3. Fill in the owner's name, ensuring it matches official records.

-

4.4. Input the property identification number or parcel number for accurate identification.

-

5.5. Review and fill out any specific details required about liens or easements associated with the property.

-

6.6. Verify information against existing property documents to ensure accuracy.

-

7.7. Include contact information for the current owner and any co-owners, if applicable.

-

8.8. Double-check the entries for typos or missing data before submitting.

-

9.9. Once all fields are correctly filled, save or submit the report as per the instructions given on pdfFiller to complete the process.

What is a Title Report for Property Template?

A Title Report for Property Template is a comprehensive document that outlines the legal status of a property, including ownership details and any liens or encumbrances. It serves as a vital resource for buyers, sellers, and investors to understand the property's history and potential issues before a transaction. Utilizing a template can streamline the process, ensuring all necessary information is included.

Why should I use a Title Report for Property Template when buying a property?

Using a Title Report for Property Template when buying a property is essential for informed decision-making. It provides critical insights into the property’s title, helping you to identify any potential legal challenges or claims against it. This template can save you time and money, making sure you avoid pitfalls that could arise from unclear or disputed ownership.

How can pdfFiller assist me with creating a Title Report for Property Template?

pdfFiller offers an easy-to-use platform that allows you to create and customize a Title Report for Property Template efficiently. You can access a variety of templates that can be edited directly in your browser, ensuring that all information is accurate and up-to-date. Additionally, pdfFiller supports collaboration, enabling you to work with other stakeholders seamlessly.

What information should be included in a Title Report for Property Template?

A comprehensive Title Report for Property Template should include the property's legal description, current owner details, any existing mortgages or liens, and any restrictions or easements. This information not only clarifies ownership but also highlights any potential legal issues. By utilizing a template, you can ensure that all relevant sections are covered, safeguarding your interests.

Can a Title Report for Property Template help in refinancing a mortgage?

Yes, a Title Report for Property Template can be highly beneficial when refinancing a mortgage. It provides lenders with the necessary background information about the property’s title, confirming that there are no outstanding issues. By presenting a clear Title Report for Property Template, you can expedite your refinancing process, making it more efficient and straightforward.

Is there a difference between a Title Report and a Title Insurance Policy?

Yes, a Title Report for Property Template and a Title Insurance Policy serve different purposes. The Title Report provides an overview of the property's legal status and any existing claims, while Title Insurance protects the buyer against future claims that may arise after the purchase. Both are crucial in real estate transactions, and understanding their differences can help you make better-informed choices.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.