Get the free Tax Preparation Knoxville - Amelse & Edmonds Tax Planning

Get, Create, Make and Sign tax preparation knoxville

Editing tax preparation knoxville online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax preparation knoxville

How to fill out tax preparation knoxville

Who needs tax preparation knoxville?

Tax Preparation Knoxville Form: A Comprehensive Guide

Understanding tax preparation in Knoxville

Tax preparation in Knoxville involves adhering to specific local regulations that govern how residents file their taxes. Familiarity with these regulations, including key tax deadlines and state-specific deductions, is crucial for ensuring compliance and maximizing refunds. Tax season deadlines, typically set by the IRS, require diligence from taxpayers to avoid late penalties and to secure timely returns.

Residents of Knoxville can benefit from local tax credits specifically designed for families, such as the earned income tax credit. The more you know about the deductions available in Tennessee, the more you can reduce your taxable income. Understanding local regulations empowers you to keep your financial affairs in order throughout the year.

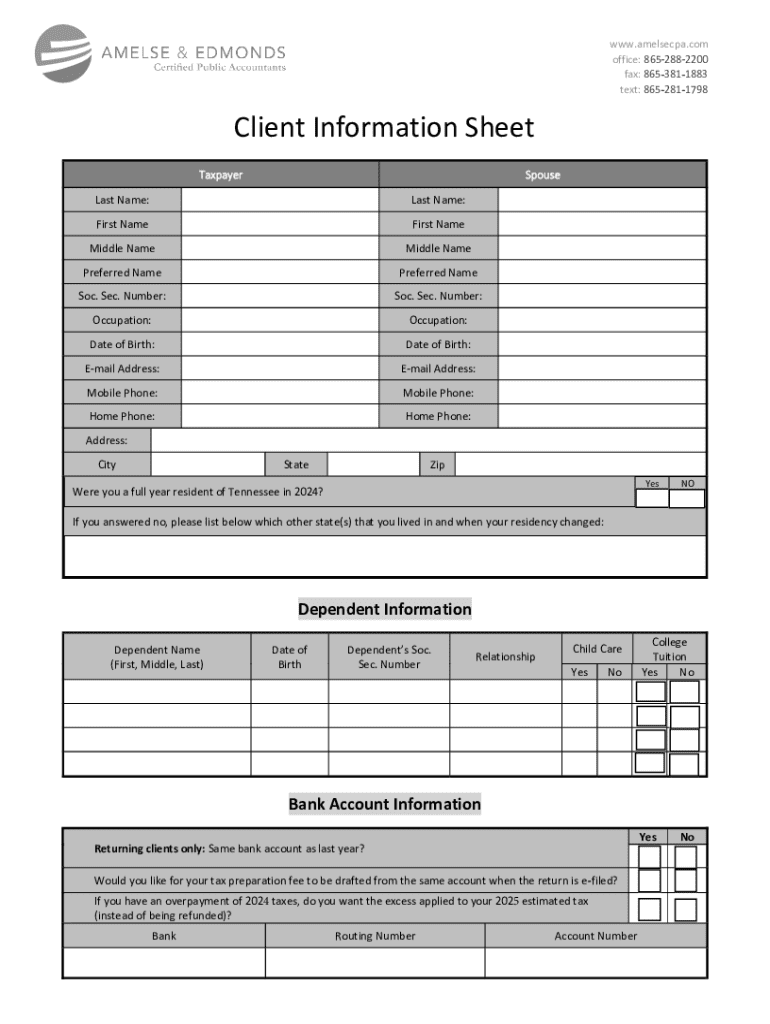

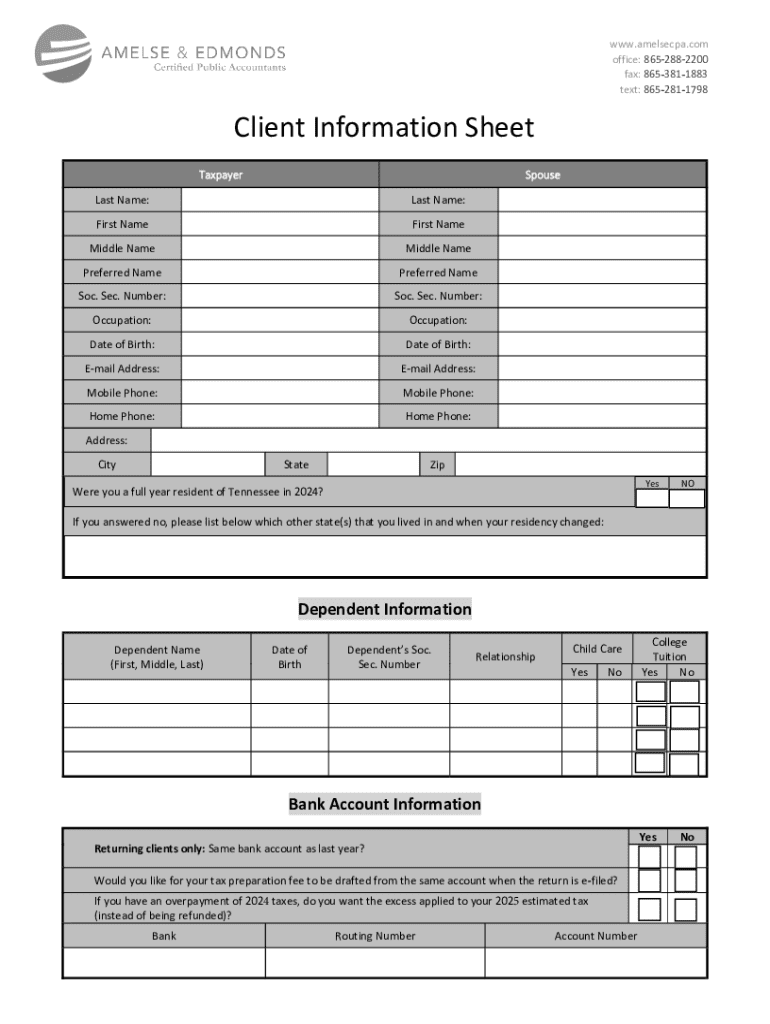

Importance of proper documentation

Maintaining organized financial records simplifies the tax preparation process significantly. Well-organized documentation allows you to produce necessary papers quickly and reduces the chances of errors when filling out forms. Common documents required for tax preparation include W-2 forms, 1099 forms for freelance work, and receipts for deductible expenses.

Additionally, proper documentation supports claims of credits and deductions, providing the evidence needed during potential audits. Families particularly benefit from this preparation by maintaining records of child-related expenses like education costs and healthcare, which can lead to significant tax breaks.

The tax preparation form: A comprehensive guide

Understanding the various types of tax preparation forms is crucial for individuals and businesses alike. The most common individual form is the Form 1040, while businesses might need different templates, including Schedule C or LLC tax forms. Each form serves specific purposes, and knowing which one to use based on personal or business income is key to a smooth filing process.

Knoxville residents primarily use forms like the W-2 for wage income or 1099 for self-employment income. Choosing the right form impacts the potential deductions and credits you can claim. If you're unsure which forms apply to your situation, tools like pdfFiller can guide users through the selection process, making it easier to find the necessary documentation.

Choosing the right form for your needs

Selecting the correct form requires careful consideration of differing factors like income sources and business type. If you're self-employed, your tax obligations change significantly compared to traditional employees. For example, freelance income reported on a 1099 comes with unique deduction potentials, making understanding the forms vital for tax efficiency.

Using tools like pdfFiller can simplify this process by offering an array of templates that help in identifying the right forms based on user responses. This service allows timely preparation and filing, thus reducing last-minute stress during tax season.

Filling out the tax preparation form

Filling out your tax preparation form involves several critical steps. Start by entering your personal information accurately, which typically includes your name, Social Security number, and address. This foundational information should be verified against official documents to prevent submission errors that could delay processing.

Next, you’ll report your income. It is essential to gather forms like your W-2, which reports personal wages, alongside any other income sources such as investments or freelance payments received. Accurate income reporting is vital as discrepancies can lead to audits or penalties.

When claiming deductions and credits, understand whether to take the standard deduction or itemize expenses. Consider filing jointly if married or claiming dependents, as both approaches significantly affect your taxable income.

Finally, after carefully reviewing all information for accuracy, ensure that you sign and submit your form based on the designated guidelines. Keeping a copy for your records is recommended for any future reference required.

Common mistakes to avoid

Some of the most frequent mistakes during tax preparation include misreporting income and overlooking available deductions. Misreporting any income can significantly alter your tax liability and might even trigger an audit. It's crucial to cross-check all forms to ensure that every source of income is accounted for.

Missing out on deductions can be equally damaging. Many taxpayers overlook deductions for common expenses like educational costs or child care, leaving potential money on the table. Conduct thorough research on available credits and routinely review your financial records to identify all possible deductions before submitting the forms.

Editing and managing your tax preparation form with pdfFiller

In the digital age, editing and managing your tax forms has never been easier. By utilizing pdfFiller, users can effectively edit text fields, add necessary information, and even draw or upload signatures to their forms. This digital platform eliminates tedious paperwork while enhancing the overall efficiency of the filing process.

Editing your tax forms with pdfFiller includes features tailored for both beginners and seasoned professionals. Users can modify pre-set templates, ensuring all necessary information aligns accurately. The platform's user-friendly interface is designed specifically for managing tax documents, streamlining the often-daunting tax prep process.

Collaborating with a tax professional

Working with a tax professional adds another layer of assurance during tax season. With pdfFiller, sharing your completed form for review is simple and secure. Whether you require advice on specific deductions or you’re preparing for more complex business tax filings, collaboration helps validate your tax strategy. Tax professionals can assist in identifying past errors that need resolution, especially if you have back taxes.

Using pdfFiller’s comment and annotation features allows streamlined communication. You and your tax professional can make notes directly on the form, ensuring that no detail goes overlooked. This collaborative approach also enhances your understanding of tax responsibilities, equipping you with knowledge for the future.

eSigning your tax preparation form

With the growing adoption of eSignatures, understanding their legality is vital for all tax filers. eSignatures are legally recognized across the United States, making them a viable alternative to traditional handwritten signatures. Using pdfFiller, users can eSign their forms easily, ensuring all necessary approvals are secured swiftly.

To eSign your tax preparation form with pdfFiller, simply draw or upload your signature. This digital method saves time and allows for immediate submission without the need for physical mailing. Once signed, you can quickly send the completed form directly to the IRS or your state tax authority.

Managing your tax preparation documents after submission

After submitting your tax preparation forms, organizing your documents becomes essential. Utilizing cloud-based document management systems simplifies storage and retrieval for future needs. Cloud solutions ensure that your data remains secure and accessible from anywhere, providing peace of mind for both individuals and families when revisiting tax information.

Tracking your tax refund is also vital after submission. Various tools and resources exist to help you monitor the status of your tax return. The IRS provides options to check refund status, ensuring you remain informed throughout the tax refund timeline.

Additional resources for tax preparation in Knoxville

Several local programs offer additional resources for tax preparation, particularly for individuals with limited income or complexities in their financial situation. The Volunteer Income Tax Assistance (VITA) program is an invaluable resource for qualifying taxpayers in Knoxville, providing free tax preparation assistance through trained volunteers.

Similarly, the Tax Counseling for the Elderly (TCE) program assists senior citizens in filing their taxes accurately, ensuring they take advantage of the benefits available to them. These services can dramatically simplify the tax process, particularly for more vulnerable populations.

Online tools and calculators

Utilizing online tools and tax estimation calculators greatly helps individuals assess their tax liabilities and potential refunds. These resources assist in pre-filing evaluations, ensuring accurate planning for payments or refunds. Understanding the available FAQs on tax preparation errors can provide valuable insights for self-filers.

Staying informed: Tax law changes

Tax laws are ever-evolving, and staying informed about changes that may affect Knoxville residents is crucial. Recent legislative updates can introduce new regulations that impact deductions, exemptions, or credits available to taxpayers. Understanding these changes can guide individuals through advantageous strategies during tax season.

To keep up-to-date with tax regulations, implement best practices like subscribing to reliable financial news outlets or government resources. Engaging with local tax experts can also provide insights into specific changes, ensuring you’re aware of how they apply to your financial situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax preparation knoxville in Gmail?

Can I create an electronic signature for the tax preparation knoxville in Chrome?

How do I edit tax preparation knoxville straight from my smartphone?

What is tax preparation knoxville?

Who is required to file tax preparation knoxville?

How to fill out tax preparation knoxville?

What is the purpose of tax preparation knoxville?

What information must be reported on tax preparation knoxville?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.