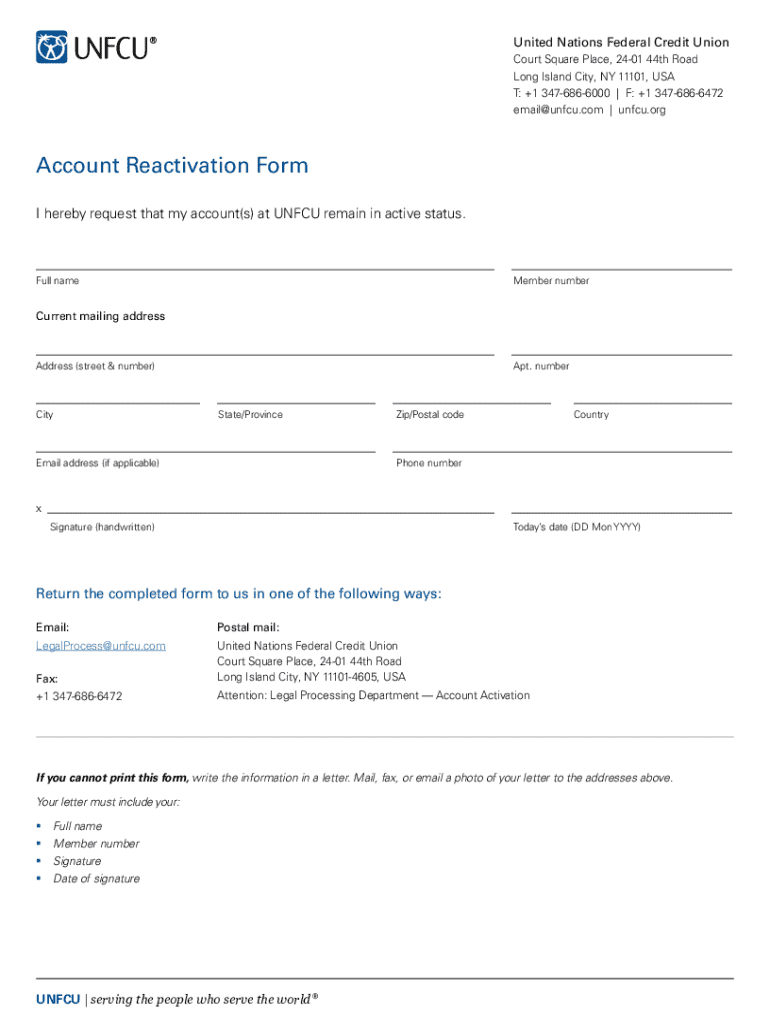

Get the free Account Reactivation Form UNFCU

Get, Create, Make and Sign account reactivation form unfcu

How to edit account reactivation form unfcu online

Uncompromising security for your PDF editing and eSignature needs

How to fill out account reactivation form unfcu

How to fill out account reactivation form unfcu

Who needs account reactivation form unfcu?

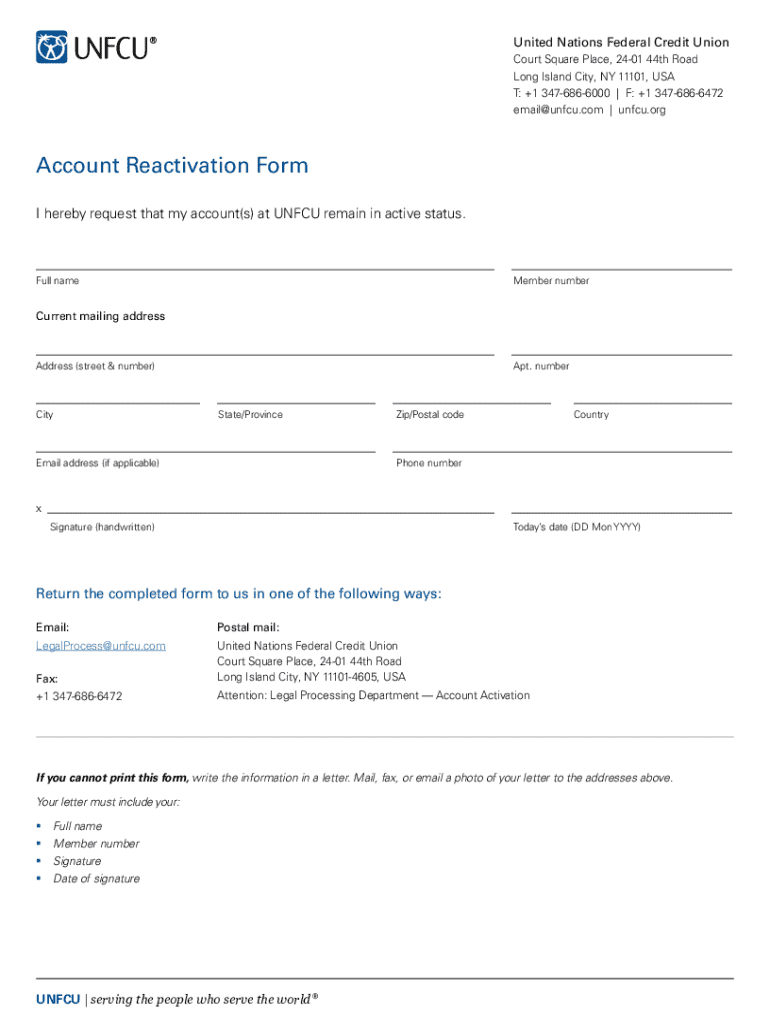

Comprehensive Guide to the Account Reactivation Form at UNFCU

Understanding the account reactivation process

Reactivating your account at UNFCU is a critical step for members who wish to regain access to their funds and financial services. The process can vary in complexity based on the reason for deactivation, but understanding the significance and requirements is vital. Reactivating your account ensures that you can continue enjoying the benefits of membership, such as access to competitive lending options and services tailored to member needs.

Eligibility for reactivation typically requires that your account has been inactive or closed for a specific duration, often due to inactivity or a request for closure. Members need to confirm that they meet these eligibility criteria to initiate the process smoothly.

Preparing for the reactivation

Before you begin the reactivation process, gathering the necessary documentation is essential. Having valid identification, recent account statements, and any correspondence from UNFCU regarding your account's status can expedite your application. This documentation serves to verify your identity and confirm your previous account status, allowing for a smoother and more efficient reactivation process.

Next, you will need to check your current account status. You can do this online through UNFCU's digital banking platform or by contacting customer support directly. Not only will this provide clarity on your account's condition, but it will also guide your approach when filling out the reactivation form.

Accessing the account reactivation form

The UNFCU account reactivation form is readily accessible through pdfFiller, a cloud-based platform designed to simplify document management. To find the form, navigate to pdfFiller's website, where users can search for 'UNFCU account reactivation form.' This user-friendly interface allows for quick access and ensures that you can start the reactivation process without unnecessary delays.

Once you locate the form, explore pdfFiller's interactive tools, which offer features that enhance the completion experience. You can save and edit your entries at any time, allowing for a flexible and user-centered approach to filling out documents.

Completing the account reactivation form

Filling out your account reactivation form necessitates precision and attention to detail. The process is straightforward, but ensuring accuracy is key. Follow these step-by-step instructions to avoid common pitfalls:

To enhance the likelihood of a successful application, double-check all information entered. Simple errors can lead to delays, so ensure thoroughness in every section.

Submitting the form

Once your form is complete, consider how you will submit it. You can either submit your completed form online through pdfFiller or opt for alternative methods like mail or fax. However, online submission is generally faster and allows for instant confirmation.

After submission, it’s crucial to confirm that your form has been successfully submitted. You will typically receive a confirmation email from UNFCU showing that your request is in process. Familiarizing yourself with the follow-up process can provide peace of mind as you wait for your account reactivation.

After submission: what to expect

The timeline for reactivating your account can vary significantly based on your specific circumstances and UNFCU's internal processing times. Typically, you might expect processing times of a few business days, but several factors, such as workload and specific account circumstances, could influence this.

It's wise to keep track of your account reactivation request during this period. Utilize any online tools provided by UNFCU to check the status of your reactivation or reach out to customer support directly for updates.

Managing your reactivated account

Once your account has been successfully reactivated, it becomes essential to implement important security measures. Setting up online banking access should be your first step. This includes updating your security settings and passwords to safeguard your information and money.

Regular activity is key to maintaining your account in good standing. Explore options such as setting up alerts for unusual account activity or establishing recurring transactions to ensure your account remains active and minimizes the risk of future issues.

Privacy and data protection considerations

Understanding your rights concerning data privacy is paramount when dealing with financial institutions like UNFCU. Members are entitled to know how their personal information is handled, stored, and protected. UNFCU has strict policies in place aimed at safeguarding member data and ensuring compliance with regulations governing data protection.

As a member, prioritizing your data's safety means being conscious of potential threats and taking appropriate actions to protect your information, such as using strong passwords and being vigilant against phishing attempts.

Frequently asked questions (FAQs)

Questions regarding the account reactivation form at UNFCU often revolve around the timeline for processing, handling inaccuracies in the submitted forms, and updating contact details. Here are some common queries:

Quick tips for efficient document management

Utilizing pdfFiller for ongoing document management can greatly enhance your experience with forms and templates. The platform offers a vast array of document templates, including the UNFCU account reactivation form, allowing for easy access and completion.

Moreover, pdfFiller's e-signature features expedite the signing process and ensure that you can finalize documents swiftly and efficiently. Keeping your documents organized is also crucial; consider strategies such as tagging documents or creating folders to maintain a streamlined document management system.

Additional help and support

Should you require further assistance during the reactivation process, contacting UNFCU customer service is advisable. They offer various support channels, including phone support, online chat, and email. This accessibility ensures that you can get the help you need in a timely manner.

You can also access more resources through pdfFiller that may assist you with other document management needs. Utilizing their platform not only helps with the reactivation form but also ensures you are well-prepared for any future paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find account reactivation form unfcu?

How do I edit account reactivation form unfcu in Chrome?

Can I create an electronic signature for the account reactivation form unfcu in Chrome?

What is account reactivation form unfcu?

Who is required to file account reactivation form unfcu?

How to fill out account reactivation form unfcu?

What is the purpose of account reactivation form unfcu?

What information must be reported on account reactivation form unfcu?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.