Get the free eEFORE CHANGING CLASSIFICATION

Get, Create, Make and Sign eefore changing classification

How to edit eefore changing classification online

Uncompromising security for your PDF editing and eSignature needs

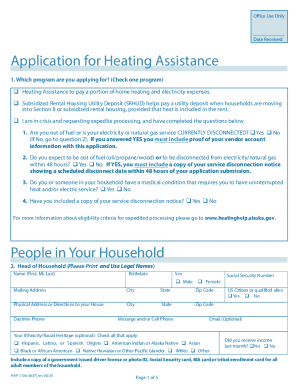

How to fill out eefore changing classification

How to fill out eefore changing classification

Who needs eefore changing classification?

Before Changing Classification Form: A Comprehensive How-To Guide

Understanding the change in classification form

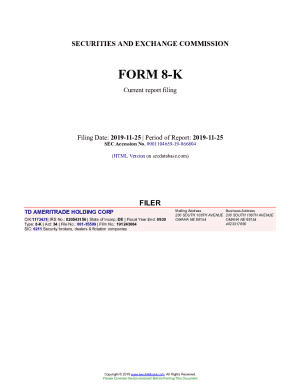

A classification form is a crucial document used to determine the legal and operational structure of a business for tax and regulatory purposes. It outlines how a business entity is categorized, impacting its tax obligations, eligibility for certain programs, and compliance with various government regulations. The importance of changing this classification may arise from shifts in business strategy, growth opportunities, or changes in legal requirements.

Common scenarios that prompt a business to consider changing its classification include alterations in business structure, such as transitioning from a sole proprietorship to a corporation or from an LLC to a partnership. Additionally, significant changes in business operations or ownership can necessitate a re-evaluation of the classification to ensure it accurately reflects the entity’s current status.

Assessing your current classification

The first step in the process of changing your classification form is to carefully review your current document status. This involves examining the existing classification to ascertain whether it is still aligned with the entity's goals. Take stock of all pertinent documentation, including tax returns and compliance records, to facilitate this review.

Identifying the need for change can hinge on various factors. For instance, business growth may create new opportunities that require a different legal structure to maximize tax benefits or enhance liability protection. Additionally, compliance with new legal or regulatory requirements could necessitate adjustments to your classification.

It's vital for business owners to consider the legal implications of their current classification as any misalignment can lead to costly penalties or missed opportunities during audits. Consulting with a tax professional or legal adviser is advisable to understand the ramifications of the current classification.

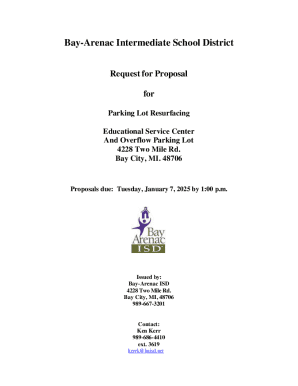

The process of changing your classification form

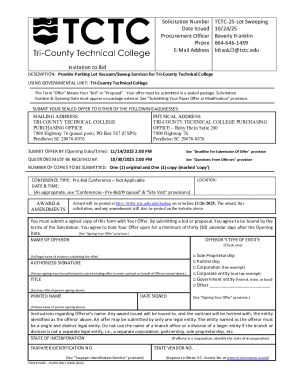

Changing your classification form is not merely a matter of filling out new paperwork; it involves a well-defined process. To initiate this change, begin by gathering all necessary information and documents that support your case for reclassification. This should include financial statements, legal documents of ownership, and prior tax filings.

Next, evaluate the required classification criteria by reviewing IRS guidelines and ensuring compliance with local regulations. This may be complex depending on whether you're changing to a corporation, partnership, or other entity classification.

Timing is also crucial. The best time to change your classification often correlates with business cycles, tax deadlines, or significant internal changes, such as mergers or expansions. Understanding these timing nuances can help in making a smoother transition.

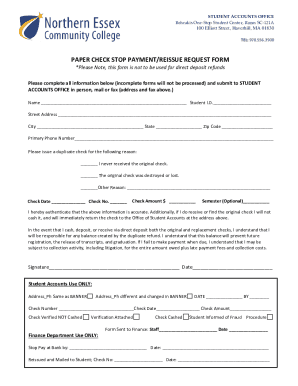

Filling out the new classification form

When it comes to filling out the new classification form, accuracy is key. Each section must be completed meticulously to ensure that the IRS and other regulatory bodies have all the information they need. The first section typically requires detailed business information, including the legal name, EIN, and the address of the entity.

Following that is the classification type where you need to specify the new classification you are applying for. It is essential to choose carefully, as each classification comes with specific implications for taxation and governance.

To ensure accuracy, double-check all entries and consider using tools like pdfFiller, which streamline the process through smart templates that reduce errors. Additionally, watch out for common mistakes such as overlooking required signatures or mislabeling information.

Editing and revising your classification form

Once your new classification form has been drafted, it's important to edit and revise it rigorously. Clarity and detail can make a significant difference in how the form is perceived by regulatory bodies. Utilize tools like pdfFiller for efficient editing; these platforms allow for easy corrections and enhancements to your document.

Collaboration can also play a key role in this stage. Involving team members in the review process can help catch errors or provide insights that you may have overlooked. Utilize features in pdfFiller to share drafts securely and solicit feedback securely.

Signing and submitting your classification form

The submission process of your classification form includes signing and sending it to the relevant authorities. Utilize eSignature features offered by pdfFiller to make this process smoother. Digital signatures are not only legally valid but also speed up the submission process.

Once signed, determine the best method for submission. Depending on the agency or institution, you may be able to submit electronically or via mail. Verify the submission guidelines to choose the most efficient route.

Following submission, monitor the progress of your application. Depending on the classification change, there may be an expected timeline for review and feedback. It is advisable to keep your internal teams updated and informed about the change.

Managing changes post-submission

After submitting your classification form, managing the changes effectively is key. Start by tracking the progress of your application. Many agencies provide an online portal or support number to check the status of your submission.

Updating internal systems and informing all stakeholders about the changes is equally important. This ensures that everyone is aligned with the new classification and aware of any implications for operations, tax reporting, or compliance.

Common questions and troubleshooting

When changing a classification form, several questions often arise. These may include inquiries about the required documents to include, the timeline for processing changes, or issues with the submission process. It's essential to prepare for these by reviewing FAQs commonly provided by the regulatory entity.

In instances where problems arise with the submission process, remedies may be available through dedicated helplines or support channels. Understanding when to seek additional help can also help alleviate stress during this transition.

Examples of successful classification changes

Successful classification changes can serve as valuable case studies for those looking to navigate a similar process. For instance, a small tech startup may have started as a sole proprietorship. As the business grew, the owner recognized the need to change to an LLC to limit liability and improve tax efficiency.

In this case, the transition was smooth due to thorough preparation, including a clear understanding of the implications of the classification change. Business owners can learn from such examples that proper planning and legal consultations are essential in facilitating successful transitions.

Using pdfFiller throughout the process

pdfFiller provides extensive advantages throughout the classification change process, making document management seamless and efficient. From editing PDFs to eSigning and secure sharing, pdfFiller offers functionalities that help streamline what can often be a complicated process.

With collaborative tools, team members can work together on documents in real-time, ensuring that all inputs are captured and edits are reflected immediately. Such efficiency bolsters the likelihood of a successful classification change, reducing the chances of errors or missed information. Utilize these features to create a robust document management approach, ensuring compliance and accuracy at each stage of the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send eefore changing classification for eSignature?

Can I create an electronic signature for signing my eefore changing classification in Gmail?

How do I complete eefore changing classification on an Android device?

What is eefore changing classification?

Who is required to file eefore changing classification?

How to fill out eefore changing classification?

What is the purpose of eefore changing classification?

What information must be reported on eefore changing classification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.