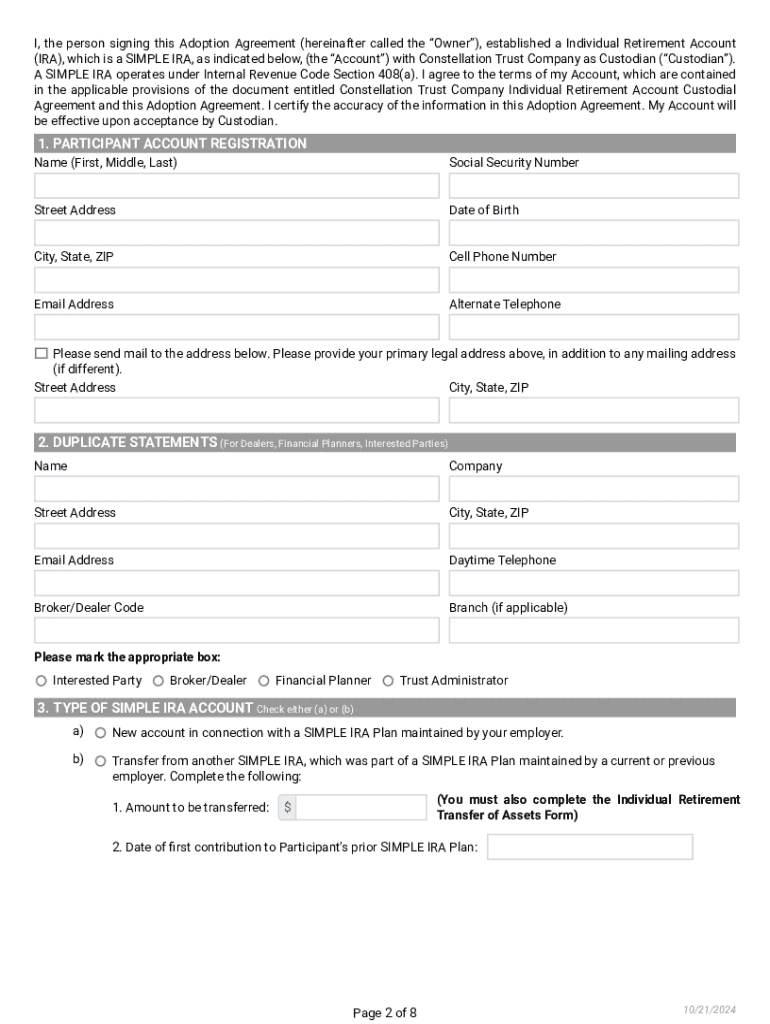

Get the free Rational Funds - Simple IRA Application

Get, Create, Make and Sign rational funds - simple

How to edit rational funds - simple online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rational funds - simple

How to fill out rational funds - simple

Who needs rational funds - simple?

Rational funds - simple form: A comprehensive how-to guide

Understanding rational funds

Rational funds are investment vehicles designed to optimize returns by strategically allocating assets across various markets. They are built on the principles of rational decision-making and objective assessment, which enables investors to minimize risks while maximizing potential gains. Within today’s financial landscape, these funds play a crucial role, catering to a range of investor profiles—from conservative to aggressive. Furthermore, they capitalize on detailed analyses and empirical data to guide investment strategies.

Key features of rational funds include systematic asset allocation, transparent methodologies, and comprehensive risk assessments. By relying on statistics and trends rather than emotions or speculative forecasts, rational funds empower investors to make informed decisions. This fundamentally shifts the focus from traditional investing, where gut feelings often prevail, to a more analytical approach.

Types of rational funds

Rational funds can broadly be categorized into several types based on their investment strategies: equity, fixed income, balanced, and specialty funds. Each type is tailored to meet different investor goals and risk appetites.

Benefits of investing in rational funds

Investing in rational funds offers several advantages that make them appealing for individual investors. First and foremost, diversification is a cornerstone benefit, as rational funds spread investments across multiple assets, reducing overall portfolio risk. This not only protects against market downturns but also balances out potential losses.

Furthermore, rational funds are managed by financial professionals who bring expertise and knowledge to the table. Investors can access managed portfolios without the stress of selecting individual securities. This professional management is complemented by accessibility, as many rational funds have lower minimum investment requirements, making them suitable for a broader audience.

Another significant benefit is the potential for higher returns. By leveraging data-driven strategies, rational funds are designed to identify and capitalize on profitable opportunities. Lastly, the lower investment minimums associated with many rational funds mean that even those with limited capital can participate in a diverse investment experience.

Analyzing rational funds

To effectively analyze rational funds, several metrics are essential for evaluation. Understanding expense ratios helps determine the cost-effectiveness of the fund; lower ratios often indicate more favorable long-term performance. Historical performance is another crucial metric, providing insights into how the fund has reacted to market fluctuations over the years.

Risk assessments are vital for gauging the fund's volatility and its capacity to endure market downturns. Investors should utilize tools like pdfFiller's interactive tools for formulas and calculations, which offer a streamlined approach to assessing funds. These metrics combined allow investors to make informed decisions tailored to their unique investment goals.

How to choose the right rational fund

Choosing the right rational fund begins with defining personal investment objectives. Understanding whether you're looking for growth, income, or stability will guide your choices. Following this, it’s essential to assess your risk tolerance; this step determines the types of funds suitable for your portfolio.

Next, comparing fund performance helps create a shortlist of viable options. Investors should look for consistency in returns over time rather than short-term spikes. Additionally, understanding the fund management teams and their experience can provide confidence in their strategies and investment decisions. Each of these steps creates a comprehensive pathway toward selecting the best rational fund.

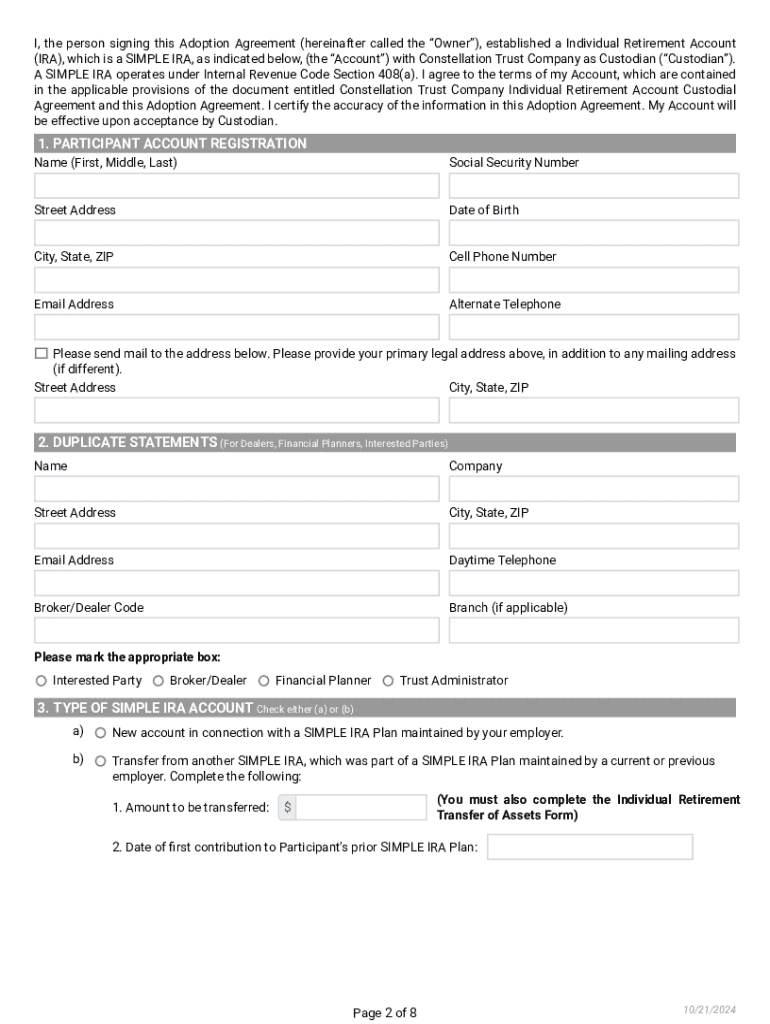

Filling out your investment form using pdfFiller

Using pdfFiller to fill out your investment form simplifies the process substantially. Start by accessing the investment form directly on the pdfFiller website, where a user-friendly interface guides you through the initial steps. Once you have the form, editing becomes easy with the built-in functionality. You can quickly add or remove information as required.

Additionally, for security and efficiency, eSigning your investment forms can be done seamlessly within the platform. pdfFiller offers advanced security features, ensuring your documents stay protected against unauthorized access. The platform also allows collaboration—making it easy to share your form with advisors or team members for their input, all from a centralized cloud-based space.

Managing your rational fund investments

Effectively managing your rational fund investments requires a structured approach. Regularly monitoring performance is essential; by keeping an eye on returns and market trends, investors can make data-driven decisions. Furthermore, rebalancing your portfolio periodically ensures that your asset allocation aligns with your risk tolerance and investment objectives.

Communicating with fund managers is another crucial aspect, and pdfFiller can facilitate this communication through document management tools. Keeping your investment documents organized in the cloud allows for easy access and retrieval. Additionally, using searchable PDF features helps quickly locate specific documents or information, enhancing your overall management experience.

Legal and compliance considerations

Investing in rational funds involves navigating various legal and compliance frameworks. A successful investment strategy requires understanding the regulations that govern fund operations. This understanding not only ensures compliance but also protects you as an investor by ensuring that you’re well-informed about your rights and obligations.

Accessibility of information is also integral, especially for those with disabilities. Utilizing tools from platforms like pdfFiller enhances the accessibility interface, ensuring that all users can comprehend and navigate investment documents efficiently. This commitment to inclusion reflects broader trends within the investment community, focusing on transparency and accessibility.

Additional insights on rational funds

Frequently asked questions about rational funds often revolve around their risk levels, expected returns, and management fees. Addressing these concerns can help demystify rational funds, providing potential investors with the assurance they need. Innovative trends within the domain of rational funds are focused on technological enhancements, including algorithmic trading and artificial intelligence to analyze market shifts.

Such advancements indicate that rational funds will continue evolving, making them an intriguing option for modern investors looking for data-backed strategies. Staying informed through trusted news sources and investment seminars can further enhance an investor's ability to navigate the complexities of this financial instrument.

Newsletter subscription and exclusive content

By subscribing to the pdfFiller newsletter, you can receive regular updates on rational funds, including expert insights and trends. This subscription provides access to a wealth of resources and tools, enhancing your understanding and management of investments. By staying engaged, you position yourself at the forefront of investment strategies and can leverage pdfFiller’s offerings for a seamless investing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

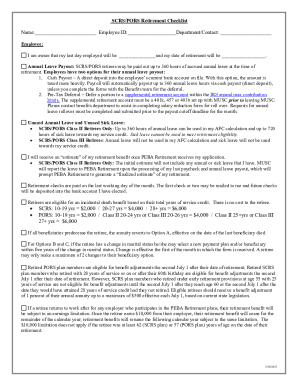

How can I send rational funds - simple to be eSigned by others?

How do I fill out rational funds - simple using my mobile device?

Can I edit rational funds - simple on an iOS device?

What is rational funds - simple?

Who is required to file rational funds - simple?

How to fill out rational funds - simple?

What is the purpose of rational funds - simple?

What information must be reported on rational funds - simple?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.