Get the free Investing for Principles and Performance

Get, Create, Make and Sign investing for principles and

How to edit investing for principles and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out investing for principles and

How to fill out investing for principles and

Who needs investing for principles and?

Investing for Principles and Form

Understanding the principles of investing

Investing is not just a financial activity; it's a disciplined approach to building wealth over time. To invest wisely, it's crucial to grasp the fundamental principles that underpin effective investing. Without understanding these basic concepts, investors may find themselves making poor decisions and suffering losses.

At its core, investing involves allocating capital to various assets with the expectation of generating a return. Investment types can range from stocks and bonds to real estate and mutual funds, each possessing unique characteristics. Understanding each type can help in strategizing the best approach suited to individual financial goals.

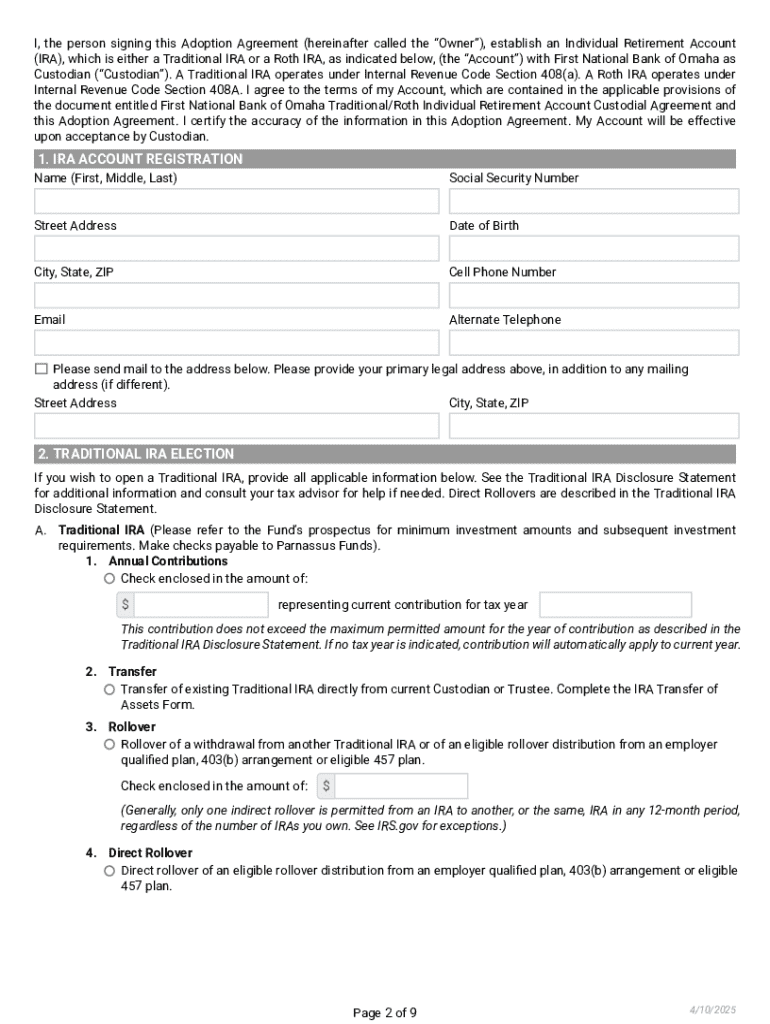

The role of forms in investment processes

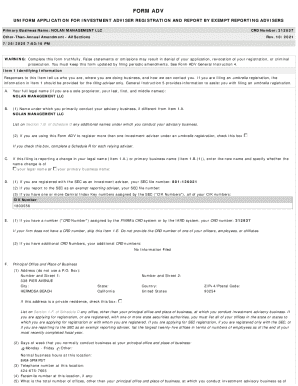

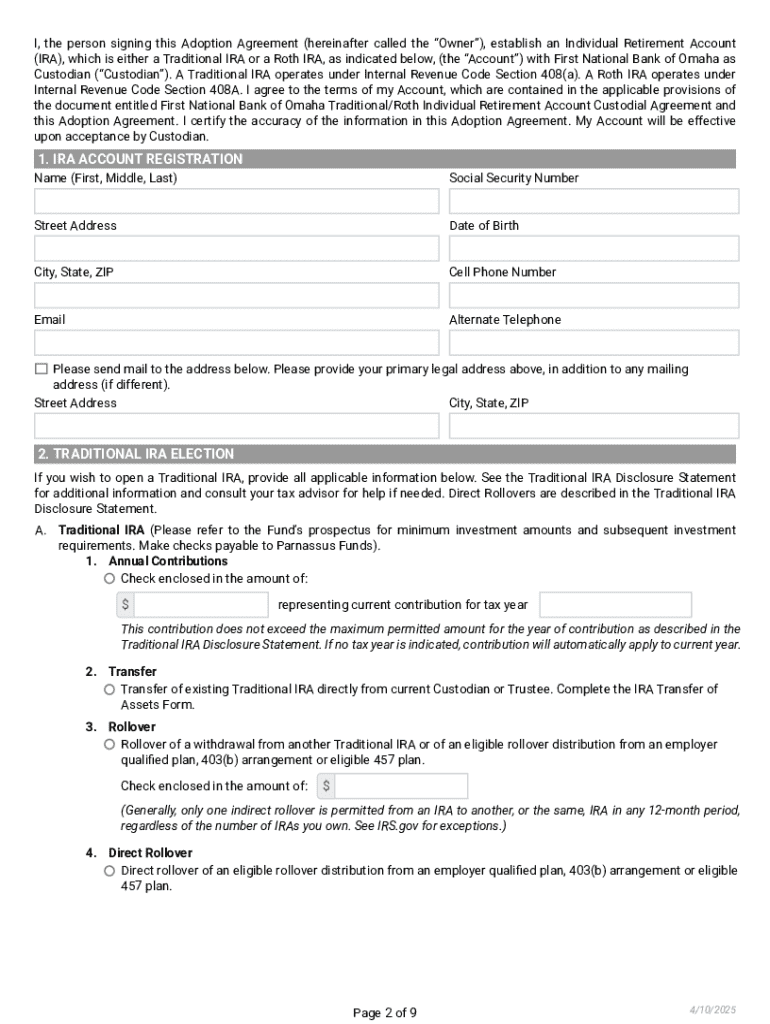

In the world of investing, the types of forms used can significantly influence the efficiency of the process. Investment applications, risk assessment forms, and financial reporting formats play vital roles in navigating the complex landscape of ensuring your investments align with your principles.

Each form carries legal and compliance considerations that every investor should familiarize themselves with. Regulatory requirements are in place to protect both investors and markets, ensuring standard practices and transparency in transactions. Neglecting these elements can result in severe consequences.

Practical steps to start investing

Before diving into investments, it's crucial to establish a solid financial foundation. Beginning with an emergency fund ensures that you have a buffer for unexpected expenses, preventing you from dipping into your investments prematurely. Managing your debt and expenses will also set you on a path toward successful investing.

Next, identifying your investment goals is imperative. Whether you aim for short-term gains or long-term wealth accumulation should dictate your investment choices. Setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals can provide clarity and motivation.

Filling out investment forms effectively

Completing investment applications accurately is critical. Start by understanding the personal information required, including your financial background, investment experience, and risk tolerance. The financial history section must provide a comprehensive view of your past investments and current obligations.

Make sure to pay attention to disclosures and signatures needed at the end of the application. These validate your intent and understanding of the investments you're making.

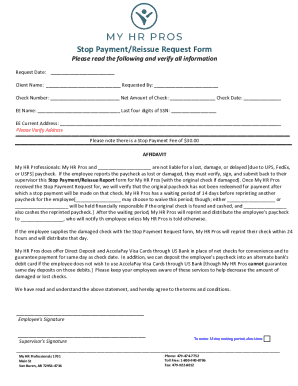

Managing your investments and documentation

Tracking the performance of your investments involves using various tools, from spreadsheets to dedicated financial software. Monitoring is essential for evaluating whether your investments align with your initial goals and risk appetite.

Organizing your documentation is equally important. Establish a systematic approach to filing that allows easy access to important documents, whether digital or paper. Regular audits and reviews will ensure that your records are up-to-date and compliant with regulations.

Leveraging technology for investment management

Modern technology has simplified investment management significantly. Utilizing cloud-based document management solutions, such as those provided by pdfFiller, can streamline the process of editing, signing, and collaborating on essential investment documents.

Incorporating interactive tools can facilitate real-time collaboration and promote efficient document creation. Template features allow investors to create customized forms effortlessly, saving valuable time.

Staying informed and evolving as an investor

Continuous education is paramount in the ever-evolving world of investments. Make use of online resources, courses, and webinars to keep yourself informed about market trends, emerging investment opportunities, and best practices.

Joining investor groups and forums can provide invaluable networking opportunities. Engaging with like-minded individuals fosters sharing of ideas and experiences, ultimately broadening your understanding of various investment strategies.

Advanced investing principles

Once you grasp the basics of investing, diving deeper into advanced principles can help refine your strategies. Exploring alternative investment strategies such as sustainable and impact investing is becoming increasingly relevant in today's socially conscious marketplace.

Understanding long-term investment strategies is essential too. Recognizing the importance of patience and discipline, particularly during market fluctuations, will aid in navigating the complexities of economic cycles.

Investor information and support systems

Accessing financial advisors and support groups can greatly enhance your investment journey. Knowing when to seek professional guidance, particularly during times of uncertainty, can be a game-changer.

Engaging with mentorship opportunities can provide insights that accelerate your learning curve and help you avoid common pitfalls.

Engaging with your investment community

Networking within the investment community can yield numerous benefits. Attending events, workshops, and conferences exposes you to new ideas and investment strategies while connecting you with peers who share similar interests.

Sharing experiences and learning from others enhances your knowledge and broadens your perspective, proving that collaboration is key to mastering the art of investing.

Conclusion

Investing for principles and form is not a one-size-fits-all approach; it's a personalized journey that requires careful planning, continued learning, and sustained dedication. By understanding core investment principles and the importance of clear forms and documentation, you set the stage for successful investment management.

Embracing technology will further enhance your ability to manage investments efficiently, while engaging with the investment community provides invaluable support. Remember, investing is a marathon, not a sprint. Stay informed, evolve your strategies, and build your investment legacy with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit investing for principles and from Google Drive?

How do I edit investing for principles and online?

How do I complete investing for principles and on an iOS device?

What is investing for principles and?

Who is required to file investing for principles and?

How to fill out investing for principles and?

What is the purpose of investing for principles and?

What information must be reported on investing for principles and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.