Get the free Mutual Funds and ETFsPrices & Performance

Get, Create, Make and Sign mutual funds and etfsprices

How to edit mutual funds and etfsprices online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual funds and etfsprices

How to fill out mutual funds and etfsprices

Who needs mutual funds and etfsprices?

Understanding Mutual Funds and ETFs: Prices Form Explained

Understanding mutual funds and ETFs

Mutual funds and Exchange-Traded Funds (ETFs) are investment vehicles that allow individuals to gain exposure to a diversified portfolio of assets. Both options are crucial for investors looking to manage risk while aiming for wealth accumulation. Understanding their structure and pricing mechanisms is fundamental for anyone interested in investing.

What are mutual funds?

A mutual fund pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. There are various types of mutual funds, including equity funds, bond funds, index funds, and balanced funds, each catering to different investment strategies and risk appetites.

The price of a mutual fund is determined by its Net Asset Value (NAV), which is the total value of the fund's assets minus its liabilities divided by the number of outstanding shares. The NAV is calculated at the end of each trading day, providing investors with a daily price that reflects the fund's performance.

What are ETFs (exchange-traded funds)?

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification and liquidity, allowing investors to buy and sell shares throughout the trading day. ETFs typically have lower expense ratios than mutual funds and can be tax-efficient due to their unique structure.

Factors affecting ETF prices include supply and demand dynamics, the underlying assets' performance, and market sentiment. Unlike mutual funds, which price once daily, ETFs can fluctuate in real-time as they are traded on exchanges, making it essential to stay informed about their current market value.

The importance of monitoring prices

Keeping track of mutual funds and ETF prices is crucial for effective investment management. Active monitoring can help investors make informed decisions, optimize their portfolios, and understand market trends, increasing the likelihood of achieving investment objectives.

Why keep track of mutual funds and ETF prices?

Monitoring prices facilitates several key components of investment strategy. Firstly, it allows for performance evaluation of existing investments against benchmarks. Secondly, staying updated with market trends can inform timely adjustments to asset allocation, enhancing overall investment performance.

Furthermore, price tracking can aid in identifying potential investment opportunities. By analyzing price movements, investors can uncover undervalued assets or trends signaling market shifts.

Tools for tracking prices

How to fill out a mutual funds and ETFs prices form

Completing a mutual funds and ETFs prices form is an organized way to document your investment portfolio. The accuracy of this information is paramount, as it directly impacts financial decisions. Here’s how to effectively fill out the form.

Key information needed

When filling out your prices form, you need to gather specific information such as personal details (name, contact information) and investment details, including the types of funds held, the purchase dates, amounts invested, and current prices.

Step-by-step guidance for completing the form

Editing and managing your prices form

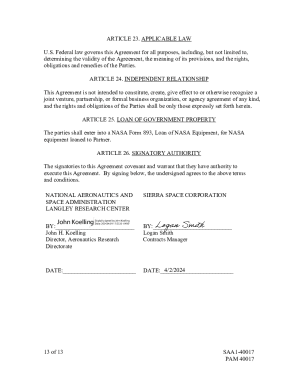

Managing your mutual funds and ETFs prices form is vital for maintaining an up-to-date financial record. Using flexible document management tools can simplify this process by providing features that assist in editing, sharing, and collaborating.

Utilizing pdfFiller's features

pdfFiller excels in providing an easy way to edit forms post-completion. The platform also integrates eSignature functionalities, allowing for quick validation processes, making collaboration among investment teams efficient.

With pdfFiller, users can store their documents in a cloud-based environment, ensuring accessibility and safety.

Tips for efficient form management

Frequently asked questions (FAQs)

As investors delve deeper into mutual funds and ETFs, several queries often arise, particularly regarding NAV and the implications of dividends. Understanding these aspects is crucial for informed investment decisions.

Common queries about mutual funds and ETFs

Clarifications on filling out the prices form

Final thoughts on tracking your investments

Investing in mutual funds and ETFs requires diligence. Continuous learning and monitoring can lead to better investment outcomes. Maintaining a structured approach to documentation, whether through a form like the mutual funds and ETFs prices form, enhances the investor's ability to make informed decisions.

Using tools like pdfFiller fosters an environment of organization, helping individuals and teams manage their portfolios efficiently and effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mutual funds and etfsprices in Gmail?

How can I edit mutual funds and etfsprices from Google Drive?

How can I get mutual funds and etfsprices?

What is mutual funds and etfs prices?

Who is required to file mutual funds and etfs prices?

How to fill out mutual funds and etfs prices?

What is the purpose of mutual funds and etfs prices?

What information must be reported on mutual funds and etfs prices?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.