Get the free BLOCKED ACCOUNT VERIFICATION

Get, Create, Make and Sign blocked account verification

How to edit blocked account verification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out blocked account verification

How to fill out blocked account verification

Who needs blocked account verification?

Understanding the Blocked Account Verification Form: A Comprehensive Guide

Understanding the blocked account verification form

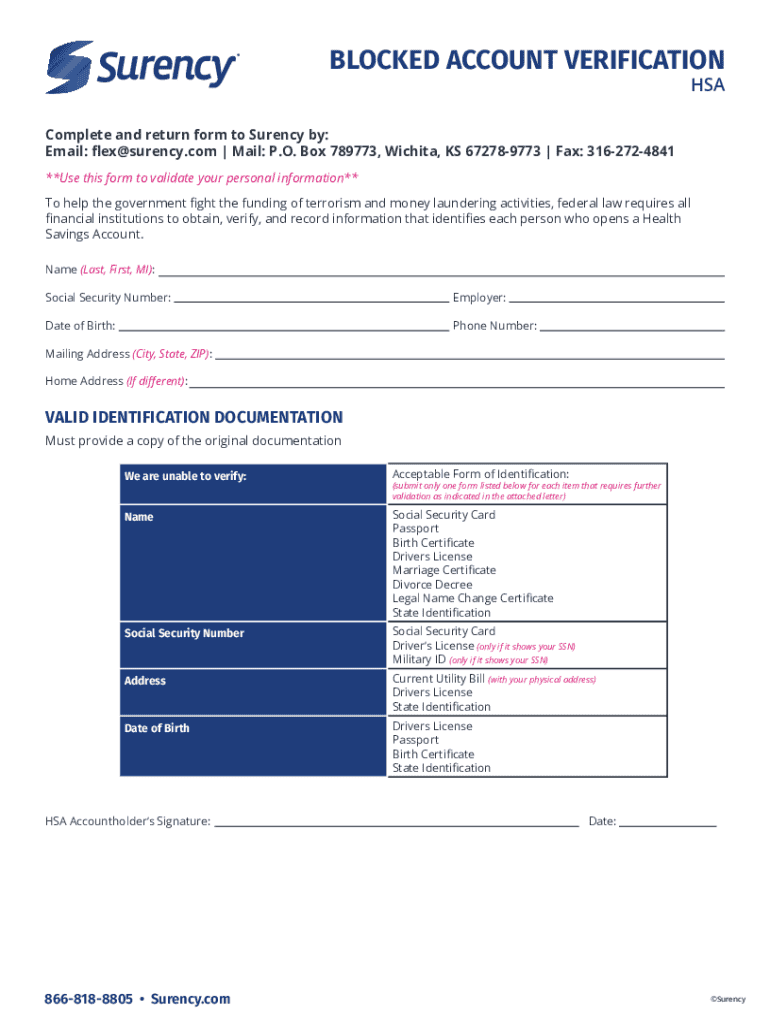

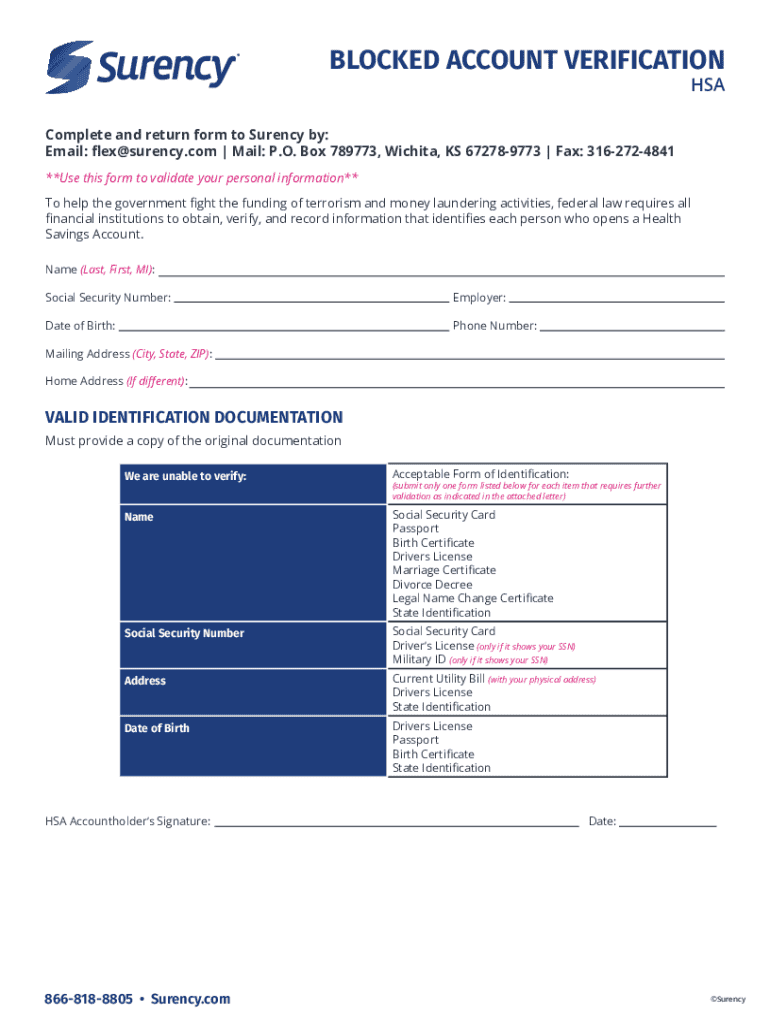

A blocked account verification form is essential for individuals and institutions dealing with financial accounts that have been suspended or restricted. This form serves as an official document that facilitates the reporting and reinstatement of access to such accounts. Often required in scenarios where there are compliance issues, incorrect transactions, or security alerts, this form emphasizes the importance of verifying the account holder's identity and transaction history.

The necessity for this form arises in various situations, including international students required to secure funds for visa applications or individuals facing freezing of accounts due to suspected fraudulent activities. For individuals and teams, understanding and accurately filling out this form is crucial, as it can directly affect access to financial resources and impact overall financial health.

Key features of the blocked account verification form

The blocked account verification form has several key features designed to capture all necessary information for effective processing. Understanding the form's structure is vital for accurate completion.

Step-by-step instructions for filling out the blocked account verification form

Filling out the blocked account verification form accurately is crucial for a swift resolution. Start by preparing the necessary documents, such as IDs and financial statements, to streamline the process.

1. Complete your personal information section: Ensure all details are correct and legible. Double-check spellings and numerical accuracy.

2. Enter financial details: Take care to accurately reflect account balances and transactions. It's wise to use the latest statements to avoid discrepancies.

3. Attach required documents: Prepare a checklist to avoid missing necessary attachments. Include copies of identification, proof of residence, and any other requested materials.

Common mistakes to avoid include leaving fields blank, using incorrect or outdated documentation, and failing to provide all necessary supporting documents, which can lead to delays in processing your request.

Editing and managing your blocked account verification form

After filling out the blocked account verification form, it’s important to review and edit the document for any errors. Tools like pdfFiller are excellent for making necessary adjustments.

Using pdfFiller, users can easily edit their forms online without hassle. Features include adding or modifying text, ensuring the document meets all requirements effortlessly. Furthermore, users can seamlessly add additional signatures or notes, making it convenient for collaborative efforts.

Sharing and collaboration on your form with team members is straightforward through pdfFiller, where you can invite colleagues to review or comment before finalization. Always remember to secure sensitive information by utilizing password protection or by sharing only through trusted channels.

E-signing the blocked account verification form

E-signatures play a vital role in the validation of documents today, especially for forms like the blocked account verification form. They ensure that submissions are recognized and legally binding.

Using pdfFiller for e-signing is straightforward. Simply follow a user-friendly process to insert your e-signature directly onto the form. This eliminates the need for physical printing, saving time and resources.

Legally, e-signatures are valid in most jurisdictions; however, users should ensure they comply with local regulations related to electronic signatures. This knowledge helps in maintaining the integrity of the submitted document.

Submitting the blocked account verification form

After completing the blocked account verification form, the next step is submission. Users have various methods available, including online submission and traditional mail.

Online submission generally offers a quicker turnaround, enabling instant processing and confirmation. Conversely, submitting by mail may take longer, but it might be necessary in specific situations. Whichever method you choose, ensure that you keep a copy of the submission records.

Upon submission, expect a confirmation, typically in the form of an email or notification. This confirmation serves as assurance that your request is being processed.

FAQs about the blocked account verification form

Individuals often have questions surrounding the blocked account verification form. One common query is how to check the status of your submission. Typically, institutions will provide a tracking system or direct contact for updates.

Another frequent concern is what to do if your form is rejected. In such cases, it's advisable to review the feedback provided, amend the necessary sections, and resubmit promptly to avoid further delays.

Maintaining best practices for re-submission, such as ensuring all required information is present and correct, significantly increases the chance of approval.

Tips and best practices for using pdfFiller with the blocked account verification form

To maximize your experience with pdfFiller, take advantage of its powerful features. Utilizing templates for the blocked account verification form provides a handy shortcut for future use.

Additionally, integrating pdfFiller with other technology solutions streamlines document workflows. The cloud-based nature of pdfFiller ensures easy access to your documents anytime, anywhere, thus enhancing productivity.

The importance of using cloud-based platforms for document management cannot be overstated, as they provide security, accessibility, and ease of collaboration.

Troubleshooting common issues

Technical difficulties can occasionally arise while dealing with the blocked account verification form. Ensuring that you have a stable internet connection is often the simplest solution.

In cases where there are issues with attachments or signatures, double-check that all necessary documents are properly uploaded and that your e-signature is correctly placed. Revisit your form-editing tools to ensure everything is in order.

Additional support and resources

For further assistance, pdfFiller provides access to live chat and customer service, ensuring you can receive real-time support with any issues encountered.

Additionally, user guides and tutorials available through the pdfFiller platform can provide more in-depth assistance on using its functionalities effectively, ensuring users can maximize their experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my blocked account verification in Gmail?

How can I edit blocked account verification on a smartphone?

How can I fill out blocked account verification on an iOS device?

What is blocked account verification?

Who is required to file blocked account verification?

How to fill out blocked account verification?

What is the purpose of blocked account verification?

What information must be reported on blocked account verification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.