Get the free NAIC Launches New Risk-Based Capital (RBC) Task Force

Get, Create, Make and Sign naic launches new risk-based

Editing naic launches new risk-based online

Uncompromising security for your PDF editing and eSignature needs

How to fill out naic launches new risk-based

How to fill out naic launches new risk-based

Who needs naic launches new risk-based?

NAIC launches new risk-based form

Overview of the NAIC and its role

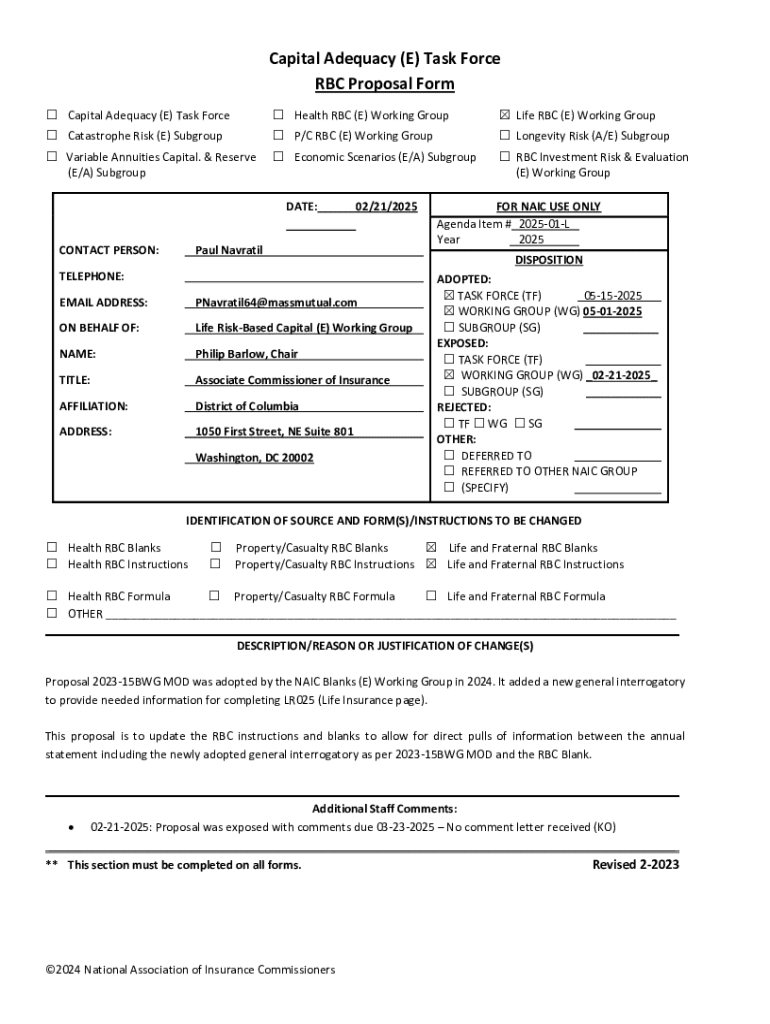

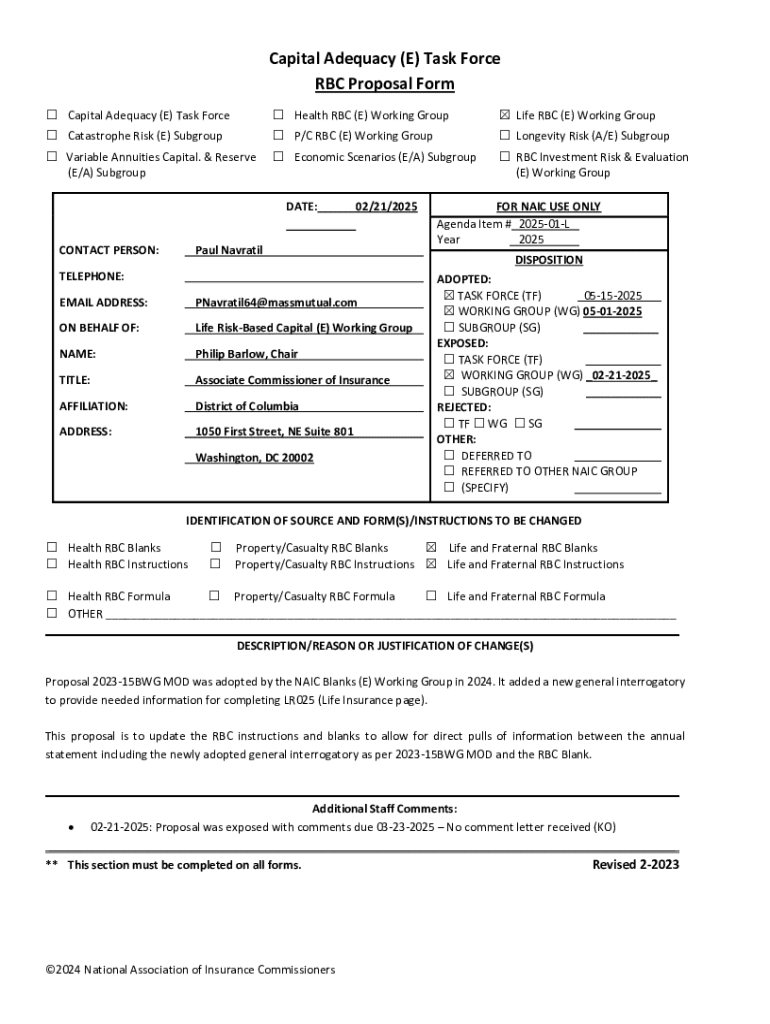

The National Association of Insurance Commissioners (NAIC) plays a pivotal role in standardizing insurance regulation across the United States. Formed in 1871, the NAIC aims to protect the interests of consumers by ensuring a stable and competitive insurance market. It provides a forum for state insurance regulators to coordinate on key issues, develop best practices, create model laws, and provide regulatory guidance to enhance the integrity of the insurance sector. This is especially crucial in an environment where regulatory reforms are radically reshaping how insurers conduct business.

With a focus on consumer protection, the NAIC's mission includes establishing uniform standards that insurance companies must adhere to, particularly in relation to their financial health. In a constantly evolving market, the NAIC's updates to procedures and forms help keep regulatory oversight aligned with current industry practices and technological advancements.

Introduction of the new risk-based form

Recently, the NAIC introduced a new risk-based form designed to streamline the way insurers assess risks and manage their portfolios. This form integrates advanced methodologies for evaluating risk factors, making it easier for regulators and insurers to understand potential exposures. Its unique design allows for a more comprehensive view of an insurer's risk profile, helping to facilitate more accurate pricing and underwriting decisions.

Key features of this new form include expanded fields for data entry, enhanced validation rules to ensure accuracy, and compatibility with digital tools. Compared to previous forms, it provides a clearer framework for risk assessment and reporting, ultimately supporting enhanced accountability and transparency within the insurance industry.

Significance of risk-based assessment in insurance

Risk-based assessments are fundamental in determining how insurance premiums are calculated and how risks are managed. With the implementation of the new risk-based form, insurers are better equipped to enhance their premium calculations by considering individualized risk factors. This allows for a more precise alignment between the premiums charged and the actual risks involved.

Furthermore, by strengthening the underwriting process through efficient risk identification, insurers can make informed decisions that not only protect their bottom line but also ensure they remain competitive in the marketplace. As insurers adopt these assessments, they can more effectively manage their portfolios, anticipate potential liabilities, and adjust pricing models to reflect evolving risk landscapes.

Steps to access the new risk-based form on pdfFiller

Accessing the new NAIC risk-based form via pdfFiller is straightforward and user-friendly. Here's how to get started:

Once logged in, users can take full advantage of pdfFiller's interactive tools and guidance to facilitate form completion.

Filling out the NAIC risk-based form: step-by-step

Completing the NAIC risk-based form accurately is vital for regulatory compliance. The following detailed instructions will assist users in filling out the form effectively:

To enhance the accuracy of data entry, double-check all entries before final submission. Take advantage of pdfFiller's validation tools, which can help identify missing or erroneous information, ensuring compliance with regulatory standards.

Collaborative features for teams

pdfFiller provides robust collaborative features that are particularly beneficial for teams working on NAIC submissions. The platform allows for real-time editing and feedback loops, making it easier for teams to collaborate efficiently.

Strengths of using pdfFiller for team collaboration include:

Numerous teams have leveraged these features to improve their efficiency and accuracy in preparing submissions for the NAIC. Case studies show that teams effectively streamlined their review processes, minimizing the time spent on document preparation while enhancing overall compliance.

Importance of compliance and best practices

Adhering to regulatory requirements is critical when completing the NAIC risk-based form. Insurers must understand common pitfalls to avoid, such as missing deadlines or submitting forms riddled with inaccuracies. Some best practices include:

Resources available for double-checking compliance include templates and guidelines provided by the NAIC, as well as external compliance consultancy services that can offer invaluable insights.

Frequently asked questions (FAQs)

Engaging with the NAIC risk-based form raises several common questions among users:

Where further clarification is needed, users can consult the pdfFiller support or FAQs to resolve their inquiries promptly.

Support and resources

For users navigating the new NAIC risk-based form, pdfFiller offers a wealth of support and resources. Users can access customer service and technical support via chat, email, or phone to troubleshoot any issues they may encounter.

In addition, pdfFiller provides online tutorials and guides designed to maximize the potential of its capabilities. Users are encouraged to explore video tutorials and comprehensive user manuals that cover everything from filling forms to advanced editing functions.

The platform also features community forums where users can share their experiences, exchange tips, and seek advice from others who have successfully navigated the NAIC submission process.

Future of risk-based assessments in insurance

Looking ahead, the landscape of risk-based assessments in insurance is set to evolve significantly. Trends such as technological integration, including AI and data analytics tools, are anticipated to reshape how insurers evaluate risks. These advancements will mean that assessments can become more predictive, personalized, and efficient.

As regulatory changes continue to take effect, the NAIC is likely to adapt its standards to align with these innovations. This intersection between technology and regulation will not only drive enhanced compliance but also foster a culture of continuous improvement within the insurance industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send naic launches new risk-based for eSignature?

How do I complete naic launches new risk-based online?

How do I complete naic launches new risk-based on an Android device?

What is naic launches new risk-based?

Who is required to file naic launches new risk-based?

How to fill out naic launches new risk-based?

What is the purpose of naic launches new risk-based?

What information must be reported on naic launches new risk-based?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.