Get the free New NAIC Risk-Based Capital Task Force Launches

Get, Create, Make and Sign new naic risk-based capital

Editing new naic risk-based capital online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new naic risk-based capital

How to fill out new naic risk-based capital

Who needs new naic risk-based capital?

Understanding the New NAIC Risk-Based Capital Form

Overview of the NAIC Risk-Based Capital Form

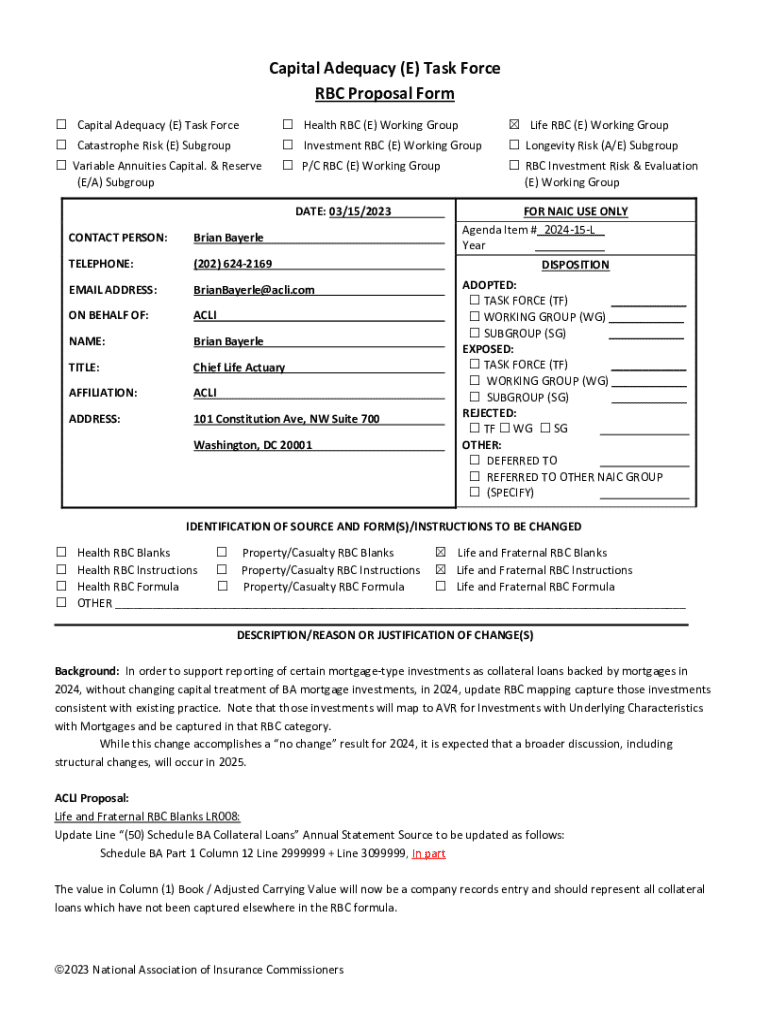

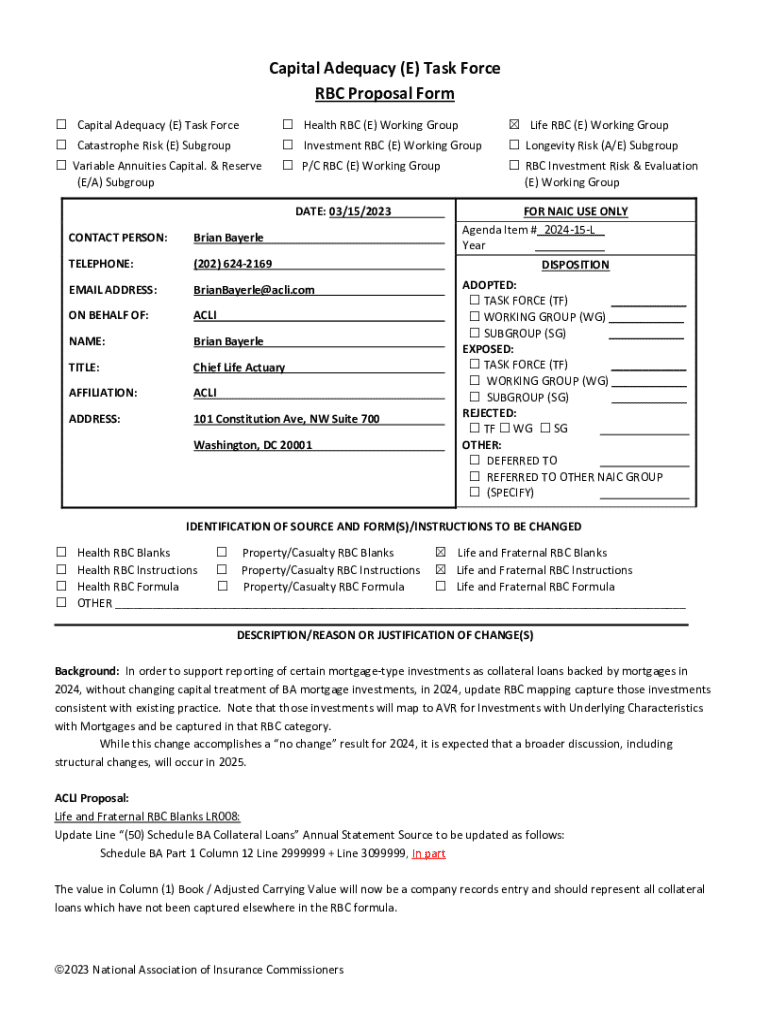

The National Association of Insurance Commissioners (NAIC) Risk-Based Capital (RBC) Form plays a crucial role in the insurance sector, serving as a key tool for assessing the capital adequacy of insurance companies. The new NAIC Risk-Based Capital Form introduces significant improvements aimed at enhancing risk assessment and regulatory compliance across various states.

The importance of the RBC form lies in its ability to provide regulators with a clear picture of an insurer's risk exposure and overall financial health. By determining a company's capital requirements based on the risks it faces, the RBC framework helps identify financially vulnerable institutions, thereby safeguarding policyholders and promoting market stability.

Implementing the new RBC form is aimed at fostering higher standards of risk management, increasing accuracy in capital assessments, and streamlining the compliance process. As the insurance landscape continues evolving, the enhancements in the RBC form reflect a proactive approach toward managing risks associated with underwriting, investments, and other operational areas.

Key features of the new NAIC Risk-Based Capital Form

The new NAIC Risk-Based Capital Form includes several key features designed to enhance the clarity and utility of data collected. Among these, a refined categorization of risk factors emerges, allowing insurers to more accurately assess and report their capital adequacy relative to operational and market conditions.

Crucially, the new form differs from its previous iterations by facilitating a more granular understanding of risk components, enabling insurers to respond effectively to state regulations. Enhanced features for accuracy and compliance also mean that data reported is now more reliable, reflecting a company's financial strength with greater precision.

Understanding the components of the NAIC RBC Form

The structure of the new NAIC Risk-Based Capital Form is designed to facilitate a comprehensive risk assessment process. In particular, the form outlines capital requirements across various segments of the insurance operations, ensuring that every aspect of risk exposure is accounted for. This segmentation includes areas such as life insurance, property and casualty insurance, and health insurance.

A significant feature of this form is its focus on risk assessment categorization. Insurers are now required to classify risks into distinct categories, such as credit risk, market risk, and operational risk. These classifications guide the calculation of capital requirements, helping organizations determine the appropriate amount of capital necessary to cover potential losses.

Step-by-step instructions for completing the NAIC RBC Form

Completing the new NAIC Risk-Based Capital Form requires careful preparation. Before starting, gather all necessary data, including financial statements, risk assessments, and previous RBC calculations. Understanding the various risk categories and how they apply to your operations is essential for accurate completion.

Once prepared, follow these detailed steps to fill out the form:

Tools for editing and managing the NAIC RBC Form

Editing and managing the new NAIC Risk-Based Capital Form is made easy with tools like pdfFiller. This cloud-based platform allows users to seamlessly make changes, ensuring that all entries reflect the most current financial data.

Using pdfFiller, you can execute the following:

eSigning the NAIC RBC Form

eSigning the new NAIC Risk-Based Capital Form is vital for compliance and validity. This electronic signature process not only enhances the efficiency of document handling but also ensures all stakeholders agree on the submissions made.

To eSign the form using pdfFiller, follow these steps:

Common challenges and solutions

Filling out the new NAIC Risk-Based Capital Form can present several challenges. Frequently encountered issues may include difficulty in accurate data gathering, misclassification of risk categories, or misunderstanding requirements dictated by state regulations.

To better navigate these challenges, consider the following tips:

Regulatory considerations around the NAIC RBC Form

The new NAIC Risk-Based Capital Form adheres to a stringent set of regulatory expectations set forth by state insurance regulators. Compliance is critical to avoid penalties, making it imperative for insurance companies to understand how different state requirements may vary.

Insurers must pay close attention to state-specific requirements, as these can impact not only reporting timelines but also the method of risk evaluation. Non-compliance, either through submission errors or failure to meet capital standards, can lead to significant repercussions, including potential fines or mandated cessation of operations.

Success stories: Effective use of the NAIC RBC Form

Several insurance firms have successfully navigated the complexities of the new NAIC Risk-Based Capital Form, incorporating effective practices into their reporting processes. Case studies reveal how these firms leveraged collaborative platforms like pdfFiller to enhance accuracy and streamline submissions.

Testimonials from users highlight the ease of managing the RBC Form, with one user mentioning, 'pdfFiller allowed our team to review, edit, and finalize our report without the usual bottlenecks associated with manual processes.' Such experiences reflect not only the efficiency gains but also the confidence that accurate submissions foster within the insurance community.

Future of NAIC Risk-Based Capital reporting

Looking ahead, the NAIC Risk-Based Capital framework is likely to continue evolving. Ongoing technological advancements promise to simplify RBC reporting, making it easier for insurers to navigate regulatory landscapes.

Preparing for these changes calls for a proactive approach. Insurers should leverage tools like pdfFiller not only to manage current forms but also to adapt to future iterations that may emerge as regulatory demands shift.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new naic risk-based capital to be eSigned by others?

How do I complete new naic risk-based capital online?

Can I edit new naic risk-based capital on an iOS device?

What is new naic risk-based capital?

Who is required to file new naic risk-based capital?

How to fill out new naic risk-based capital?

What is the purpose of new naic risk-based capital?

What information must be reported on new naic risk-based capital?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.