Get the free Mn m 4: Fill out & sign online

Get, Create, Make and Sign mn m 4 fill

Editing mn m 4 fill online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mn m 4 fill

How to fill out mn m 4 fill

Who needs mn m 4 fill?

Complete Guide to the MN 4 Fill Form: Your Step-by-Step Resource

Understanding the MN 4 Fill Form

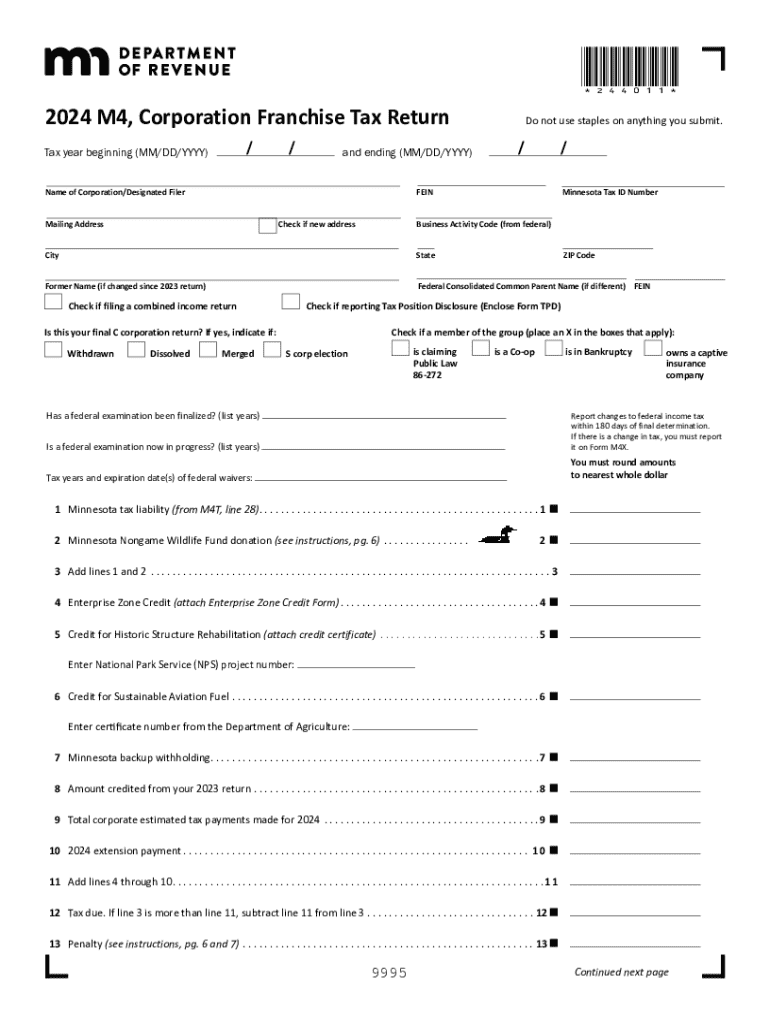

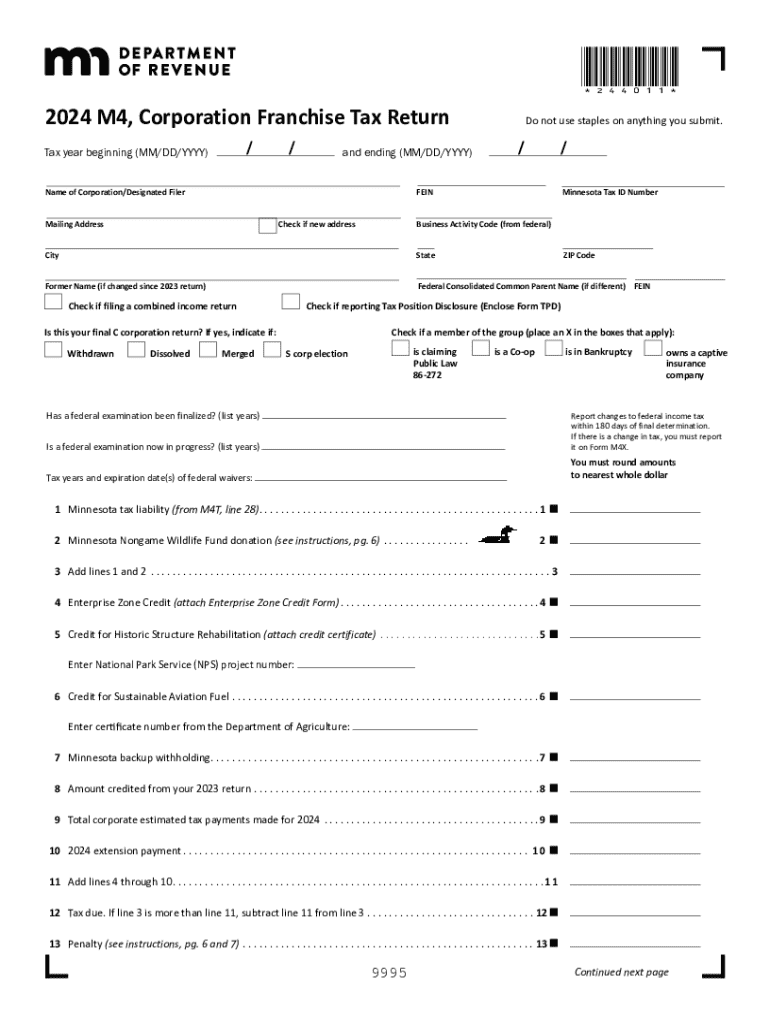

The MN M 4 fill form, officially known as the Minnesota Employee Withholding Allowance/Exemption Certificate, is crucial for ensuring proper withholding of state income tax from your paychecks. Its main purpose is to provide clarity on how much tax should be withheld based on your personal situation. This minimizes discrepancies during tax time and helps individuals tailor their withholding to their financial needs.

Anyone who earns taxable income in Minnesota and needs to have state taxes withheld should fill out the MN M 4 Form. This includes employees, contractors, and anyone who may not fall into traditional employment roles. Additionally, those who have experienced life events—like marriage, divorce, or children—may also want to reassess their withholding.

Overview of the filing process

Completing the MN M 4 form involves several steps. First, you must gather all required documentation. Then, accurately fill out the sections that pertain to your financial situation. Each year, the state of Minnesota sets specific deadlines, so stay alert to these dates to avoid penalties. Typically, the MN M 4 has to be submitted to your employer, who will retain a copy and use the form for tax withholding.

Step-by-step guide to filling out the MN 4 form

Before starting to fill out the form, you will need to gather several pieces of information, including your Social Security number, address, and income details. Having all necessary documents organized will make the process smoother and reduce the risk of errors.

Preliminary requirements

Ensure that you have all essential documentation at hand, including proof of income, past tax returns, and any relevant details regarding deductions and credits. This preparation is crucial for accurate data entry.

Detailed instructions for each section

Tools and features for easy completion

One of the most efficient ways to complete the MN M 4 fill form is by utilizing interactive tools provided by PDFfiller. The fillable PDF feature allows you to input your data online seamlessly. Moreover, with PDFfiller's cloud capabilities, you can save your progress and return later to finish filling out the necessary sections.

Collaborative options

PDFfiller also offers options for collaboration. You can share the form with team members or family members for their input or review. This feature facilitates real-time editing, which can enhance accuracy and ensure that everyone is on the same page before submission.

Common mistakes to avoid

Individuals filling out the MN M 4 form often make errors such as omitting necessary information or miscalculating their income. It's important to double-check all entries, particularly for accuracy in names, figures, and filing status.

Utilizing error-checking tools available on PDFfiller can help reduce mistakes. These tools are designed to flag potential issues, enabling you to correct them before submission.

Submitting your MN 4 fill form

Once your MN M 4 fill form is completed, the next step is submission. The state of Minnesota offers flexible options for submitting this form. You can choose to submit electronically via PDFfiller, which is fast and convenient.

Alternatively, for those preferring traditional methods, mailing the completed form to your employer remains an option. Remember to follow up with them if you don't receive confirmation of receipt, ensuring everything is in order.

Special circumstances for the MN 4 form

Certain situations warrant special consideration when filing your MN M 4 form. For example, if you recently experienced a change in personal or financial circumstances, you should update your withholding to reflect these changes.

If you are required to submit multiple forms for different pay periods, it’s essential to keep track of each submission carefully. This vigilance can prevent confusion and ensure all withholding remains accurate.

Need help? Support options available

If you encounter challenges while filling out the MN M 4 fill form, PDFfiller offer dedicated support services. You can contact customer support for personalized assistance or access a wealth of online resources. FAQs and troubleshooting guides are just a click away on their website.

Additionally, you can explore community forums where others share tips and experiences about form-filling challenges. These community resources often provide valuable insights.

Increasing efficiency with PDFfiller

When dealing with documents like the MN M 4 fill form, leveraging the full suite of tools offered by PDFfiller can significantly increase your efficiency. From document management features to e-signing capabilities, every tool is geared toward providing a seamless experience.

Best practices include maintaining organized records of your tax documents online and ensuring any necessary sharing occurs with ease using the platform's collaboration features. This will not only save time but also enhance your preparation for any future financial assessments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mn m 4 fill directly from Gmail?

How can I send mn m 4 fill for eSignature?

How do I edit mn m 4 fill straight from my smartphone?

What is mn m 4 fill?

Who is required to file mn m 4 fill?

How to fill out mn m 4 fill?

What is the purpose of mn m 4 fill?

What information must be reported on mn m 4 fill?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.