Get the free North Carolina Form CD-418 (Cooperative or Mutual ...

Get, Create, Make and Sign north carolina form cd-418

Editing north carolina form cd-418 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out north carolina form cd-418

How to fill out north carolina form cd-418

Who needs north carolina form cd-418?

North Carolina Form -418: A Comprehensive Guide for Businesses

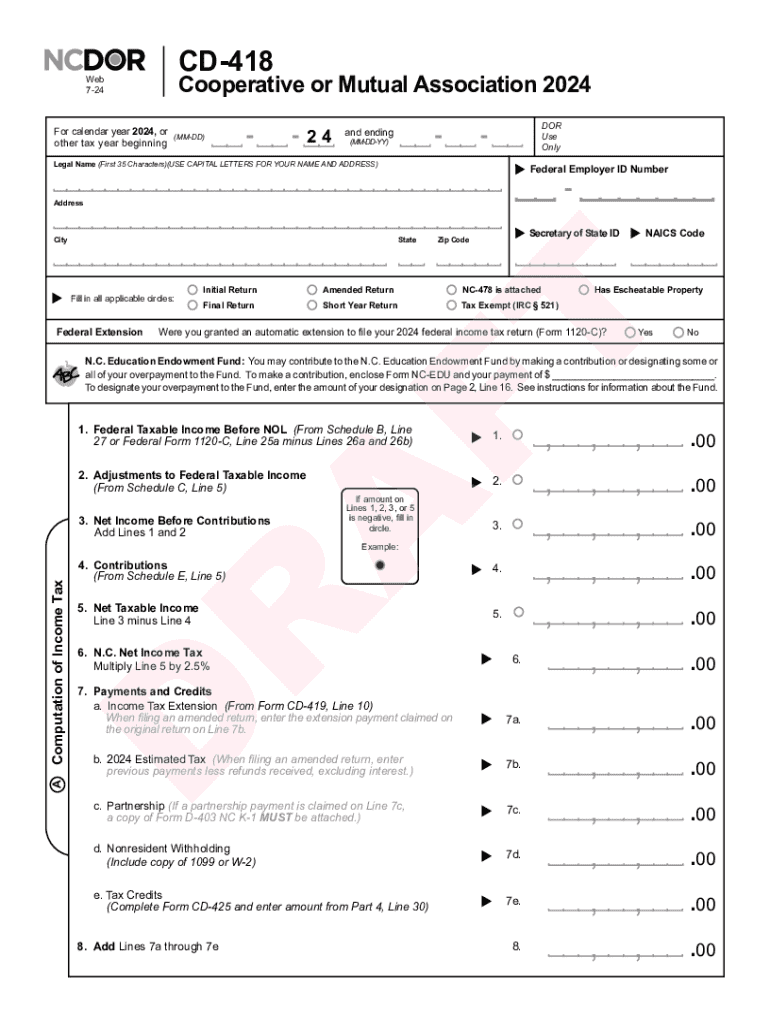

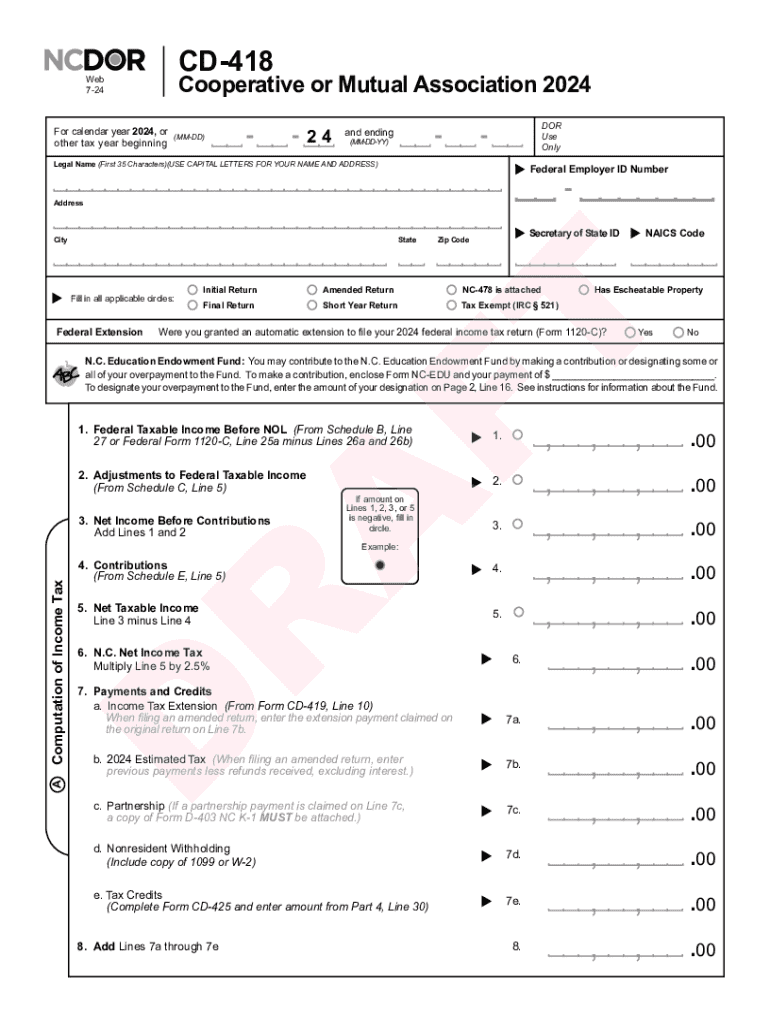

Overview of Form -418

The North Carolina Form CD-418, also known as the Application for Extension for Filing Corporate Income and Franchise Tax Return, is a key document for businesses operating in North Carolina. This form allows corporations to apply for a six-month extension to file their corporate income tax return and franchise tax return. It is essential for businesses to understand the form's purpose and necessity to ensure compliance with state tax regulations.

Filing Form CD-418 is crucial for avoiding penalties associated with late submissions of corporate tax returns. By obtaining an extension, businesses can secure ample time to prepare accurate returns without facing financial repercussions. Moreover, timely submission of this form ensures that companies remain in good standing with the North Carolina Department of Revenue.

Benefits of using pdfFiller for Form -418

pdfFiller offers numerous advantages that simplify the process of filling out and managing the North Carolina Form CD-418. With streamlined document creation and management tools, businesses can efficiently generate, store, and organize this vital tax form. The platform's user-friendly interface minimizes the time spent on form completion while maximizing accuracy.

One of the standout features of pdfFiller is its ease of editing and customizing the Form CD-418 template, allowing users to incorporate specific business data seamlessly. The platform also supports digital signature capabilities, enabling secure eSigning for enhanced legitimacy and compliance. Furthermore, pdfFiller promotes collaboration through its team tools, making it possible for multiple individuals to work on the form simultaneously, which is particularly beneficial in larger organizations.

Step-by-step guide to filling out Form -418

To start using pdfFiller for your Form CD-418, you'll need to create an account on the platform. Once registered, access the template for Form CD-418 through the pdfFiller dashboard, where you can find a wide array of forms related to North Carolina tax requirements.

Navigating the form fields is simplified on pdfFiller, with clear labels indicating where to input your business information, owner or contact details, and relevant tax information. Accurate documentation of your corporate structure, along with identifying information such as the employer identification number (EIN), will be vital for your return. The platform also assists with tax calculations, helping to ensure accuracy and compliance with North Carolina tax regulations.

Interactive features of pdfFiller for Form -418

pdfFiller is equipped with an advanced form editor designed to enhance user experience. This tool offers various editing features such as text editing, form field customization, and the ability to add checkboxes, signature fields, and comments where necessary. These tools are essential for businesses looking to streamline their document management processes.

Real-time collaboration options enable teams to work together efficiently on Form CD-418. This is particularly beneficial during tax season when timely completion is critical. The eSigning feature allows users to sign documents electronically, ensuring secure and fast processing. Users can learn how to take advantage of these features through tutorials available on pdfFiller’s platform.

Submitting your completed Form -418

After completing Form CD-418, businesses have multiple options for submission. The preferred method is electronic filing through the North Carolina Department of Revenue's online system, which ensures quicker processing. The pdfFiller platform facilitates this submission process, providing step-by-step instructions to guide users through the electronic submission.

For those opting to mail their form, it is essential to include any required documentation, such as payment for any estimated taxes owed, to avoid unnecessary delays. The completed form should be sent to the appropriate address specified by the North Carolina Department of Revenue. Ensuring you keep copies of all submitted forms will also help maintain accurate records.

FAQs about Form -418

Filing tax forms can often bring about various questions. One common inquiry is: what happens if a mistake is made on the Form CD-418? In such cases, it is advisable to submit a corrected form as soon as possible to minimize potential penalties and complications. Staying proactive in maintaining accurate records is essential.

Another frequently asked question pertains to tracking submission status. Once you’ve submitted your form, you can check the status through the North Carolina Department of Revenue website, often requiring relevant identifying information about your business to access the status.

Related forms and documents

In addition to Form CD-418, several other forms are vital for corporate tax filings in North Carolina. Understanding these related forms ensures comprehensive compliance and accurate tax reporting. For example, the corporate income tax return and the extension application are directly connected to filing requirements.

Connecting Form CD-418 with your overall business taxes is essential, as the taxes owed or estimated can influence your total corporate tax obligations. Links to download these related forms can typically be found on the North Carolina Department of Revenue's website, ensuring accessibility and convenience for business owners.

Leveraging pdfFiller for ongoing document management

For businesses, managing forms like the North Carolina Form CD-418 is just the beginning. Adopting pdfFiller as your document management solution can enhance efficiency and organization significantly. Best practices for managing business forms involve regularly updating templates and keeping documents readily accessible in a digital format.

pdfFiller's features support long-term document needs, positioning it as an all-in-one resource for documentation. By integrating pdfFiller into your business workflow, you gain the advantage of streamlined processes, from tax filings to everyday documentation requirements, allowing for a more agile approach to business operations.

User testimonials and success stories

Many North Carolina businesses have shared their success stories in using pdfFiller for managing their Form CD-418 and other essential documents. For instance, a local manufacturing company reported tremendous time savings by switching to pdfFiller, allowing for seamless collaborations among team members while ensuring compliance with tax obligations.

These real experiences illustrate how pdfFiller transformed document management across different industries. Businesses that have adopted this tool often mention increased efficiency and reduced paperwork, highlighting its impact on improving overall productivity.

Advanced tools in pdfFiller for business owners

For those looking to further streamline their business processes, pdfFiller offers advanced tools. Custom document templates can be designed for ongoing use, ensuring consistency across all forms and documents. This is particularly beneficial for businesses that deal with various regulatory forms each tax season.

Additionally, pdfFiller's reporting tools allow business owners to analyze their documents, leading to informed decisions based on real-time data. By maximizing efficiency through automated workflows, businesses not only enhance productivity but also reduce the risk of errors associated with manual processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send north carolina form cd-418 for eSignature?

How do I make edits in north carolina form cd-418 without leaving Chrome?

Can I create an electronic signature for the north carolina form cd-418 in Chrome?

What is north carolina form cd-418?

Who is required to file north carolina form cd-418?

How to fill out north carolina form cd-418?

What is the purpose of north carolina form cd-418?

What information must be reported on north carolina form cd-418?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.