Get the free California Business Machines Credit Application

Get, Create, Make and Sign california business machines credit

How to edit california business machines credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california business machines credit

How to fill out california business machines credit

Who needs california business machines credit?

California Business Machines Credit Form: A Comprehensive Guide

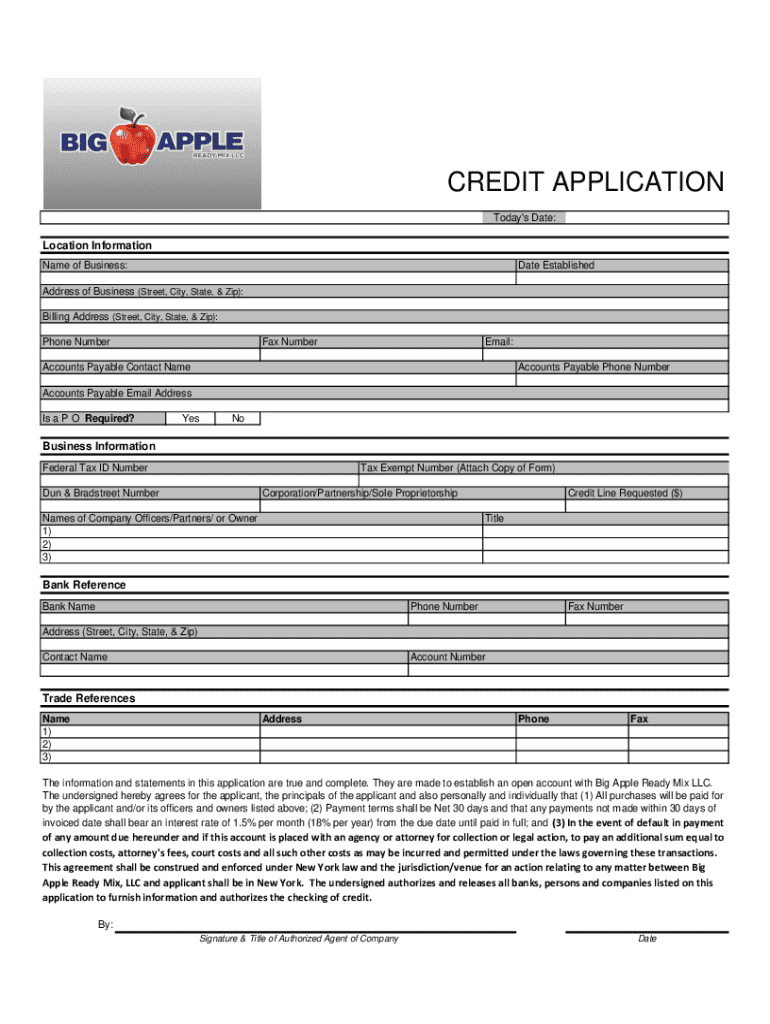

Understanding the California Business Machines Credit Form

The California Business Machines Credit Form is a crucial document designed to streamline the process of requesting credit for the purchase or lease of business equipment. It serves as a formal application through which businesses can demonstrate their creditworthiness and outline their financing needs for various hardware solutions, including copiers, printers, and office automation products.

For businesses operating in California, especially those located in competitive regions such as the San Fernando Valley, this credit form is vital. It not only provides a mechanism for accessing necessary funding but also helps establish a credit history with suppliers, which can lead to better terms and conditions in future transactions. The ability to leverage credit effectively can significantly impact a business's operational capacity and growth potential.

Eligibility criteria for using the credit form

To qualify for the California Business Machines Credit Form, businesses must meet specific eligibility requirements. Generally, any established business operating within California that requires financing for purchasing or leasing equipment can apply. This includes small and medium-sized enterprises, as well as larger corporations, provided they can demonstrate stable operational history and a good credit rating.

Necessary documentation typically includes the business’s Tax ID, financial statements, a list of bank details, and records of credit history. Additionally, businesses may need to provide references and details of existing supplier relationships, especially if they are seeking a substantial line of credit for ongoing hardware solutions. Ensuring accuracy and completeness in providing this information can significantly impact the approval process.

Step-by-step guide to completing the credit form

Completing the California Business Machines Credit Form accurately is essential for a successful application. Here’s a step-by-step guide to ensure you meet all requirements.

Step 1: Gather required information

Before filling out the form, gather pertinent information such as your business identification details, including the Tax ID and DUNS number. You'll also need to collect financial information, which consists of your credit history and bank details to facilitate the review process.

Step 2: Download the California Business Machines Credit Form

Access the form through the official pdfFiller platform. The form is available in multiple formats, such as PDF and Word, making it easy to choose the format that suits your needs best.

Step 3: Fill out the form accurately

Start by carefully entering your business information. Be sure to provide detailed financial statements and clarify the purpose of the credit request. Double-check key areas, as incomplete or inaccurate submissions are a common pitfall that can lead to application rejection.

Step 4: Review and validate information

Once the form is filled out, take time to review all entered data for accuracy. This review phase is crucial, as compliance with California regulations can greatly influence approval timelines and outcomes.

Submitting the California Business Machines Credit Form

Submitting your completed California Business Machines Credit Form can be done through various methods, including online submission, traditional mail, or fax. Each method has its pros and cons, depending on your preference for speed versus documentation control.

To ensure a successful submission, adhere to guidelines provided by the relevant authority for electronic files or paper forms. After submission, expect a processing time that may vary depending on the volume of requests and organizational policies. It is advisable to confirm receipt of your application to track progress effectively.

Managing your credit applications and documents

Once your California Business Machines Credit Form has been submitted, maintaining a record of your applications and related documents is crucial. Utilizing pdfFiller can streamline this process remarkably. With pdfFiller, you can store and categorize your submitted forms, making future reference and retrieval quick and efficient.

Moreover, tracking the status of your credit application becomes simple with pdfFiller’s tracking tools. Should you need to edit or resubmit your form, the platform allows easy modifications to accommodate any changes needed based on feedback received.

Troubleshooting common issues with the credit form

Navigating the California Business Machines Credit Form can come with its challenges. Common issues often include missing information or misunderstandings related to financial documentation requirements. Should you encounter problems, consulting the FAQs section available on the pdfFiller platform can offer quick answers to your queries.

For additional support, contacting customer service is advisable. pdfFiller provides dedicated customer support to assist users with completing and submitting their credit forms. Understanding the terminology associated with credit applications can also ease the process, ensuring you remain informed about potential obligations and conditions.

Why choose pdfFiller for your credit form needs

pdfFiller stands out as a cloud-based platform that offers incredible advantages for document management. Users can effortlessly edit PDFs, electronically sign documents, and collaborate with others, all from a single accessible location. This accessibility is particularly beneficial for businesses managing multiple credit forms across different teams.

With features like eSigning and real-time collaboration, pdfFiller enhances the user experience significantly. Testimonials from satisfied users highlight the efficiency and time-saving nature of the platform, making it a favorite among California businesses seeking reliable hardware solutions.

Insights on financial management for businesses

Effective management of credit and financing forms the backbone of success for many businesses in California. Best practices include carefully assessing financial needs, leveraging available credit options sensibly, and maintaining a clear understanding of financial projections. Regular reviews of incoming invoices and statements ensure that businesses can anticipate cash flow requirements.

Integrating technology into financial management practices can enhance operational efficiency, reduce clerical errors, and streamline the overall processes. It is also beneficial for businesses to keep a repository of additional forms and documents needed for various operations, facilitating a seamless approach to credit management.

Interactive tools and resources

Utilizing interactive tools can significantly enhance understanding and management of business finances. Essential financial calculators, like those for credit risk assessment and loan comparisons, allow businesses to make informed decisions. Furthermore, pdfFiller provides templates for various business forms, easing the paperwork burden.

Interactive features within pdfFiller facilitate a more dynamic approach to document management, enabling users to adapt forms based on their specific requirements efficiently. Engaging with these tools ensures that businesses can stay organized and optimize their credit processes effectively.

Current trends in business credit and financing

The business credit landscape in California is continually evolving, driven by technological advancements and changing economic conditions. Emerging technologies, such as AI and machine learning, are reshaping document management and credit application processes, making them more efficient and user-friendly.

Case studies of businesses that successfully leveraged credit forms highlight innovative financing strategies aiding their growth. Keeping pace with these trends ensures that California businesses remain competitive and can take advantage of favorable financing options available in the market today.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my california business machines credit directly from Gmail?

How do I make changes in california business machines credit?

How do I make edits in california business machines credit without leaving Chrome?

What is california business machines credit?

Who is required to file california business machines credit?

How to fill out california business machines credit?

What is the purpose of california business machines credit?

What information must be reported on california business machines credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.