Get the free Max DTI

Get, Create, Make and Sign max dti

How to edit max dti online

Uncompromising security for your PDF editing and eSignature needs

How to fill out max dti

How to fill out max dti

Who needs max dti?

Max DTI Form: A Comprehensive How-to Guide

Understanding the Max DTI Form

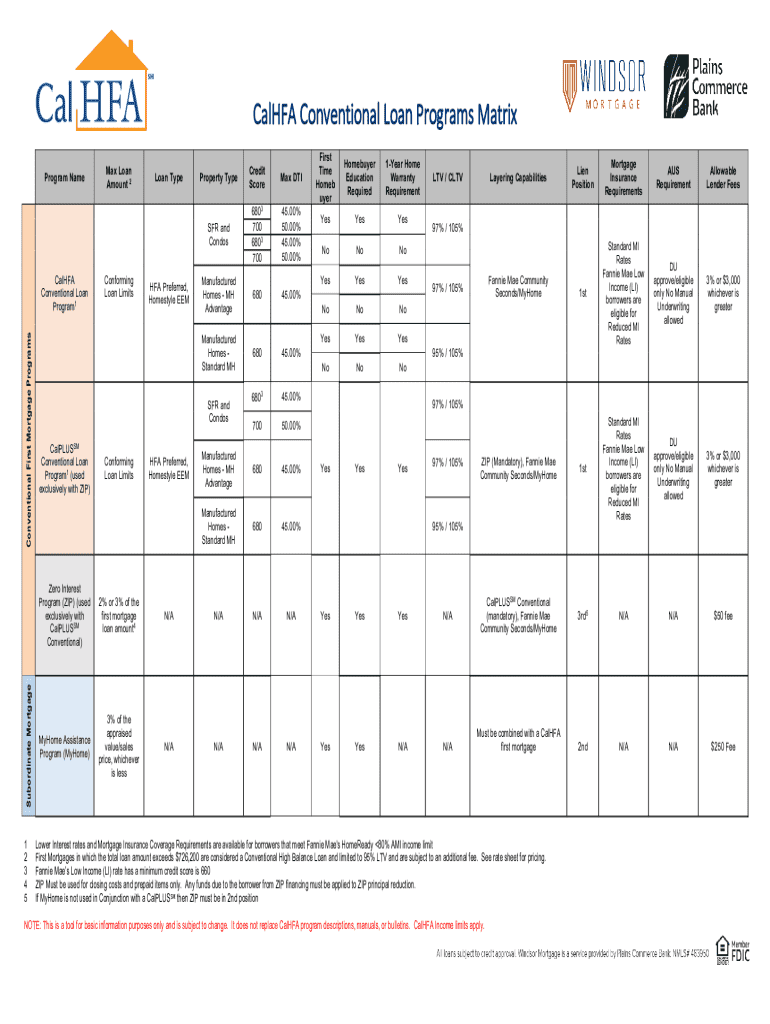

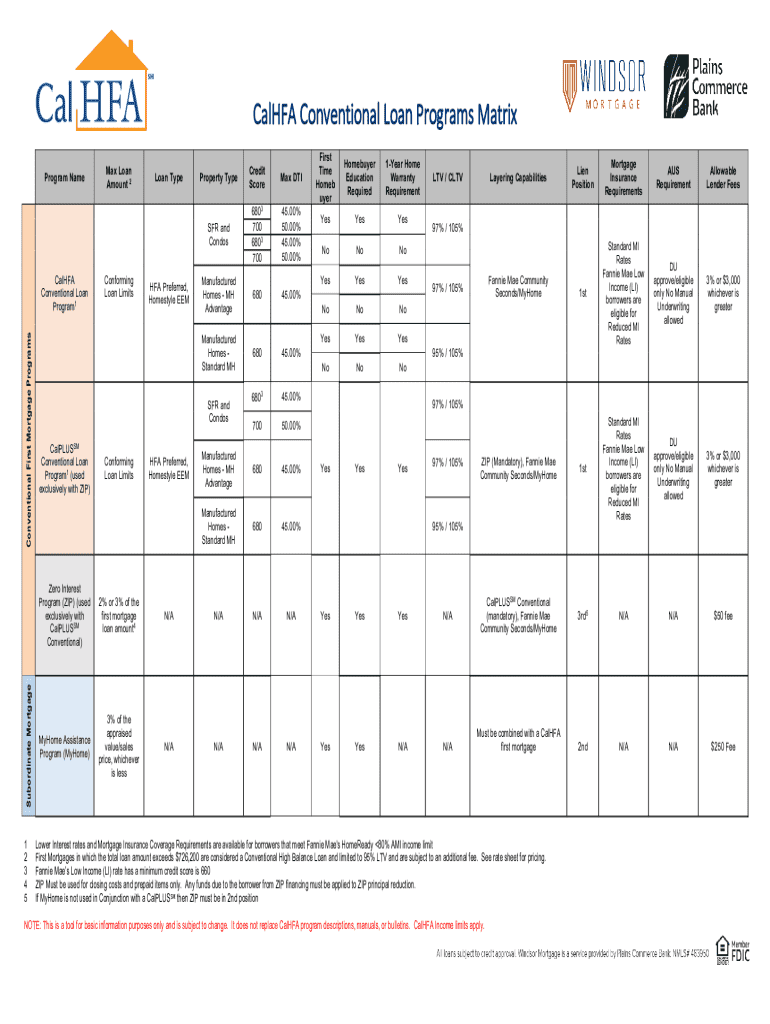

The Max DTI Form is a crucial document used in various financial applications. This form is designed to help lenders assess a borrower's debt-to-income ratio (DTI), which is a significant factor in determining loan eligibility. By documenting income and existing debt obligations, this form provides lenders with a clear picture of a borrower's financial health, thereby enabling them to make informed lending decisions.

Understanding the Max DTI Form is vital, as it helps establish one's financial standing in the eyes of lenders. The completion of this form can affect not only approval chances but also the terms and interest rates offered on potential loans. A well-structured Max DTI Form enhances the chances of a favorable financial outcome.

Who needs the Max DTI Form?

Individuals seeking loans are the primary users of the Max DTI Form. This includes borrowers looking for mortgage loans, personal loans, or any form of credit where the lender needs to analyze their financial commitments in relation to their income. Additionally, teams or organizations involved in financial decisions, such as loan officers or mortgage brokers, rely on this form to facilitate the lending process and ensure compliance with regulatory standards.

Furthermore, this form is particularly important for first-time homebuyers. By accurately filling out the Max DTI Form, they can present themselves as potentially reliable borrowers, enhancing their chances of being approved for the necessary financing to secure their new home.

When to use the Max DTI Form?

The Max DTI Form is utilized during key financial scenarios, primarily when applying for a mortgage, personal loan, or any form of credit where the assessment of monthly debts against income is crucial. It's critical to provide this form when applying for any loan where lenders mandate a thorough review of financial obligations to assess a borrower's capacity to take on additional debt.

In times of financial uncertainty, such as changes in employment or unexpected expenses, individuals should revisit and potentially update their Max DTI Form to reflect current income and debt obligations. This ensures that any new financial applications are based on the most accurate and relevant data, helping to avoid issues in the loan approval process.

DTI (Debt-to-Income) overview

The debt-to-income ratio (DTI) is a critical metric used by lenders to gauge a borrower's financial health. To calculate the DTI, you divide total monthly debt payments by gross monthly income. This ratio is typically expressed as a percentage, indicating the portion of a borrower's income that goes towards servicing debts. There are two primary types of DTI ratios: the front-end DTI, which reflects housing expenses such as mortgage payments and property taxes, and the back-end DTI, which includes all monthly debts.

Understanding DTI is pivotal in financial decisions. A lower DTI ratio suggests a borrower can manage debt comfortably, making them more appealing to lenders. Conversely, a higher DTI indicates potential strain, which can lead to more stringent loan terms, higher interest rates, or even denials. Monitoring this ratio can empower borrowers to make strategic financial decisions that align with their long-term goals.

Step-by-step instructions for filling out the Max DTI Form

Before diving into filling out the Max DTI Form, it’s essential to gather the necessary documents and information. Prepare your last few pay stubs, any additional income sources such as rental income or bonuses, and a comprehensive list of monthly debts, which should include mortgage payments, car loans, credit card payments, and any other financial obligations. Staying organized will streamline the process and reduce the likelihood of errors.

Once you have all necessary documents at hand, you can begin filling out the Max DTI Form as follows:

Editing the Max DTI Form

Editing the Max DTI Form can be straightforward, especially with tools like pdfFiller. To access and edit the form, simply upload it onto the pdfFiller platform. Once uploaded, you can use various editing tools that allow you to adjust text, add signatures, or even annotate sections that require clarification. This functionality is invaluable, as it facilitates accuracy and ease when preparing your financial documents.

Collaboration features in pdfFiller enhance the editing experience as well. Users can share the form with others, allowing for real-time editing and feedback. This is beneficial for teams working together on financial assessments or when additional input is needed from financial advisors to ensure the form is filled out correctly.

eSigning the Max DTI Form

Using eSignatures for the Max DTI Form adds an essential layer of efficiency and legality to the document. eSignatures are legally valid and offer significant advantages in document management, providing both security and convenience. This method eliminates the need for physical signatures and ensures that the document can be signed swiftly from any location.

To eSign the document in pdfFiller, follow these simple steps: first, locate the eSignature option within the platform. Next, either draw, upload, or type your signature in the designated field. After signing, you can save the changes and share the document as needed, ensuring compliance with all necessary regulations while safeguarding the integrity of the signature process.

Managing your Max DTI Form

Once your Max DTI Form is completed, safely storing it is paramount. Using cloud storage features in pdfFiller allows users to keep their documents organized and easily accessible. This prevents data loss and keeps financial information secure. Additionally, organizing forms and categorizing them appropriately ensures that when future updates are required, you can locate the necessary documents swiftly.

Tracking changes and versions of the Max DTI Form is crucial, particularly when dealing with multiple edits or collaborative efforts. Version control helps users retain a clear history of modifications, which is not only important for reference but also essential should any disputes arise regarding the document contents. pdfFiller provides tools that enable users to track edits and ensure that they are working with the latest version of the document.

Frequently asked questions (FAQs)

Common questions often arise about the Max DTI Form, particularly regarding debt-to-income ratio impacts. One frequently asked question is, 'What happens if my DTI is too high?' In such cases, potential borrowers may face challenges securing a loan due to perceived risk by lenders. For borrowers with high ratios, it might be necessary to eliminate some debts or find ways to increase income before reapplying.

Another common inquiry is, 'How often should I update my DTI information?' It is advisable to update your DTI information whenever there is a significant change in income or debt obligations to ensure accuracy in financial assessments. Regular updates also facilitate better loan application processes and can improve the quality of financial advice from professionals.

Additional tools and resources

Leveraging interactive DTI calculators can immensely aid borrowers in evaluating their debt-to-income ratios. These calculators, some of which are available on the pdfFiller platform, provide users with immediate feedback based on real financial figures, enabling them to make informed decisions. By inputting your income and debt obligations, these tools offer quick insights into your DTI ratio, helping you strategize before applying for loans.

Furthermore, expanding your knowledge on debt management is crucial. Resources focusing on financial literacy, budgeting, and debt-elimination strategies can provide valuable insights that support beneficial financial behavior, potentially leading to improved DTI ratios and overall fiscal health.

Downloadable PDF guide

Accessing the PDF version of the Max DTI Form Guide is simple and advantageous for offline reference. Users can download a comprehensive guide, which offers step-by-step instructions and valuable tips, ensuring that you can always refer back to important information without needing internet access.

Benefits of keeping a physical copy of the guide include the ability to make notes, highlight critical sections, and refer to procedures as needed during the document preparation, enhancing your experience and understanding of the Max DTI Form.

Explore more on DTI ratios

Further learning and resources on DTI ratios can provide a deeper understanding of financial decision-making. Articles discussing various aspects of DTI ratios, including how they affect loan eligibility and the importance of maintaining a low DTI, can be found on the pdfFiller platform, providing valuable insights that cater to both individuals and financial professionals.

Stay informed on financial trends by subscribing to insights and updates from pdfFiller. This keeps you abreast of the latest developments in document management and financial wellness, ensuring that you are well-equipped to navigate the financial landscape effectively.

Footer

For any queries or assistance, reaching out to pdfFiller support can provide users with the help they need. Their knowledgeable customer service team can guide you through any document-related challenges you may encounter.

Additionally, navigation links to other guides and features on pdfFiller can enhance your user experience, offering intuitive tools to manage your financial documents efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in max dti?

Can I edit max dti on an iOS device?

How do I complete max dti on an Android device?

What is max dti?

Who is required to file max dti?

How to fill out max dti?

What is the purpose of max dti?

What information must be reported on max dti?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.