Get the free Business Development CreditsVirginia Tax

Get, Create, Make and Sign business development creditsvirginia tax

Editing business development creditsvirginia tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business development creditsvirginia tax

How to fill out business development creditsvirginia tax

Who needs business development creditsvirginia tax?

Business Development Credits: Virginia Tax Form

Overview of business development credits in Virginia

Business development credits are essential financial incentives designed to encourage investment and growth within businesses operating in Virginia. These credits can significantly reduce tax liability for eligible entities, fostering a stable economic environment. As businesses seek to innovate and expand, these credits serve as critical resources, assisting in offsetting various costs associated with training, investment, and overall operational growth.

In Virginia, numerous types of business development credits are available to eligible businesses. The Qualified Equity and Subordinated Debt Investments Credit and the Worker Training Tax Credit are two prominent examples. Each credit targets specific areas of business financing and workforce development, ultimately strengthening the state's economic fabric.

To claim these credits, businesses must meet certain eligibility criteria, ensuring they align with the state’s economic goals. These criteria often include having a defined business purpose, demonstrating a commitment to employee development, and maintaining adequate documentation.

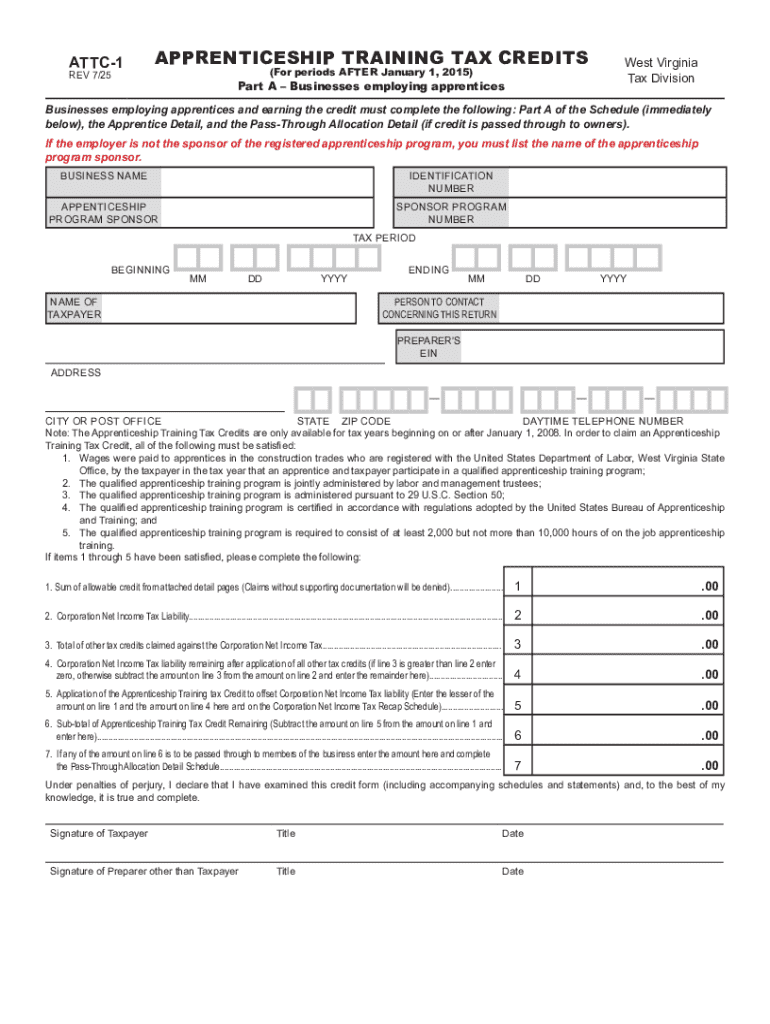

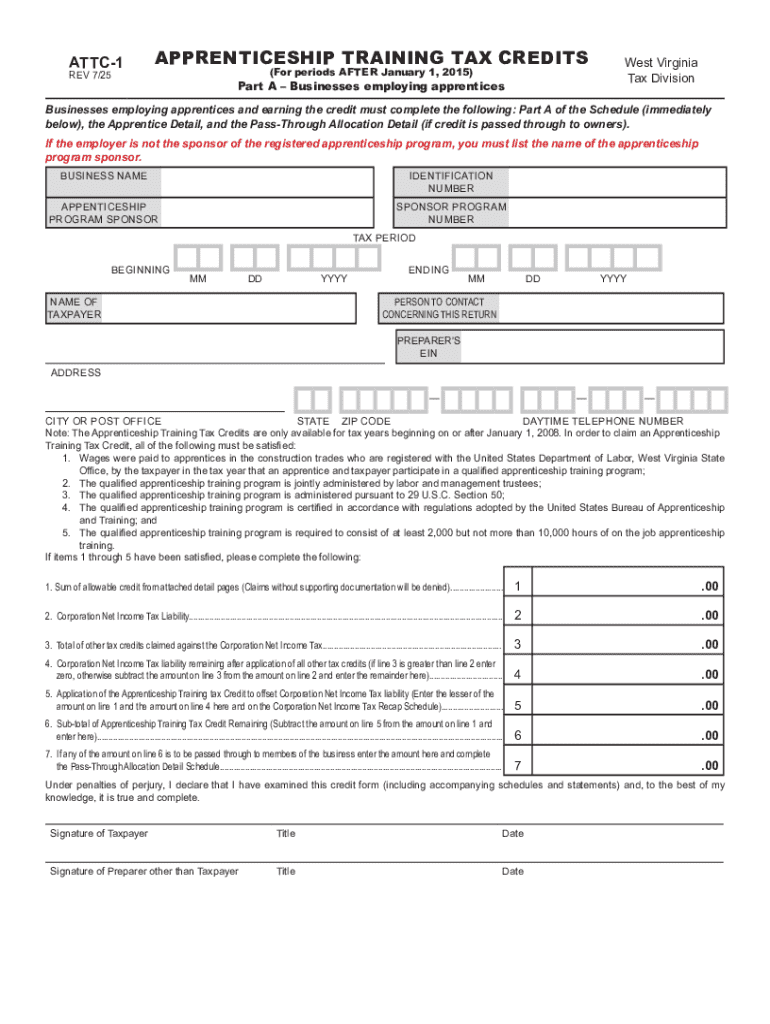

Understanding the Virginia tax form for business development credits

Filling out the Virginia tax form for business development credits requires a clear understanding of its structure. The form is designed to collect essential information about the submitting business and the specific credits being claimed. Clarity and accuracy when completing this form are essential for a successful application.

The primary sections of the form encompass several essential components, from basic personal and business information to intricate calculations related to claimed credits. Each section serves a distinct purpose, guiding users through the application process.

Step-by-step guide to filling out the Virginia tax form

Filling out the Virginia tax form might seem complex, but breaking it down into manageable steps makes the process easier. By gathering required information and methodically completing each section, businesses can maximize their chances of successfully claiming credits.

The first step involves gathering all necessary information and documents to ensure your submission is complete. This preparation is critical for avoiding delays or rejections.

Once all documents are gathered, begin completing the personal and business information sections of the form. Accuracy in providing this information is crucial, as discrepancies can lead to complications down the road.

Next, calculate the available credits by evaluating each credit category, utilizing prescribed formulas provided by the Virginia tax guidelines. Break down each credit, examining investment figures and training expenses.

Compiling supporting documents is the next step. Be proactive in validating all claims with comprehensive documentation—this could include employee training records and investment contracts.

Finally, review and finalize the form to ensure all sections are completed accurately. Be vigilant for common errors such as incorrect calculations or missing signatures, as these can easily derail your application.

Interactive tools and resources from pdfFiller

pdfFiller offers a user-friendly platform that simplifies the document creation process, making it easy to access, complete, and submit the Virginia tax form for business development credits. The intuitive layout allows users to manage documents effortlessly, enhancing productivity and saving time.

Accessing the Virginia tax form via pdfFiller is straightforward. Users can search for the specific template and interact directly with editable fields, facilitating a hassle-free experience.

Tips for successful submission

When submitting your Virginia tax form for business development credits, adhering to best practices can make a significant difference in the outcome. Understanding deadlines and timelines for submissions is paramount to ensure compliance and avoid any unnecessary penalties.

Establish a calendar timeline for submission deadlines, ensuring that your credits are claimed within the specified periods set by the Virginia Tax Department. Late submissions could result in lost opportunities for credit application.

Real-life examples and case studies

Numerous businesses across Virginia have successfully leveraged business development credits to enhance their operations. For instance, a tech startup that utilized the Qualified Equity and Subordinated Debt Investments Credit to secure necessary funding and grow their team saw a significant increase in their market competitiveness.

Similarly, a local manufacturing company utilized the Worker Training Tax Credit to enhance employee skills, leading to increased productivity and reduced operational costs. These success stories highlight the impact of such credits on fostering business growth, job creation, and economic stability within the region.

Additional considerations for recipients of business development credits

Once a business successfully claims and receives business development credits, it’s crucial to be aware of the tax implications and reporting requirements. Recipients should maintain diligent records and prepare for any necessary reporting in upcoming tax years to ensure compliance.

Keeping organized records will facilitate future audits and simplify the credit application process for subsequent years. Proper documentation, including investment receipts and employee training logs, will support continued eligibility for credits, aiding the business's long-term growth strategy.

Virginia business development credit expiry dates and updates

Businesses should be mindful of key dates related to Virginia business development credits, ensuring timely applications and compliance with all regulations. It’s vital to stay informed about any legislative changes that may affect the availability or structure of these credits.

Notable changes in legislation could alter eligibility criteria, expiration of credits, or introduce new incentives. Looking ahead, the future outlook for business development credits in Virginia appears promising, with ongoing support aimed at fostering local businesses.

Connect with resources and experts

Engaging with available resources can significantly enhance your understanding and management of business development credits. The Virginia Tax Department offers various tools and contact points for businesses seeking guidance.

Explore links to helpful state resources dedicated to tax credits and business support. Seeking advice from tax professionals specializing in business development credits can further clarify eligibility, maximizing potential benefits for your business.

you know?

Business development credits in Virginia not only encourage economic growth but also support workforce training, thus improving employee skills and productivity. These credits can serve as powerful assets for businesses to enhance their operational capacity.

A common misconception about business development credits is that they are only beneficial for large corporations; in reality, small businesses often reap the most rewards, leveraging these incentives to drive their growth and success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business development creditsvirginia tax in Gmail?

How can I send business development creditsvirginia tax to be eSigned by others?

How do I make edits in business development creditsvirginia tax without leaving Chrome?

What is business development creditsvirginia tax?

Who is required to file business development creditsvirginia tax?

How to fill out business development creditsvirginia tax?

What is the purpose of business development creditsvirginia tax?

What information must be reported on business development creditsvirginia tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.