Get the free MOA FUNDS SPOUSE BENEFICIARY IRA INHERITANCE REQUEST FORM. Accessible PDF

Get, Create, Make and Sign moa funds spouse beneficiary

How to edit moa funds spouse beneficiary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out moa funds spouse beneficiary

How to fill out moa funds spouse beneficiary

Who needs moa funds spouse beneficiary?

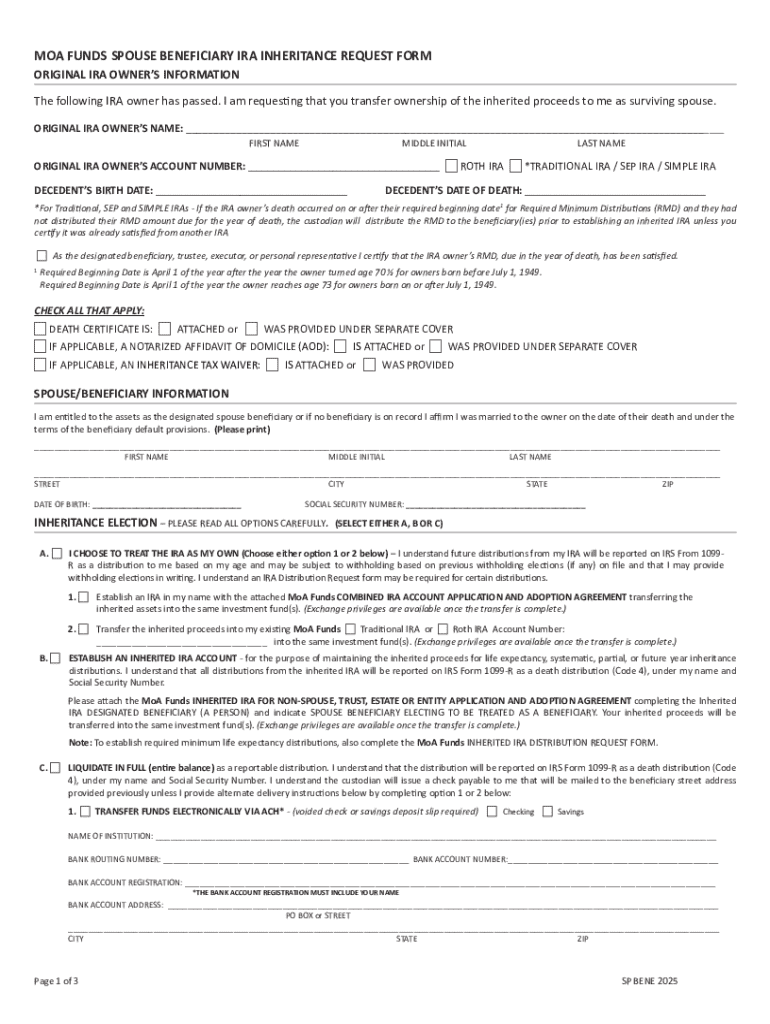

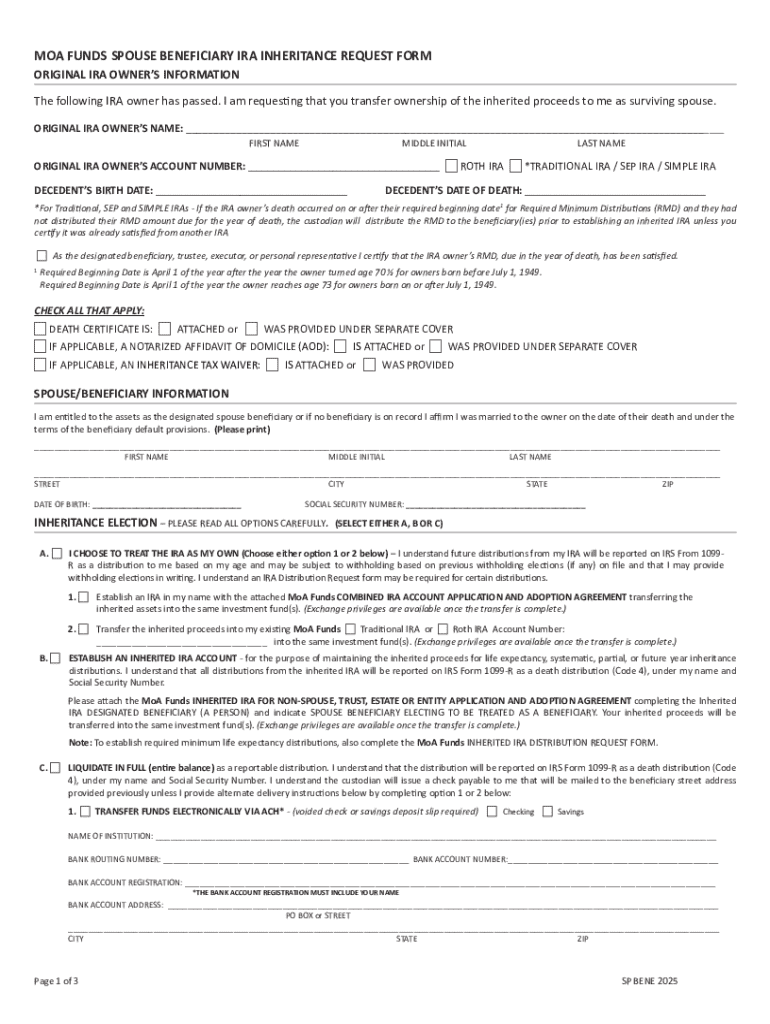

Understanding the MOA Funds Spouse Beneficiary Form: A Comprehensive Guide

Understanding MOA funds and the importance of a spouse beneficiary

MOA Funds, or Managed Operating Accounts Funds, are designed to assist individuals in managing and growing their assets efficiently. These funds often provide various investment opportunities tailored to suit individual risk appetites and financial goals, encompassing retirement accounts, savings plans, and other financial ventures that promote fiscal growth. By leveraging these funds, individuals can secure a stable economic future and ensure that their resources are working effectively.

One crucial aspect of planning for one's financial future is the designation of beneficiaries, particularly a spouse as a beneficiary. Designating your spouse as a beneficiary of your MOA Funds ensures that in the event of your passing, your partner will have immediate access to the assets without the need for lengthy probate proceedings. This designation not only provides peace of mind but also streamlines the transition of assets, preventing potential financial strife for your loved ones during a difficult time.

Overview of the spouse beneficiary form

The MOA Funds Spouse Beneficiary Form serves as the official document used to declare your spouse as the designated beneficiary of your funds. This form carries significant legal weight, ensuring that your spouse will be acknowledged as the rightful heir upon your death. Completing this form accurately is necessary to fulfill legal requirements and safeguard your spouse's financial interests, facilitating a smoother transition of assets during challenging times.

Key components of the form include personal identification information, specific details about the beneficiary designation, and spousal consent sections. It’s imperative to understand each component clearly to avoid unnecessary complications in the future. Terms such as 'contingent beneficiary' and 'primary beneficiary' convey essential distinctions in beneficiary designations that can impact risk management within estate planning.

Step-by-step guide to filling out the spouse beneficiary form

Before you start filling out the spouse beneficiary form, ensure all pertinent documents are on hand. This will simplify the process and ensure accuracy. Commonly required documents include your marriage certificate, identification, and previous beneficiary designations if applicable. Preparing this information beforehand can save time and minimize confusion when completing the form.

Detailed instructions for each section include filling out personal information such as full names, addresses, and Social Security numbers. Next is the beneficiary designation where you indicate your spouse as the primary beneficiary. Ensure that all details provided are consistent and accurate. Additionally, if required, spousal consent must be documented, denying any claims from potential contesting parties posthumously.

Interactive tools for form management

Utilizing tools like pdfFiller can enhance your experience when managing the MOA Funds Spouse Beneficiary Form. These interactive tools allow users to upload, edit, and sign their forms online effortlessly. By providing a cloud-based platform, pdfFiller ensures that users can access their documents from anywhere, making financial management straightforward and organized.

Incorporating eSignature integration into the form process is highly beneficial. Digital signatures establish the authenticity of the document and validate consent rapidly. Utilizing pdfFiller’s eSignature features, you can seamlessly incorporate signatures to meet all legal requirements quickly, addressing the crucial aspect of legal compliance effectively.

Common mistakes to avoid

While completing the spouse beneficiary form, certain frequent errors may complicate the process. Misunderstanding beneficiary terminology, such as 'contingent' versus 'primary', can lead to unintended consequences in the event of a claim. Additionally, omitting critical information, such as accurate identification numbers or signatures, can delay the processing of the form, leading to potential financial difficulties for your spouse.

To ensure accuracy, double-check all information entered on the form before submission. Consider seeking guidance from professionals in estate planning if there is any uncertainty regarding terminology or sections of the form. This proactive approach helps in avoiding potential issues down the line.

Submitting your spouse beneficiary form

After completing the spouse beneficiary form, the next step is to determine how to submit it. Depending on the platform, you may have online submission options through resources such as pdfFiller. This eliminates the waiting time associated with mailing forms and allows for immediate processing.

If you're required to mail your form, ensure it is sent to the correct address as outlined on the document. To verify that your form has been successfully submitted, consider following up through the appropriate channels, ensuring that you maintain an organized record of submission.

Managing changes after submission

Life is filled with changes, and your financial plans should reflect those changes accordingly. Modifying your beneficiary designation may be necessary due to various reasons such as divorce, the death of a spouse, or changes in your financial situation. To make these modifications, you’ll need to submit a new spouse beneficiary form to replace the previous one.

It’s crucial to keep your information updated to reflect any significant life changes promptly. Not only does this practice ensure clarity and adherence to your current wishes, but it also protects your loved ones from potential confusion or financial disputes regarding your assets in the event of your passing.

FAQs about the spouse beneficiary form and MOA funds

Addressing common queries about the MOA Funds Spouse Beneficiary Form can provide clarity to potential users. One often-asked question is, 'What happens if I don't designate a beneficiary?' Without a beneficiary designation, assets may need to go through probate, a potentially lengthy and costly process that can delay access to funds for heirs. Moreover, policies may default to a specific individual based on existing laws, not aligning with your wishes.

Another frequent inquiry is whether one can have multiple beneficiaries. Yes, designating multiple beneficiaries is possible and can offer flexibility in estate planning. Regularly reviewing your beneficiary designations ensures they remain aligned with your current intentions.

Additional support

For assistance with filling out the MOA Funds Spouse Beneficiary Form, reaching out to pdfFiller provides a wealth of resources and help. Their support team can guide users through any difficulties faced during form completion or submission. Additionally, if you want to delve deeper into estate planning, connecting with estate planning advisers can further ensure proper management of your assets.

Feedback from users

Many users have reported a positive experience when utilizing the MOA Funds Spouse Beneficiary Form through pdfFiller. Testimonials highlight the efficiency and ease of managing the form online, significantly reducing the time and effort needed to complete necessary documentation. Users have praised the ability to edit, sign, and submit the form from any location, emphasizing the platform’s user-friendly interface and robust features.

The streamlined process provided by pdfFiller has not only simplified documentation but has also offered users reassurance that their financial planning is in good hands. Feedback reflects consistent satisfaction among users, inspiring confidence in the efficacy of using a comprehensive online document management solution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in moa funds spouse beneficiary?

How can I edit moa funds spouse beneficiary on a smartphone?

How do I edit moa funds spouse beneficiary on an iOS device?

What is moa funds spouse beneficiary?

Who is required to file moa funds spouse beneficiary?

How to fill out moa funds spouse beneficiary?

What is the purpose of moa funds spouse beneficiary?

What information must be reported on moa funds spouse beneficiary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.