Get the free NYLI Funds 403(b)(7) Distribution Form

Get, Create, Make and Sign nyli funds 403b7 distribution

How to edit nyli funds 403b7 distribution online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nyli funds 403b7 distribution

How to fill out nyli funds 403b7 distribution

Who needs nyli funds 403b7 distribution?

NYLI Funds 403b7 Distribution Form How-to Guide

Understanding NYLI Funds 403b7 Distribution

The NYLI Funds 403b7 is a specialized retirement plan designed for employees of non-profit organizations, allowing for tax-deferred savings. It is an excellent option for those looking to save for retirement while benefitting from tax incentives. Understanding the distribution options available under this plan is crucial for making an informed decision about your retirement savings. The main distribution options include a lump-sum distribution, a direct rollover to another retirement account, and annuity payments that provide a steady income over time.

Knowing your distribution rights is equally important. This involves understanding the terms and conditions associated with each distribution type, as well as the potential impact on your finances in terms of taxes and future retirement benefits.

Pre-distribution considerations

Before filling out the NYLI Funds 403b7 distribution form, it is essential to assess your eligibility. Generally, eligibility is based on age and service criteria. You must be at least 59½ years old or have separated from service to access your funds without penalties. Tax implications also play a vital role in your decision-making process, as early withdrawals may lead to significant tax liabilities.

Consider your immediate financial needs versus your long-term financial planning. Are you in a situation where you need cash quickly due to unforeseen circumstances? Alternatively, is it more beneficial to leave your funds invested for greater long-term growth? Evaluating alternative funding options can also provide clarity about the best route for your financial future.

Accessing the NYLI Funds 403b7 Distribution Form

To access the NYLI Funds 403b7 distribution form, you can find it on the NYLI website or other reputable financial services platforms such as pdfFiller. The form is generally located within the retirement or distribution section. If you need assistance, contacting customer support can provide guidance.

For those using pdfFiller, the process is user-friendly. You'll need to sign up and create an account to take full advantage of the platform's features. Once signed in, searching for the NYLI Funds 403b7 form is straightforward, and you can start filling it out electronically.

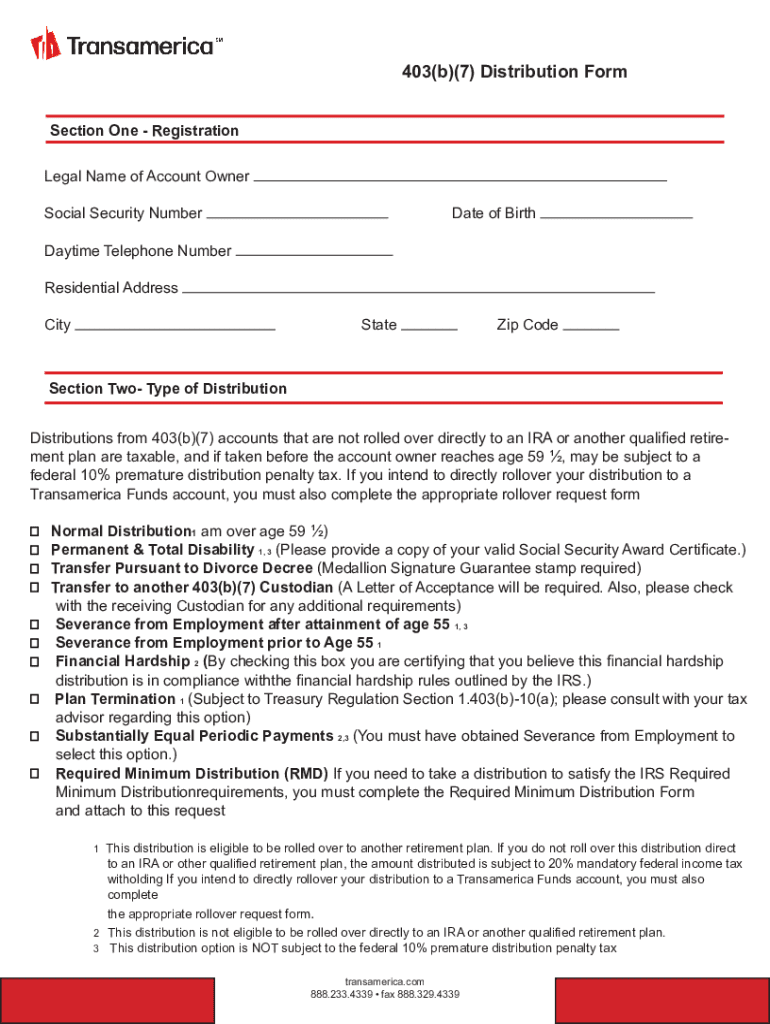

Step-by-step instructions for completing the distribution form

Completing the distribution form accurately is essential for a smooth processing time. Start by gathering the necessary personal information, which includes your full name, Social Security number, and employment details. You will also need to provide information about your financial institution for where to direct the funds.

When filling out the form, follow these steps carefully:

After completing the form, review it thoroughly for any inaccuracies or missing information, as mistakes can delay your distribution request.

Utilizing pdfFiller tools for efficient form management

pdfFiller enhances the process of managing your distribution form with various user-friendly features. Within the platform, you can edit the document directly to make any necessary changes. Adding notes or annotations can help clarify any questions or comments you might have as you complete your form.

One standout feature is the eSigning capability. You can create an electronic signature that meets legal standards, making it easier to finalize your documents without printing and scanning. Additionally, you can send the form for others to sign, facilitating collaboration if you need input from financial advisors or family members.

Submitting the NYLI Funds 403b7 Distribution Form

Proper submission of your distribution form ensures that your request is processed timely. Depending on your choice, you may submit the form via email or traditional mail. Keep in mind the processing times associated with each method—email often yields faster results. It's also important to check the NYLI guidelines regarding submission, including any required documentation.

Once submitted, tracking the status of your distribution request can provide peace of mind. You can contact NYLI customer service to inquire about your request or check online for any updates regarding your distribution.

Common issues and solutions

Filling out the NYLI Funds 403b7 distribution form can be a straightforward process, yet common mistakes like incorrect personal details or submission issues can occur. It's critical to double-check each field to avoid any inaccuracies that may lead to processing delays. Understanding these common pitfalls can help streamline your experience.

If you encounter submission problems, the first step is to review the guidelines for correctness. Also, having your contact details readily available for customer support will speed up problem-solving. Here are some common issues and how to resolve them:

Understanding the impact of your distribution

The impact of withdrawing from your NYLI Funds 403b7 plan can extend beyond immediate financial relief. Distributions can result in tax consequences that may affect your annual tax filings. If you're under age 59½, withdrawals may incur penalties which could significantly impact your overall savings for retirement.

Moreover, taking a distribution might influence your eligibility for additional retirement benefits based on your employer's plans. Understanding these far-reaching implications is vital for comprehensive retirement planning. Individuals typically benefit most from consulting with a financial advisor to weigh the pros and cons of distributions.

FAQs about NYLI Funds 403b7 Distribution

If you have questions regarding your NYLI Funds 403b7 distribution form, you’re not alone. Many individuals share similar uncertainties, particularly with regard to eligibility, fees, and the nuances of various distribution types. This section aims to clarify common inquiries.

Make sure to stay updated regarding any changes to regulations or rules affecting your distribution options, as these can influence your financial decisions significantly if you're approaching retirement age.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nyli funds 403b7 distribution for eSignature?

How do I complete nyli funds 403b7 distribution online?

How do I fill out nyli funds 403b7 distribution on an Android device?

What is nyli funds 403b7 distribution?

Who is required to file nyli funds 403b7 distribution?

How to fill out nyli funds 403b7 distribution?

What is the purpose of nyli funds 403b7 distribution?

What information must be reported on nyli funds 403b7 distribution?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.