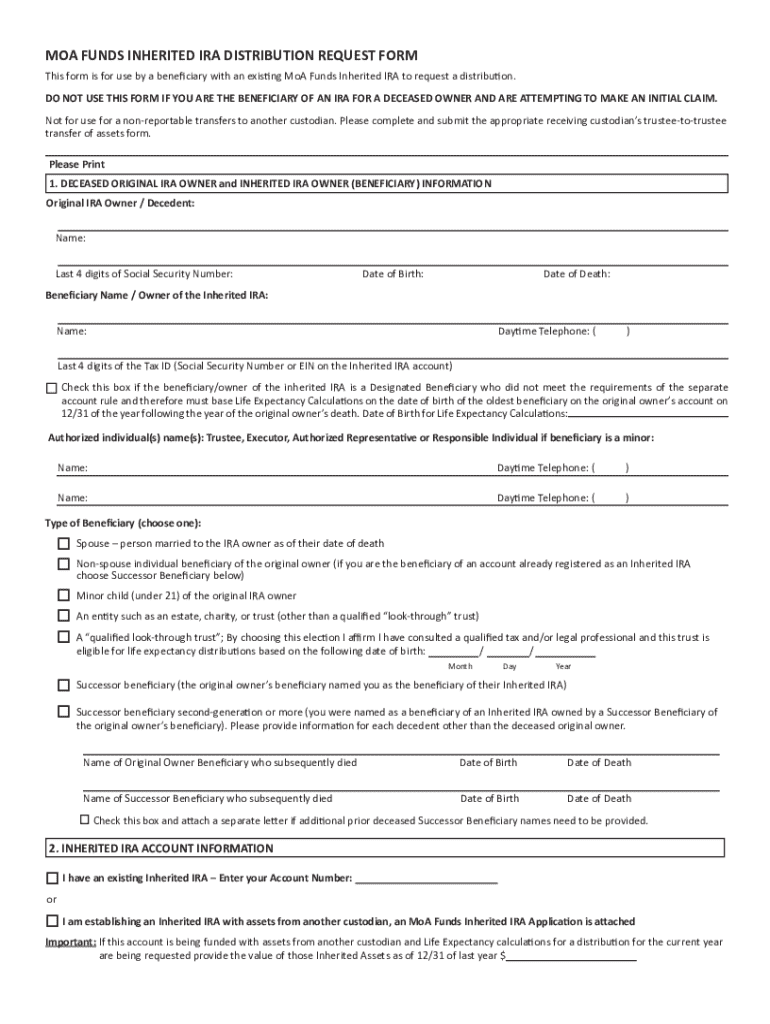

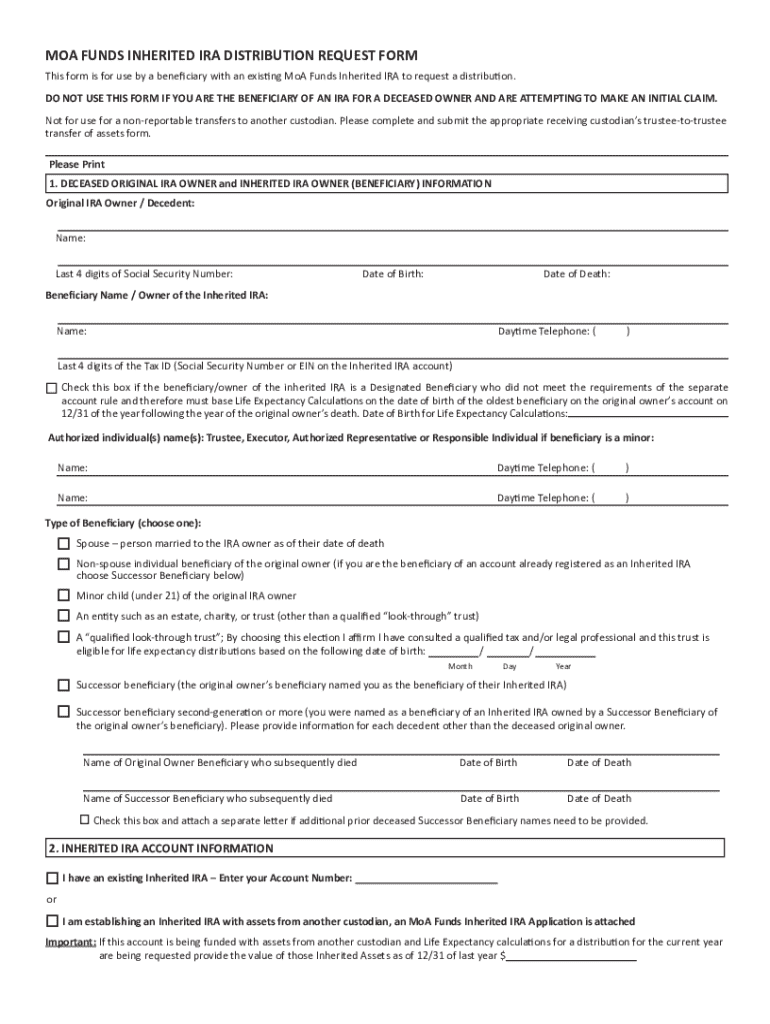

Get the free MOA FUNDS INHERITED IRA DISTRIBUTION REQUEST FORM. Accessible PDF

Get, Create, Make and Sign moa funds inherited ira

How to edit moa funds inherited ira online

Uncompromising security for your PDF editing and eSignature needs

How to fill out moa funds inherited ira

How to fill out moa funds inherited ira

Who needs moa funds inherited ira?

A Complete Guide to MoA Funds Inherited IRA Form

Understanding MoA funds & inherited IRAs

MoA funds, or Management of Assets funds, represent a specialized category of investments tailored for optimal asset growth and management. These funds hold significant value for retirement planning, particularly when considering inherited IRAs. An inherited Individual Retirement Account (IRA) allows beneficiaries to manage and withdraw funds contributed by a deceased account holder. This unique structure provides financial flexibility but also comes with specific rules and regulations.

As people increasingly prioritize retirement planning, MoA funds have emerged as crucial elements within this framework. Not only do they offer diverse investment options, but they also ensure that heirs can maintain and potentially increase the value of their inheritance through wise financial strategies. Understanding how these funds fit into inherited IRAs is essential for ensuring tax efficiency and compliance.

The MoA funds inherited IRA form

At the heart of managing an inherited IRA with MoA funds is the MoA funds inherited IRA form. This document serves as the gateway to transitioning the account to the beneficiary's name while retaining the tax advantages associated with an IRA. Given the complexities surrounding inherited IRAs, this form is pivotal in ensuring that the transfer adheres to IRS regulations.

Filing this form accurately is critical as it affects how the beneficiary can access funds, make withdrawals, and maintain the inherited IRA’s status. The essential information required typically includes personal details of both the deceased account holder and the beneficiaries, along with financial institution details where the IRA is held. Furthermore, key terms such as 'non-spouse beneficiary,' 'stretch IRA,' and 'permission to access' play an important role in the overall process.

Step-by-step instructions for completing the MoA funds inherited IRA form

Personal information section

The personal information section of the MoA funds inherited IRA form is straightforward but very important. You must provide comprehensive details such as full name, current address, date of birth, and Social Security number. Accuracy in this section helps in verifying your identity and ensuring there are no delays in processing your form.

Tips for accurate data entry include double-checking spelling and ensuring all numbers are correct. Missteps in this section may lead to significant delays or even rejection of your form.

Beneficiary information section

In the beneficiary information section, you must specify the beneficiaries of the inherited IRA. It is essential to include full names, birthdates, and Social Security numbers. If there are multiple beneficiaries, indications of the percentage each one will receive should also be clearly documented. Carefully considering who will receive what portion of the funds can prevent future legal disputes and tax complications.

It’s important to keep in mind whether your beneficiaries are designated as primary or contingent, and to understand how these designations affect the distribution process.

Financial institution details

Selecting the right financial institution to manage your inherited IRA and MoA funds can influence your investment strategy. When completing this section, include the institution's name, address, and any account numbers associated with the IRAs.

Documentation needed for submission often includes the original death certificate, the deceased's will, and proof of identity for all beneficiaries. Having these documents ready enhances efficiency and helps avoid unnecessary holdups.

Editing and managing your MoA funds inherited IRA form

Once the MoA funds inherited IRA form is complete, you may need to edit or manage it. Using tools like pdfFiller can significantly simplify this process. To upload your form, simply navigate to the pdfFiller platform, where you can import your form directly from your device or cloud storage.

Editing with pdfFiller allows for easy adjustments. You can add necessary comments, highlight sections, or modify existing entries to ensure everything is current and accurate. Tips for editing and customizing your form include using the ‘save as’ feature to keep various versions and ensuring that any changes do not violate the IRA account rules.

Signing the form electronically

Signing the MoA funds inherited IRA form electronically is not only efficient but also secure. The step-by-step process for eSigning typically involves navigating to the designated signature section of your document within pdfFiller, then following the prompts to add your electronic signature securely.

The advantages of using pdfFiller for eSigning include enhanced security, the ability to sign from anywhere, and streamlined documentation processes that keep your records organized.

Common mistakes to avoid when filing the MoA funds inherited IRA form

Certain pitfalls can jeopardize the execution of your MoA funds inherited IRA form. One of the most common mistakes includes overlooking essential information, leading to incomplete submissions that could delay access to your funds. It’s critical to read through the entire form and ensure that all sections are filled correctly.

Misunderstanding tax implications associated with inherited IRAs is another frequent oversight. Knowing the tax responsibilities attached to withdrawals can avoid unexpected penalties. Additionally, delaying submission of the form can have grave consequences, including the loss of rights to inherited IRA assets or excess taxes on the distributions.

Frequently Asked Questions about MoA funds inherited IRAs

What happens if the form is filed incorrectly? If the MoA funds inherited IRA form is filed incorrectly, it may result in processing delays, increased scrutiny from the IRS, or the possible designation of your inherited IRA as taxable. To remedy this, promptly correcting any errors as soon as they are discovered is crucial.

Can MoA funds be transferred after the form is submitted? Yes, under certain conditions, MoA funds can be transferred to other qualified retirement accounts after the form is submitted, which may offer further management benefits and investment strategies.

How are withdrawals handled in an inherited IRA? Withdrawals in an inherited IRA are typically required based on the beneficiary's IRS-designated status. Non-spouse beneficiaries must withdraw minimum distributions annually, adhering to IRS guidelines to avoid penalties.

Providing your feedback

Feedback plays an integral role in the continuous improvement of document management tools such as the MoA funds inherited IRA form process. If you have insights or suggestions, consider submitting them directly through pdfFiller’s platform.

Your feedback can help enhance the overall user experience and ensure that the functionalities meet the requirements of both new and seasoned users in managing their documents efficiently.

MoA virtual assistant support

The MoA virtual assistant can greatly facilitate your journey through the form-filing process, providing essential guidance and support. Users can leverage live chat or consult other support options available through pdfFiller to address specific questions.

These support features enhance user confidence and ensure that any complexities regarding the MoA funds inherited IRA form are navigated successfully. Take advantage of the digital resources available to streamline your experience.

Best practices for long-term management of inherited IRA funds

Developing a strategy for the distribution of MoA funds from an inherited IRA requires careful planning. Beneficiaries should establish clear financial goals and determine how to utilize the inherited funds effectively. This might include a combination of investment growth, expense management, or even charitable giving.

Tax planning tips are also vital for inherited IRAs. Staying informed about current tax laws and working with financial advisors can help beneficiaries understand the best practices regarding withdrawals and distributions, ultimately optimizing the financial benefits of the inherited funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my moa funds inherited ira in Gmail?

How do I edit moa funds inherited ira straight from my smartphone?

How do I fill out moa funds inherited ira using my mobile device?

What is moa funds inherited ira?

Who is required to file moa funds inherited ira?

How to fill out moa funds inherited ira?

What is the purpose of moa funds inherited ira?

What information must be reported on moa funds inherited ira?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.