Get the free Consumer Credit Application - Regina

Get, Create, Make and Sign consumer credit application

How to edit consumer credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumer credit application

How to fill out consumer credit application

Who needs consumer credit application?

Consumer Credit Application Form: A Comprehensive How-to Guide

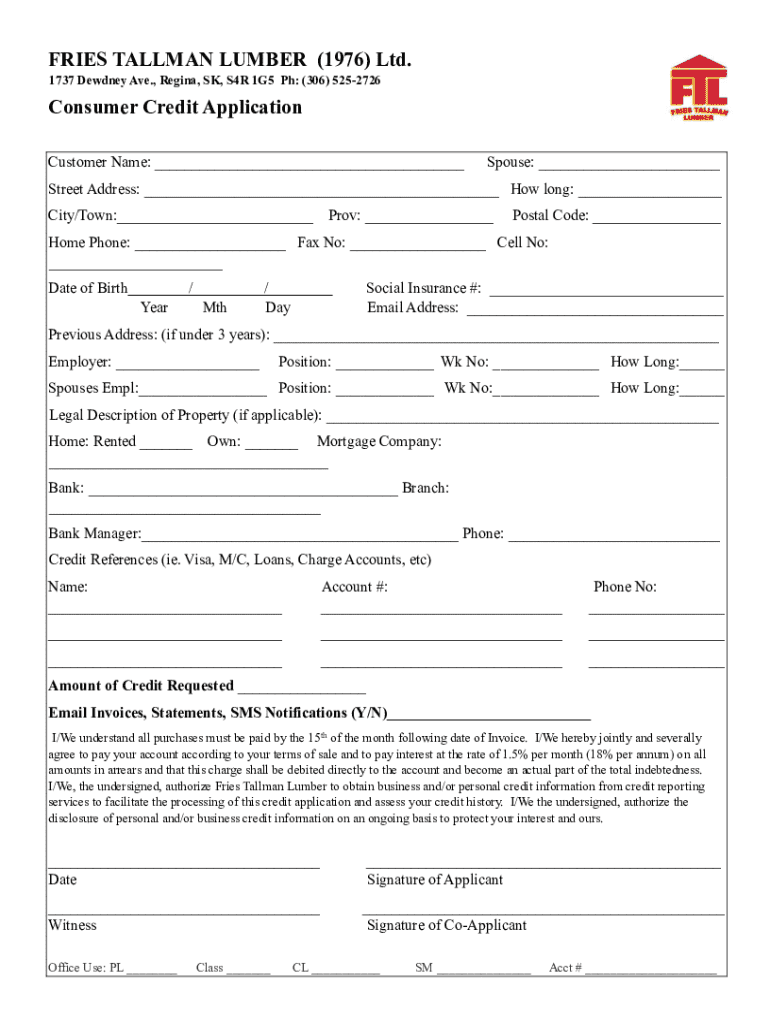

Understanding consumer credit application forms

A consumer credit application form is a crucial document that potential borrowers complete when seeking credit. This form collects essential information from the applicant, which lenders analyze to determine creditworthiness. Accurate completion of this form is paramount as it directly influences credit approval decisions. Mistakes or discrepancies can delay processing or even result in denial.

The implications of inaccurate information extend beyond mere denial; they can also lead to legal troubles if fraudulent details are provided. Borrowers should be diligent in ensuring every section of the consumer credit application form is filled out correctly to avoid unnecessary complications.

Purpose and use cases of consumer credit application forms

Consumer credit application forms are indispensable in various scenarios requiring financial assistance. Common use cases include applying for personal loans, credit cards, auto loans, and mortgages. Each case has distinct requirements that applicants must consider when filling out their forms.

The individuals typically completing these forms range from average consumers seeking personal credit to small business owners pursuing financing for business operations.

Key components of a consumer credit application form

A consumer credit application form comprises several key components that provide lenders with a comprehensive overview of an applicant's financial health. The personal information section gathers basic identifying details such as the applicant's name, address, and contact information. Here, the importance of an applicant's Social Security number cannot be overstated, as it helps validate identity and check credit histories.

The financial information section is vital as it reveals income sources, amounts, and employment details, allowing lenders to assess repayment capacity. In addition, the account information section outlines any existing debts and obligations, alongside a broad overview of assets and liabilities. This holistic view enables lenders to make informed decisions.

Step-by-step guide to completing a consumer credit application form

Completing a consumer credit application form requires careful attention to detail. Here is a practical step-by-step guide to ease your process.

Utilizing platforms like pdfFiller for electronic signatures not only simplifies the signing process but also enhances document management.

Navigating special sections of a consumer credit application

Consumer credit application forms often contain special sections such as disclosures and consent notices. Understanding your rights, especially under regulations like the Equal Credit Opportunity Act (ECOA), is essential to prevent discrimination during the application process.

Additionally, if you are applying with a co-applicant, this section will require you to include their information, which is vital for shared liabilities. Properly filling out this section can significantly improve the chances of obtaining credit approval.

Frequently asked questions about consumer credit applications

Filling out a consumer credit application can raise several questions. Below are some frequent queries you might have during the process.

Managing your completed consumer credit application

After completing your consumer credit application, managing the document effectively is vital. Platforms like pdfFiller provide a secure way to save and store important documents, granting you access from anywhere.

Moreover, collaborating with team members on shared applications is straightforward. To follow up with lenders, maintaining structured communication is recommended. Track your application status diligently and explore additional funding options if necessary.

Best practices for a successful credit application

To improve your chances of approval, it's essential to prepare your financial information meticulously. Keep your documents organized and readily accessible to streamline the application process.

By adhering to these best practices, you can present a compelling case to potential lenders.

Conclusion of application process insights

Completing a consumer credit application form is more than a mere formality; it’s a step towards financial empowerment. The journey from application to approval can be swift with proper preparation and an understanding of your lender's requirements. pdfFiller’s cloud-based platform is designed to help you navigate this process with ease and efficiency, making it simpler to fill out, edit, sign, and manage your documents seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consumer credit application for eSignature?

How do I edit consumer credit application in Chrome?

How do I edit consumer credit application on an iOS device?

What is consumer credit application?

Who is required to file consumer credit application?

How to fill out consumer credit application?

What is the purpose of consumer credit application?

What information must be reported on consumer credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.