Get the free Application Form for AePS Registration & Modification

Get, Create, Make and Sign application form for aeps

Editing application form for aeps online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application form for aeps

How to fill out application form for aeps

Who needs application form for aeps?

Application Form for AEPS Form - How-to Guide Long Read

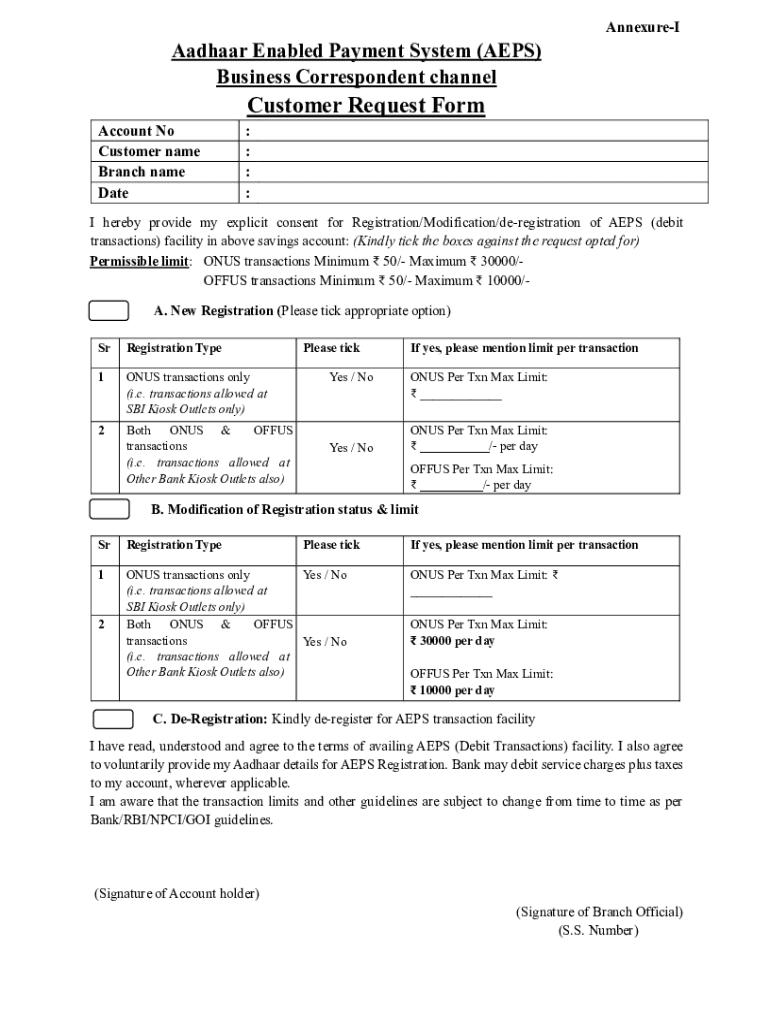

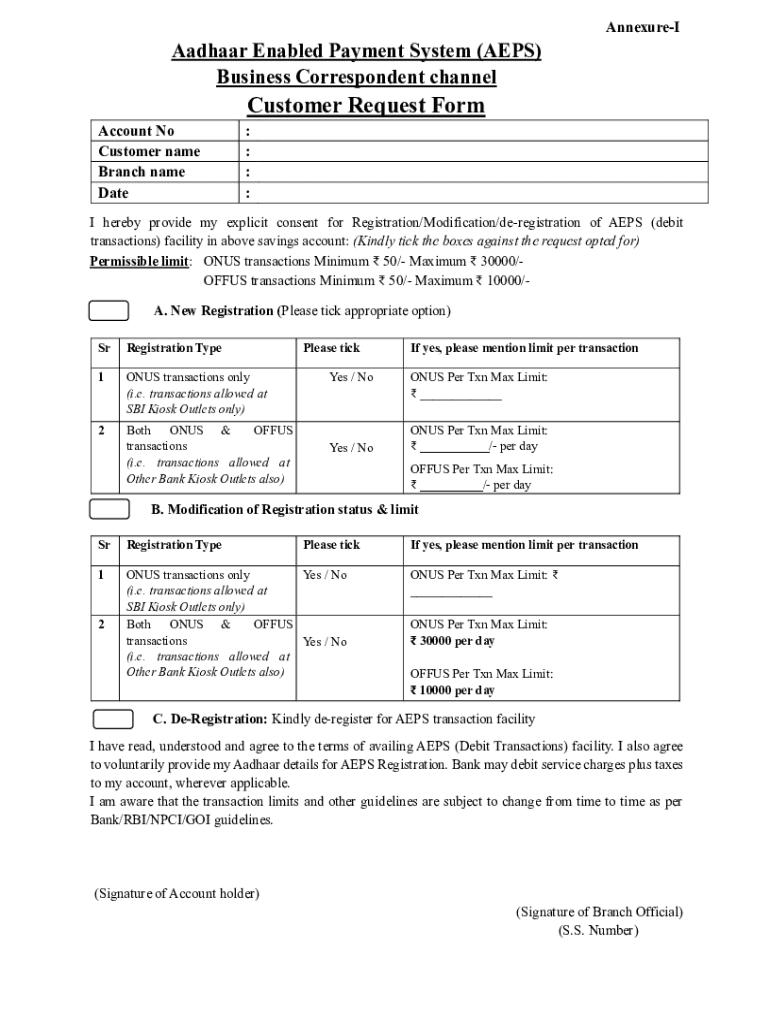

Understanding the AEPS application form

The AEPS (Aadhaar Enabled Payment System) form serves as a crucial document designed to facilitate seamless financial transactions in India. The primary purpose of the AEPS form is to link an individual’s Aadhaar number with their bank account to enable cashless transactions through biometric authentication. This innovative system not only enhances transaction efficiency but also ensures inclusivity in financial services, allowing even those without traditional banking experience to access financial tools easily.

The AEPS form plays a significant role in the landscape of payment systems, particularly in India where digitization is rapidly evolving. By utilizing the AEPS form, users can perform various banking transactions such as cash withdrawal, balance inquiry, and fund transfer with ease and security. The complexity of navigating financial services diminishes significantly when the AEPS system is in place.

Who needs to fill out the AEPS form?

Individuals from various backgrounds can benefit from the AEPS system. As an individual, utilizing the AEPS for personal transactions offers convenience, security, and quick access to funds. Particularly for those who may be unbanked or new to digital finance, filling out the AEPS form opens up new avenues for managing personal finances. This could include rural residents lacking immediate access to banks, who can now facilitate transactions using only their Aadhaar information.

Teams and organizations, particularly those involved in collaborative financial management or focusing on employee welfare programs, stand to gain significant advantages from AEPS as well. Companies can streamline payroll systems and reimbursements, ensuring timely payment transfers that enhance employee satisfaction and productivity. Filling out the AEPS form in this context fosters collective engagement in the digital economy.

Key features of the AEPS form

The AEPS application form consists of several essential components crucial for proper processing. Key fields typically required include personal details such as the applicant's name, phone number, and email address. Moreover, sufficient bank information must be included, such as the bank account number and IFSC code, in addition to the biometric Aadhaar number, which serves as the method of identification and authorization for transactions.

Moreover, robust security features are integrated within the AEPS system to ensure user privacy and data protection. The importance of data encryption within financial applications cannot be overstated, as it safeguards sensitive information from unauthorized access. By filling out the AEPS form, users can trust that their financial transactions will remain secure against cyber threats, thanks to these layered security measures.

Step-by-step guide to filling out the AEPS form

1. Gathering necessary information: Before you begin filling out the AEPS form, ensure you have all essential documents handy. This includes your Aadhaar card, bank account details, and any identification documents that may be necessary. Having this information organized can save you time and ensure accuracy during the filling process.

2. Accessing the AEPS application form: The AEPS application form can typically be found on various platforms, including banks' websites and specialty financial service portals like pdfFiller. Navigate through the online portal to find either a downloadable PDF or an interactive online version that suits your needs.

3. Filling out the form: Use pdfFiller’s platform for an interactive, user-friendly experience. Tools are available where you can easily edit your entries, sign documents electronically, and even collaborate with team members if you’re working in a group context. Be diligent while entering your personal and financial information—accuracy is key to avoiding delays in processing.

4. Reviewing your application: Before submitting your application, thoroughly check all your entries for potential errors. pdfFiller provides features that allow you to review your application systematically, ensuring that you haven’t missed any crucial information or made mistakes that could hinder your application.

5. Submitting the AEPS form: There are various submission methods available, whether you choose to submit online, via email, or in physical form to a designated financial institution. Make sure to sign the application properly, using pdfFiller’s e-signature features to complete the process fully.

Managing your AEPS application

Once you've submitted your AEPS form, tracking your application status is crucial. Many banks and financial institutions provide mechanisms for users to check the status of their application online. Regularly checking will keep you informed about any potential issues that might need your attention.

If you find the need to make revisions or corrections after submission, don't fret. Knowing how to navigate pdfFiller’s tools can make this process straightforward. You can easily amend your application and resubmit it, ensuring that all information is current and accurate.

Frequently asked questions about the AEPS form

How long does the approval process take? Generally, the approval time for AEPS applications can vary widely depending on the institution's processing time. On average, users can expect a response within a few business days.

What if I encounter issues while filling out the form? Should you face any challenges, pdfFiller’s customer support services and community forums are excellent resources for obtaining assistance. They can provide guidance tailored to your specific situation.

Can I save my progress on pdfFiller before submitting? Absolutely! One of the advantages of using pdfFiller is its ability to allow users to save their work frequently, enabling you to revisit and revise your document as needed.

Leveraging pdfFiller for your document needs

Utilizing pdfFiller for the AEPS form brings several advantages. The platform is cloud-based, which allows for accessibility from anywhere, ideal for teams that require document collaboration. It seamlessly integrates with various documents and forms type, further enhancing teamwork efficiency.

Additionally, pdfFiller offers a comprehensive range of other templates and forms that can be utilized for various document management tasks beyond AEPS. This versatility means that users are likely to find solutions for their other document-related needs in one convenient platform.

Interactive tools and resources available on pdfFiller

pdfFiller provides a variety of useful interactive tools designed to aid users throughout the form-filling process. These can include checklists to ensure completeness and resources that guide you through every step, which can greatly enhance your experience.

For those who may be new to digital tools, access to tutorials, customer support, and community forums are a treasure trove of resources available at your fingertips. Utilizing these features can turn a potentially daunting task into a streamlined experience.

Final tips for success with AEPS and pdfFiller

To ensure a successful form submission, keep in mind best practices such as taking your time while filling out the AEPS form, as accuracy is vital. Always guarantee the safety of your submitted information by utilizing the security features offered by pdfFiller.

As you explore the capabilities of pdfFiller, you’ll undoubtedly discover numerous solutions for your broader document needs. Whether it’s contract signing or invoice creation, pdfFiller empowers users with the tools necessary to manage documents efficiently in today’s digital landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify application form for aeps without leaving Google Drive?

How do I complete application form for aeps online?

How do I make edits in application form for aeps without leaving Chrome?

What is application form for aeps?

Who is required to file application form for aeps?

How to fill out application form for aeps?

What is the purpose of application form for aeps?

What information must be reported on application form for aeps?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.