Get the free Minor to Major Conversion Form Revised 3 Applicants ...

Get, Create, Make and Sign minor to major conversion

How to edit minor to major conversion online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minor to major conversion

How to fill out minor to major conversion

Who needs minor to major conversion?

A Complete Guide to Minor to Major Conversion Form

Understanding the minor to major conversion

In the financial ecosystem, accounts are often classified into minors and majors, each serving distinct purposes. Minor accounts typically cater to younger users or individuals with limited access to certain services, whereas major accounts offer a broader range of functionalities and benefits. Converting from a minor to a major account signifies a step towards greater financial independence, control, and management capabilities.

Transitioning to a major account can provide users with significant advantages. Major accounts often offer better transaction limits, advanced features for wealth management, and accessibility to various financial tools that are not available within minor accounts. This strategic move can enhance not only an individual’s financial health but also support their long-term financial goals.

Eligibility criteria for conversion

Before embarking on the conversion journey, it's imperative to understand the eligibility criteria for making the switch. Minor accounts generally have specific requirements including age restrictions typically set at under 18 years. For users aspiring to convert to a major account, various conditions must be met.

In addition, documentation proves pivotal during this process. Users should ensure that all necessary papers are at hand, showcasing not only their identity but also the transition logistics as per legal agreements.

Preparing for the conversion process

A well-planned approach leads to successful conversion. Start by gathering required documents that evidence your eligibility for a major account. Commonly required documents include proof of identity, such as a government-issued ID or birth certificate. For minors, consent forms from guardians may also be required to authenticate the request.

Verifying your current account status is equally essential. Ensure there are no outstanding issues like unresolved transactions or account freezes, as these can delay your conversion process. By consolidating your documentation and double-checking your account status, you pave a smoother path towards obtaining your major account.

Initiating the conversion request

Once documentation is ready, initiating your conversion request becomes the next crucial step. To request your conversion, access the minor to major conversion form via pdfFiller. It allows you to input your information seamlessly and track changes as needed.

Consider your submission methods; you can submit your request online through pdfFiller or opt for physical submission at the designated location. Each method has its unique advantages — online submissions are usually quicker and allow instant tracking, while physical submissions can provide a tangible record if needed.

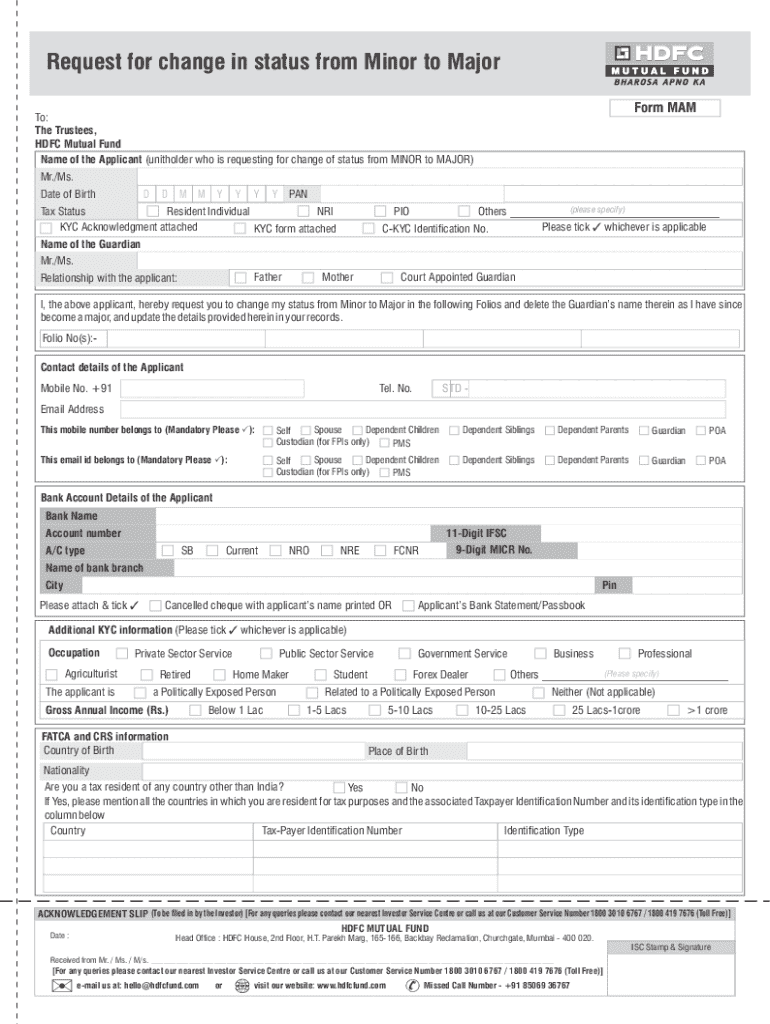

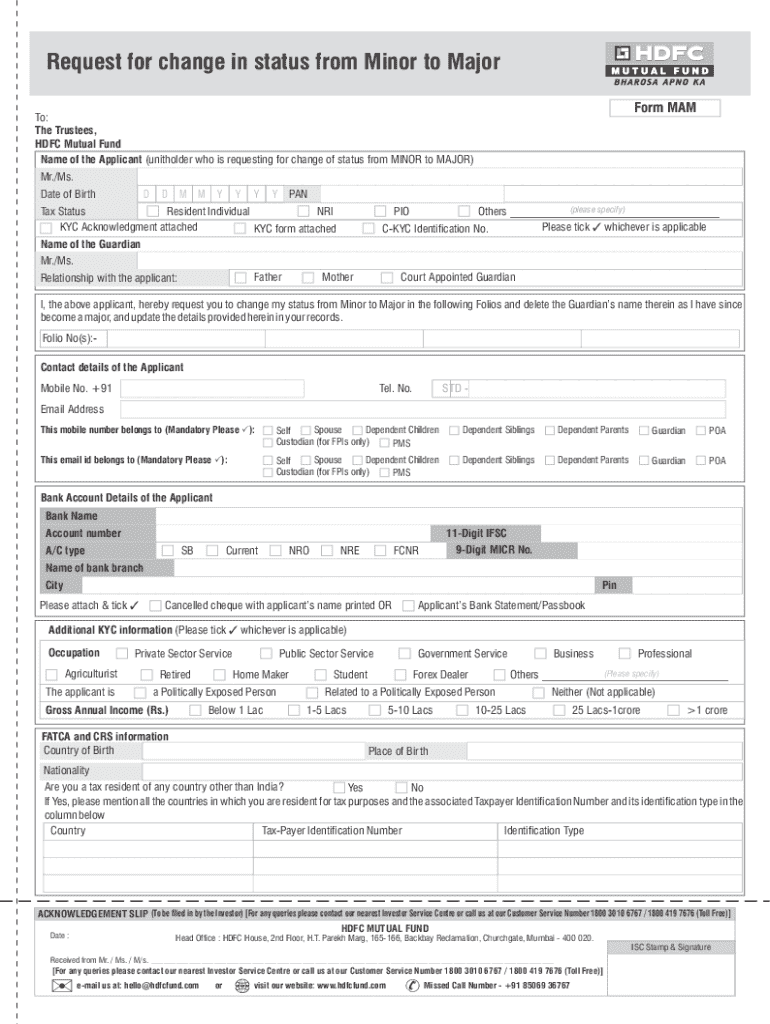

Guidelines for completing the minor to major conversion form

Completing the conversion form correctly is vital for ensuring that your application is processed without delays. The conversion form consists of several sections that must be filled out precisely. Start with the 'Personal Information Section', where you'll provide essential details, including your name, address, and date of birth.

Watch out for common mistakes such as missing signatures or incorrect information, which can lead to unnecessary delays. Ensuring the accuracy and completeness of your documentation is essential for a smooth conversion process.

What to expect after submission

After you've submitted your conversion request, patience reigns supreme. Processing times can vary significantly based on several factors, including the complexity of your request and the platform's workflow. Typically, you can expect to receive confirmation or follow-up communication within a few days.

If you experience delays, be prepared to follow up with customer support to ensure there are no issues holding up your conversion.

Managing your new major account

Congratulations on successfully transitioning to a major account! Following your conversion, accessing your new major account online introduces you to diverse functionalities and enhanced features. The initial setup often requires verifying your new account details and customizing preferences to meet your specific needs.

With your major account set up, you can leverage advanced tools that facilitate efficient document handling, enhancing your overall productivity.

Common inquiries and troubleshooting

As you navigate the minor to major conversion process, you may have questions or encounter roadblocks. Understanding common inquiries can simplify your experience. For instance, many users ponder about the duration for processing conversion requests or the types of documents needed for verification.

Real-life examples and case studies

Transitioning from a minor to a major account can yield transformative results. Consider Sarah, a young entrepreneur who initially operated with a minor account tailored for limited transactions. Upon converting to a major account, she gained access to advanced analytical tools that allowed her to grow her business exponentially.

Sarah's success exemplifies the potential benefits of making this transition. The insights gained from her experience highlight how leveraging a major account can empower users through strategic financial management, enhanced tools for collaboration, and greater accessibility.

Enhancing your document management skills

Navigating your new major account encompasses more than just accessing new features; it also involves developing efficient document handling skills. Familiarizing yourself with platforms like pdfFiller opens doors to streamlined workflows. Utilize features that facilitate e-signing, document storage, and collaborative workspaces for both personal and professional documents.

Overall, leveraging the features provided by your major account can lead to a more organized and effective document management experience.

Final thoughts on minor to major conversion

The transition from minor to major accounts represents a pivotal step towards maximizing your potential within digital document management. By understanding the processes involved and effectively using the tools available through pdfFiller, users can harness a wealth of opportunities for growth, efficiency, and productivity.

Embrace the enhanced capabilities that a major account brings, and explore the features within pdfFiller that empower you to edit, sign, and manage your documents effortlessly, catering to your individual needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the minor to major conversion in Chrome?

How do I fill out minor to major conversion using my mobile device?

How do I complete minor to major conversion on an iOS device?

What is minor to major conversion?

Who is required to file minor to major conversion?

How to fill out minor to major conversion?

What is the purpose of minor to major conversion?

What information must be reported on minor to major conversion?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.