Get the free MOA FUNDS - SIMPLE INDIVIDUAL RETIREMENT ACCOUNT (IRA). Accessible PDF

Get, Create, Make and Sign moa funds - simple

How to edit moa funds - simple online

Uncompromising security for your PDF editing and eSignature needs

How to fill out moa funds - simple

How to fill out moa funds - simple

Who needs moa funds - simple?

Moa Funds - Simple Form: A Comprehensive Guide

Understanding Moa funds

Moa funds represent a unique financial product aimed at simplifying investing for individuals and teams. By pooling resources, these funds provide a structured method for making investments aligned with specified objectives. Understanding Moa funds is essential for effective financial planning, allowing investors to gain diversified exposure to a range of asset classes while minimizing concentration risk associated with single investments.

The significance of Moa funds in financial planning can’t be understated. They not only streamline access to various investment opportunities but also allow individuals to navigate complexities associated with self-managing multiple investment vehicles. The simple form process involved in initiating or contributing to Moa funds demystifies the onboarding experience, making it accessible for all.

Preparing to fill out the Moa funds simple form

Before diving into the actual filling out of the Moa funds simple form, it's crucial to prepare adequately. This preparation includes gathering necessary documentation, which may comprise identification documents, financial statements, and any additional paperwork specific to your investment context. Ensuring these documents are in order will significantly streamline the process.

Setting up an account with pdfFiller is a straightforward process. Simply visit their website, and follow these steps: register using a valid email address, create a secure password, and verify your account. The benefits of using pdfFiller for form management are immense, including its user-friendly interface, the ability to share forms seamlessly, and robust tools for editing documents on the go.

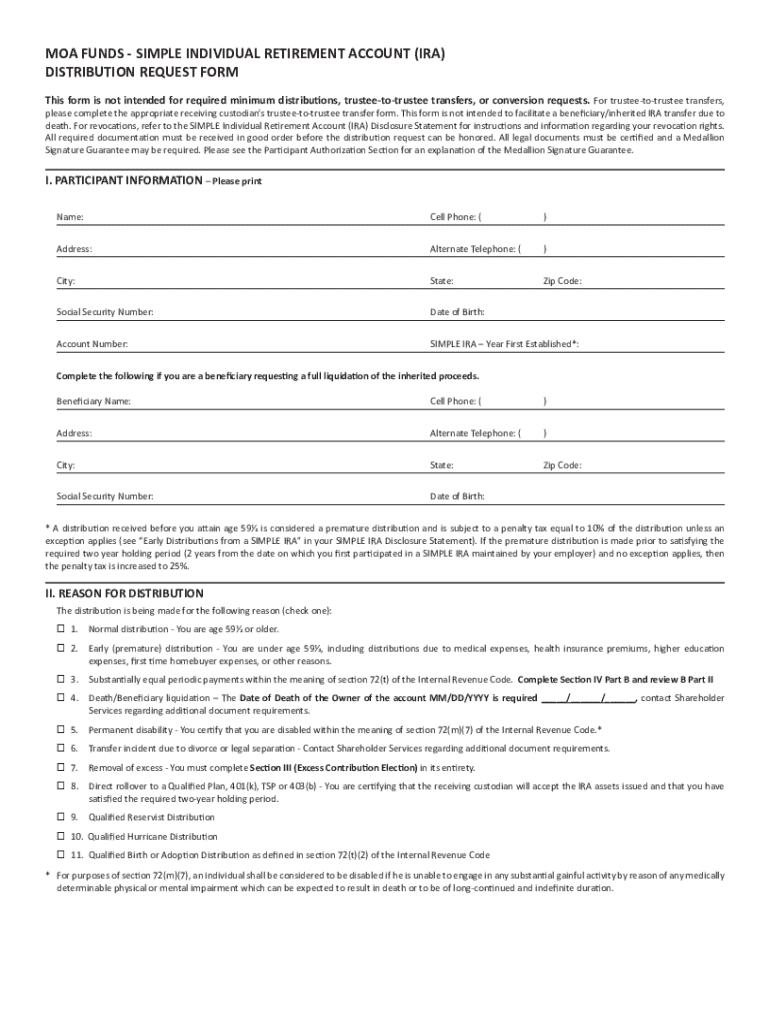

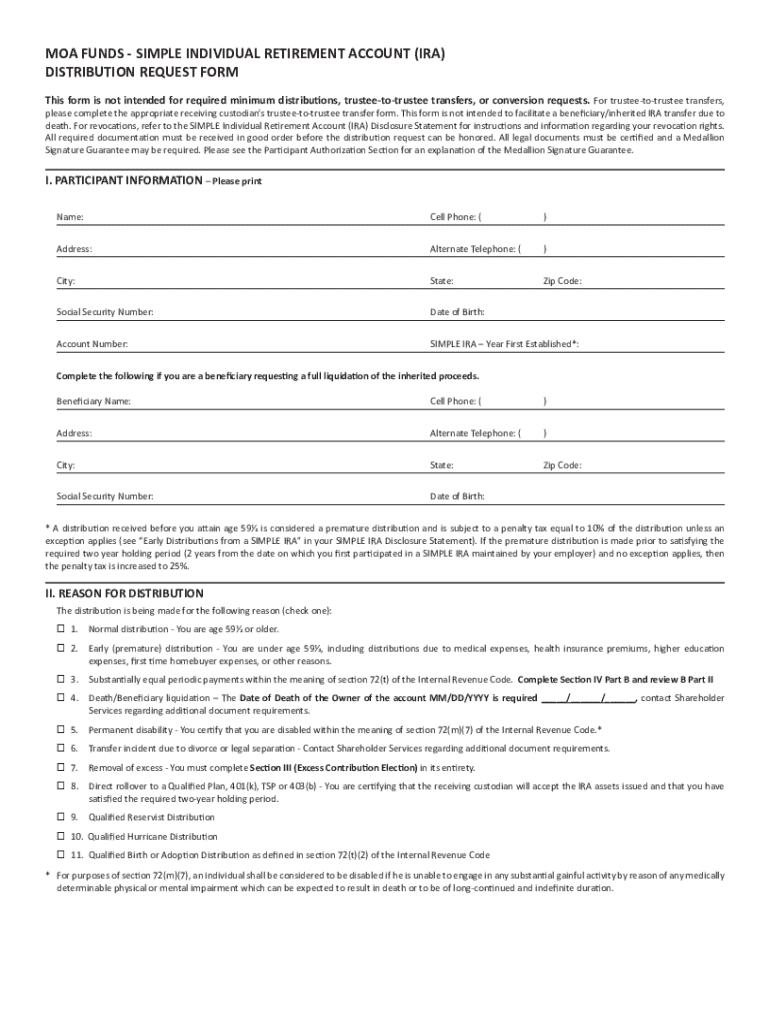

Navigating the Moa funds simple form

Navigating the Moa funds simple form requires an understanding of its visual structure. The form is typically divided into several sections, each with its unique purpose. The basic sections include personal information, financial details, and legal disclaimers, each designed to collect critical data necessary for processing your investment efficiently.

Interactive tools within pdfFiller can significantly enhance your experience. Fillable fields allow you to input data effectively, while comments and notes help in clarifying any lingering doubts directly on the form, ensuring that nothing is overlooked. Leveraging these tools can make the process of completing your Moa funds simple form far less daunting.

Step-by-step instructions for completing the form

When filling in personal information, ensure accuracy in your name, address, and contact details. Accurate data is crucial as discrepancies can lead to processing delays or complications with your investment. Moreover, detailing financial information effectively requires you to report both income and expenses comprehensively. This section may necessitate precise figures from your latest financial statements.

Reviewing legal terms and conditions is another essential step. Ensure you understand key points, particularly any specific charges or fees that may be associated with your Moa funds investment. Utilizing pdfFiller tools for editing your submitted forms is equally important, allowing for quick corrections and the ability to add digital signatures for validation as needed.

Managing your Moa funds application

Once you’ve submitted the Moa funds simple form, managing your application becomes vital. Keeping track of your application status is easily done through the pdfFiller platform, where you can find updates provided regularly. If you encounter any issues or delays, knowing how to address these promptly can prevent unnecessary complications. Being proactive is essential for a smooth experience.

Should you need to make amendments after submission, the process is straightforward. Simply log into your pdfFiller account, locate the submitted form, and follow instructions for making changes. The importance of timely revisions cannot be overstated, as delays could affect your investment strategy or returns potentially impacting your overall financial health.

Common challenges and solutions

Common challenges encountered when completing the Moa funds simple form include form errors and issues with documentation. If you face any errors during the process, it’s essential to understand your options. Assess the error type carefully and refer back to the instructions on pdfFiller for help in resolving them. Ignoring these errors may lead to delays in processing your application.

Getting support from pdfFiller is an option when self-help resources fall short. They offer a variety of resources for assistance, including community forums and dedicated customer support via chat or email. Having access to these resources can make navigating the Moa funds simple form far less tedious, further enhancing your overall application experience.

Best practices for using pdfFiller with Moa funds

To optimize your experience with the Moa funds simple form, consider implementing best practices for document management. Organizing your documents logically within the pdfFiller platform ensures quick access when required, particularly as financial documentation can often span over various forms and templates. Utilize file naming conventions that make it easy to understand the contents at a glance.

Leveraging a cloud-based platform like pdfFiller comes with several advantages. Besides enabling access from anywhere, it inherently enhances security and privacy measures when submitting sensitive information such as personal financial data. Ensure you understand and utilize the security features available in pdfFiller to protect your information as you engage with your Moa funds.

Impact of Moa funds on financial health

Understanding and managing Moa funds effectively can lead to positive long-term implications for your financial health. The benefits of having a clear grasp on your funds contribute significantly towards achieving your investment objectives, improving potential returns, and minimizing associated risks. A well-managed investment portfolio can ease the anxiety of fluctuating market conditions and augment your financial resilience.

Moreover, proper documentation—such as that provided through the Moa funds simple form—can streamline financial processes across the board. It ensures you not only understand the associated expenses and performance metrics of your investments, but also empowers informed decision-making going forward. Emphasizing good financial practices can unlock better returns and performance over time, enhancing the overall efficacy of your investment strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my moa funds - simple directly from Gmail?

How do I edit moa funds - simple in Chrome?

How can I edit moa funds - simple on a smartphone?

What is moa funds - simple?

Who is required to file moa funds - simple?

How to fill out moa funds - simple?

What is the purpose of moa funds - simple?

What information must be reported on moa funds - simple?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.