Get the free MOA FUNDS REQUIRED MINIMUM DISTRIBUTION ELECTION FORM. Accessible PDF

Get, Create, Make and Sign moa funds required minimum

Editing moa funds required minimum online

Uncompromising security for your PDF editing and eSignature needs

How to fill out moa funds required minimum

How to fill out moa funds required minimum

Who needs moa funds required minimum?

MOA Funds Required Minimum Form: A Comprehensive Guide

Understanding MOA Funds and Their Importance

MOA funds, or Minimum Operating Account funds, are financial resources set aside for businesses and individuals that help maintain solvency and operational capability. Specifically, these funds can play a crucial role in retirement planning, where understanding Required Minimum Distributions (RMDs) becomes essential. RMDs pertain to the mandatory withdrawals that individuals must make from their retirement accounts once they reach a certain age, ensuring that account holders do not defer taxes on their retirement savings indefinitely. This aspect of financial planning is vital, as failing to take RMDs can lead to hefty penalties, emphasizing the importance of timely and accurate management of MOA funds.

Understanding the intricacies of RMD is not just a compliance issue but a cornerstone of strategic individual financial planning that can significantly influence tax implications and overall retirement lifestyle.

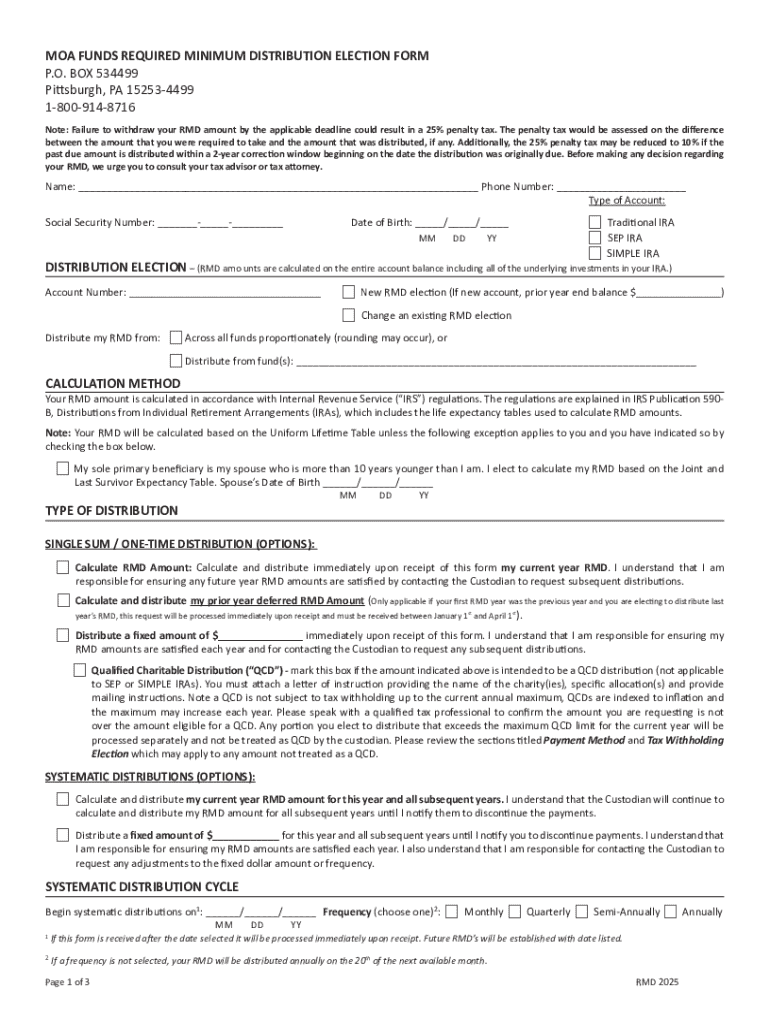

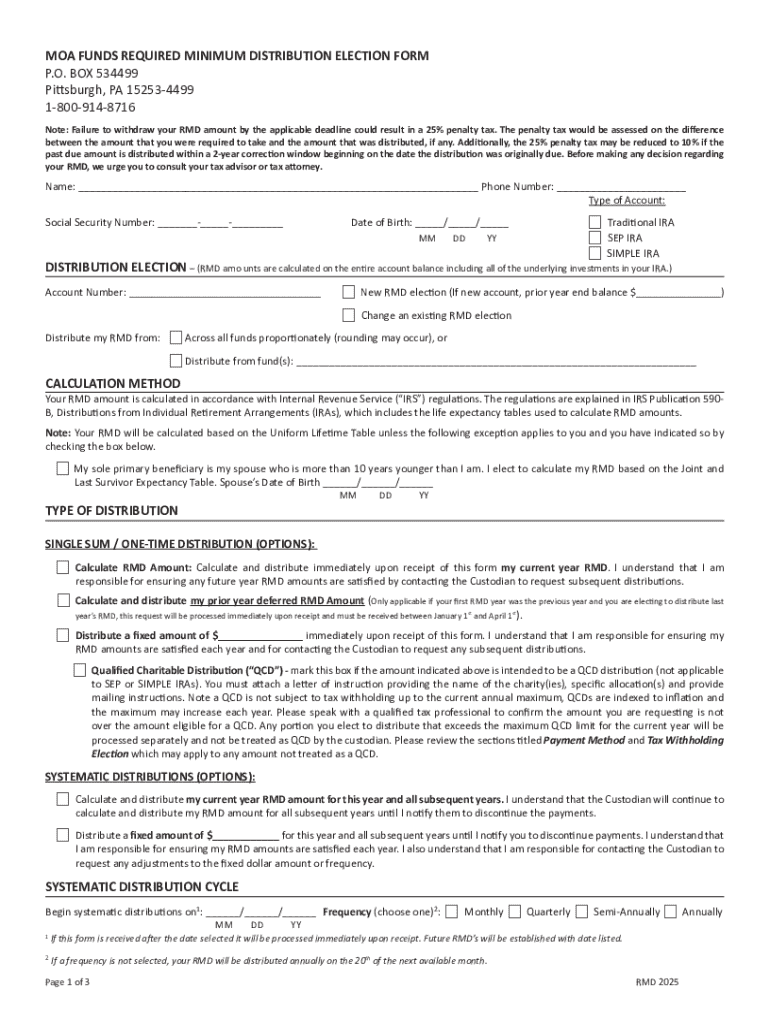

The MOA Funds Required Minimum Form Explained

The MOA Funds Required Minimum Form is a critical document designed for those who must report their RMDs to financial institutions. Completing this form accurately ensures that individuals meet their financial obligations without penalty. The key components of this form generally include personal identification details, account type, balance information, and specific distribution requests. Anyone who holds a qualified retirement account, such as an IRA or 401(k) and is approaching the RMD age, typically needs to complete this form to initiate the correct distributions.

Filling out this form promptly and accurately can mean the difference between compliance and incurring unnecessary penalties, making it important for individuals to prioritize this task in the financial calendar.

Step-by-step guide to completing the MOA Funds Required Minimum Form

Completing the MOA Funds Required Minimum Form can seem daunting, but breaking it down into manageable steps can simplify the process.

Let's break down these steps further to make the process clearer.

Gather necessary information

Before diving into the form, ensure that you have gathered all necessary items, including:

Filling out the form

When filling out the MOA Funds Required Minimum Form, pay close attention to each section:

Review process before submission

Before you hit submit, take a moment to double-check your entries. Verify that all information matches your record, as mistakes can complicate your RMD processing. Common pitfalls include incorrect Social Security numbers or discrepancies between account types and balances.

Managing and submitting your MOA Funds Required Minimum Form

Once the MOA Funds Required Minimum Form is complete, the next step is submission. Individuals can choose from different submission options, enhancing flexibility and speed in managing their RMDs.

After submission, tracking is paramount. Keep records of submission confirmations and set reminders for follow-ups, making it easier to manage future RMD obligations.

Tools and features offered by pdfFiller for form management

pdfFiller provides a robust platform for managing the MOA Funds Required Minimum Form, integrating a variety of tools to streamline the process. For example:

These features not only enhance user experience but also provide an all-in-one solution for effective document management.

Frequently asked questions (FAQs) about the MOA Funds Required Minimum Form

As individuals navigate the completion and submission of the MOA Funds Required Minimum Form, several common questions arise, including:

By addressing these questions, individuals can approach the completion of the form with greater confidence and awareness.

Troubleshooting common issues when filling the MOA Funds Required Minimum Form

Completing online forms can sometimes lead to technical difficulties. Users may encounter issues such as system outages or problems with document uploads. When filling out the MOA Funds Required Minimum Form, common challenges include missing or incorrect information due to oversight. In such instances, here are suggested solutions:

Proactively troubleshooting can save time and ensure that your form submissions are accurate and timely.

Conclusion: The importance of timely and accurate form submission

The timely and accurate submission of the MOA Funds Required Minimum Form is a vital component of retirement planning. Delays in submission can lead to unwanted penalties, and inaccuracies can result in serious financial implications. By leveraging tools like pdfFiller, individuals can simplify the document completion process, ensuring they meet their distribution obligations effectively. Understanding the nuances of the MOA Funds Required Minimum Form empowers individuals to take control of their financial future with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send moa funds required minimum for eSignature?

How do I edit moa funds required minimum straight from my smartphone?

How do I edit moa funds required minimum on an iOS device?

What is moa funds required minimum?

Who is required to file moa funds required minimum?

How to fill out moa funds required minimum?

What is the purpose of moa funds required minimum?

What information must be reported on moa funds required minimum?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.