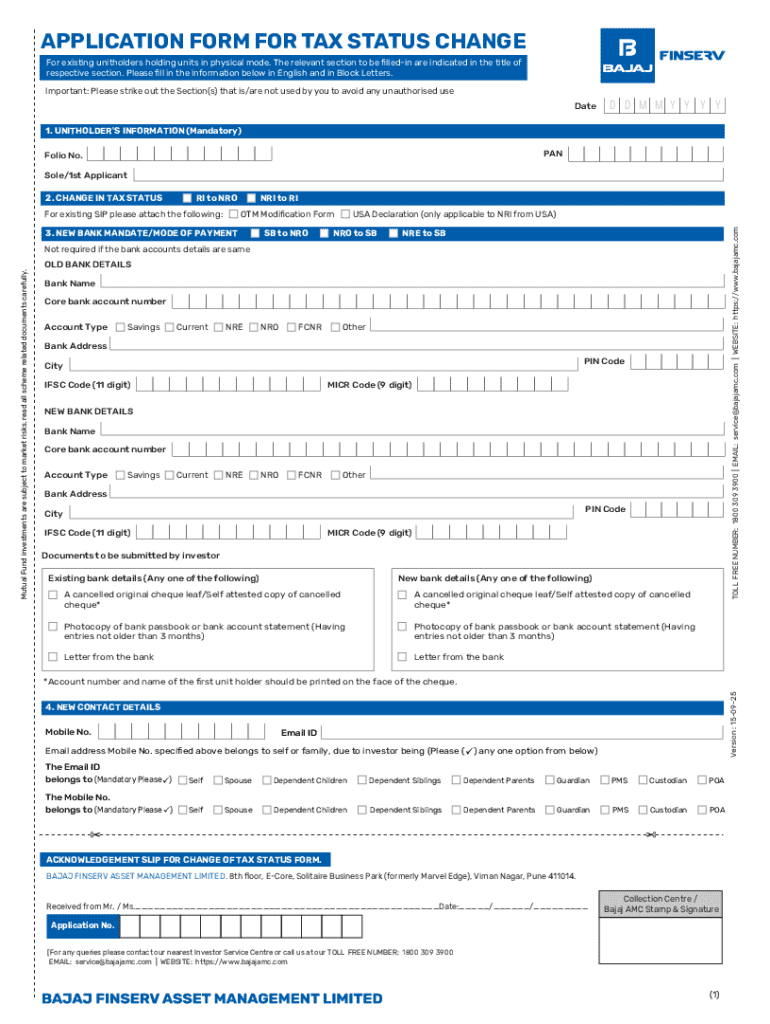

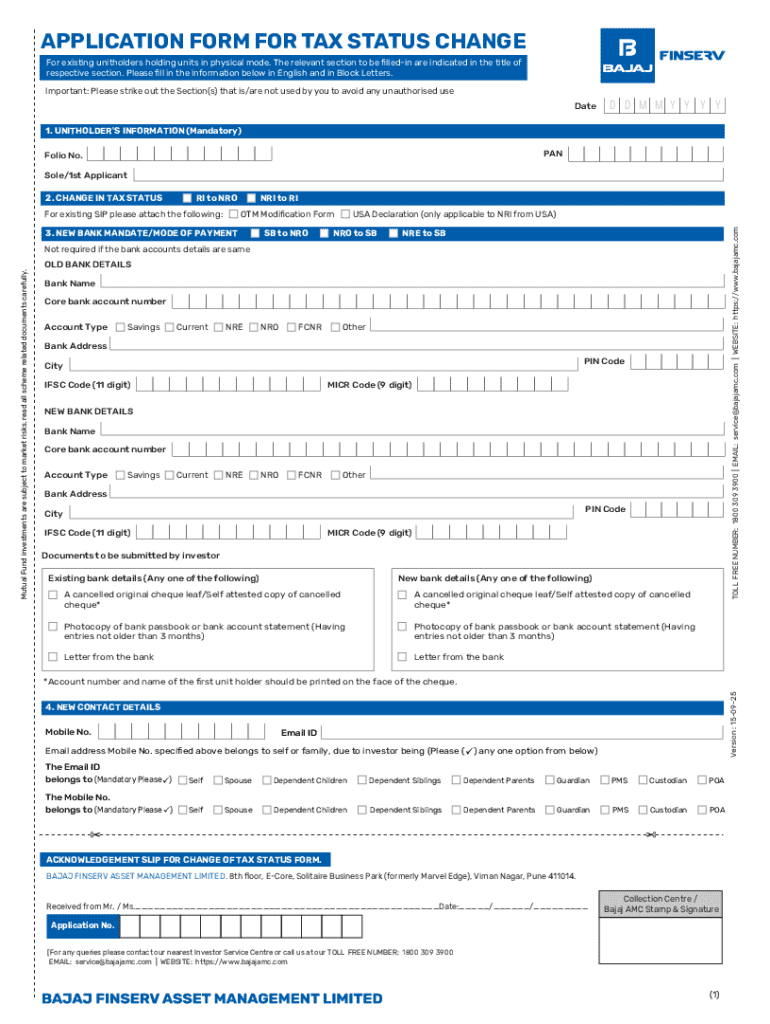

Get the free Change of Tax Status Form (15-09-25)

Get, Create, Make and Sign change of tax status

How to edit change of tax status online

Uncompromising security for your PDF editing and eSignature needs

How to fill out change of tax status

How to fill out change of tax status

Who needs change of tax status?

Navigating the Change of Tax Status Form: A Comprehensive Guide

Understanding the change of tax status form

The change of tax status form plays a crucial role for individuals and businesses alike who wish to update their tax classification. This form allows taxpayers to report a change in their tax filing status, which can have significant implications on how their tax liabilities are calculated. Changes in life circumstances, such as marriage, divorce, or changes in dependent status, often necessitate filling out this form. By understanding this form, you empower yourself to maintain compliance with tax regulations and optimize your tax benefits.

Who needs to fill out the change of tax status form?

Anyone who has experienced a change in personal circumstances related to taxes may need to fill out the change of tax status form. This includes individuals filing as single, married, or head of household. Common scenarios that require this form include a recent marriage or divorce, the birth of a child, or the loss of a dependent. Businesses might also need to update their tax status to accurately reflect changes in ownership or operational structure.

Preparing to complete the change of tax status form

Before filling out the change of tax status form, preparation is key. Gather all necessary personal and financial information, including your Social Security number, information about your dependents, and details regarding your current tax status. Make note of critical deadlines to ensure your update is processed timely, particularly during tax season when submissions are high.

Understanding tax status options

Navigating through the options available for tax status is equally important when preparing your change of tax status form. Tax statuses generally include Single, Married Filing Jointly, Married Filing Separately, and Head of Household. Each status varies significantly in terms of tax liabilities and benefits, affecting deductions, credits, and overall tax responsibility.

Step-by-step guide to filling out the change of tax status form

Filling out the change of tax status form on pdfFiller is a straightforward process. Start by accessing the form on the pdfFiller website, where you can quickly locate and download the necessary documentation. pdfFiller’s platform makes the form-filling process more efficient with interactive tools that guide you through each section, ensuring accuracy and completeness.

Filling out the form

Begin with the personal information section, ensuring you include your full name, address information, and Social Security number accurately. This is fundamental because any discrepancies can lead to processing delays or denials. Next, review the current tax status information; accurately reflecting your current status helps the IRS understand your personal situation before the update.

When selecting your new tax status, it’s essential to choose the one that fits your current circumstances. For example, if you have just married, note the new status appropriately. Be honest and verify the information against any previous tax returns or documentation you may have on file.

Common mistakes to avoid

Many taxpayers stumble upon similar mistakes when filling out the change of tax status form. One common error is mismatching personal information such as name or address information with IRS records, which can delay processing. Additionally, failure to account for all dependents or omitting necessary supportive documents can adversely affect your submission.

Submitting the change of tax status form

Once you have accurately filled out the change of tax status form, the next step is submission. Depending on your preference and the guidelines set by your local tax office, you may submit the form online via the IRS website, send it through the mail, or deliver it in person. Each method has its pros and cons; for instance, online submissions can often be processed faster, while in-person submissions allow for immediate confirmation.

Tracking your submission

After submission, it’s critical to track the status of your form to ensure that it has been processed correctly. For online submissions, the IRS provides confirmation features. If you mailed your form, consider using a service that offers tracking information. Generally, expect processing to take anywhere from a few weeks to several months depending on the IRS workload.

Managing your tax status changes

Once your change in tax status is accepted, ensure that all related documents reflect this update. For instance, your tax account information and any relevant certificates or registrations associated with your business name should be revised to maintain consistency. This consistency across all platforms helps avoid confusion and potential legal issues related to your tax obligations.

Additionally, it’s important to consider how this change might affect your overall tax liabilities and benefits. Consulting with a tax advisor after the change can help you understand any new deductions or credits that may become available to you based on your new status.

Utilizing pdfFiller for future document management

Utilizing pdfFiller not only simplifies the process of managing your change of tax status form but also offers powerful tools for all future document needs. With features for editing, storing, and signing documents all in one platform, you can manage your tax-related paperwork efficiently without the hassles traditional methods often entail. This allows for a seamless workflow that uses technology to benefit your document management.

Additional tools and resources on pdfFiller

Beyond the change of tax status form, pdfFiller provides a suite of tools that assist with diverse tax-related documentation. From interactive templates to collaboration features for teams, you can manage tax forms collaboratively and securely. These functionalities help users stay organized, meet deadlines, and enhance their overall efficiency when dealing with financial documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my change of tax status directly from Gmail?

Can I create an eSignature for the change of tax status in Gmail?

How do I complete change of tax status on an Android device?

What is change of tax status?

Who is required to file change of tax status?

How to fill out change of tax status?

What is the purpose of change of tax status?

What information must be reported on change of tax status?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.