Get the free 1095 a health insurance marketplace statement

Get, Create, Make and Sign 1095 a health insurance

How to edit 1095 a health insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1095 a health insurance

How to fill out form 1095-a health insurance

Who needs form 1095-a health insurance?

Understanding Form 1095-A Health Insurance Form: A Comprehensive Guide

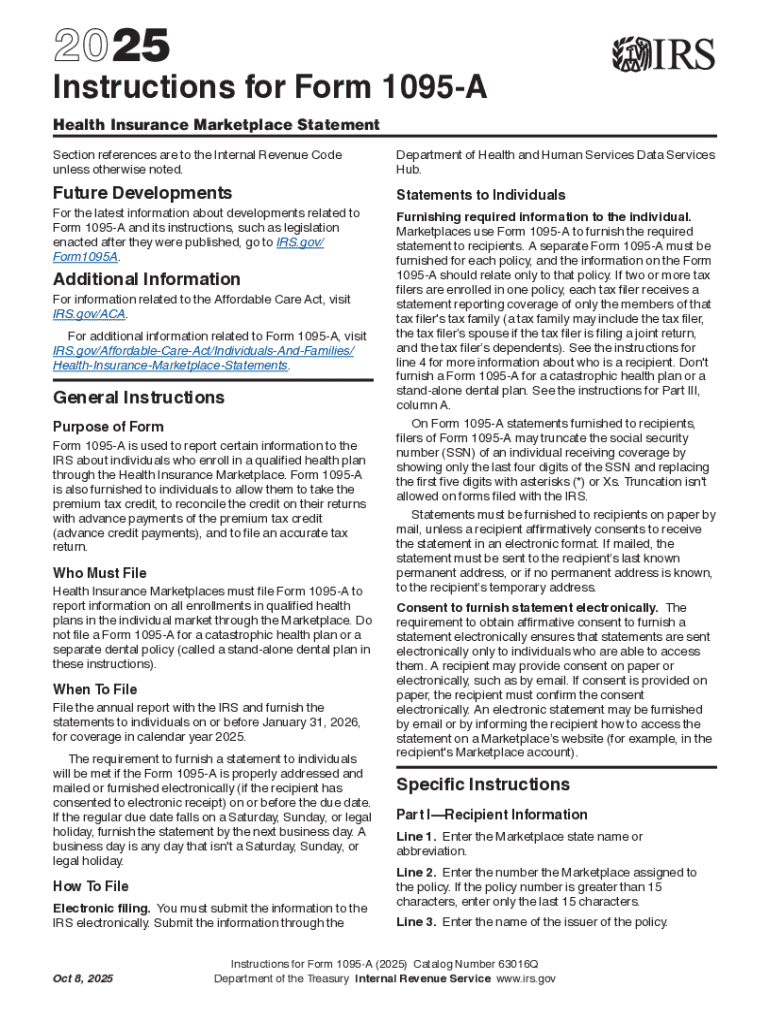

Understanding Form 1095-A

Form 1095-A is an IRS document that you receive if you enrolled in a health plan through the Health Insurance Marketplace. This form provides essential information about your insurance coverage, specifically detailing the months you were covered, the premium amounts, and the premium tax credit available to you. This form is pivotal in determining your health coverage when filing your annual tax return.

The primary recipients of Form 1095-A include individuals and families who obtained health insurance through the federal or state Marketplace. Unlike most forms, you don’t need to wait until April to receive Form 1095-A, as it’s typically provided by January 31 of each year. If you’ve reported your Marketplace enrollment on your tax return, understanding the contents of this form is crucial.

The importance of Form 1095-A for tax filers

Form 1095-A plays a critical role in your tax filing process. When filling out your federal tax return, you must include key details from this form in order to correctly calculate your premium tax credit. This credit is designed to reduce the monthly premium costs of your health insurance purchased through the Marketplace. Accurate reporting using Form 1095-A can directly impact the tax you owe or the refund you might receive.

The form includes three pivotal sections: the months of coverage, the premium amounts, and the premium tax credit calculation. If any of this data is incorrect or missing, it could lead to delays in your tax refund or the likelihood of facing penalties. Therefore, it’s essential to verify all information provided in Form 1095-A against your records.

Health coverage and taxes

Navigating your health coverage and taxes can be complex, but numerous tools exist to simplify the process. Utilizing resources such as tax calculators or specific tax software that integrates with Form 1095-A can significantly ease the burden of tax filing. These tools allow you to input data from your 1095-A to auto-calculate potential tax credits and complete your return more efficiently.

When using Form 1095-A for tax filing, there are crucial steps to follow. First, ensure you enter all relevant information from the form onto your tax return accurately. Make sure to double-check for common mistakes such as incorrectly calculating the premium tax credit or failing to report months of coverage. Lastly, keep an eye on deadlines, with January through April being the key months for receiving Form 1095-A and filing your taxes.

Filling out Form 1095-A: A guide

Filling out Form 1095-A involves understanding its various sections. The form is structured into three main parts: Part I provides information about you and your family, Part II details the month-by-month coverage information, and Part III outlines your premium tax credit details. Each part is filled with specific terms and codes critical for tax accuracy.

Here is a breakdown of how to complete the form with its specific sections: - **Part I**: Fill in your personal information: name, address, and Social Security number, as well as the names and details of family members covered under the policy. - **Part II**: Document the months you had coverage. This section contains a matrix indicating the months covered by your plan. - **Part III**: Report the amounts you paid in premiums and the premium tax credit you are eligible for. This information is essential for accurately filing your taxes.

Interaction with other IRS forms

Form 1095-A interacts with other key IRS forms, notably Form 1095-B and Form 1095-C. Understanding the differences and similarities among these forms is crucial for effective tax preparation. While Form 1095-A is specific to those who received coverage through the Marketplace, Form 1095-B pertains to other insurance providers and Form 1095-C is related specifically to employer-sponsored plans.

When integrating data from Form 1095-A into your Form 1040, it is essential to locate the correct sections on your tax return. This involves inputting the premium tax credit amount correctly and ensuring that you report all months of coverage. Reviewing IRS instructions can help ensure compliance and accuracy in your tax filing.

Managing your Form 1095-A

Storing and accessing your Form 1095-A meticulously is crucial. Adopt best practices such as keeping a digital copy that is securely backed up. You might consider using tools like pdfFiller for managing this document efficiently. Digital storage offers ease of access while ensuring your document is protected against loss or damage.

Editing and printing Form 1095-A can also be streamlined with pdfFiller’s platform. The e-signature and document editing tools make it easy to modify the form if discrepancies arise. Maintaining clear records is fundamental for proving your coverage when necessary. Suggested practices include keeping copies of all communication with your insurance carrier and your filed forms.

Additional resources

For those navigating Form 1095-A, there are numerous educational resources available. The IRS website contains official guidance and publications that detail the requirements and expectations for filing taxes that involve this form. Additionally, there are tutorials and video guides available on pdfFiller that demystify the form-filling process.

If personalized assistance in filing is needed, accessing the Assister Network can connect you with experts who can offer tailored advice. Alternatively, reaching out directly to tax professionals can alleviate any filing uncertainties, ensuring you remain compliant and fully leverage the available tax benefits.

About pdfFiller

pdfFiller provides unique features for document management, including intuitive tools designed specifically for users handling tax documents like Form 1095-A. The platform allows for seamless PDF editing, electronic signing, and effective collaboration, making document management simple and efficient.

Users have found immense benefits from employing pdfFiller in their processes. Case studies highlight how individuals and teams can maneuver through their document requirements with ease, ensuring that critical information like Form 1095-A is always accessible and editable as needed.

Navigating the pdfFiller platform is straightforward. Users can follow a step-by-step guide to utilize the tools available specifically for Form 1095-A and leverage the capabilities of the platform to its fullest extent. With pdfFiller, managing your essential tax documents becomes a more structured and less daunting task.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 1095 a health insurance from Google Drive?

How can I edit 1095 a health insurance on a smartphone?

How do I fill out 1095 a health insurance using my mobile device?

What is form 1095-a health insurance?

Who is required to file form 1095-a health insurance?

How to fill out form 1095-a health insurance?

What is the purpose of form 1095-a health insurance?

What information must be reported on form 1095-a health insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.