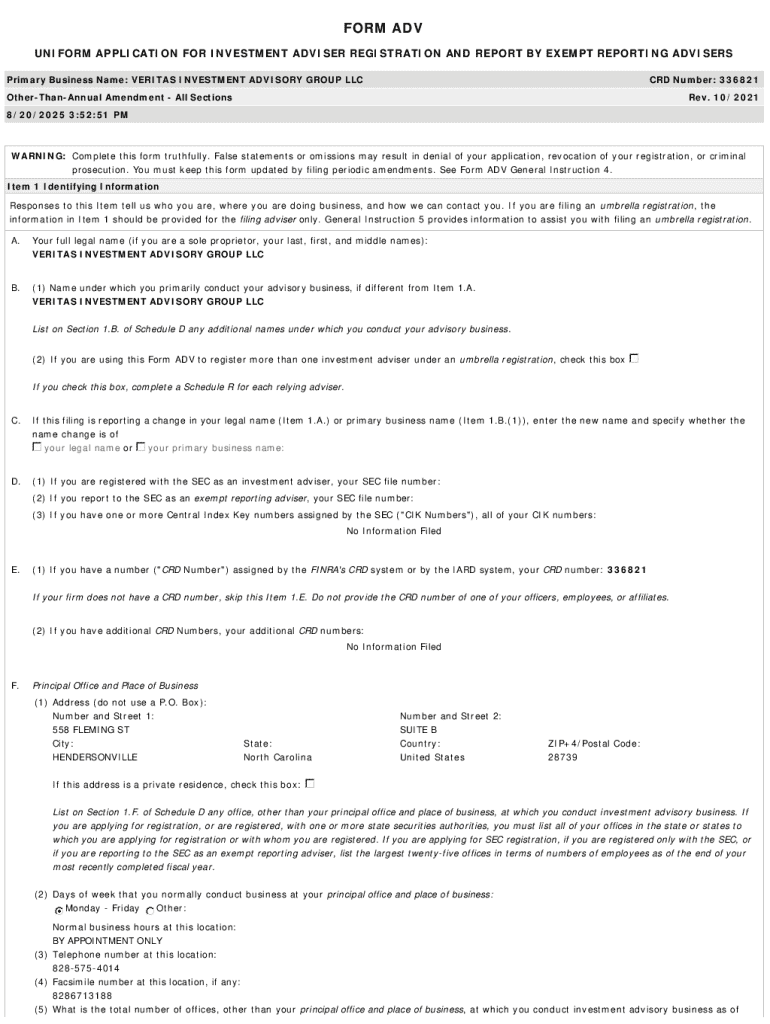

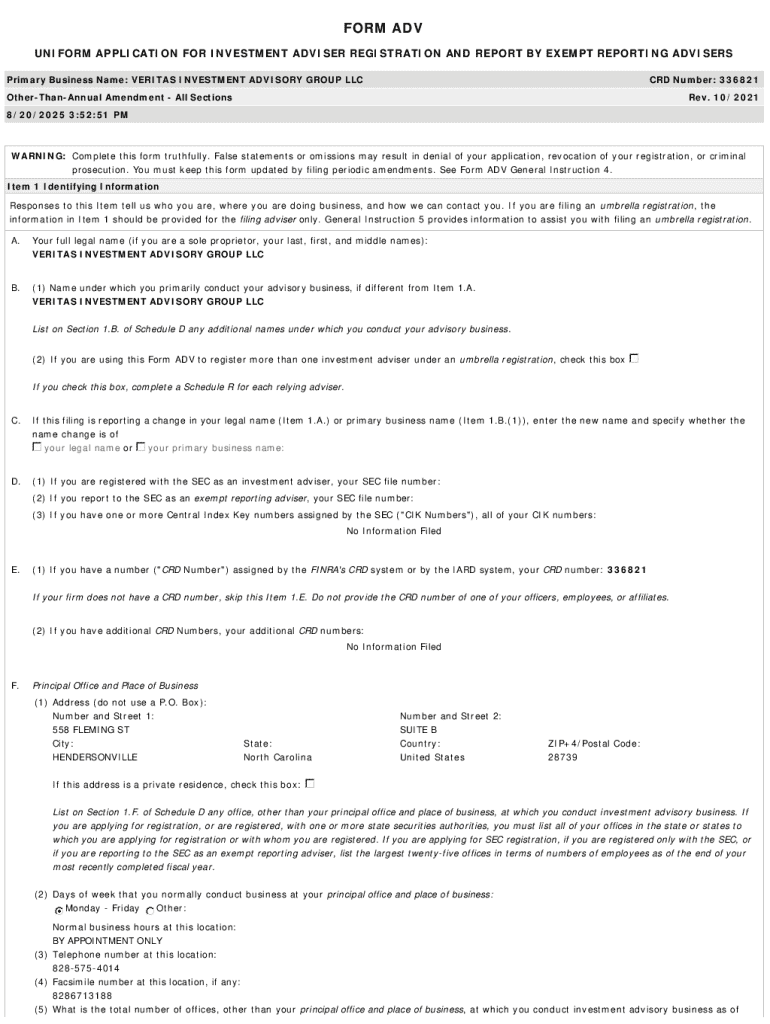

Get the free VERITAS INVESTMENT ADVISORY GROUP LLC

Get, Create, Make and Sign veritas investment advisory group

How to edit veritas investment advisory group online

Uncompromising security for your PDF editing and eSignature needs

How to fill out veritas investment advisory group

How to fill out veritas investment advisory group

Who needs veritas investment advisory group?

Veritas Investment Advisory Group Form: A Comprehensive Guide

Understanding the Veritas Investment Advisory Group Form

The Veritas Investment Advisory Group Form serves as a crucial document for individuals and organizations seeking professional investment advice. This form gathers essential data to align investment strategies with personal or organizational goals. Selecting the right advisory form is significant because it shapes the advisory relationship, informs appropriate investment strategies, and ultimately affects financial success.

With the growing complexity of investment markets, professionals need structured forms that ensure clarity and compliance. The Veritas form is designed to establish a comprehensive understanding of the investor's objectives, risk tolerance, and expected outcomes. Hence, it's not merely a bureaucratic requirement; it's a foundational tool in steering investment success.

Who can benefit from this form?

The Veritas Investment Advisory Group Form is beneficial for various stakeholders in the investment landscape. Individuals looking for tailored investment advisory services can leverage this form to articulate their specific financial goals, enabling advisors to design bespoke investment strategies.

Furthermore, teams and organizations seeking structured investment management can utilize this form to ensure all team members and stakeholders are aligned on investment objectives. By clearly stating strategies and goals, this form helps minimize miscommunication and enables collective investment decision-making.

The role of PDF solutions in investment documentation

In today's digital age, efficient document management is critical, especially in the investment advisory field. Utilizing cloud-based platforms for investment documentation, such as pdfFiller, enhances accessibility and collaboration among all parties involved. With the demand for streamlined operations, these digital solutions can store, edit, and share documents securely and conveniently.

pdfFiller, in particular, aligns perfectly with modern document needs, offering tools that empower users to edit PDFs easily, eSign documents, and collaborate dynamically. The importance of these capabilities cannot be understated, as they significantly reduce the time and effort required in managing compliance and transaction processes.

Step-by-step guide to filling out the Veritas Investment Advisory Group Form

Filling out the Veritas Investment Advisory Group Form can be a straightforward process when you know what to prepare. Gather essential personal and financial information before starting, including income details, existing investments, and risk tolerance indicators. Having these documents handy will make filling out the form considerably smoother.

Once you have your information ready, navigate each section carefully to provide accurate responses. Understanding the purpose of each section is crucial. It will reflect your investment objectives, risk tolerance, and experience, which will guide your advisor in creating optimized strategies.

Best practices for completing the form

To ensure that the Veritas Investment Advisory Group Form is filled out accurately, follow some best practices. After completing your entries, thoroughly review the document for any inaccuracies or omissions. This step is vital in preventing delays in processing your advisory services.

Utilizing pdfFiller’s editing tools can greatly enhance clarity. Make use of features that allow you to emphasize important details or provide additional context within the form. Taking these extra steps makes it easier for your advisor to understand your investment philosophy, leading to better-tailored strategies.

Editing and customizing your completed form

Once you have completed the Veritas Investment Advisory Group Form, using pdfFiller's editing capabilities can help you make any necessary adjustments easily. The platform provides an array of tools such as comments and notes, allowing for refining your submissions before they reach your advisor.

Moreover, if you're likely to fill out the form multiple times, consider creating reusable templates within pdfFiller. This feature significantly cuts down on time spent for future submissions and helps maintain consistency across your documentation.

Securing your document: The importance of eSigning

In the realm of investment agreements, eSigning has become a fundamental practice. An electronic signature offers legal validity and is widely accepted in financial transactions today. pdfFiller simplifies the signing process, providing a seamless way to secure your documents without the need for printing or scanning.

The steps to add your eSignature to the Veritas form are straightforward. By following the intuitive prompts on pdfFiller, you can apply your signature quickly while ensuring compliance with electronic signature laws. This adds an additional layer of convenience and security, critical in today’s fast-paced investment environment.

Collaborative features: Involving your advisors

collaboration is vital in investment strategies. With pdfFiller's collaborative features, you can invite team members or investment advisors to review and comment on the completed Veritas Investment Advisory Group Form. This fosters transparency and accelerates the decision-making process by ensuring everyone involved can provide input.

Setting permissions and access controls also enhances data security, allowing sensitive information to be shared securely. When sharing the form for feedback and approval, consider the best methods for distributing the document, ensuring that tracking changes and obtaining approvals becomes a streamlined process via pdfFiller’s platform.

Maintaining and managing your documents

Post-submission, managing your document ensures that access remains organized and efficient. Establishing a digital filing system tailored to your needs allows for easy retrieval of investment documents whenever required. This practice curtails the stress of searching for important records.

Utilizing pdfFiller’s organizational tools can foster an even more systematic approach. Features like tags and custom folders enable you to categorize all investment forms efficiently, ensuring that you maintain an organized portfolio that is accessible at your fingertips.

Ensuring compliance and staying informed

Compliance is a critical aspect of investment documentation. Understanding key regulations that affect investment advisory forms, such as those set by financial regulatory authorities, can help you remain compliant and avoid potential pitfalls. Staying informed about updates in compliance standards is essential for both legal protection and operational efficacy.

pdfFiller assists users in staying current with compliance requirements by regularly updating its features and ensuring that all templates reflect current regulations. Scheduling periodic consultations with your advisors also allows you to review and adjust your investment strategy to match evolving financial environments.

Conclusion: Empower your investment journey with confidence

In conclusion, the Veritas Investment Advisory Group Form serves as a pivotal element in the investment advisory process, establishing a foundation for personalized and effective investment strategies. With the added capabilities of pdfFiller, users can enhance their experience in handling this document by utilizing advanced editing features, collaborative tools, and seamless signature processes.

Embracing technology in investment documentation not only empowers investors but also streamlines the path to achieving their financial goals. Taking the next steps with confidence through efficient document management can transform your investment journey, leading to more informed and successful decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my veritas investment advisory group in Gmail?

Can I edit veritas investment advisory group on an Android device?

How do I fill out veritas investment advisory group on an Android device?

What is veritas investment advisory group?

Who is required to file veritas investment advisory group?

How to fill out veritas investment advisory group?

What is the purpose of veritas investment advisory group?

What information must be reported on veritas investment advisory group?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.