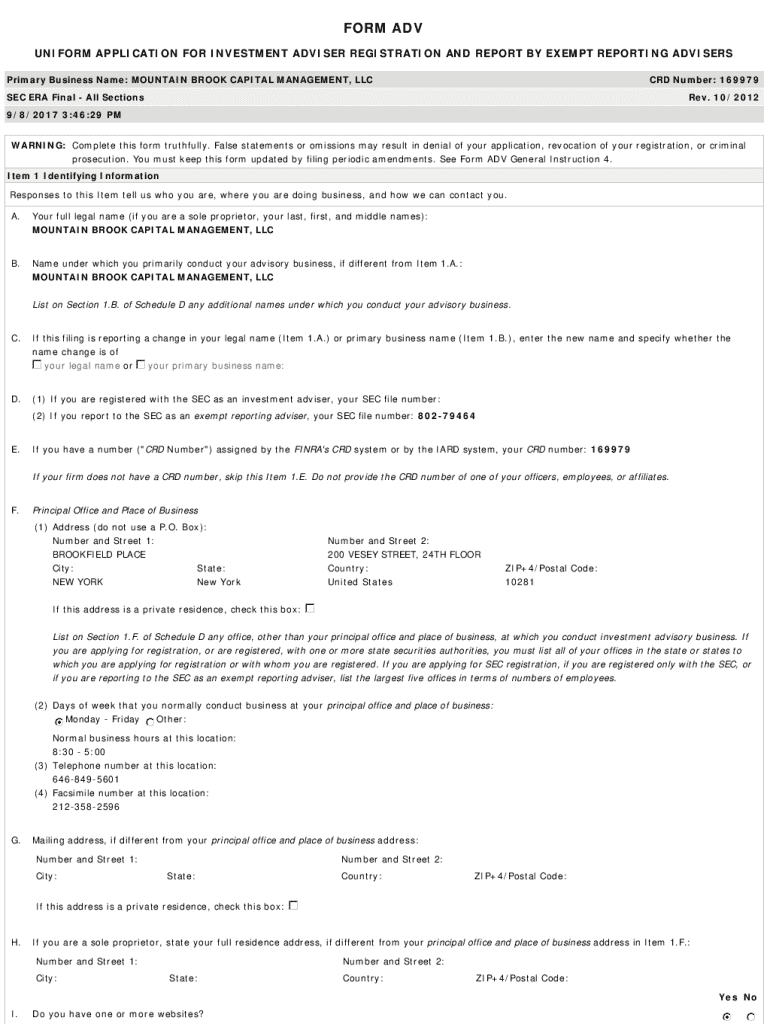

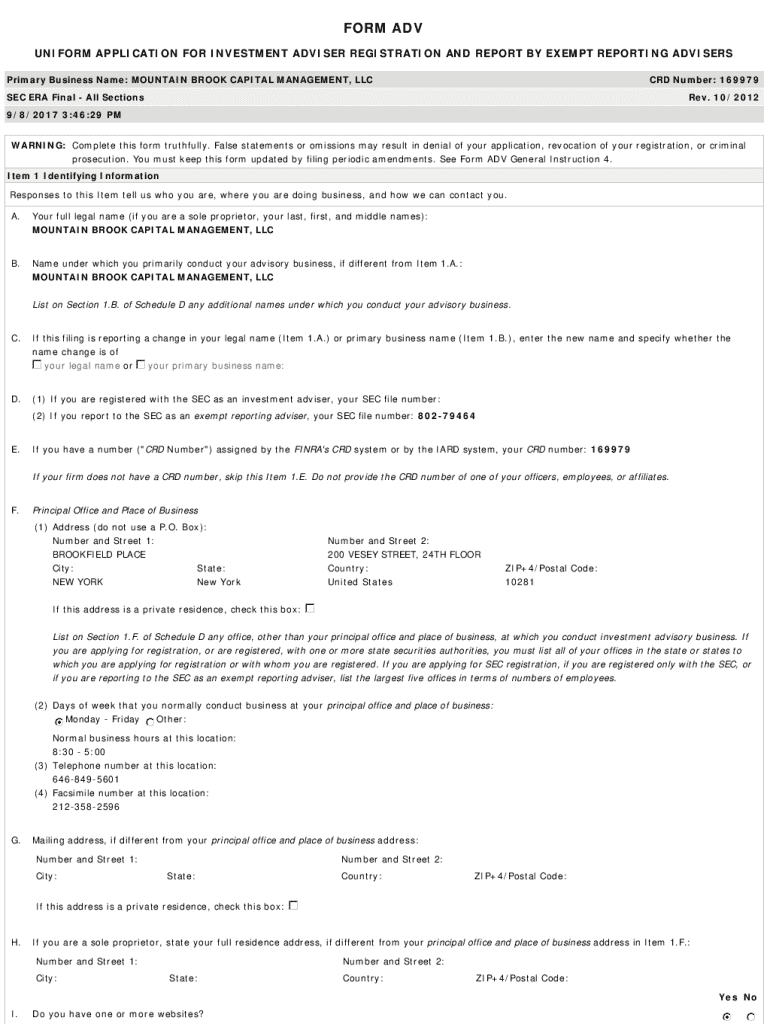

Get the free MOUNTAIN BROOK CAPITAL MANAGEMENT, LLC

Get, Create, Make and Sign mountain brook capital management

How to edit mountain brook capital management online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mountain brook capital management

How to fill out mountain brook capital management

Who needs mountain brook capital management?

Mountain Brook Capital Management Form: A Comprehensive Guide

Overview of Mountain Brook Capital Management Form

The Mountain Brook Capital Management Form serves as a crucial tool in the realm of financial advisory and personal wealth management. This form is designed to streamline communication between clients and their financial advisors, particularly wealth advisors, ensuring that vital information regarding investments and financial goals is accurately captured and conveyed.

Its importance lies in its ability to establish a foundational understanding of a client's financial landscape, allowing for tailored advice and effective planning. Financial advisors can utilize this form to guide clients through their financial journeys, helping them achieve their specific financial goals while ensuring client focus remains paramount.

Understanding capital management forms

Capital management forms encompass various templates and structures used in wealth management. They are integral to documenting financial planning processes and ensuring that clients' financial objectives are thoroughly understood and addressed. Within Mountain Brook, there are several specific types of capital management forms, each tailored to accommodate unique aspects of wealth management such as risk assessment, investment management services, and family financial planning.

Examples of these forms include asset allocation templates, risk assessment questionnaires, and tax planning forms. These instruments are not just templates; they play a significant role in directing the flow of advice from financial professionals to clients, ensuring both parties are aligned in their objectives. By integrating forms into broader financial strategies, advisors can more effectively manage clients’ investments, adapt to market changes, and refine planning efforts.

Step-by-step instructions for using the form

Using the Mountain Brook Capital Management Form does not have to be a daunting process. Here's a simple, step-by-step guide to getting started and making the most out of this essential tool.

Signing and finalizing the form

Finalizing the Mountain Brook Capital Management Form is an essential step in the wealth management process. After ensuring all essential information is accurately filled out, you will need to sign the document. This is done conveniently through pdfFiller by applying an electronic signature. The electronic signature process is legally binding and holds the same validity as a handwritten signature, making it suitable for all financial transactions.

After signing, it's crucial to save your completed form appropriately. Best practices suggest organizing your documents for easy future reference, categorizing them based on client specifics, financial goals, or any relevant investment strategies. This organization helps maintain clarity and quick access as financial plans evolve.

Troubleshooting common issues

While the Mountain Brook Capital Management Form is designed for ease of use, users may occasionally encounter challenges. Common challenges include technical issues with the pdfFiller platform or mistakes made during the form-filling process. It’s essential to stay calm and know that solutions are readily available.

For technical issues, accessing support from pdfFiller is straightforward. Users can reach out via the help section or chat support, which is available for proactive assistance. Additionally, familiarizing yourself with common mistakes can prevent future errors, such as not providing complete financial data or misinterpreting the form’s requirements.

Benefits of utilizing pdfFiller for capital management forms

Leveraging pdfFiller for the Mountain Brook Capital Management Form introduces a multitude of benefits. One of the most significant advantages is the cloud-based convenience it provides, allowing users to access their documents from anywhere, whether on a laptop, tablet, or smartphone. This flexibility is especially beneficial for financial advisors who may be on the go or working with clients in various locations.

Additionally, pdfFiller grows beyond basic document creation, offering comprehensive document management features. Users can track edits, manage versions, and collaborate in real-time with team members, ensuring that all input is integrated seamlessly into the final documents. This efficient document management streamlines workflows, making it simpler to maintain organization within busy financial teams.

Use cases and scenarios

Both individuals and financial advisors in Mountain Brook have utilized the Mountain Brook Capital Management Form to successfully enhance their financial workflows. For personal finance management, individuals have reported significant improvements in tracking their investment goals and collaborating effectively with their wealth advisors.

Financial advisors leverage the form to better serve their clients, ensuring that every investment strategy aligns with personal financial goals. In business use scenarios, advisors can manage multiple clients efficiently by utilizing the form to gather critical information upfront, allowing them to focus on planning and delivery of investment management services tailored to client needs.

Additional tips for maximizing the form's utility

To harness the full potential of the Mountain Brook Capital Management Form, integrating it within a broader financial strategy is key. This involves maintaining comprehensive records and aligning all forms with defined goals and objectives. Financial advisors should encourage clients to revisit their financial plans regularly, allowing adjustments to align with changing circumstances or market dynamics.

Utilizing other financial tools offered by pdfFiller can also enhance your experience. Features such as document analytics and additional templates designed for specific financial tasks can broaden the effectiveness of your forms. Combining these resources can lead to a holistic approach to financial planning that empowers clients and establishes long-lasting relationships.

Testimonials and user experiences

Feedback from users of the Mountain Brook Capital Management Form has been overwhelmingly positive. Clients have shared that the form facilitated clearer communication with their wealth advisors, ultimately contributing to more successful investment outcomes.

Advisors have also expressed appreciation for the structure the form provides, finding it invaluable in organizing client data and facilitating meaningful discussions about financial goals. These testimonials illustrate not only the effectiveness of the form itself, but the broader impact it can have on fostering clarity, focus, and collaborative success in financial planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the mountain brook capital management electronically in Chrome?

How do I complete mountain brook capital management on an iOS device?

How do I edit mountain brook capital management on an Android device?

What is mountain brook capital management?

Who is required to file mountain brook capital management?

How to fill out mountain brook capital management?

What is the purpose of mountain brook capital management?

What information must be reported on mountain brook capital management?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.