Get the free posb personal loan application form

Get, Create, Make and Sign posb personal loan application

Editing posb personal loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out posb personal loan application

How to fill out posb bank application formsposb

Who needs posb bank application formsposb?

Understanding POSB Bank Application Forms and Their Use

Understanding POSB Bank application forms

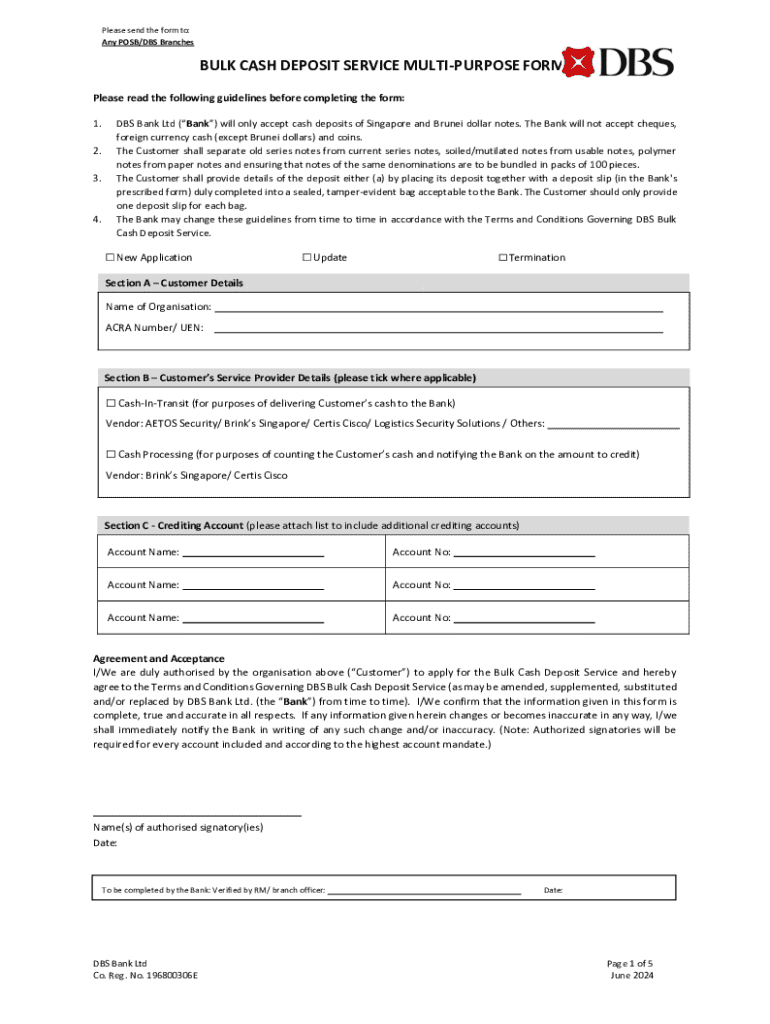

POSB Bank, a well-established banking institution in Singapore, has been serving its customers since 1877. It primarily focuses on providing a wide range of financial services tailored to meet the needs of everyday Singaporeans. POSB Bank application forms are essential documents that facilitate access to various banking services, including savings and current accounts, loans, and credit cards. Understanding these forms is crucial for customers who wish to navigate their banking needs efficiently.

The importance of application forms in banking services cannot be overstated. They serve as a formal request for services, allowing the bank to collect necessary information about the applicant. This data is critical for assessing eligibility, understanding customer needs, and ensuring compliance with regulatory requirements.

Types of POSB application forms

POSB provides various application forms tailored for a wide array of financial products. Here are some key types:

Navigating the POSB bank application process

Obtaining POSB bank application forms is a straightforward process. There are two primary ways to access these forms: online or through physical branches. To get forms online, customers can visit the official POSB website, where forms for various products are available for download. This digital approach is convenient, allowing users to save time and minimize paperwork.

For those who prefer in-person interactions, visiting a physical POSB branch is another option. Branch staff are equipped to provide assistance with the form selection process and clarify any questions about the required details. Once the form is complete, applicants can submit it through several methods, including uploading via the POSB website, sending it by mail, or delivering it in person at a branch.

Filling out the POSB application forms

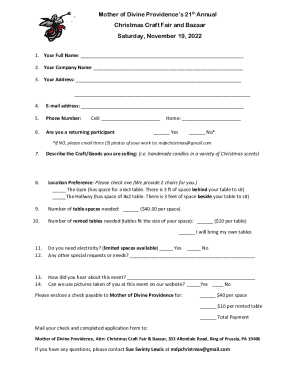

When filling out POSB application forms, understanding key sections is crucial to ensuring accurate submission. The primary areas to focus on include:

To ensure your application is processed smoothly, avoid common mistakes such as incomplete sections and missing documentation. Utilizing tools like pdfFiller can enhance the form preparation process, allowing users to edit, sign, and manage their forms conveniently, ensuring all sections are accurately completed before submission.

Managing your application

Once your POSB application has been submitted, understanding the follow-up process is essential. Applicants can typically expect processing times that vary based on the type of application. For instance, bank account applications are generally quicker to process compared to loans, which may take longer due to comprehensive assessments.

Clients can track their application status through the POSB website or mobile app. If any updates or changes are required post-submission, customers must contact bank support promptly. FAQs are available regarding issues like application rejection, providing insights on next steps and appeals.

Additional services related to POSB applications

In addition to standard banking services, POSB offers various loans, each catering to different financial needs. Understanding loan application forms is vital for those seeking financing options, such as housing loans or educational loans like semester-based tuition financing. Each type of loan comes with its own application form and specific requirements; should the applicant plan to secure a loan, it is crucial to carefully review these documents.

Investment services are another significant component offered by POSB. Customers looking to delve into investment opportunities can find relevant application forms within the bank's portfolio. Key investment options include fixed deposits, unit trusts, and insurance products, with each investment application form requiring detailed financial statements and risk assessments based on individual circumstances.

Useful links for POSB users

Navigating the POSB digital landscape is made simpler through direct links to form downloads and online applications available on the POSB website. Customers can access pdfFiller tools to facilitate smooth form filling and signing processes, ensuring all documents are ready for submission. Direct contact information for POSB's customer support services is also readily available, allowing users to seek assistance with any errors or queries promptly.

Need help? Customer support and assistance

Should any issues arise during the application process, POSB provides multiple customer support channels. Customers can reach out via live chat, phone support, or email assistance depending on their preference. It’s advisable to gather all pertinent information, such as application reference numbers and personal identification details, before contacting support. This preparation can help resolve common issues swiftly, ensuring applicants remain informed throughout the process.

Market insights for POSB products

POSB has a significant presence in the Singapore banking market, which directly influences its product offerings and attractiveness to customers. Compared to other banks in Singapore, POSB emphasizes inclusivity and digital banking solutions for all sectors. Recent trends indicate a push towards stronger online services and convenient banking applications, catering to the evolving needs of tech-savvy individuals and families.

Special considerations for new applicants

New residents and expatriates in Singapore may encounter specific requirements when applying for POSB banking services. These applicants may need to provide additional documentation, including valid work permits or residency proof. Understanding these nuances ensures a smoother application process, helping newcomers to integrate smoothly into the financial system while accessing essential banking services.

Leveraging pdfFiller for your banking needs

Using pdfFiller offers numerous benefits when managing POSB documents. Users can easily edit, sign, and share application forms from any device with internet access, promoting seamless collaboration. The platform provides secure document management within the cloud, ensuring sensitive information is protected while streamlining the process of banking-related documentation.

Beyond POSB forms, pdfFiller allows access to a variety of other banking forms, including those required for different banking institutions, helping users streamline their financial management tasks efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in posb personal loan application without leaving Chrome?

How do I fill out posb personal loan application using my mobile device?

How do I fill out posb personal loan application on an Android device?

What is posb bank application formsposb?

Who is required to file posb bank application formsposb?

How to fill out posb bank application formsposb?

What is the purpose of posb bank application formsposb?

What information must be reported on posb bank application formsposb?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.