Get the free CAPVEST PARTNERS LLPForm ADV

Get, Create, Make and Sign capvest partners llpform adv

Editing capvest partners llpform adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out capvest partners llpform adv

How to fill out capvest partners llpform adv

Who needs capvest partners llpform adv?

Capvest Partners LLP Form ADV Form: A Comprehensive Guide

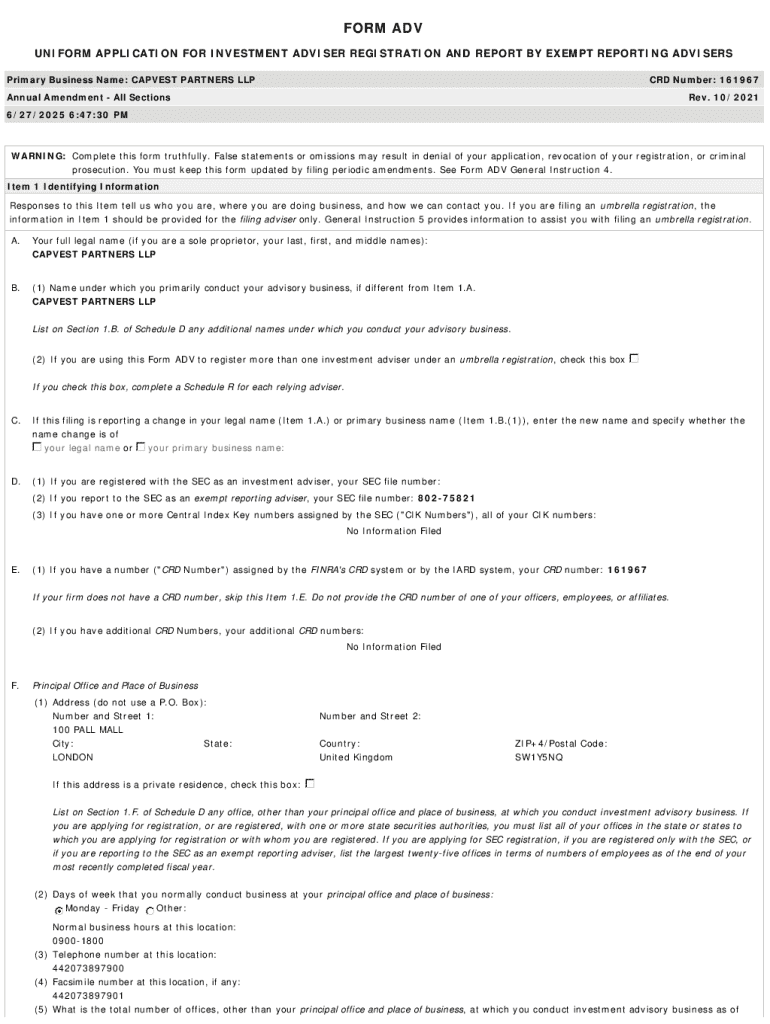

Understanding Form ADV: An overview

Form ADV is a critical document used by investment advisors to register with the Securities and Exchange Commission (SEC) and State regulators. This form provides essential information about the advisor's business, the services offered, and the fees charged. The primary aim of Form ADV is to ensure transparency in the investment advisory industry, helping clients make informed decisions when selecting their advisors.

The importance of Form ADV extends beyond mere compliance. It acts as a disclosure document, ensuring potential clients fully understand their advisor's operations and qualifications. Additionally, it plays a crucial role in consumer protection by preventing fraudulent practices and safeguarding investor interests.

Why Capvest Partners LLP uses Form ADV

Capvest Partners LLP is a registered investment advisor that adheres strictly to regulatory mandates, including the filing of Form ADV. This practice not only aligns with legal requirements but also reinforces their commitment to transparency and ethical practices in wealth management.

Investment firms like Capvest Partners LLP must comply with specific regulations to operate legally. The SEC requires Form ADV to ensure that investment advisors disclose relevant information about their services and practices. This helps maintain market integrity, as clients are entitled to know who manages their investments.

Step-by-step guide to completing Form ADV

Filling out Form ADV is a meticulous process that requires careful attention to detail. Preparing to fill out the form involves gathering necessary information about your business, including ownership details, business practices, and services offered.

Understanding the terminology used within the form is essential as well. Each section has specific requirements that must be accurately reported to avoid compliance issues.

Filling out Part 1 of Form ADV

Part 1 of Form ADV consists of various sections that ask for detailed information about your advisory services. This includes the name, physical address, and different types of clients served. Each section needs to be completed thoroughly, as failure to do so can result in incomplete filings that lead to delays or penalties.

Completing Part 2: The brochure

Part 2 of Form ADV requires a comprehensive brochure that outlines your firm’s practices and services. This brochure serves to inform clients about your investment philosophy, potential risks involved in investments, and the fee structure, including any conflicts of interest.

Best practices for clarity include using straightforward language and avoiding jargon. Information must be easily understandable to ensure clients fully comprehend your offerings.

Additional sections of Form ADV

Beyond Parts 1 and 2, there are additional sections in Form ADV that focus on business practices, disclosures, and other pertinent information. Describing your business practices accurately is crucial as it helps build credibility with clients. Any disciplinary history, if applicable, must also be disclosed to maintain transparency.

Common mistakes to avoid

Filling out Form ADV requires diligence. Many investment advisors make mistakes that can lead to compliance issues. Inaccurate information entry can stem from misinterpreted terminology or data errors, which can impact your advisor's standing with regulatory bodies.

Furthermore, failing to include required disclosures can lead to serious repercussions. Regularly updating your Form ADV is equally important, as any changes to your business model or services must be reflected without delay.

Tools for editing and managing Form ADV

Managing the Form ADV shouldn't be a cumbersome task. Tools like pdfFiller provide intuitive features for editing, signing, and collaborating on Form ADV documents. The interactive capabilities allow users to fill out forms easily, ensuring a streamlined experience.

Using pdfFiller not only simplifies but centralizes document management. This cloud-based platform makes it easy to store and retrieve your completed forms securely while maintaining compliance standards.

FAQs about Form ADV and Capvest Partners LLP

Frequently asked questions (FAQs) help clarify common concerns among investment advisors and their clients regarding Form ADV. Understanding how often to file, amend, and the implications of late filings are crucial aspects for compliance.

The importance of staying compliant with Form ADV

Investment advisors must stay compliant with Form ADV to meet regulatory obligations. Compliance ensures that everything from fee disclosures to services offered is relayed accurately to clients. Non-compliance can lead to significant penalties.

The repercussions of failing to file or incorrectly completing Form ADV could include regulatory investigations, damages to reputation, and potentially losing your clients’ trust. Hence, remaining proactive in your compliance efforts is essential for longevity in the financial advisory industry.

Engaging with Capvest Partners LLP

Individuals interested in services offered by Capvest Partners LLP can contact them directly through various channels. Establishing consultation opportunities is encouraged for personalized guidance on filling out Form ADV and understanding specific requirements.

Getting in touch may also yield insights into investment strategies suited to individual needs, helping clients maximize their investment potential.

User testimonials and success stories

Many advisors using pdfFiller, including those from Capvest Partners, have shared success stories highlighting how the platform has streamlined their document workflows. The increased efficiency gained through better document management is evident in improved compliance rates.

Case studies further demonstrate how using pdfFiller has helped advisors maintain organized records, making updates to Form ADV straightforward and hassle-free. User experiences underscore how technology can elevate the standards of service in the investment advisory field.

Getting started with pdfFiller

If you're ready to enhance your document management process, starting with pdfFiller is easy. Create an account that grants you access to a full suite of tools designed specifically for handling documents like Form ADV.

Navigating the user dashboard is intuitive, allowing for quick access to features like document editing, eSigning, and collaboration tools. Applying best practices in managing your investment advisory documents ensures both compliance and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get capvest partners llpform adv?

How do I complete capvest partners llpform adv online?

How do I edit capvest partners llpform adv in Chrome?

What is capvest partners llpform adv?

Who is required to file capvest partners llpform adv?

How to fill out capvest partners llpform adv?

What is the purpose of capvest partners llpform adv?

What information must be reported on capvest partners llpform adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.