Get the free TAYLOR TURNER WEALTH MANAGEMENT LLC

Get, Create, Make and Sign taylor turner wealth management

How to edit taylor turner wealth management online

Uncompromising security for your PDF editing and eSignature needs

How to fill out taylor turner wealth management

How to fill out taylor turner wealth management

Who needs taylor turner wealth management?

Taylor Turner Wealth Management Form: A Comprehensive Guide

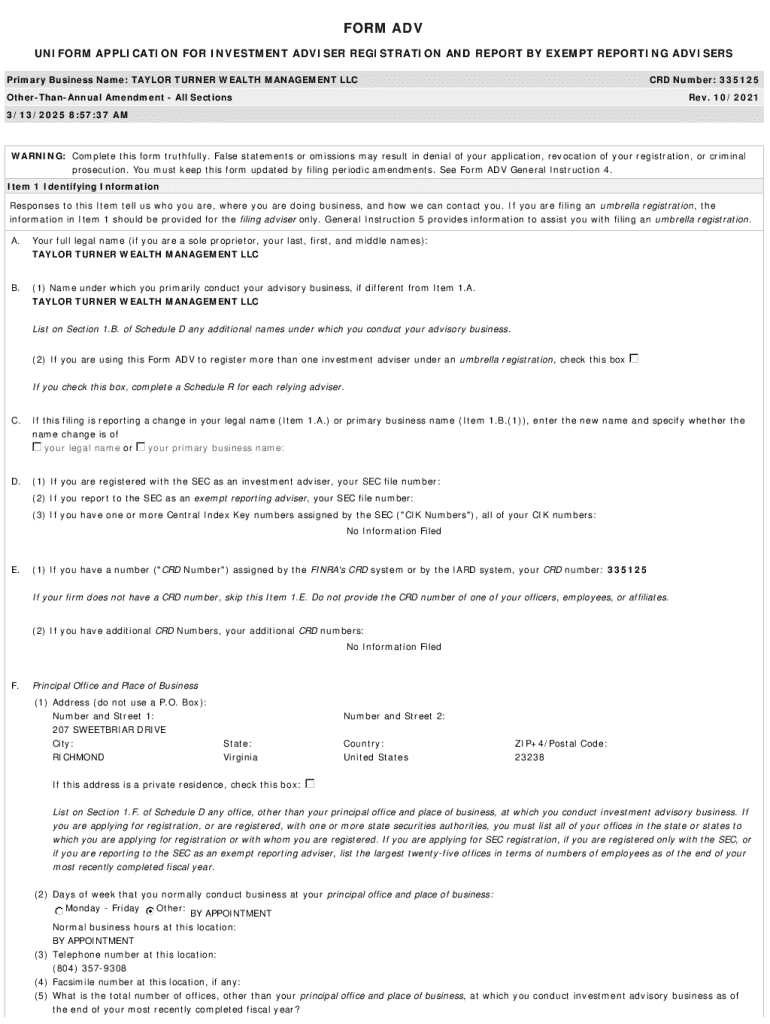

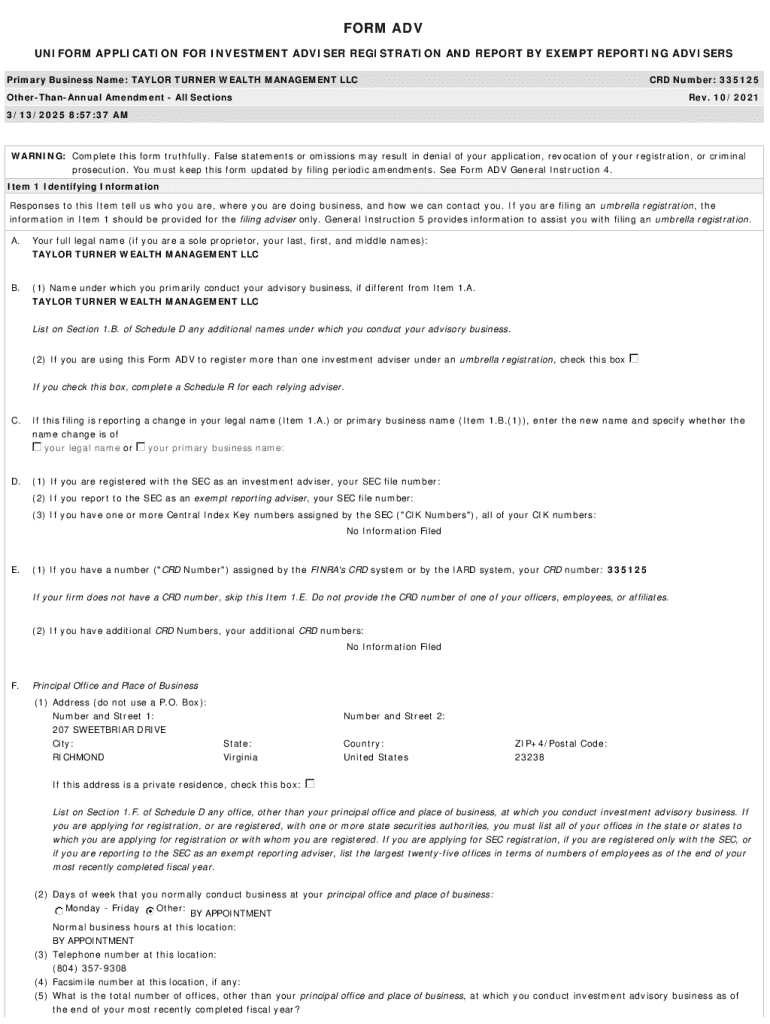

Understanding the Taylor Turner Wealth Management Form

The Taylor Turner Wealth Management Form serves as an essential tool in the landscape of financial planning and asset management. Its primary purpose is to streamline the process of understanding an individual or organization's financial situation and goals. By clearly articulating these objectives, the form enables wealth managers to build tailored strategies that align with their clients' aspirations.

In the world of finance, where the decisions made today echo into the future, clarity is paramount. This is where the Taylor Turner Wealth Management Form shines, offering a structured approach to gathering vital information that informs investment decisions, portfolio construction, and overall wealth growth.

Preparing to fill out the form

To ensure that the Taylor Turner Wealth Management Form is filled out effectively, preparation is key. The first step involves gathering necessary documentation, including income statements, tax returns, and details about existing investments. These documents not only provide the foundational data needed but also enhance the accuracy of your submissions.

Complete documentation is vital. Inaccuracies can hinder the financial planning process and lead to misguided strategies. Therefore, having everything organized before you start filling out the form is prudent. To facilitate this, a readiness checklist can come in handy.

Step-by-step guide to completing the form

Filling out the Taylor Turner Wealth Management Form can be broken down into manageable parts. Understanding how to approach each section is crucial for clarity and completeness. First, you’ll start with personal information, which lays the groundwork for tailoring your investment strategy.

Following that, a financial overview should be provided, detailing income, expenses, assets, and liabilities. Lastly, the section on investment preferences is vital as it reflects your risk tolerance and goals, influencing the strategies recommended by wealth managers.

As you navigate through the form, make note of common pitfalls such as skipping required fields or providing incomplete data. Precision is key for effective wealth management.

Editing and customizing your form

Once the Taylor Turner Wealth Management Form is filled out, it’s important to ensure that it is polished and ready for submission. Utilizing pdfFiller simplifies the editing process significantly. With its array of tools, you can easily make adjustments, insert additional information, or even enhance the presentation of the document.

Editing is straightforward and can include the use of text boxes, annotations, or highlights to ensure key data stands out. Collaboration is also facilitated through pdfFiller, allowing you to invite stakeholders such as family members or financial advisors to review the document. This collaborative approach can foster a more comprehensive financial strategy.

eSigning the Taylor Turner Wealth Management Form

In today's digital environment, eSigning has become a standard practice, and the Taylor Turner Wealth Management Form is no exception. Signing this form electronically not only streamlines the process but enhances the overall efficiency of handling such documents. With pdfFiller, the eSigning process is user-friendly and complies with legal standards.

After you've finalized the contents of the form, you can easily apply your electronic signature. An important consideration in this process is the verification of your identity, ensuring the integrity of the document.

Managing your completed form

Once the Taylor Turner Wealth Management Form has been completed and signed, the next step is efficient management of the document. Using pdfFiller's secure cloud storage ensures that your information is protected while being easily accessible whenever you need it. This feature adds layers of convenience, especially when collaborating with financial advisors.

Furthermore, sharing the completed form with your financial advisors should be done thoughtfully. Best practices dictate that you consider permissions and access levels to maintain confidentiality while facilitating effective collaboration.

Frequently asked questions (FAQ)

As users start to engage with the Taylor Turner Wealth Management Form, a few common questions often arise. These typically revolve around how to accurately fill out the form and ensure that all relevant information is captured correctly. Addressing such concerns proactively can greatly enhance user confidence.

In addition, technical difficulties associated with pdfFiller, such as challenges with logging in or accessing saved documents, can occur. Providing straightforward solutions to these issues ensures a seamless user experience.

Real-life applications of the wealth management form

Understanding how the Taylor Turner Wealth Management Form functions in real-life situations can demystify its importance. Users have successfully leveraged this form to navigate their financial landscapes more effectively, leading to informed decisions and strategic investment moves. Success stories abound, showcasing the transformative impact of structured financial assessments.

Case studies indicate that individuals and teams utilizing this form reported better clarity in their financial objectives and enhanced collaboration with financial advisors. The implications extend beyond individual success, as comprehensive wealth management becomes a cornerstone of financial stability and growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit taylor turner wealth management from Google Drive?

How do I fill out the taylor turner wealth management form on my smartphone?

How do I complete taylor turner wealth management on an iOS device?

What is taylor turner wealth management?

Who is required to file taylor turner wealth management?

How to fill out taylor turner wealth management?

What is the purpose of taylor turner wealth management?

What information must be reported on taylor turner wealth management?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.