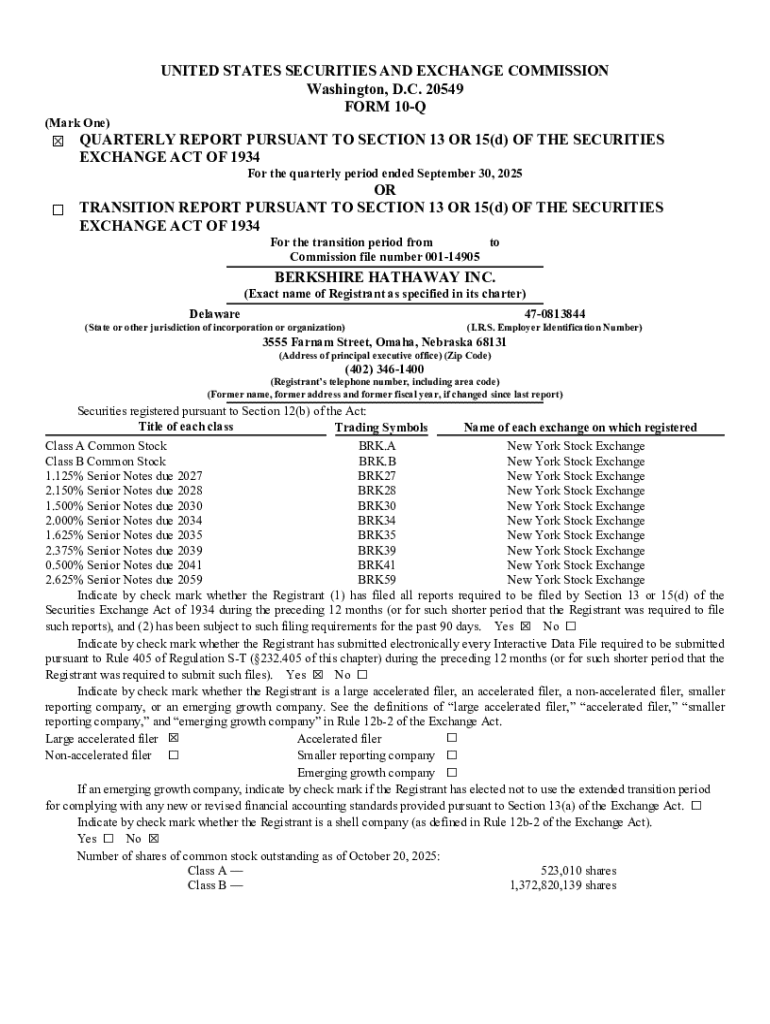

Get the free 375% Senior Notes due 2039

Get, Create, Make and Sign 375 senior notes due

How to edit 375 senior notes due online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 375 senior notes due

How to fill out 375 senior notes due

Who needs 375 senior notes due?

Understanding the 375 Senior Notes Due Form: A Comprehensive Guide

Understanding 375 senior notes: An overview

375 senior notes represent a form of debt financing used by companies to raise capital, where these debt instruments take precedence over other forms of debt in case of liquidation. Defined essentially as unsecured bonds that promise repayment to investors before other creditor claims, they are a vital aspect of the capital structure for many organizations. Due to their senior nature, these notes attract risk-averse investors looking for stable returns with lower risk exposure.

The 375 senior notes stand out due to their specific characteristics, including fixed interest rates, predetermined maturity dates, and terms that specify repayment options for purchasers. Companies use these notes to finance various activities - from expansions and acquisitions to refinancing existing debts - while ensuring that they provide consistent returns to their holders.

The purpose of the 375 senior notes due form

The 375 senior notes due form is a critical document that serves both legal and practical purposes in the context of financial transactions involving these instruments. From a legal standpoint, the due form signifies the formal representation of a company’s obligations to repay its bondholders within specified terms. This documentation is essential for maintaining clarity and accountability in financial dealings.

For issuers and investors alike, utilizing this form correctly is paramount. Issuers must present accurate information to build trust with purchasers, while investors rely on precise details for evaluating the creditworthiness of the issuing entity. Failing to use the form correctly can lead to misunderstandings and potential legal disputes over terms, repayment schedules, or amounts due, impacting both parties involved.

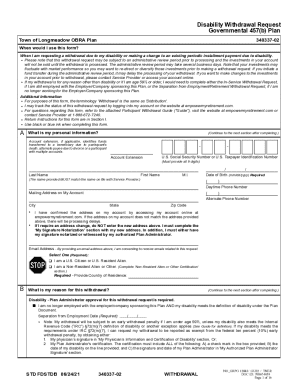

Part 1: Gathering necessary information

Completing the 375 senior notes due form requires detailed information about the issuing entity and its financial commitments. Personal and business information, including the issuer's name, registered address, and tax identification number, is the foundation. Furthermore, key financial details such as outstanding debt amounts, interest rates, and terms of repayment must be meticulously documented to ensure accuracy.

Other vital documents supporting the submission may include financial statements, historical data on previous issues, and any current market analysis relevant to the senior notes. Collecting this data beforehand streamlines the completion process and mitigates the risk of errors or omissions that could delay processing or lead to compliance issues.

Part 2: Step-by-step instructions for filling out the 375 senior notes due form

Step 1: Initial setup and accessing the form

To initiate the process of filling out the 375 senior notes due form, first visit the pdfFiller website. The form is available for download in various formats, including PDF and Word, for your convenience. Users can select the format that best fits their requirements, ensuring they have the necessary tools to complete the documentation.

Step 2: Completing part A – Basic information

Part A of the form requires basic yet essential information about the issuer. This includes the company’s legal name, address, and type of business entity. Each field in this section is designed to facilitate accurate record-keeping for both the issuer and potential investors. Take special care to enter names exactly as they are registered, as discrepancies can lead to processing delays.

Step 3: Completing part B – Financial information

This part focuses on financial data that defines the financial landscape of the senior notes being issued. Include information such as the total amount of senior notes issued, interest rate, maturity date, and any obligations related to the repayments. This information is critical for investors as it plays a significant role in assessing risk and potential returns.

Step 4: Verifying information accuracy

Verification is key to successful form submission. Scrutinize the entries for common errors like misspellings or incorrect figures. A straightforward method is to compare the information in the form against the original documents gathered earlier. Consider involving a colleague for a fresh perspective to spot any mistakes you might have missed.

Step 5: Preparing for submission

Before submitting the completed form, ensure all required documents and signatures are in order. Gathering these materials in advance prevents the pitfall of incomplete submissions, which could slow down processing times. Use a checklist to confirm everything is included, easing the path to finalizing your senior notes due form.

Editing and managing the 375 senior notes due form

After initially filling out the 375 senior notes due form, the next step involves efficient editing and management of this document. pdfFiller provides the tools necessary for seamless editing, allowing users to make adjustments as necessary without hassle. The platform’s cloud-based capabilities facilitate access from any location, ensuring that updates can occur in real-time.

Furthermore, the collaborative features of pdfFiller enable teams to work on the document simultaneously, enhancing productivity. This is especially useful in larger organizations where multiple stakeholders are involved in the issuance of senior notes, helping everyone stay aligned throughout the process.

Signatures and compliance

The inclusion of signatures is a non-negotiable aspect of the 375 senior notes due form. Electronic signatures, as facilitated by pdfFiller, provide a rapid and compliant method for finalizing documents. eSigning not only expedites the formality of the process but also adheres to modern legal standards for document verification and authenticity.

Ensure that all parties involved are familiar with the eSigning process. pdfFiller simplifies this with step-by-step instructions for signing, making the entire process straightforward while guaranteeing compliance with legal requirements.

Common mistakes to avoid

While filling out the 375 senior notes due form, certain pitfalls can commonly hinder progress. Misinterpretation of required fields is frequent, leading to incomplete or inaccurately filled entries. It's crucial to understand exactly what each field requires to avoid detrimental errors.

Missing documents often cause unnecessary delays in the processing stage. Ensure that every necessary document is gathered prior to submission. Additionally, always stay updated with any amendments to financial terms that may affect the form, as neglecting this can lead to significant repercussions for both issuers and holders.

FAQs about 375 senior notes due form

Resources for further assistance

For ongoing support during the process of filling out the 375 senior notes due form, pdfFiller provides numerous resources. Customer support is readily accessible, offering assistance through various channels, including chat, email, or phone. They can guide users through complex issues regarding document management or specific queries related to senior notes.

In addition to personal customer support, pdfFiller also offers a variety of templates and forms pertinent to the issuance of senior notes, ensuring users have everything needed at their fingertips. Community forums provide a platform where users can share experiences and advice, further enhancing understanding and competency in managing their financial documents.

Real-life use cases and examples

Numerous businesses have effectively utilized the 375 senior notes due form to streamline their capital-raising processes. For instance, a mid-sized tech company issued senior notes to fund a major product launch, utilizing pdfFiller to manage everything from the completion of the due form to electronic signatures, ensuring a swift and organized process.

Testimonials highlight how pdfFiller's platform simplifies managing financial documents. Users often highlight the immediate access to editing tools, making updates straightforward and real-time collaboration between stakeholders effortless. Many organizations report that lessons learned through using the 375 senior notes due form led to more efficient processes and clearer communication among team members.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 375 senior notes due?

How can I edit 375 senior notes due on a smartphone?

How do I complete 375 senior notes due on an iOS device?

What is 375 senior notes due?

Who is required to file 375 senior notes due?

How to fill out 375 senior notes due?

What is the purpose of 375 senior notes due?

What information must be reported on 375 senior notes due?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.