Get the free CORRESPONDENT LENDING QUICK REFERENCE GUIDE

Get, Create, Make and Sign correspondent lending quick reference

Editing correspondent lending quick reference online

Uncompromising security for your PDF editing and eSignature needs

How to fill out correspondent lending quick reference

How to fill out correspondent lending quick reference

Who needs correspondent lending quick reference?

Understanding and Utilizing the Correspondent Lending Quick Reference Form

Understanding correspondent lending

Correspondent lending serves as a significant facet of the mortgage industry, acting as an intermediary between lenders and borrowers. In this model, mortgage professionals such as banks and mortgage brokers originate loans directly to borrowers while simultaneously selling them to larger lenders or investors. This unique structure allows correspondent lenders to offer tailored solutions that meet the specific needs of customers seeking funding.

The role of correspondent lending has evolved, providing increased flexibility and faster access to funds. Unlike traditional lending, which often requires direct relationships and varied processes between borrowers and lenders, correspondent lending streamlines these interactions, facilitating efficient borrowing experiences.

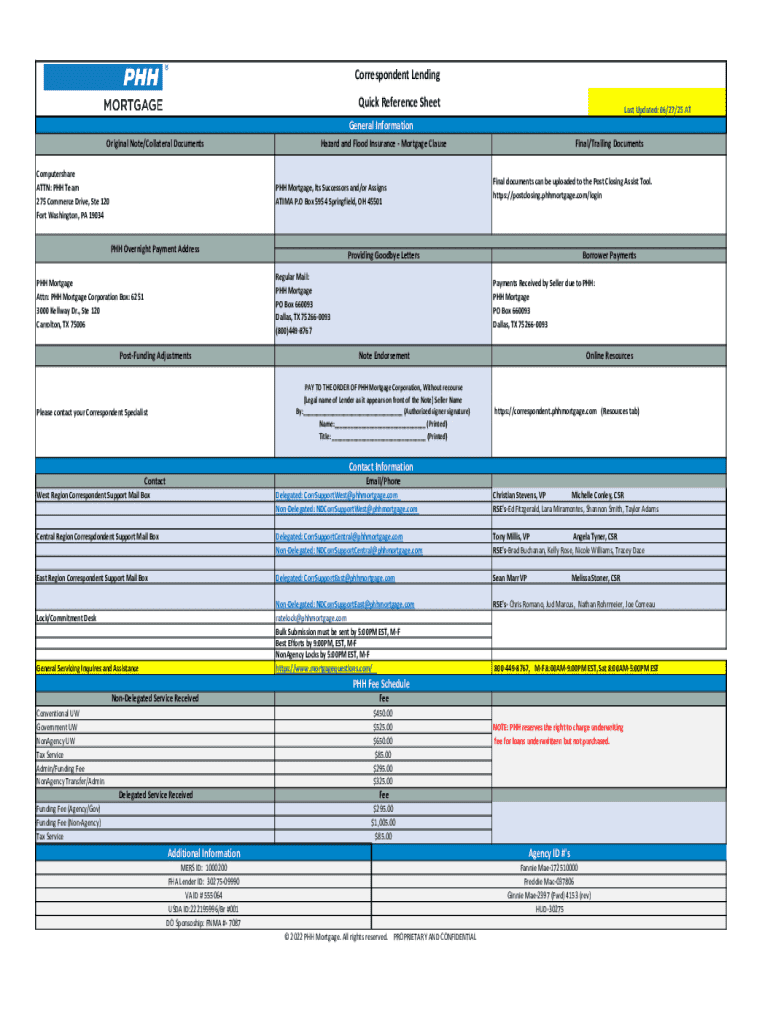

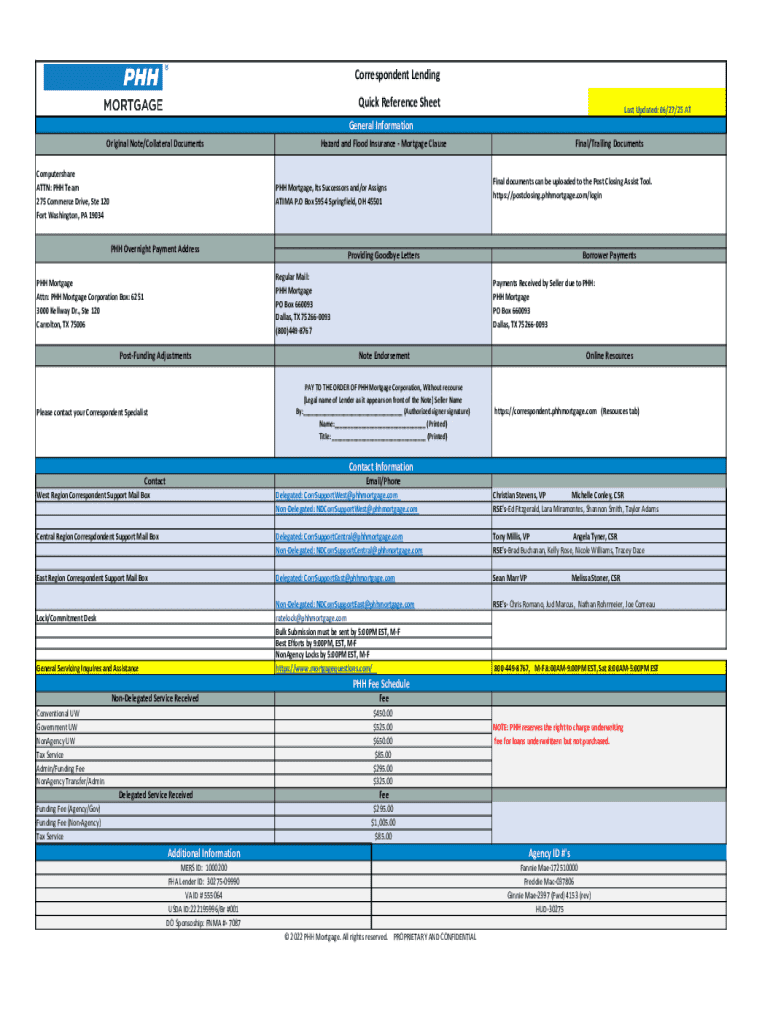

Overview of the correspondent lending quick reference form

The correspondent lending quick reference form is crucial for streamlining the application process while ensuring compliance with various regulations. This document summarizes essential details needed to evaluate a borrower's application efficiently. Using this form can expedite lending decisions, helping lenders respond quickly to borrower inquiries.

Mortgage professionals and lenders are the primary users of the quick reference form. This targeted audience includes banks, independent mortgage companies, and brokers, all of whom need reliable, accessible information as they engage with clients. Utilizing this form can lead to faster loan approvals, ultimately benefiting both parties.

Contents of the correspondent lending quick reference form

Each correspondent lending quick reference form requires specific information that’s vital for processing a loan application. Borrower details are paramount and should include crucial information such as the borrower's full name, contact details, income level, financial history, and any relevant credit information. Additionally, accurate loan information detailing the loan amount, term length, and type of loan must be meticulously noted.

The form typically includes several common sections, such as eligibility criteria, which outline the borrower's requisite qualifications, and required documentation, identifying the necessary paperwork to support the loan request. Finally, a clear approval process section elucidates the steps for moving forward once the form is submitted.

Step-by-step guide to fill out the correspondent lending quick reference form

Filling out the correspondent lending quick reference form efficiently is essential for success within the lending process. Start by preparing to complete the form, ensuring you gather necessary documents and pertinent information. This helps avoid delays during submission.

As you begin filling in borrower information, specificity is key. Provide detailed, accurate information regarding the borrower’s financial situation. Move on to detailing loan information by clarifying various loan options that meet the borrower’s needs. Once completed, it's crucial to double-check for accuracy before submission. This helps reduce the likelihood of errors that could lead to delays.

Finally, understanding the submission process is vital; know how and where to submit the form to ensure correct processing time.

Tips for editing and managing your correspondent lending quick reference form

Utilizing tools like pdfFiller enhances your ability to effectively edit the correspondent lending quick reference form. Editing PDFs using this platform is user-friendly; you can easily add or modify text, making necessary adjustments as situations change.

Incorporating eSignature features can simplify the signing process, allowing multiple stakeholders to sign the form without needing to be in the same location. This not only speeds up the process but also enhances the document's security and integrity. Collaboration among team members is also essential; pdfFiller facilitates sharing forms and collecting feedback seamlessly. Best practices for document management, such as organizing files and ensuring they are easily retrievable, will aid in maintaining effective oversight.

Troubleshooting common issues with the correspondent lending quick reference form

Common mistakes can be detrimental when completing the correspondent lending quick reference form. Awareness of these potential errors is pivotal for ensuring a streamlined process. Common issues may include incorrect borrower information, missing documentation, or unclear loan terms. Identifying these mistakes in advance can save time and energy.

If your form is rejected, take a moment to re-evaluate eligibility criteria and ensure that all required documentation is complete and accurate. Understanding the reasons for rejection assists in improving future submissions.

Legal considerations when using the correspondent lending quick reference form

Privacy rights are significant when dealing with sensitive borrower information. It is essential to implement measures to protect borrowers' data during the lending process. This means ensuring secure transmission and limiting access to personal information only to authorized individuals.

Additionally, regulatory compliance is paramount in the realm of correspondent lending. Both federal and state requirements relate to documentation and borrower interactions. Familiarizing yourself with these regulations assists in maintaining adherence while navigating the lending landscape.

Additional tools and resources for lenders

Access to financial calculators available on pdfFiller, such as loan qualification and repayment calculators, can enhance the efficiency of your lending process. These tools support understanding how different scenarios impact borrower terms and rates.

It's also beneficial to have access to guides on correspondent lending regulations, ensuring you're up-to-date with compliance and legal information. Having the right resources at your disposal can strengthen your position in the lending market.

For further assistance, knowing how to reach out to professionals in the lending industry can clarify complex issues that may arise during the borrowing process.

Engaging with the correspondent lending community

Connecting with forums and online communities focused on correspondent lending offers unique insights and peer support. Engaging in discussions with professionals facing similar challenges can foster collaboration and knowledge exchange.

Exploring partnership opportunities within the correspondent lending space can streamline your operations. Collaborating with platforms like pdfFiller for enhanced services can yield mutual benefits and expand your service offerings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out correspondent lending quick reference using my mobile device?

How do I complete correspondent lending quick reference on an iOS device?

Can I edit correspondent lending quick reference on an Android device?

What is correspondent lending quick reference?

Who is required to file correspondent lending quick reference?

How to fill out correspondent lending quick reference?

What is the purpose of correspondent lending quick reference?

What information must be reported on correspondent lending quick reference?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.