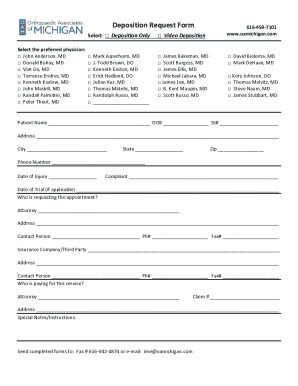

Get the free Insurance Transfer Form Vision Super. Insurance Transfer Form Vision Super

Get, Create, Make and Sign insurance transfer form vision

Editing insurance transfer form vision online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance transfer form vision

How to fill out insurance transfer form vision

Who needs insurance transfer form vision?

Understanding Insurance Transfer Forms: A Comprehensive Guide

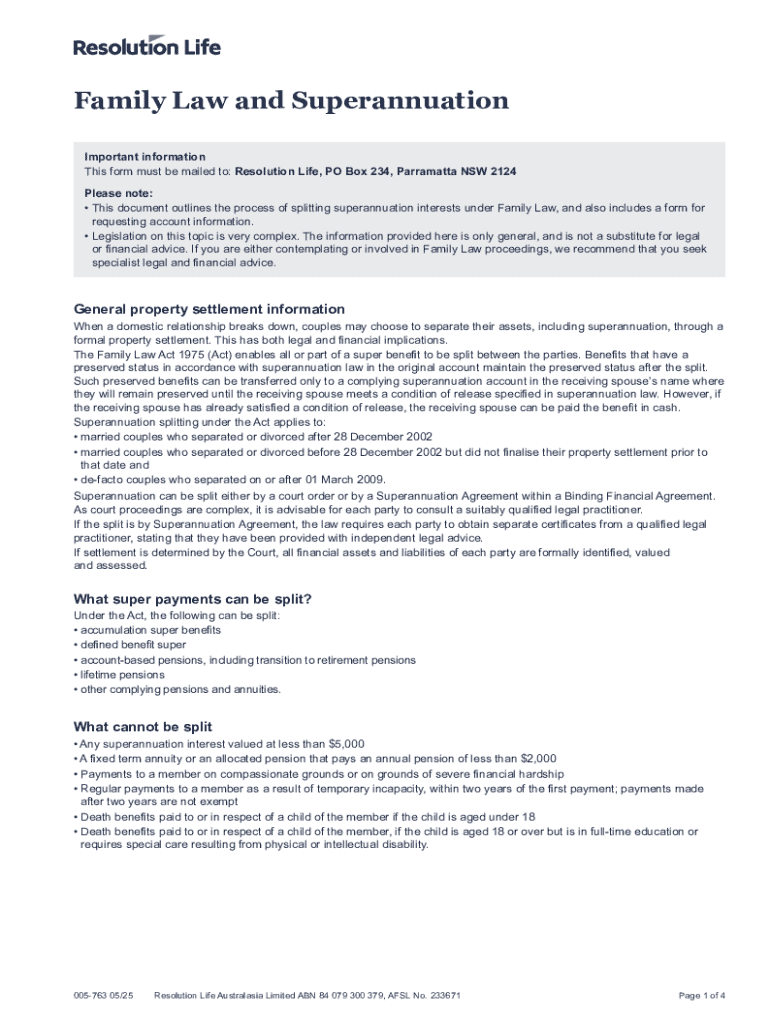

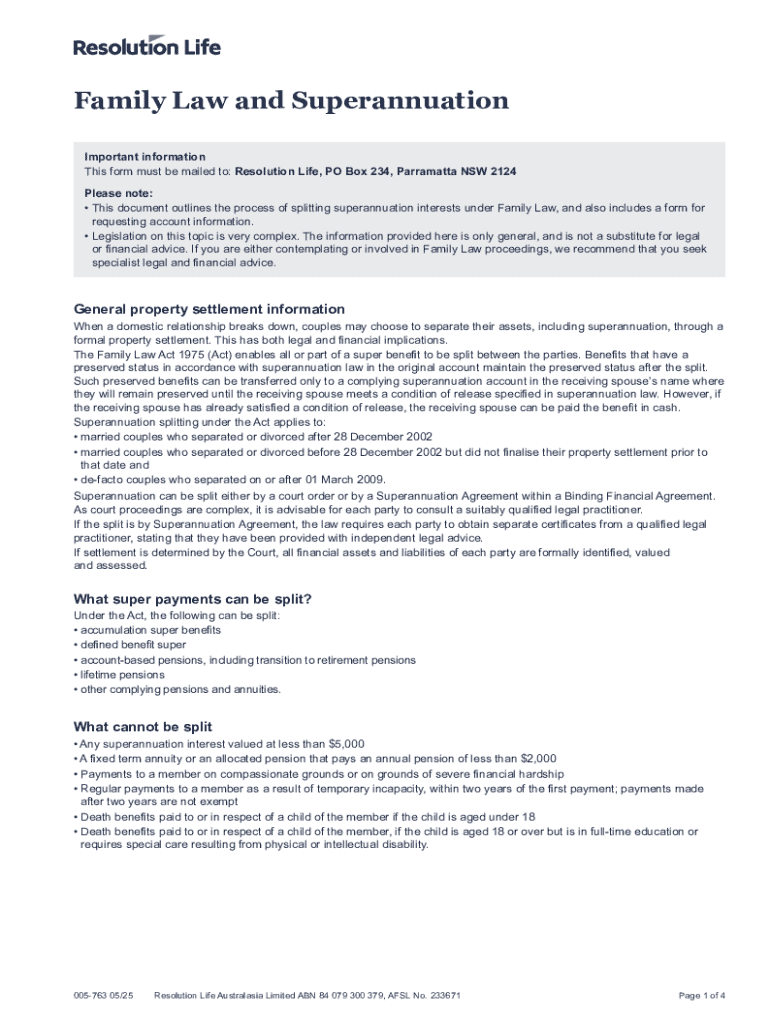

Overview of insurance transfer forms

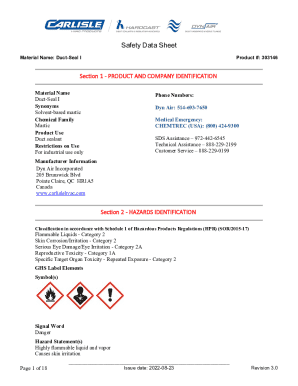

An insurance transfer form, specifically a vision form, serves as a crucial document in updating or transferring insurance coverage from one entity to another. This form is essential for maintaining coverage continuity, ensuring policyholders retain their benefits even amidst changes in ownership or residency. It’s often needed in scenarios such as when an individual changes jobs, moves to a new address, or transfers ownership of a vehicle. Understanding when and how to use these forms can save individuals and businesses from potential insurance gaps.

Accurate documentation in insurance transfer forms is paramount. Errors can lead not only to denial of coverage but may also result in legal complications if claims are made under incorrect or outdated information. Ensuring that the form is meticulously completed protects the policyholder's rights and helps maintain the validity of the insurance contract. Ignoring this can lead to significant repercussions, which is why understanding the importance of these forms cannot be overstated.

Types of insurance transfer forms

Different types of insurance transfer forms cater to various types of coverage, and knowing their specific requirements is essential for a successful transfer process. Each form comes with unique features that reflect the nature of the insurance being transferred.

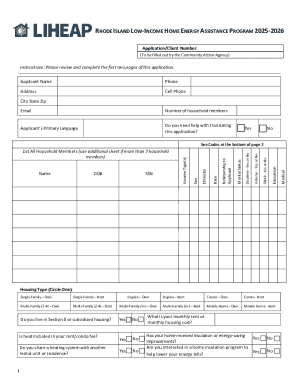

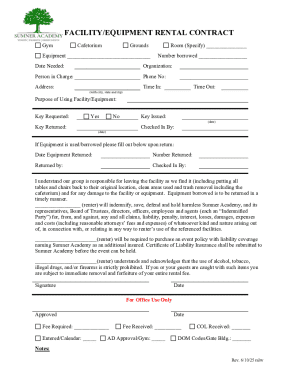

Step-by-step guide to completing an insurance transfer form

Filling out an insurance transfer form involves several critical steps to ensure accuracy and completeness. Each stage, from gathering documents to submission, plays a vital role in the lifecycle of the form.

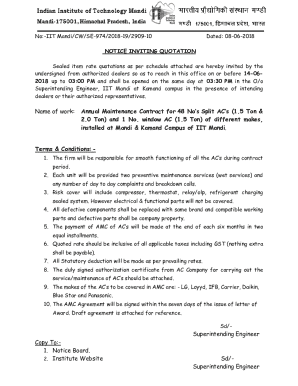

Editing and managing your insurance transfer forms

Once you've submitted the forms, effective management becomes essential. Ensuring you have the capability to edit, share, and store your documents securely will support smooth transitions and adjustments as needed.

Troubleshooting common issues

Despite careful preparation, issues may still arise. Understanding common pitfalls can facilitate quicker resolutions and smoother interactions with insurers.

Best practices for insurance transfers

Establishing a system for managing your insurance documents is vital in maintaining organization and easy access when needed. Adopting best practices can result in smoother transactions and ensure you remain in good standing with your insurers.

Conclusion

Mastering the process of insurance transfer forms, particularly the vision form, equips individuals and teams with the knowledge and tools to navigate their insurance needs confidently. Leveraging resources like pdfFiller can streamline this process, enabling users to edit, eSign, and manage documents efficiently from any device.

With thorough understanding and proper management practices, policyholders can ensure continuous coverage, protect their rights, and negate the chances of experiencing disruptions in their insurance services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my insurance transfer form vision directly from Gmail?

How do I edit insurance transfer form vision on an iOS device?

How do I complete insurance transfer form vision on an Android device?

What is insurance transfer form vision?

Who is required to file insurance transfer form vision?

How to fill out insurance transfer form vision?

What is the purpose of insurance transfer form vision?

What information must be reported on insurance transfer form vision?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.