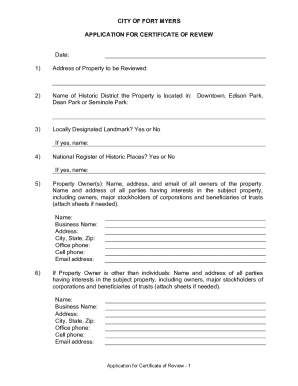

Get the free Estate (Large) Forms

Get, Create, Make and Sign estate large forms

Editing estate large forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estate large forms

How to fill out estate large forms

Who needs estate large forms?

Comprehensive Guide to Estate Large Forms

Understanding estate large forms

Estate large forms are specialized legal documents required in the management and distribution of an estate following the passing of an individual. These forms encompass a range of paperwork necessary from the initiation of the probate process to the finalization of asset distribution. They serve as the foundation for all legal proceedings pertaining to estate management, ensuring that the wishes of the deceased are honored and adhered to throughout the various stages of administration.

The importance of these forms in estate planning cannot be overstated. For individuals and families, having the proper estate large forms in place is crucial for a smooth transition during a challenging time. Without comprehensive documentation, disputes may arise, leading to prolonged legal battles that strain familial relationships and resources. Effectively prepared estate forms not only facilitate clear communication among executors, beneficiaries, and advisors but also safeguard the deceased's wishes from potential challenges.

Types of estate large forms

Estate large forms can be categorized into two primary groups: primary estate forms and supporting estate forms. Primary estate forms include essential legal documents such as wills, trust documents, and power of attorney. These documents outline the structure for how assets will be distributed, who will manage these assets, and who is granted the authority to make decisions on behalf of the deceased.

Supporting estate forms are equally important as they assist in the overall management and execution of the estate. This category includes petitions for probate, which initiate the court's involvement, inventories of assets that catalog the estate's contents, and notices to creditors that inform them about the estate and collect any claims. Together, these documents form a comprehensive ecosystem that ensures all aspects of estate administration are legally compliant and transparent.

Detailed look at important estate forms

Estate executors are responsible for managing the estate's settlement, and they require a variety of estate large forms to successfully fulfill their duties. First and foremost is the executor of an estate forms, which guides them through the necessary paperwork to initiate and complete the probate process. These forms often include letters testamentary, which grant the executor legal status to act on behalf of the deceased.

In addition to the executor forms, the probate process necessitates specific completion of forms. For instance, the petition for probate initiates court proceedings; careful completion of this form is crucial to avoid delays. The petition for administration is another important form, applicable when the deceased did not leave behind a will. Asset management involves creating an inventory of assets, which not only helps identify what is at stake but also serves as an essential part of the probate process.

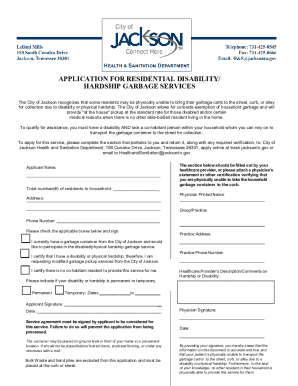

How to fill out estate large forms

Filling out estate large forms accurately is vital for legal compliance and efficiency in the probate process. Start by gathering all necessary documentation related to the deceased's assets, existing wills, and any existing powers of attorney, as this information will form the basis for filling out the forms. Each major form, such as the petition for probate or the inventory of assets, often has a standardized format; following these can help ensure completeness.

It's important to be vigilant when completing these forms, as small errors can cause significant delays. Common pitfalls include failing to include all required signatures or forgetting vital information about assets. To avoid these issues, share the completed forms with your legal advisor for validation before submission. To enhance the filling experience, utilizing interactive tools available on platforms like pdfFiller can streamline this process by allowing users to fill, edit, and sign documents online.

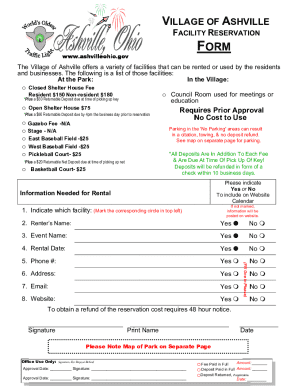

Editing and collaborating on estate forms

Collaboration is key when it comes to handling estate large forms, especially if multiple family members or legal advisors are involved in the planning process. Utilizing collaborative features offered by pdfFiller can facilitate smooth communication and ensure everyone is on the same page. Family members can provide input on the forms, allowing for a comprehensive understanding and reducing potential conflicts that could arise if forms are handled solo.

Moreover, editing tools play a crucial role in maintaining clarity and compliance. Ensuring that all forms adhere to legal requirements not only protects the validity of the documents but also assures all parties involved understand the content. With pdfFiller, users can make revisions in real-time and ensure that the final versions of the documents are both legally sound and clearly articulated to mitigate misunderstandings down the line.

Managing your estate documents

A well-organized estate documentation strategy is vital for efficiency and peace of mind. Keeping all estate large forms centralized in a secure platform such as pdfFiller allows executors, family members, and advisors to access the latest versions of documents whenever needed. This centralized document management reduces the risk of miscommunication and ensures critical information is readily available during moments when immediate decisions may be necessary.

Furthermore, tracking changes and versions of these important documents cannot be understated. Estate management often involves evolving situations, where documents require updates as circumstances change. Being able to track prior versions helps maintain clarity on the history of decisions made and can provide protection against potential future disputes.

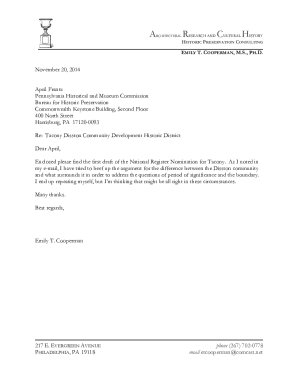

Case studies and real-life examples

Real-life examples provide valuable insights into the effectiveness of using estate large forms. One notable instance involved a family who faced significant delays in the probate process due to incomplete or inaccurate forms. By revisiting the estate large forms with the help of a legal advisor and utilizing collaborative features to engage all family members, they were able to streamline their process, ensuring each person understood their role and the forms they were responsible for.

Another successful case involved a professional executor who meticulously cataloged assets using an inventory form, making the entire probate process smoother for the heirs. The executor's thorough approach to using estate forms allowed for a clear understanding among beneficiaries and eliminated confusion over asset distribution. These stories underscore the transformative effects of effectively utilizing estate large forms to facilitate smoother estates processes.

Frequently asked questions about estate large forms

When dealing with estate documents, individuals often have similar concerns. Common FAQs include, 'What forms do I need to start the probate process?' or 'How can I correct a mistake on a filed document?' These questions represent the challenges that many face when dealing with the legalities of estate management. Understanding what forms to prepare in advance can save time and stress, especially during what is often a difficult period.

In response to common queries, experts often suggest being proactive in document preparation, using interactive tools for filing, and consulting advisors if issues arise. These strategies not only reduce confusion but also empower individuals and families to effectively navigate the complexities surrounding estate large forms.

Best practices for using estate large forms

To ensure that your estate large forms are compliant and effective, you should adhere to best practices for completion and management. One critical best practice is understanding the specific legal requirements that vary by state; what may be acceptable in one jurisdiction could be inadequate in another. Consulting with a legal professional can provide insights into these nuances and promote compliance.

Additionally, document security should never be overlooked, especially since estate forms often contain sensitive information. Utilizing platforms like pdfFiller ensures that your documents are protected through encryption and secure access features, safeguarding both your information and the privacy of your family members during this process. By integrating these practices, individuals can safeguard both their assets and the integrity of their estate management.

Leveraging technology to simplify estate management

Advancements in technology offer substantial benefits for estate planning—particularly through cloud-based platforms. Utilizing services such as pdfFiller empowers individuals and teams to seamlessly create, edit, and manage their estate large forms from any location. With mobile and desktop accessibility, estate planning can become more collaborative and flexible than ever, letting families work together without geographical constraints.

The integration of e-signatures eliminates the need for physical document exchanges, enhancing the efficiency of signing forms. Moreover, users can keep their estate large forms up-to-date and easily accessible, ensuring that any necessary modifications reflect promptly in the documents. This technological approach not only improves efficiency but also aligns with modern expectations for convenience in managing essential documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit estate large forms from Google Drive?

How can I send estate large forms for eSignature?

How do I execute estate large forms online?

What is estate large forms?

Who is required to file estate large forms?

How to fill out estate large forms?

What is the purpose of estate large forms?

What information must be reported on estate large forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.