Get the free APPLICATION PACKAGE FOR BANKING BUSINESS ...

Get, Create, Make and Sign application package for banking

Editing application package for banking online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application package for banking

How to fill out application package for banking

Who needs application package for banking?

Creating an Efficient Application Package for Banking Forms

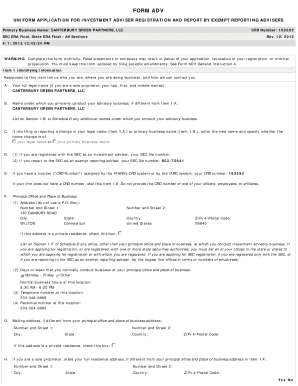

Understanding the application package for banking forms

An application package for banking forms is a comprehensive compilation of documents that individuals or businesses prepare to request banking services such as loans or accounts. This package is crucial as it not only streamlines the application process but also enhances the chances of approval by presenting all necessary information clearly and concisely.

Using a well-structured application package saves time for both applicants and lenders. Banks process numerous applications daily, and having a complete package minimizes back-and-forth communication, ensuring swift evaluations. Typical components of an application package may include personal identification, proof of income, credit history, and various forms specific to the type of service requested.

Crafting your application package: Step-by-step process

Creating an effective application package begins with understanding your specific banking needs. Are you seeking a personal loan, a mortgage, or maybe a business line of credit? Knowing this helps narrow down which financial institutions align best with your requirements.

Determine your banking needs

Identifying the type of banking service you need is essential. Whether it’s a personal loan, auto loan, or mortgage, each option has unique requirements that differ across lenders. Exploring these options allows you to tailor your package appropriately, setting the stage for a higher likelihood of approval.

Gather essential documentation

During the loan choices phase, gathering all necessary documentation is key. Start with personal identification documents like government-issued IDs, Social Security numbers, or relevant tax documents. Additionally, financial statements verifying income and asset ownership are crucial. Lenders will scrutinize your credit history, which is why knowing your credit scores ahead of time can be beneficial to understand your standing before submitting.

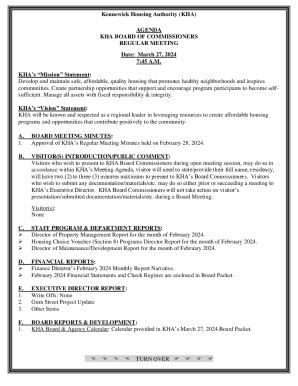

Organize required forms

Each application generally requires standardized forms. Ensure you have the application form, consent form, and any supplementary documents that may be required specific to your chosen loan. These may vary from lender to lender, so checking ahead can prevent delays.

Using technology for efficient document collection

In today’s digital age, leveraging technology can significantly ease the process. Tools for organizing your documents, such as pdfFiller, allow you to collect and manage your papers efficiently. Cloud-based solutions not only save physical space but enable access from anywhere, ensuring you can update and share your application package seamlessly.

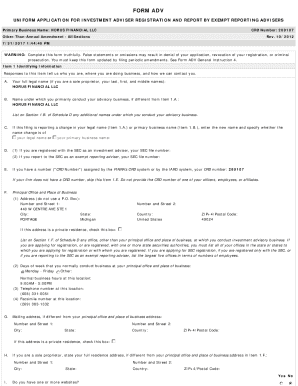

Filling out your banking application forms

Online banking applications have become increasingly popular, streamlining the process for applicants. Following a systematic approach when filling out these forms is crucial to navigate potential pitfalls such as missing information or errors.

Navigating online banking applications

When filling out online forms, start by carefully following each prompt. Most systems offer guidance, such as tooltips or FAQs, to assist. Common pitfalls include neglecting to double-check entries, especially in sensitive areas like personal information or financial data, which can delay processing.

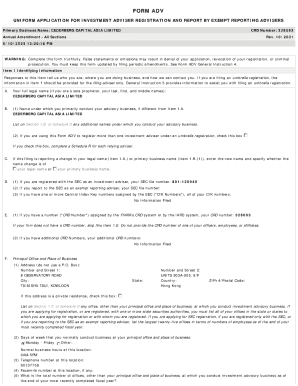

Important sections to pay attention to

Several sections require careful attention when completing your banking application forms. The Personal Information section is foundational, where accurate details are crucial for identification. The Employment and Income section must reflect your current financial situation authentically to provide a clear picture to the bank. Lastly, declare your Assets and Liabilities accurately to give lenders a comprehensive view of your financial landscape.

Special considerations

For self-employed applicants, additional documentation may be necessary. This could include profit and loss statements or tax returns to prove income stability. Moreover, disclosing non-standard income formats, like freelance or commission-based earnings, requires a thoughtful explanation. Tailoring your application package to cover these aspects can illustrate your financial reliability.

Tips for a successful application submission

Submitting a stellar application package often hinges on thorough preparation. Before sending off your documents, double-check everything. This can be done using a checklist that verifies the completeness of your submission, including necessary signatures and dates.

Double-check your application packet

Reviewing all submitted documents is essential. Make sure that each component of your application packet is complete and accurate. Even minor errors can lead to delays or denials. Utilize a checklist to validate every piece of information and ensure consistency across documents.

Communicating with your lender

After submission, staying engaged with your lender can prove beneficial. Prepare for potential follow-ups by keeping all communications documented. Understanding what to expect in terms of processing times can ease concerns and provide clarity throughout the waiting period.

The approval process: What happens next?

Post-submission, it’s important to grasp what unfolds. The approval process entails a thorough review, typically by underwriters, who evaluate your application based on specific criteria set by the bank. Understanding this timeline can help in managing expectations.

If your application is denied, it can be disheartening. However, take this as a learning opportunity. Request feedback from the lender on the reason for denial; knowing areas for improvement can aid in strengthening future applications.

Maintaining documentation after submission

Once your application is submitted, securing your application materials becomes vital. Best practices suggest both physical and digital storage solutions to safeguard your documents. Using platforms like pdfFiller enhances document management and security, allowing for easy retrieval whenever necessary.

Engage throughout the process

Setting reminders for checking your application status keeps you informed about any developments. Maintain communication with your bank, as proactive engagement signals your commitment and may provide timely updates. Keeping meticulous records of all interactions further strengthens your position in the process.

Troubleshooting common issues with banking forms

Discrepancies in documentation can arise during the application process. Understanding your lender’s specific requirements, as they may vary by institution, will help you navigate these challenges. If issues arise, address them promptly with your lender to find resolutions.

Leveraging technology to enhance your banking experience

Utilizing tools like pdfFiller for document management can streamline your banking experience significantly. The advantages of digital platforms include easy edits, signatures, and collaboration, ensuring your application and associated documents are maintained in an organized, user-friendly setting.

Such convenience can alleviate stress, providing you with more time to focus on preparing for your banking needs instead of being bogged down by paperwork.

Future considerations in your banking journey

Staying informed about changes in banking regulations is paramount, particularly as they can affect your future borrowing opportunities. Knowing industry trends and potential shifts enables you to adjust your strategies accordingly.

Preparing for future applications means maintaining financial health and keeping your documentation organized. Regularly updating your financial records and ensuring that you meet credit standards will set a solid foundation for any future banking needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the application package for banking in Gmail?

How do I complete application package for banking on an iOS device?

Can I edit application package for banking on an Android device?

What is application package for banking?

Who is required to file application package for banking?

How to fill out application package for banking?

What is the purpose of application package for banking?

What information must be reported on application package for banking?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.