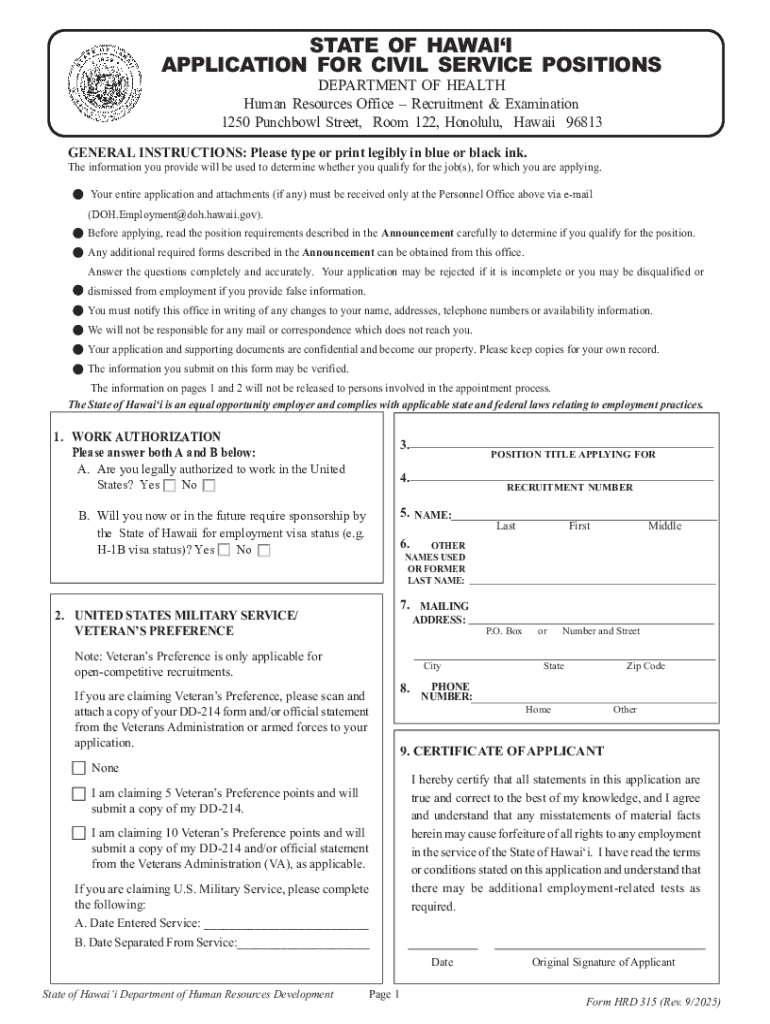

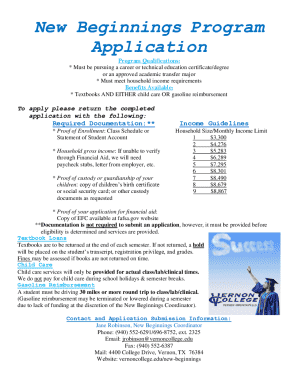

Get the free LAST DAY TO FILE APPLICATIONS: Continuous

Get, Create, Make and Sign last day to file

How to edit last day to file online

Uncompromising security for your PDF editing and eSignature needs

How to fill out last day to file

How to fill out last day to file

Who needs last day to file?

Last Day to File Form: A Comprehensive Guide

Understanding tax filing deadlines

Meeting tax filing deadlines is crucial for individuals and businesses alike. Failing to adhere to these timelines can result in penalties, interest accrued on unpaid amounts, and even audits. Understanding when your taxes are due helps avoid unnecessary stress and keeps your financial responsibilities in check.

Key tax dates vary across different jurisdictions but typically include important milestones like National Tax Day, deadlines for specific forms, and state-specific deadlines. The last day to file tax forms serves as a significant cut-off point for completing annual tax obligations, where the culmination of yearlong financial activities must be reported accurately.

The final tax filing deadline acts as a reminder to gather all necessary information, such as income statements and tax documents, to report to the IRS and state tax agencies. This guide will navigate you through critical dates and what to expect on the last day to file form.

Key dates to remember

One of the most prominent dates in the tax calendar is National Tax Day, typically falling on April 15th. This date provides taxpayers with a fixed point to prepare for and submit their tax returns. However, when April 15th falls on a weekend or holiday, the deadline is pushed to the next business day. Therefore, it’s essential to mark your calendars and keep informed about any changes to this date.

Filing for an extension can grant you additional time to meet your obligations. By filing Form 4868, individuals can extend their filing deadline to October 15th. It's important to note that this extension only applies to filing the forms, not to making payments, which remain due by the original deadline.

The last day to file forms: what you need to know

As the last day to file form approaches, anxiety often escalates. Understanding what happens on this critical day can help mitigate panic. Generally, filing must be completed by midnight local time to be considered on time. Submitting your forms a day early can ease any last-minute complications.

Consequences for failing to meet the deadline include hefty penalties and additional interest on taxes owed. The IRS assesses a late filing penalty, usually a percentage of your owed taxes, which can pile on quickly if not addressed promptly.

Choosing between filing online or paper filings plays a significant role in ensuring timely submission. Electronic filing through pdfFiller is particularly beneficial since it minimizes processing times and allows quick access to forms and documents. However, on the last filing day, keep in mind that online platforms can experience heavy traffic.

Gathering necessary documents

Before diving into the last day filing rush, ensure you have all essential tax documents prepared. Common documents include W-2s from employers, 1099s for freelance or side jobs, and statements from banks detailing any interest earned over the year.

Organizing these files can streamline the filing process. Consider storing important documents in clearly labeled folders or files, consolidating your tax information to reduce the chances of missing required paperwork. Using a tool like pdfFiller can assist in managing and organizing these documents efficiently.

pdfFiller offers interactive features that allow users to create, fill, and edit tax forms quickly, making it an invaluable resource during the final rush.

Step-by-step instructions for filing your form

To navigate the last day to file forms successfully, follow these steps strategically to avoid common pitfalls:

Post-filing considerations

Once you've submitted your tax return, it’s critical to confirm that your form was received by the IRS or state tax agencies. If you filed electronically, pdfFiller can provide a confirmation receipt—a practice that helps to ensure peace of mind.

After filing, keep track of your return. Many states and the IRS offer online portals where taxpayers can monitor the status of their returns after submission. Additionally, adopting best practices for record-keeping ensures you can easily withdraw filed documents if needed.

Common FAQs around filing deadlines

Many taxpayers find themselves in a bind as deadlines approach. If you missed the last day to file form, prompt action is key. The IRS allows for late returns, but you should file as soon as possible to minimize penalties and interest.

Managing penalties can become daunting, but communicating with the IRS often leads to payment plans or reduced penalties. Understanding state-specific filing requirements can also prevent future issues, as each jurisdiction may have different penalties for late filings.

Conclusion: proactive steps for future filings

To prevent a last-minute scramble in future tax seasons, consider setting up calendar reminders for critical deadlines. Utilizing software like pdfFiller can enhance document management, providing notifications and tools to streamline upcoming filings.

By consistently organizing your tax documents and preparing ahead of deadlines, you can navigate the complexities of tax filing more efficiently. Taking these proactive steps will not only benefit your filing experience but will also ease the anxiety often associated with the last day to file form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my last day to file in Gmail?

How can I modify last day to file without leaving Google Drive?

How can I send last day to file for eSignature?

What is last day to file?

Who is required to file last day to file?

How to fill out last day to file?

What is the purpose of last day to file?

What information must be reported on last day to file?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.