Get the free Oklahoma Gift Statutes

Get, Create, Make and Sign oklahoma gift statutes

How to edit oklahoma gift statutes online

Uncompromising security for your PDF editing and eSignature needs

How to fill out oklahoma gift statutes

How to fill out oklahoma gift statutes

Who needs oklahoma gift statutes?

Guide to Oklahoma Gift Statutes Form

Understanding Oklahoma gift statutes

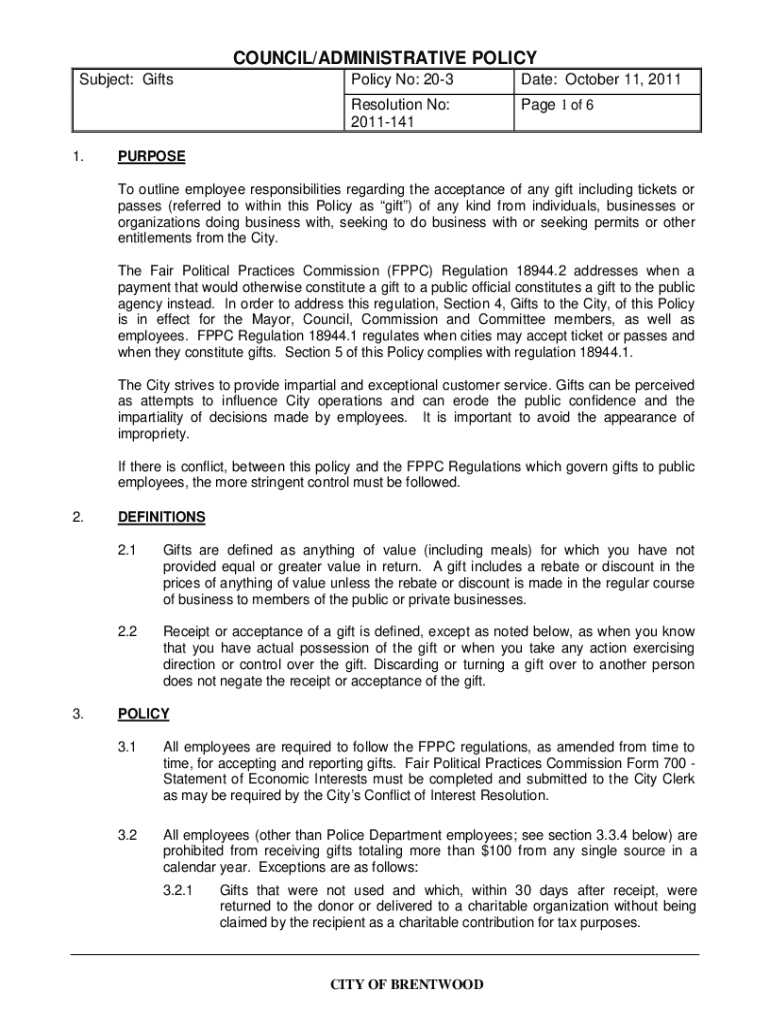

Oklahoma gift statutes are crucial legal guidelines that dictate how gifts are handled within the realm of state governance and public service. These statutes are designed to maintain transparency and ensure ethical behavior among state officers and employees. Understanding these statutes is essential for both individuals and organizations that engage in the giving or receiving of gifts, especially within official capacities.

The importance of Oklahoma gift statutes cannot be overstated. They help prevent corruption and conflicts of interest by regulating the gifts that public officials and employees can accept. The primary objectives of these statutes are to foster honesty in public service and maintain the integrity of governmental transactions.

Types of gifts recognized under Oklahoma law

Oklahoma law recognizes various types of gifts, each with distinct implications and considerations. Understanding these different categories is vital for compliance with state regulations.

Gifts made with intent to influence

Gifts that are given with the intent to influence a public official's decision are classified as such and are subject to strict scrutiny. The implications for the giver can be severe, ranging from fines to criminal charges. Therefore, it is crucial to understand the legal considerations and reporting requirements associated with these gifts. Individuals must disclose such gifts to relevant authorities, maintaining transparency and compliance.

Extra compensation for official duties

In addition to gifts, the statute recognizes extra compensation that public officials might receive for their official duties. It's important to distinguish between acceptable compensation and gifts. Extra compensation must be transparently reported and documented to avoid any potential conflicts of interest or ethical violations.

Specific provisions and exceptions

Oklahoma gift statutes contain specific provisions and notable exceptions that dictate who can give gifts and under what circumstances they can be accepted. Understanding these nuances is paramount.

Gift regardless of giver status

One clarity provided by the Oklahoma gift statutes is that gifts can be accepted irrespective of the giver's status. This means that gifts can be given by individuals from various backgrounds, but certain conditions apply. For example, gifts should not be accepted if they can influence the performance of official duties.

Gifts from lobbyist or regulated entity

When it comes to gifts from lobbyists or regulated entities, stricter compliance factors come into play. Public officials must be aware of the guidelines governing the acceptance of gifts from these parties to avoid potential ethical violations. This includes adhering to set limits on the value of gifts and ensuring that proper disclosures are made to relevant authorities.

Definitions and legal exceptions

It's essential to understand key terms like 'gift' and 'influence' as defined by Oklahoma law. Additionally, notable legal exceptions exist, which clarify situations when certain gifts may be permissible despite potential influences or conflicts. Comprehending these definitions ensures greater compliance with the statutes.

Key documentation and reporting requirements

Proper documentation is a crucial aspect of the Oklahoma gift statutes. Individuals and organizations must maintain detailed records of any gifts received to ensure transparency and compliance. This prevents misunderstandings and demonstrates adherence to the state’s regulations.

To facilitate compliance, it is essential for recipients to follow steps for documenting gifts accurately. This includes capturing the date of receipt, the value of the gift, the donor's information, and the context of why the gift was given. Utilizing templates for documenting gifts received can simplify the recording process and help ensure no details are overlooked.

Filing the Oklahoma gift statutes form

Filing the Oklahoma gift statutes form is a critical step for ensuring compliance with state regulations. Detailed instructions for filling out the form include providing personal identification details, the nature of the gift, the date it was received, and information about the giver.

To avoid common mistakes, individuals should double-check the accuracy of the information entered, ensure that all required sections are completed, and remember to submit the form within the stipulated time frame. Tips for ensuring compliance include seeking assistance from compliance officers or colleagues if there are any uncertainties about the process.

Interactive tools for managing gift transactions

Utilizing interactive tools available on pdfFiller can significantly enhance the management of gift transactions. Cloud-based document management allows users to edit, sign, and collaborate on documents from anywhere, making it easier for teams to maintain compliance with Oklahoma gift statutes.

The benefits of using such tools include seamless organization of documentation, easy access to previously filed forms, and the ability to communicate effectively on gift-related matters among team members. By leveraging these interactive tools, individuals can reduce the risk of errors and ensure that all transactions are recorded accurately.

Ensuring compliance and best practices

Adhering to Oklahoma gift statutes is not just about following the letter of the law; it also involves embracing best practices for compliance. Strategies include developing internal policies that align with legal requirements, regular training sessions for staff about ethical gift acceptance, and ensuring clarity in the reporting process.

The importance of transparency and thorough record-keeping cannot be overstated. Maintaining accurate logs of gifts received as well as keeping communication channels open among team members is vital in preventing issues related to potential conflicts of interest. Regular training and updates for all stakeholders involved ensure that everyone remains informed about any changes in the statutes.

Review and audit processes

Conducting a regular internal review of gift-related practices is essential to ensure ongoing compliance with Oklahoma statutes. This review allows organizations to identify any weaknesses in their processes and address them proactively.

Indicators of compliance with Oklahoma statutes can include a history of accurate gift reporting, transparency in gift acceptance, and adherence to defined limits on the value of gifts. In cases of complexity or uncertainty, seeking legal counsel can be a wise decision to navigate the intricate landscape of gift laws.

Frequently asked questions (FAQs)

Oklahoma gift statutes often leave individuals with various questions. Common queries include what constitutes a permissible gift, how to handle situations when in doubt about accepting a gift, and the potential consequences of violations.

Many individuals are unsure about scenarios involving gift acceptance and disclosure. It's vital to understand the nuances of these situations and clarify when gifts must be reported. Awareness of the impact of violations is also paramount, as these can lead to disciplinary actions or legal repercussions.

Additional notes and resources

For individuals looking to delve deeper into the Oklahoma gift statutes, valuable resources are available. These include links to relevant statutes and regulations, guides for further reading to expand understanding, and contact information for legal assistance if needed.

Utilizing these resources can provide invaluable support for ensuring compliance and navigating the complexities surrounding gift acceptance and reporting. Staying informed about changes in legislation and regulations is essential for all stakeholders involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send oklahoma gift statutes for eSignature?

How do I fill out the oklahoma gift statutes form on my smartphone?

Can I edit oklahoma gift statutes on an Android device?

What is oklahoma gift statutes?

Who is required to file oklahoma gift statutes?

How to fill out oklahoma gift statutes?

What is the purpose of oklahoma gift statutes?

What information must be reported on oklahoma gift statutes?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.