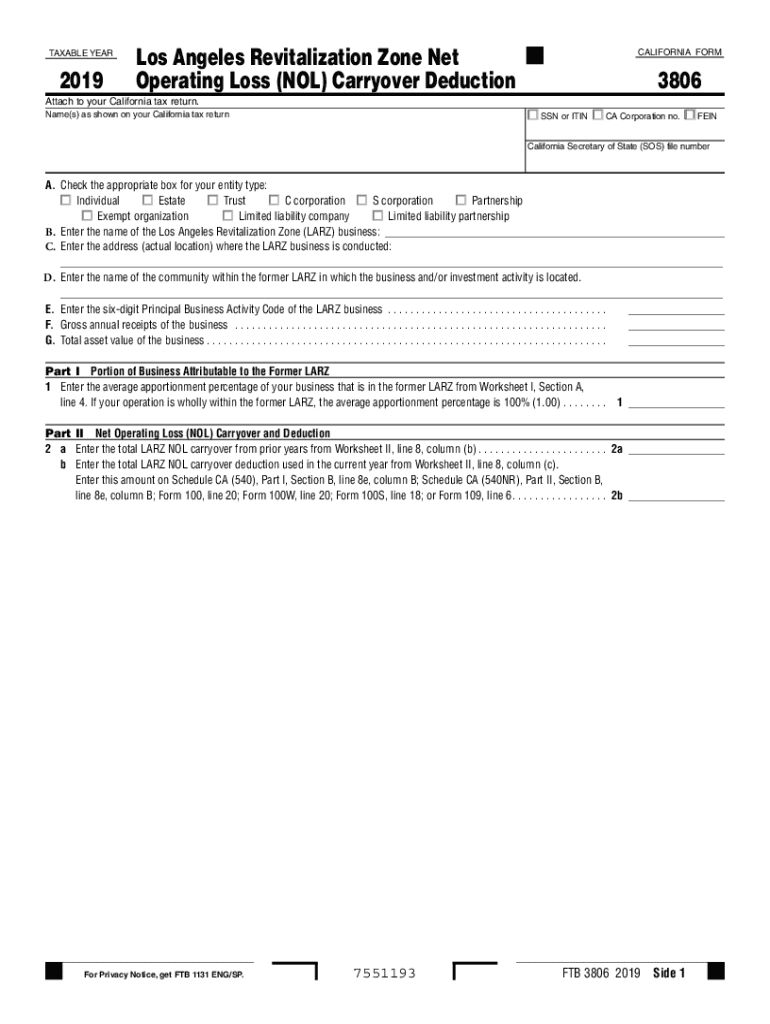

Get the free 2019 3806 Los Angeles Revitalization Zone Net Operating Loss (NOL) Carryover Deducti...

Get, Create, Make and Sign 2019 3806 los angeles

How to edit 2019 3806 los angeles online

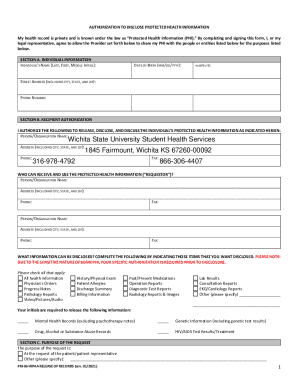

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2019 3806 los angeles

How to fill out 2019 3806 los angeles

Who needs 2019 3806 los angeles?

Your Comprehensive Guide to the 2 Los Angeles Form

Overview of Form 2

Form 2, also known as the 2 Los Angeles Form, is a crucial document for both individuals and businesses operating within Los Angeles. This form serves the purpose of reporting various types of income, ensuring compliance with local taxation requirements. With its comprehensive guidelines, Form 2 holds significant importance as it directly affects the financial responsibilities of residents and businesses alike. Properly completing this form is essential to avoid penalties, making it imperative for those filing to understand the nuances involved.

Key dates relevant to the 2 Los Angeles Form include the filing deadline, typically set for April 15, and any potential extensions that may apply. Understanding these deadlines helps taxpayers prepare and file on time, ensuring compliance with local regulations.

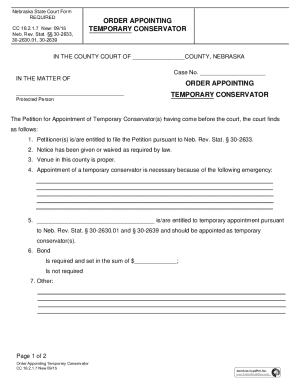

Who needs to file Form 2?

Both individuals and businesses are required to file Form 2 if they meet certain criteria established by the California taxation authorities. For individuals, this includes those with a gross income exceeding a specific threshold, typically defined by local ordinances. Businesses, especially those engaged in employee compensation or self-employment, must also adhere to filing requirements based on their earnings.

Exceptions to filing may exist, particularly for those who fall below the income thresholds or meet specific criteria, such as students or those receiving disability payments. It's vital to review the specific instructions provided by local taxation authorities to confirm whether you are subject to filing.

Detailed instructions for completing Form 2

When it comes to filling out Form 2, the process can be streamlined through careful attention to detail. Here’s a step-by-step guide to ensure accuracy in your submission.

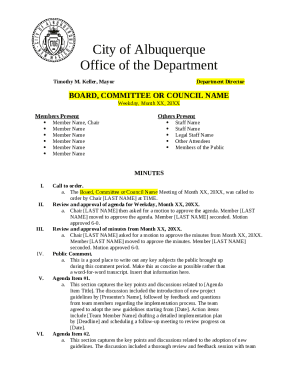

Editing and managing Form 2 with pdfFiller

Managing your 2 Los Angeles Form becomes significantly more accessible with pdfFiller. Users can seamlessly upload their forms and utilize editing tools to rectify any errors or add necessary information. The platform enhances collaboration, enabling teams to work on the form simultaneously, thereby eliminating redundancies.

pdfFiller also provides options to save and export completed forms in various formats, ensuring that your documents are always available and secure, whether you are accessing them from home or while on the go.

Common mistakes to avoid when filing Form 2

Filing mistakes can have serious repercussions, from delays to penalties. To ensure a smooth filing process, here are some frequent errors to avoid:

Frequently asked questions about Form 2

As you prepare to file your 2 Los Angeles Form, you may have questions regarding the specific requirements or processes. Here are some of the most common queries:

Additional insights on filing in Los Angeles

Filing in Los Angeles comes with its own set of unique considerations. Local regulations may differ from those in other parts of California, and it's beneficial for residents to stay updated on any changes that could affect their filing requirements. For example, the introduction of new legislation under TCJA provisions may impact the deductions available to you or change how your income is taxed.

Local resources, such as workshops and assistance from tax professionals, can help residents understand the specifics of their filing obligations. Additionally, being mindful of recent legislation and shifts in the local job market can influence how personal financial matters are handled.

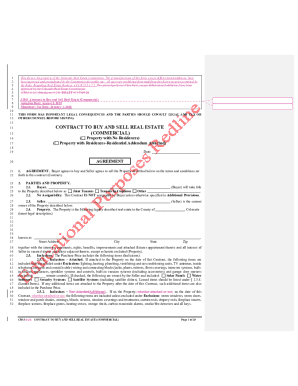

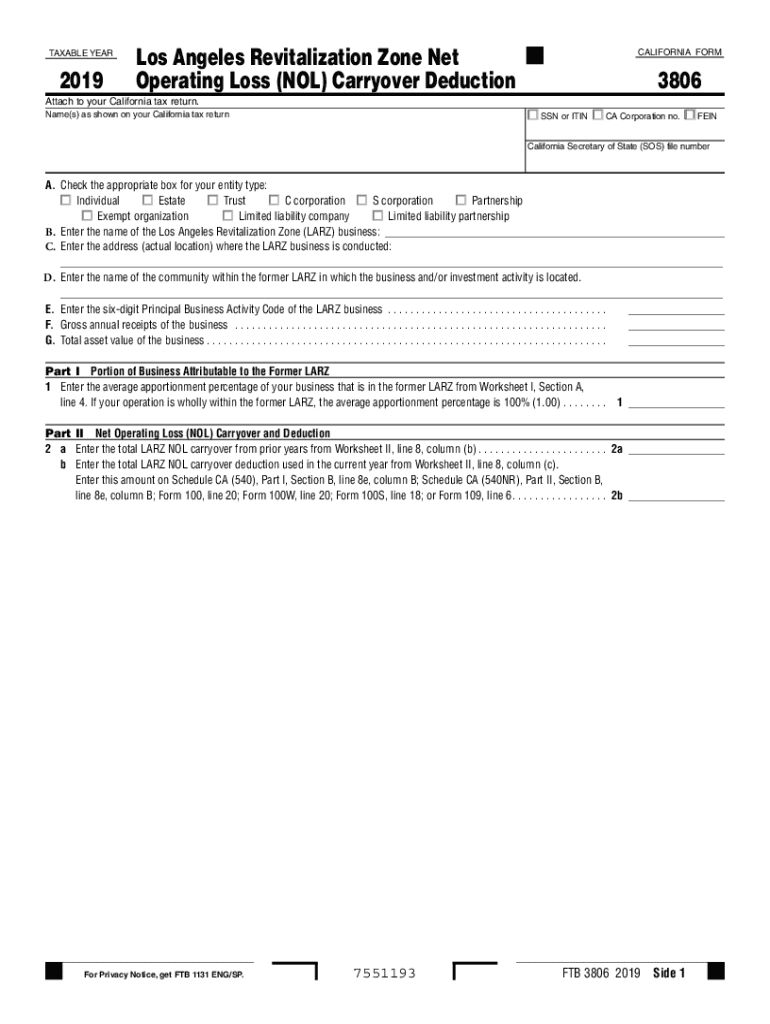

2019 updates and changes to form 3806

The 2019 iteration of the Form 3806 introduced several key updates reflecting changes in tax law. Understanding these modifications is essential for compliant and accurate filing. One important change relates to the treatment of deductions and the adaptation following the Tax Cuts and Jobs Act (TCJA), which significantly altered how certain expenses, such as employee compensation and net operating losses, are addressed.

These changes may require you to modify how you report income and claim deductions compared to the previous year's filings. Thorough awareness of these details can prevent costly missteps and ensure you’re utilizing every benefit available to you.

Utilizing pdfFiller for seamless eSigning and collaboration

With pdfFiller, the process of electronically signing Form 2 becomes straightforward and efficient. The platform’s features allow for multiple users to collaborate smoothly on the completion of the document. This is particularly advantageous for teams, as it fosters seamless communication and ensures that every document revision is accounted for.

Security measures are also in place, safeguarding your sensitive information as you manage documents online. By using pdfFiller, you not only accelerate the filing process but also ensure a secure and organized approach to document management.

Conclusion of Form 2 insights

The 2 Los Angeles Form plays an essential role in ensuring compliance with local tax regulations. By following the detailed instructions outlined in this guide, utilizing tools like pdfFiller, and avoiding common mistakes, individuals and businesses can navigate the filing process with confidence.

As you prepare to complete your form, be mindful of deadlines and ensure the accuracy of your submissions. With the right approach and tools at your disposal, managing your documentation can be both effective and efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2019 3806 los angeles online?

How do I edit 2019 3806 los angeles straight from my smartphone?

How do I fill out the 2019 3806 los angeles form on my smartphone?

What is 2019 3806 los angeles?

Who is required to file 2019 3806 los angeles?

How to fill out 2019 3806 los angeles?

What is the purpose of 2019 3806 los angeles?

What information must be reported on 2019 3806 los angeles?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.